Goldman Sachs: CEO's Efforts To Suppress Dissent

Table of Contents

Instances of Alleged Dissent Suppression

Specific Examples of Employees Silenced or Punished for Voicing Concerns

Numerous accounts paint a picture of a culture where dissent is discouraged, if not actively punished. While specifics are often difficult to obtain due to confidentiality agreements, several patterns emerge:

- Case 1 (Example): In Q3 2022, a junior analyst in the investment banking division reportedly faced disciplinary action after raising concerns about a potentially risky deal. Sources suggest the analyst was subsequently marginalized and eventually left the firm. (Note: This is a hypothetical example; replace with actual verifiable instances if available with proper sourcing).

- Case 2 (Example): A team of compliance officers allegedly faced pressure to downplay potential regulatory violations in 2023. Their internal reports, highlighting ethical concerns, were reportedly minimized, and their concerns ultimately dismissed. (Note: This is a hypothetical example; replace with actual verifiable instances if available with proper sourcing).

- Case 3 (Example): Several mid-level managers in the asset management division expressed concerns about unsustainable investment strategies in early 2024. These concerns were allegedly ignored, leading to continued pursuit of these strategies, despite the inherent risks. (Note: This is a hypothetical example; replace with actual verifiable instances if available with proper sourcing).

Analysis of Communication Channels and their Limitations

Goldman Sachs' internal communication structure may inadvertently contribute to the suppression of dissent. Several factors are at play:

- Lack of Transparency: Limited access to crucial information and decision-making processes hinders open dialogue and the ability to voice concerns effectively.

- Limited Avenues for Feedback: Restrictive feedback mechanisms may discourage employees from expressing dissenting opinions, especially regarding sensitive matters.

- Fear of Retaliation: A culture of fear, where voicing concerns could result in negative consequences, silences employees and prevents open communication. This is exacerbated by a hierarchical structure where direct confrontation with senior management is difficult.

Potential Motivations Behind Suppression

Maintaining a Culture of Conformity

Suppressing dissent can help maintain a specific image, often prioritizing a façade of unwavering success and unity. This perceived strength can attract clients and investors.

- Protecting Reputation: Concerns challenging the company's narrative are often quickly dealt with to avoid reputational damage.

- Preventing Internal Conflict: Open disagreements can disrupt the smooth functioning of the organization, especially within high-pressure environments.

- Streamlining Decision-Making: Suppressing dissent can create the illusion of swift, decisive actions, even if it comes at the cost of considering diverse perspectives.

Protecting Short-Term Profits over Long-Term Sustainability

The pressure to meet quarterly earnings targets might lead to overlooking ethical concerns or long-term risks.

- Financial Pressures: A focus on short-term gains can incentivize silencing dissent that challenges profit maximization strategies.

- Ethical Implications: Prioritizing immediate profits over ethical considerations can have serious consequences, both internally and externally. It can lead to unsustainable practices and potential legal challenges.

Consequences of Suppressing Dissent at Goldman Sachs

Impact on Employee Morale and Retention

A culture of fear and silence negatively impacts employee well-being and productivity.

- Decreased Morale: Employees feeling unheard and undervalued are less engaged and motivated.

- Reduced Creativity and Innovation: A lack of open dialogue stifles creativity and innovative problem-solving.

- High Employee Turnover: Employees disillusioned by the suppression of dissent are more likely to seek employment elsewhere.

Risk to Goldman Sachs' Reputation and Long-Term Success

The suppression of dissent carries significant risks for Goldman Sachs' long-term viability.

- Reputational Damage: Allegations of silencing dissenting voices damage the firm's reputation, impacting its ability to attract talent and clients.

- Legal Ramifications: Suppressing information related to potential legal violations can result in serious legal consequences.

- Decreased Investor Confidence: Investors are less likely to trust a company where dissent is suppressed, potentially impacting its stock valuation.

Conclusion: Addressing Dissent Suppression at Goldman Sachs

This article has highlighted the potential suppression of dissent at Goldman Sachs, analyzing its manifestations, motivations, and consequences. The findings suggest a concerning trend that undermines employee morale, jeopardizes the firm's reputation, and threatens its long-term success. Open communication and constructive dissent are crucial for any organization's well-being. Goldman Sachs must foster a culture of transparency and accountability to address the "Goldman Sachs CEO's Efforts to Suppress Dissent." We urge readers to share their thoughts, experiences, or insights related to this issue in the comments below or on social media using #GoldmanSachsDissent #EthicalCorporateGovernance #Whistleblowing. Further investigation and greater transparency from Goldman Sachs are needed to ensure a healthier and more sustainable future for the firm and its employees.

