Gold (XAUUSD) Finds Support: US Data Dampens Rate Hike Prospects

Table of Contents

Weakening US Economic Data

Recent US economic data has painted a picture of slowing growth, surprising markets and significantly impacting expectations for future Federal Reserve policy. Several key indicators suggest a potential economic slowdown, dampening the urgency for further aggressive rate hikes. This shift has significant implications for the gold market.

-

Cooling Inflation: July's Consumer Price Index (CPI) figures showed inflation cooling faster than anticipated. This suggests the Federal Reserve's rate hike strategy may be bearing fruit, reducing the need for further aggressive action.

-

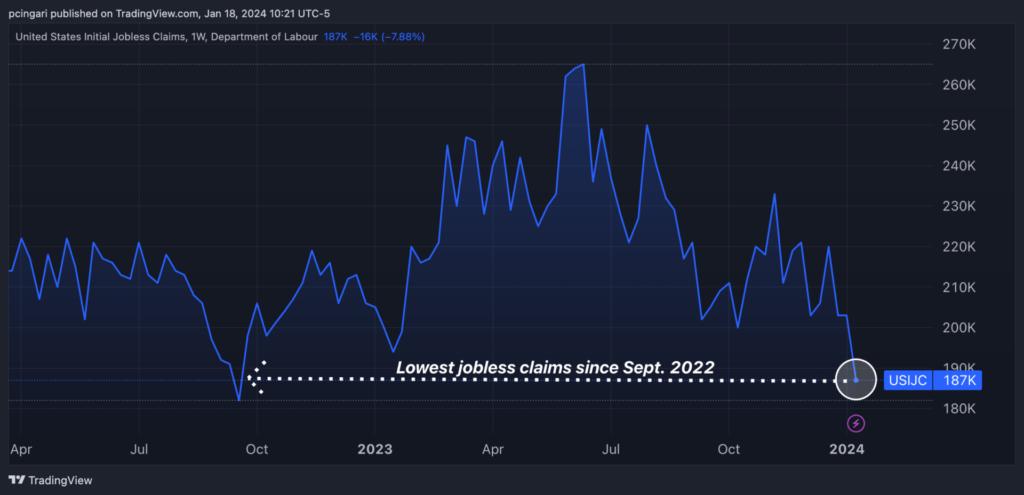

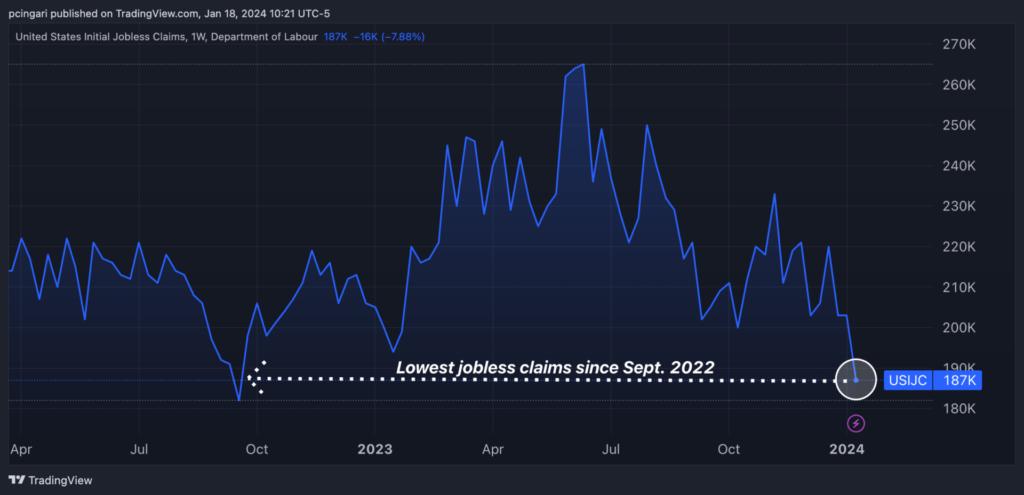

Softening Labor Market: Nonfarm payroll numbers have come in below expectations in recent months, indicating a potential softening in the labor market. This lessens concerns about wage inflation and reduces pressure on the Fed to maintain its hawkish stance.

