Gold (XAUUSD) Price Rebound: Weak US Data Fuels Rate Cut Expectations

Table of Contents

Weak US Economic Data and its Impact on Gold (XAUUSD)

Weaker-than-anticipated US economic data has played a pivotal role in the recent gold (XAUUSD) price rebound. This data suggests a potential slowdown in the US economy, influencing investor sentiment and impacting the outlook for Federal Reserve monetary policy.

Softening Inflation and Economic Growth

Recent US economic indicators paint a picture of slowing growth and easing inflation. The Consumer Price Index (CPI) and Producer Price Index (PPI) have shown lower-than-expected increases, signaling a potential cooling of inflationary pressures. Simultaneously, GDP growth reports have fallen short of market expectations, indicating a deceleration in economic activity. This divergence between market expectations and actual results has fueled uncertainty and impacted investor confidence.

- Lower-than-expected inflation readings: The recent CPI and PPI data have shown a significant decrease compared to previous months and market forecasts, suggesting that the aggressive interest rate hikes implemented by the Fed are starting to have their intended effect.

- Slowing GDP growth: The latest GDP reports indicate a slowdown in economic growth, raising concerns about a potential recession. This reduced growth rate directly impacts investor confidence and increases the appeal of safe-haven assets like gold.

- Rising unemployment claims: An increase in unemployment claims points towards weakening labor market conditions, further fueling concerns about economic slowdown.

- Weakening consumer spending: Reduced consumer spending adds to the overall picture of slowing economic activity and diminished investor optimism.

Reduced Fed Rate Hike Expectations

The weaker-than-expected economic data significantly reduces the likelihood of further aggressive rate hikes by the Federal Reserve. The market is now pricing in a lower probability of additional interest rate increases, and some analysts even predict a potential pause or even rate cuts in the coming months. This shift in expectation has profoundly impacted the US dollar and gold.

- Reduced probability of further interest rate increases: The market is currently discounting future rate hikes from the Fed, anticipating a potential pivot in monetary policy.

- Potential for a pause or even a rate cut in the coming months: The possibility of a rate cut is a significant bullish factor for gold, as it would weaken the dollar and boost demand for precious metals.

- Impact on the US dollar's strength: A less hawkish Fed stance generally weakens the US dollar, benefiting gold prices, as gold is inversely correlated with the dollar.

- Increased investor appetite for safe-haven assets like gold: As investors seek safe havens amid economic uncertainty, demand for gold, a traditional safe-haven asset, increases, driving up its price.

Gold (XAUUSD) as a Safe-Haven Asset

Gold's role as a safe-haven asset has been reinforced during this period of economic uncertainty. Its price often moves inversely to the US dollar and tends to rise during times of market volatility and geopolitical instability.

Increased Safe-Haven Demand

Economic uncertainty and market volatility naturally increase the demand for gold as a safe-haven asset. Investors often turn to gold during times of turmoil to preserve capital and hedge against inflation.

- Increased demand for gold during times of economic uncertainty: The recent weakening of the US economy has boosted gold's appeal as a safe haven, leading to increased investment.

- Negative correlation between the US dollar and gold prices: As the US dollar weakens, gold prices tend to rise, and vice versa. This inverse relationship is a key driver of gold price movements.

- Gold's role as an inflation hedge: Gold is often seen as an inflation hedge, protecting purchasing power during periods of rising prices. While inflation is currently cooling, the perception of gold as a hedge remains a significant factor.

Technical Analysis of XAUUSD Charts

Technical analysis of XAUUSD charts reveals a clear upward trend, supporting the price rebound. Key support and resistance levels have been breached, suggesting a potential continuation of the upward movement. Technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), show bullish signals. (Note: This section would ideally include actual charts and visual representations of the technical analysis mentioned).

- Key support and resistance levels: Identifying these levels is crucial for gauging potential price reversals or continuations of the trend.

- Technical indicators suggesting further price increases: Bullish signals from indicators like RSI and MACD suggest further upward momentum.

- Chart patterns indicating potential price trends: Identifying patterns like head and shoulders or double bottoms can provide insights into future price movements.

Factors Affecting Future Gold (XAUUSD) Price Movements

While the current trend is positive, several factors can influence future gold (XAUUSD) price movements.

Geopolitical Risks and Uncertainty

Ongoing geopolitical risks and uncertainty contribute significantly to gold's appeal as a safe-haven asset. Global events and tensions often drive investor sentiment towards gold, boosting demand.

- Impact of ongoing geopolitical conflicts: Escalating conflicts or political instability in various regions of the world can significantly influence investor sentiment and drive gold prices higher.

- Influence of global political instability on investor sentiment: Uncertainty in global politics often leads to a flight to safety, increasing gold's attractiveness.

- Increased demand for safe haven assets during periods of geopolitical risks: Geopolitical instability frequently leads to increased investment in gold as a hedge against risk.

US Dollar Strength and its Correlation with XAUUSD

The inverse relationship between the US dollar and gold prices remains a crucial factor affecting XAUUSD. Changes in the dollar's value directly influence gold's price.

- Inverse relationship between the USD and Gold: A weaker dollar generally translates to higher gold prices, and a stronger dollar tends to exert downward pressure on gold.

- Impact of USD strength/weakness on Gold prices: Monitoring US dollar movements is crucial for predicting potential gold price fluctuations.