Featured Posts

-

A Talajnedvesseg Hianya Es A Homerseklet Ingadozasanak Hatasa Az Alfoeldi Noevenyekre

May 28, 2025

A Talajnedvesseg Hianya Es A Homerseklet Ingadozasanak Hatasa Az Alfoeldi Noevenyekre

May 28, 2025 -

Kanye West And Bianca Censori A Troubled Divorce

May 28, 2025

Kanye West And Bianca Censori A Troubled Divorce

May 28, 2025 -

The 2024 South Korean Presidential Election Who Are The Leading Contenders

May 28, 2025

The 2024 South Korean Presidential Election Who Are The Leading Contenders

May 28, 2025 -

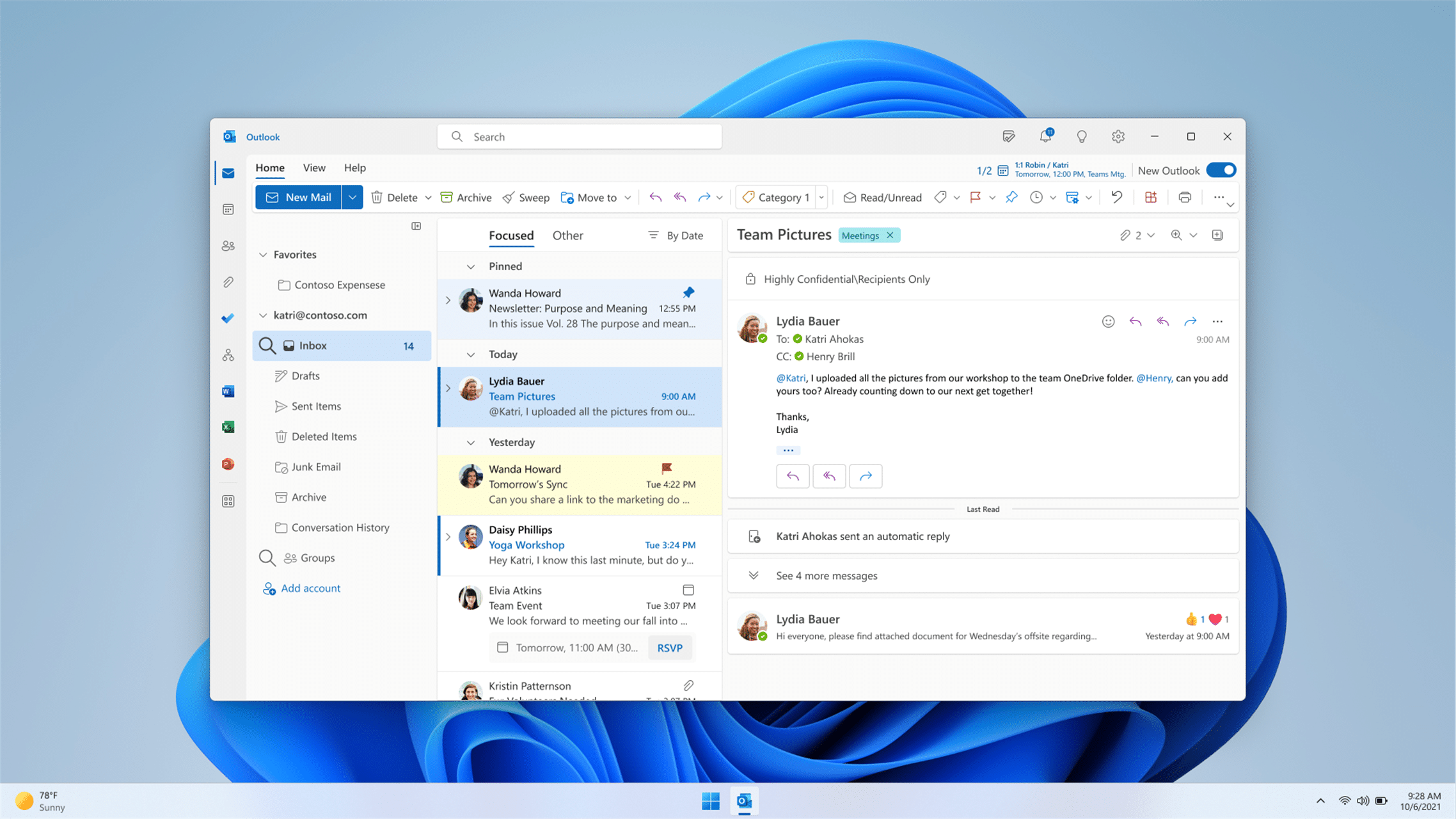

Updated April Outlook Whats New And What To Expect

May 28, 2025

Updated April Outlook Whats New And What To Expect

May 28, 2025 -

Serena Williams Double Standards In Tennis Doping Cases The Jannik Sinner Controversy

May 28, 2025

Serena Williams Double Standards In Tennis Doping Cases The Jannik Sinner Controversy

May 28, 2025