Gold Road Sold To Gold Fields In A$3.7 Billion Transaction

Table of Contents

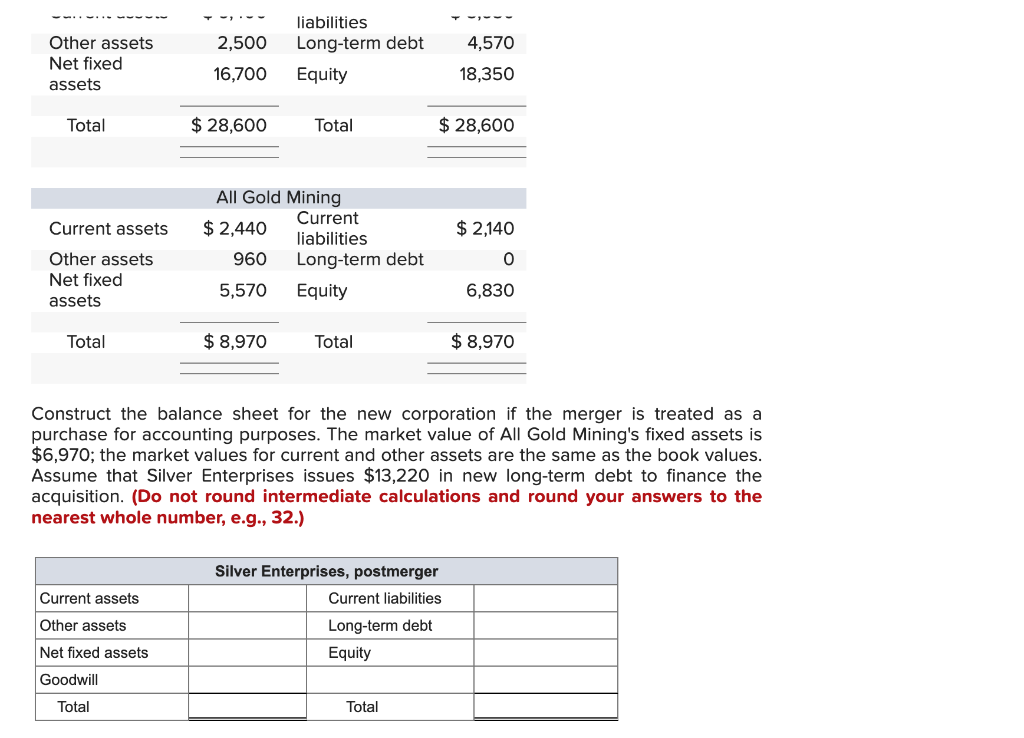

Deal Details and Financial Implications of the Gold Road Acquisition

Transaction Value and Structure

Gold Fields secured Gold Road Resources for a substantial A$3.7 billion. While the exact breakdown between cash and stock remains to be fully disclosed, early reports suggest a combination of both payment methods to ensure a smooth transaction. The offer price represented a significant premium over Gold Road's market price at the time of the announcement, reflecting the strategic value Gold Fields placed on acquiring the company. This premium indicates a strong belief in Gold Road's assets and future growth potential.

Impact on Gold Fields' Portfolio

This acquisition significantly bolsters Gold Fields' presence in the Australian gold market, enhancing its portfolio in several key ways:

- Increased gold production capacity: Gold Road's assets contribute substantial additional gold production to Gold Fields' existing operations, immediately boosting output.

- Diversification of gold reserves: The acquisition diversifies Gold Fields' gold reserves, reducing reliance on individual mines and mitigating risks associated with specific projects.

- Enhanced operational efficiencies: Through integration, Gold Fields anticipates streamlining operations and realizing cost synergies, leading to improved profitability.

- Access to new exploration opportunities: Gold Road's exploration portfolio opens new avenues for Gold Fields, providing potential for future resource discoveries and growth.

Shareholder Approval and Regulatory Approvals

The successful completion of this Gold Road acquisition hinges upon securing shareholder approval from both Gold Fields and Gold Road's investors. Additionally, the deal requires the green light from relevant regulatory bodies, including the Australian Competition and Consumer Commission (ACCC). The ACCC will scrutinize the deal to ensure it doesn't harm competition within the Australian gold mining market. Any potential delays or hurdles in securing these approvals could impact the transaction timeline.