-

Contracting Manufacturing: The Manufacturing Purchasing Managers' Index (PMI) has indicated a contraction in the industrial sector, pointing towards weakening economic activity. This further supports the argument for a less aggressive approach to interest rate hikes.

This confluence of weaker-than-expected data points strongly suggests a slowdown in the US economy, influencing investor sentiment and impacting asset prices, including gold.

Reduced Likelihood of Further Rate Hikes

The weaker economic data significantly reduces the pressure on the Federal Reserve to continue raising interest rates aggressively. The market is now pricing in a lower probability of further significant rate increases in the coming months. This shift in expectations has profound implications for both the US dollar and gold prices.

-

Market Predictions: Many market analysts are predicting a higher probability of a rate hike pause, or at least a slowdown in the pace of hikes, in the upcoming Federal Open Market Committee (FOMC) meeting.

-

Weakening Dollar: Reduced expectations for future rate hikes are already contributing to a weakening of the US dollar index (DXY). A weaker dollar typically benefits gold, as it becomes cheaper for investors holding other currencies to purchase.

This changing outlook on Federal Reserve policy is a key driver of the recent increase in demand for gold, making it an attractive investment choice in a climate of less aggressive monetary policy.

Gold as a Safe Haven Asset

Amidst the economic uncertainty created by slowing growth and shifting interest rate expectations, investors are increasingly turning to gold as a safe haven asset. Gold's historical performance during periods of economic turmoil underscores its role as a portfolio diversifier.

-

Inflation Hedge: Gold is often considered an inflation hedge, preserving purchasing power during periods of rising prices. Even with cooling inflation, the potential for future inflationary pressures remains a concern, driving demand for gold.

-

Market Volatility: Investors seek the stability of gold in times of market volatility and economic downturn. Its inherent value and limited supply make it a reliable store of value during periods of uncertainty.

The current market climate, characterized by uncertainty and slowing economic growth, reinforces gold's appeal as a dependable safe haven asset.

Gold (XAUUSD) Outlook and Call to Action

In summary, weaker US economic data has reduced expectations of further aggressive rate hikes from the Federal Reserve. This has led investors to seek safe haven assets like gold, providing support for XAUUSD. The decreased probability of aggressive rate hikes is a primary factor boosting gold (XAUUSD) prices.

While predicting future gold prices with certainty is impossible, the current market conditions suggest a positive outlook for gold in the near term. However, it's crucial to remember that the market is dynamic, and unforeseen events can impact gold prices.

Stay informed about the latest economic data and its impact on Gold (XAUUSD) prices. Consider diversifying your portfolio with Gold (XAUUSD) to mitigate risks and safeguard your investment against economic uncertainty. Understanding the interplay between economic indicators, Federal Reserve policy, and the behavior of safe haven assets like gold is key to successful investing.

Featured Posts

-

Could A Wnba Strike Happen Angel Reeses Take On Player Pay

May 17, 2025

Could A Wnba Strike Happen Angel Reeses Take On Player Pay

May 17, 2025 -

Uber Expands Pet Friendly Rides In Delhi And Mumbai With Heads Up For Tails

May 17, 2025

Uber Expands Pet Friendly Rides In Delhi And Mumbai With Heads Up For Tails

May 17, 2025 -

Ultraviolette Tesseract Electric Scooter Launched At R1 2 Lakh With 261 Km Range And 20 1 Bhp

May 17, 2025

Ultraviolette Tesseract Electric Scooter Launched At R1 2 Lakh With 261 Km Range And 20 1 Bhp

May 17, 2025 -

The Future Of Ridesharing Arrives Waymo And Ubers Austin Robotaxi Launch

May 17, 2025

The Future Of Ridesharing Arrives Waymo And Ubers Austin Robotaxi Launch

May 17, 2025 -

Jackbit Casino Review A Top Bitcoin Casino For Us Players

May 17, 2025

Jackbit Casino Review A Top Bitcoin Casino For Us Players

May 17, 2025