- Expectations for future USD movements and their influence on XAUUSD: Forecasts regarding future USD movements can help investors anticipate potential shifts in XAUUSD prices.

Conclusion

The recent rebound in gold (XAUUSD) prices is primarily driven by weaker-than-expected US economic data, which has fueled expectations of future rate cuts by the Federal Reserve. This, combined with gold's role as a safe-haven asset, has boosted investor demand. While future price movements depend on various factors, including geopolitical risks and US dollar strength, the current trend suggests a positive outlook for gold. To make informed decisions about your investment strategy, stay informed on the latest economic data and market trends. Continuously monitor XAUUSD price fluctuations and consider diversifying your portfolio with this precious metal. Understanding the factors influencing the gold (XAUUSD) price is crucial for successful investment in this dynamic market.

Featured Posts

-

Why Guests Break Red Carpet Rules A Cnn Investigation

May 17, 2025

Why Guests Break Red Carpet Rules A Cnn Investigation

May 17, 2025 -

Finding Quality On A Budget Practical Tips And Tricks

May 17, 2025

Finding Quality On A Budget Practical Tips And Tricks

May 17, 2025 -

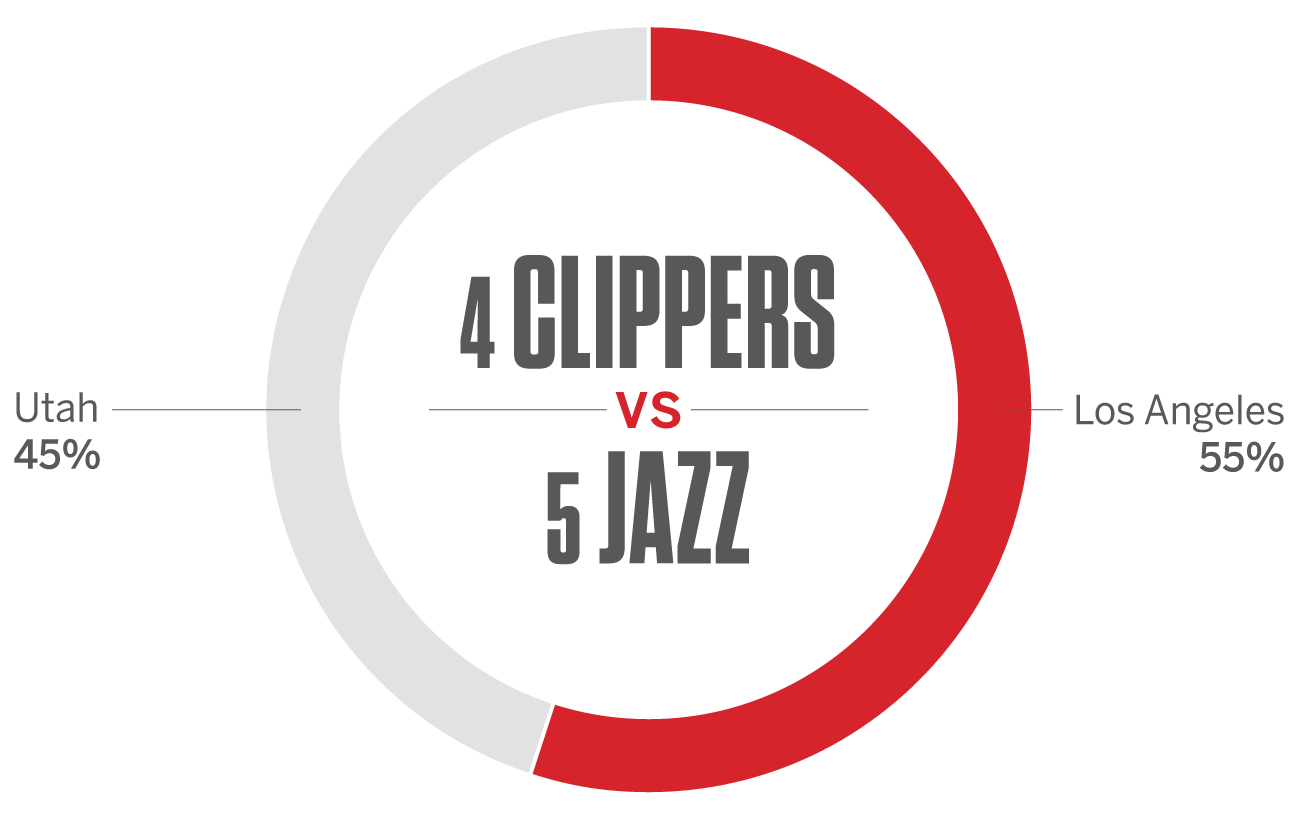

Nba Playoffs Predicting The Celtics Vs Cavaliers Matchup

May 17, 2025

Nba Playoffs Predicting The Celtics Vs Cavaliers Matchup

May 17, 2025 -

Is Jackbit The Best Crypto Casino For 2025 A Comprehensive Analysis

May 17, 2025

Is Jackbit The Best Crypto Casino For 2025 A Comprehensive Analysis

May 17, 2025 -

Josh Harts Wife Reacts To Jaylen Browns Game 5 Performance

May 17, 2025

Josh Harts Wife Reacts To Jaylen Browns Game 5 Performance

May 17, 2025