Impact on Gold Road Shareholders and Employees

Shareholder Returns

Gold Road shareholders received a substantial offer price per share, resulting in significant gains for many. The premium offered considerably exceeded the pre-announcement share price, delivering attractive returns to investors. This aspect of the Gold Road acquisition will undoubtedly be viewed favorably by the market.

Future of Gold Road Employees

Gold Fields has provided assurances regarding the future of Gold Road employees, emphasizing a commitment to job security and integration into the Gold Fields team. The company's official statements highlight a planned phased integration process aiming to minimize disruption and ensure a smooth transition for all employees. However, further details on specific roles and responsibilities are anticipated in the coming months.

Strategic Rationale Behind Gold Fields' Acquisition of Gold Road

Growth and Expansion Strategies

Gold Fields' acquisition of Gold Road aligns with its ambitious growth and expansion strategies within the Australian gold mining sector. Gold Road's high-quality assets, such as the Gruyere gold mine, represent a key attraction for Gold Fields. This mine's significant gold reserves and proven production capabilities contribute directly to Gold Fields' production targets and overall growth ambitions.

Synergies and Cost Savings

Gold Fields anticipates realizing significant cost synergies by integrating Gold Road's operations into its existing infrastructure. This includes optimizing supply chains, sharing resources, and leveraging economies of scale. These cost savings are crucial for enhancing the overall profitability of the combined entity.

Long-Term Vision

Gold Fields' long-term vision for Gold Road includes continued development and exploration of the acquired assets. The company plans to invest in enhancing existing operations and exploring new opportunities within Gold Road’s extensive exploration portfolio. This commitment signifies a long-term strategy to maximize the value of these assets for Gold Fields.

Market Reaction and Analyst Commentary on the Gold Road Gold Fields Deal

Share Price Movements

The announcement of the Gold Road acquisition was met with largely positive market reaction. Gold Fields' share price experienced a modest increase, reflecting investor confidence in the strategic rationale behind the deal. While Gold Road shares were naturally affected by the takeover, the premium offered appeased investor concerns.

Expert Opinions

Industry analysts have largely praised the Gold Road acquisition as a strategic move for Gold Fields, highlighting the benefits of increased production, diversified reserves, and potential cost synergies. Some analysts, however, expressed reservations about potential regulatory hurdles and the integration challenges associated with combining two distinct mining operations. The consensus, however, points towards a positive long-term outlook for Gold Fields following this significant acquisition.

Conclusion

The Gold Road acquisition by Gold Fields, valued at A$3.7 billion, is a defining moment in the Australian gold mining industry. This strategic deal significantly enhances Gold Fields' position, providing substantial increases in gold production capacity, diversifying reserves, and offering considerable cost-saving opportunities. While challenges remain, such as regulatory approvals and integration processes, the long-term outlook appears positive for Gold Fields. The Gold Road acquisition showcases the ongoing consolidation within the gold mining sector and its emphasis on larger scale operations.

To stay informed about the further development of this significant Gold Road acquisition and other crucial mergers and acquisitions within the gold mining industry, follow reputable financial news sources and industry publications. Understanding the dynamics of these major Gold Road acquisitions is crucial for staying ahead in this evolving market.

Featured Posts

-

The Kevin Costner Demi Moore Romance What We Know

May 06, 2025

The Kevin Costner Demi Moore Romance What We Know

May 06, 2025 -

Ashton Kutcher And Demi Moore Daughters Regrettable Comment On Ex Stepdad

May 06, 2025

Ashton Kutcher And Demi Moore Daughters Regrettable Comment On Ex Stepdad

May 06, 2025 -

Far Right Candidate Faces Centrist In Romanias Crucial Election Runoff

May 06, 2025

Far Right Candidate Faces Centrist In Romanias Crucial Election Runoff

May 06, 2025 -

Demi Moores Daughter Ruminates On Ashton Kutcher Then Recants

May 06, 2025

Demi Moores Daughter Ruminates On Ashton Kutcher Then Recants

May 06, 2025 -

Patrick Schwarzenegger Lands Major Part In Luca Guadagnino Movie

May 06, 2025

Patrick Schwarzenegger Lands Major Part In Luca Guadagnino Movie

May 06, 2025