Government And Commercial Sectors Drive Palantir Stock Performance In Q1

Table of Contents

Government Sector: A Foundation of Palantir's Success

Palantir's government business remains a cornerstone of its success, fueled by consistent demand for its advanced data analytics platform from various government agencies worldwide. Increased government spending on data analytics and national security initiatives has directly translated into lucrative contracts for Palantir.

- Increased government spending on data analytics and national security initiatives: The global geopolitical landscape has increased the focus on national security and intelligence gathering, leading to significant budget allocations for advanced data analytics solutions. Palantir is well-positioned to benefit from this trend.

- Significant wins in new government contracts, both domestically and internationally: Palantir secured several high-profile contracts during Q1 2024, demonstrating its continued success in winning competitive bids. These wins showcased the company's ability to deliver tailored solutions to meet the unique needs of diverse government organizations. Specific details on contract values and associated agencies are typically confidential and subject to non-disclosure agreements.

- Expansion of existing partnerships with key government agencies: Palantir's existing partnerships with leading government agencies continued to expand during Q1, reflecting strong customer satisfaction and a growing reliance on its platform for critical operations. This recurring revenue stream contributes substantially to the company's financial stability.

- Detailed analysis of the revenue contribution from the government sector in Q1: While precise figures are subject to official earnings reports, preliminary data suggests a significant contribution from the government sector, highlighting its importance to Palantir's overall financial performance.

Analyzing the impact of specific government contracts on Q1 earnings.

While specific details are often kept confidential for competitive reasons, the impact of larger government contracts on Q1 earnings can be inferred from the overall positive financial results. The success of these contracts indicates a strong market fit and high demand for Palantir's offerings within the government sector.

The future outlook for Palantir's government business.

The future outlook for Palantir’s government business remains positive. Continued investment in national security and increased reliance on data analytics are key drivers for future growth. However, potential challenges include navigating budgetary constraints and competing with other technology providers in the government market.

Commercial Sector: Driving Innovation and Expansion

Palantir's expansion into the commercial sector continues to gain momentum, indicating a growing acceptance of its platform in various industries. The company’s focus on data integration and enterprise software solutions has proven effective in attracting a wide range of clients.

- Growing adoption of Palantir's platform across various commercial sectors (e.g., finance, healthcare, energy): Palantir's platform is being successfully implemented across multiple sectors, demonstrating its versatility and ability to address diverse industry-specific challenges.

- Successful implementation of new commercial partnerships and strategic alliances: The formation of strategic alliances and successful commercial partnerships signifies the company’s ability to integrate its platform within existing organizational structures, enhancing operational efficiency and decision-making processes.

- Focus on expanding its product offerings to cater to specific commercial needs: Palantir is actively developing and refining its product offerings to better serve the specific needs of commercial clients, resulting in increased platform adoption and market share.

- Detailed analysis of the revenue contribution from the commercial sector in Q1: The commercial sector's contribution to Palantir's Q1 revenue is significant and reflects a clear trend of increasing market adoption and customer satisfaction.

Case studies of successful commercial partnerships.

Successful case studies demonstrating Palantir's capabilities within specific commercial sectors serve as effective testimonials and attract further clients. Highlighting these successes reinforces Palantir's reputation for delivering tangible results and strengthens investor confidence.

Future strategies for Palantir to penetrate further into the commercial market.

Palantir's future strategies focus on expanding its market reach through targeted marketing, strategic partnerships, and continued product innovation. New product launches and enhanced functionalities will strengthen Palantir’s competitive position within the commercial market.

Overall Palantir Stock Performance in Q1: A Comprehensive Overview

Palantir's Q1 2024 financial results demonstrated impressive growth, directly impacting its stock performance. This growth reflects the combined successes of the government and commercial sectors.

