GOP Tax Bill Faces Setback: Conservative Demands Halt Progress

Table of Contents

Conservative Concerns Fueling the GOP Tax Bill Impasse

The current impasse surrounding the GOP tax bill stems from deep-seated disagreements within the Republican party itself. Conservative lawmakers are voicing serious objections to key aspects of the proposed legislation, arguing it deviates from core conservative principles. These concerns are not merely minor quibbles; they represent fundamental ideological clashes that are proving incredibly difficult to reconcile.

Several specific issues are fueling the opposition:

- Spending Levels: Conservatives argue the bill doesn't go far enough in cutting government spending, potentially increasing the national debt. They are pushing for stricter spending caps and a more fiscally conservative approach.

- Tax Cuts for the Wealthy: While the bill includes tax cuts across the board, conservatives contend that the benefits disproportionately favor the wealthy, widening the income inequality gap. They are demanding more targeted tax relief for middle- and lower-income families.

- Lack of Sufficient Tax Simplification: Many conservatives believe the bill fails to achieve sufficient tax simplification, leaving the tax code overly complex and burdensome for individuals and businesses. They are advocating for a more streamlined and transparent tax system.

Key figures like Senator [Insert Senator's Name] and Representative [Insert Representative's Name] have been vocal in their opposition, publicly expressing their concerns and demanding changes before they will lend their support. “[Insert a relevant quote from a conservative politician expressing their concerns about the bill],” stated Senator [Senator's Name] in a recent press conference. This level of dissent signifies a major challenge for the bill's proponents.

The Political Fallout of the GOP Tax Bill Delay

The delay of the GOP tax bill carries significant political ramifications. The longer the bill remains stalled, the more damage is inflicted on the Republican party's image and agenda. This internal conflict undermines the party's message of unity and competence, potentially affecting voter confidence and impacting upcoming elections.

The consequences of this delay extend beyond politics:

- Loss of Political Momentum: The prolonged debate saps the Republicans’ political momentum, making it harder to advance other key legislative priorities.

- Damage to the Republican Party's Reputation: The internal fighting weakens public trust in the Republican party, portraying an image of disunity and ineffectiveness.

- Negative Market Reactions due to Uncertainty: The uncertainty surrounding the bill's fate can negatively impact investor confidence and potentially slow economic growth.

- Potential for Political Gridlock: The ongoing dispute could lead to a broader political gridlock, hindering progress on other important legislative issues.

Potential Paths Forward for the GOP Tax Bill

Several paths forward could potentially resolve the impasse surrounding the GOP tax bill. However, each presents significant challenges and uncertainties. Reaching a compromise requires significant concessions from both sides, a feat that seems increasingly difficult given the deep divisions within the party.

Possible solutions include:

- Negotiations between different factions within the Republican party: Open dialogue and compromise are essential to bridge the ideological gaps.

- Amendments to the bill to address conservative concerns: Modifying the bill to incorporate conservative priorities could garner broader support.

- A complete rewrite of the bill: Starting afresh might be necessary if compromises prove impossible.

- Abandoning the bill altogether: This drastic measure would represent a significant political defeat for the Republican party.

The Role of Lobbying and Special Interests

The influence of lobbying and special interest groups cannot be overlooked. Powerful lobbies representing various industries are actively working to shape the bill's final form, potentially exacerbating the existing divisions within the Republican party. Some groups are actively lobbying for specific tax breaks or provisions that benefit their interests, further complicating the legislative process. Understanding the role of these special interests is crucial for a complete understanding of the challenges facing the GOP tax bill.

Conclusion: The Future of the GOP Tax Bill Remains Uncertain

The GOP tax bill faces significant hurdles. The strong conservative opposition, coupled with the potential economic and political ramifications, creates a precarious situation. The outcome remains uncertain, with several possible scenarios ranging from a significantly amended bill to its complete abandonment. The coming weeks will be crucial in determining the fate of this legislation. Stay informed about further developments regarding the GOP tax bill and its potential consequences; its impact on the American economy and political landscape will be far-reaching. [Link to relevant news source or government website].

Featured Posts

-

The Future Of The Catholic Church West Palm Beach Students React To The Papal Transition

May 18, 2025

The Future Of The Catholic Church West Palm Beach Students React To The Papal Transition

May 18, 2025 -

Iconic Casino Scenes A Cinematic Retrospective

May 18, 2025

Iconic Casino Scenes A Cinematic Retrospective

May 18, 2025 -

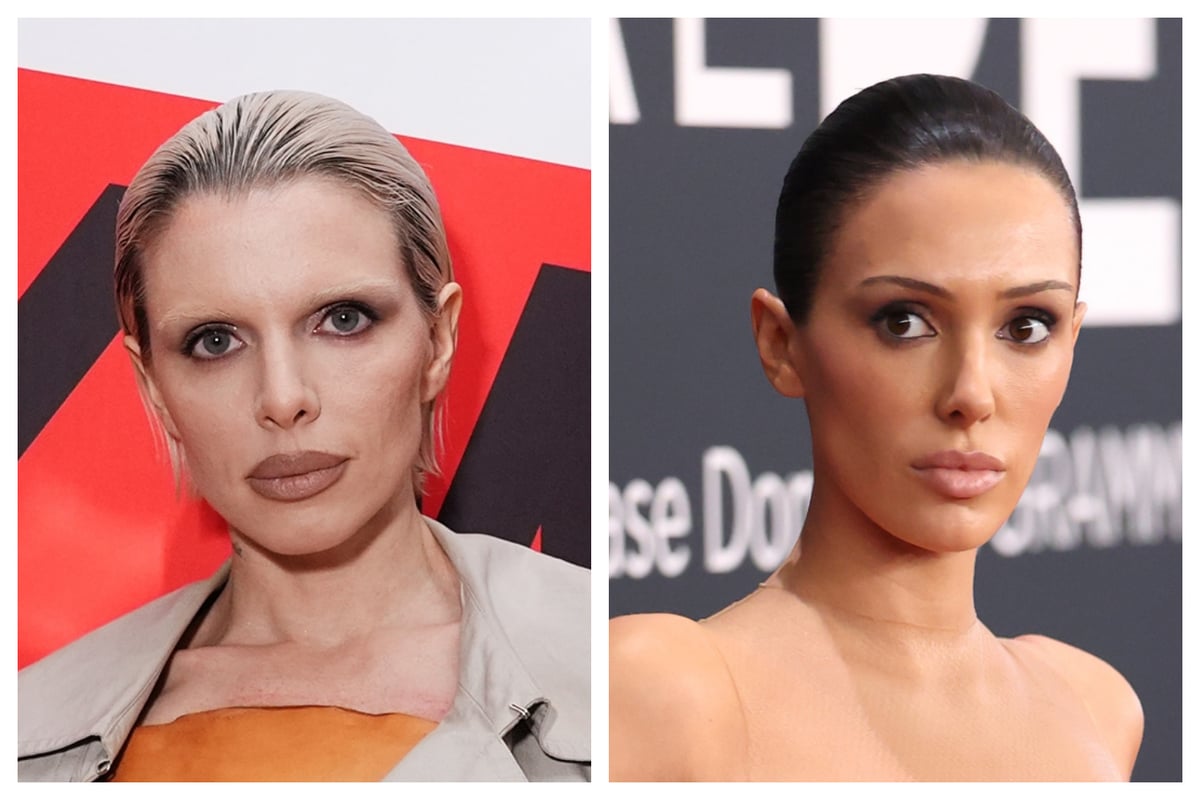

Kanye West Bianca Censori And Julia Fox A Fashion Face Off

May 18, 2025

Kanye West Bianca Censori And Julia Fox A Fashion Face Off

May 18, 2025 -

Delhi And Mumbai Get Uber Pet Convenient Pet Travel

May 18, 2025

Delhi And Mumbai Get Uber Pet Convenient Pet Travel

May 18, 2025 -

Barbara Mensch Recounts The History Of The Brooklyn Bridge

May 18, 2025

Barbara Mensch Recounts The History Of The Brooklyn Bridge

May 18, 2025