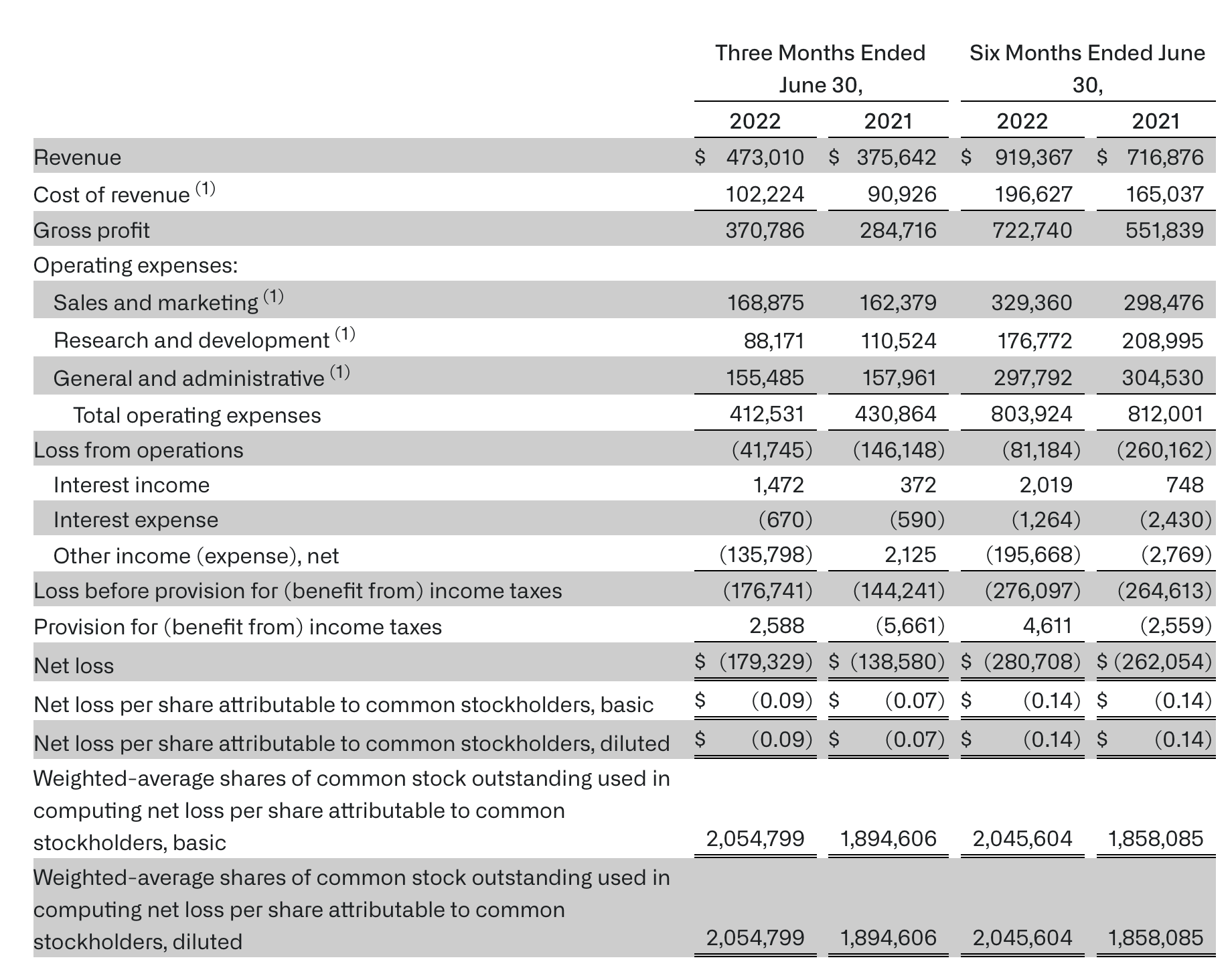

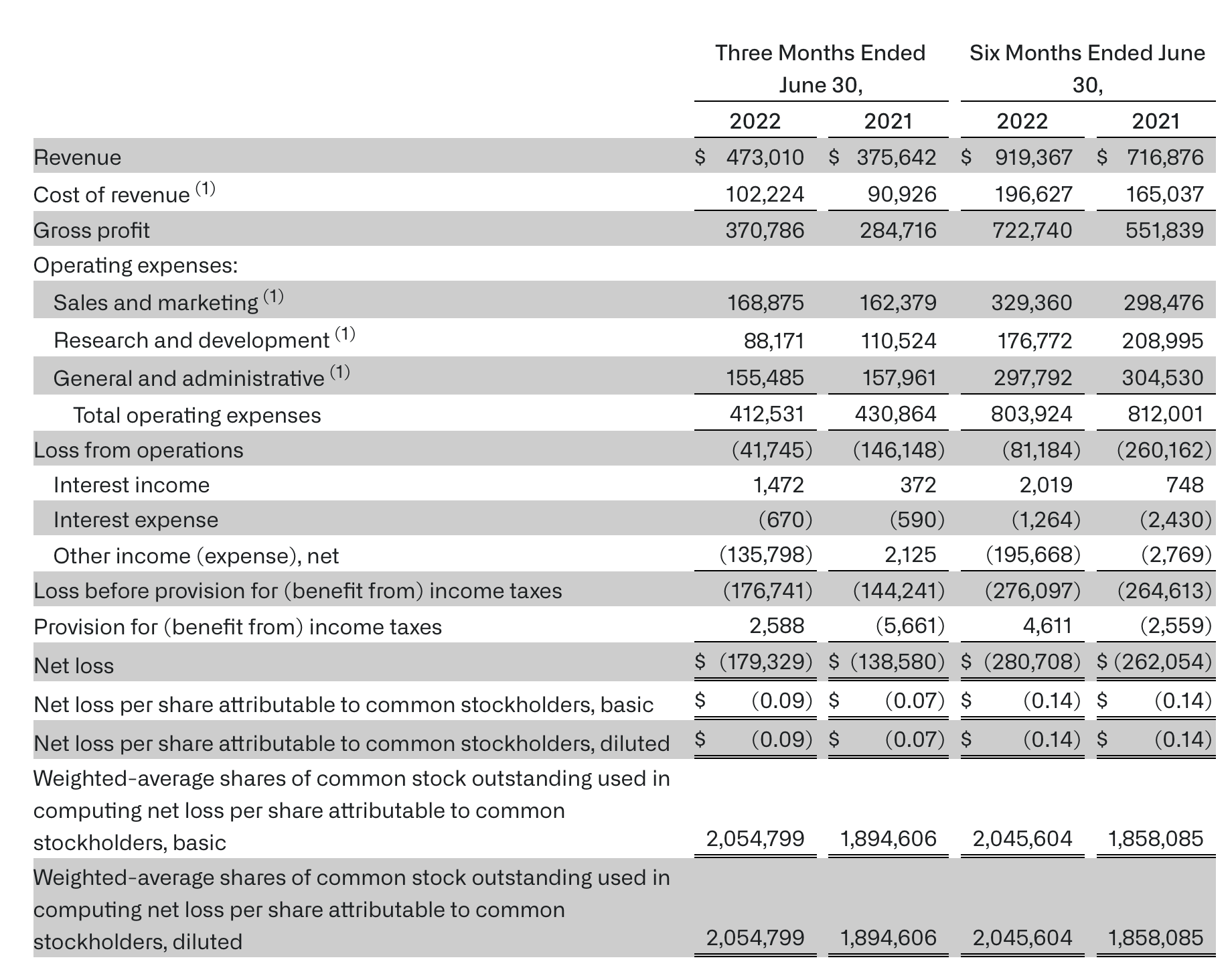

- Detailed analysis of Palantir's Q1 financial results: A thorough examination of the Q1 financial results reveals robust revenue growth, improved margins, and positive cash flow, all contributing to the positive investor sentiment surrounding Palantir stock.

- Comparison of Q1 performance with previous quarters and industry benchmarks: Comparing Q1 2024 performance against previous quarters and industry benchmarks showcases Palantir's accelerated growth and outperformance relative to competitors.

- Discussion of the factors influencing investor sentiment toward Palantir: Investor sentiment is influenced by factors including revenue growth, profitability, market share gains, and future growth prospects. The positive Q1 results have significantly bolstered investor confidence.

- Prediction of Palantir stock’s performance for the rest of the year, considering the performance of the government and commercial sectors: Forecasting future stock performance requires careful consideration of ongoing growth in both sectors and any potential market headwinds.

A summary of analyst ratings and recommendations.

Analyst ratings and recommendations provide valuable insight into the market's overall perception of Palantir's future prospects. A consensus of positive ratings often translates to increased investor interest and potential stock price appreciation.

Conclusion

Palantir's strong Q1 2024 performance was undeniably driven by robust growth in both its government and commercial sectors. Increased government contracts and the impressive expansion within the commercial market contributed significantly to the company's financial success and positive Palantir stock performance. This positive momentum suggests continued growth for the company.

Call to Action: Stay informed about the continued performance of Palantir stock by following our regular updates on Palantir's government and commercial sector progress and its impact on the company's overall financial health. Understand the key factors influencing Palantir stock performance and make informed investment decisions based on the company’s growth in both government and commercial sectors. Analyze Palantir's Q2 earnings to further gauge the company's ongoing progress.

Featured Posts

-

Wynne Evans Dropped From Go Compare Advert Following Strictly Scandal

May 09, 2025

Wynne Evans Dropped From Go Compare Advert Following Strictly Scandal

May 09, 2025 -

Expensive Babysitting Costs A Man 3 600 In Daycare Fees

May 09, 2025

Expensive Babysitting Costs A Man 3 600 In Daycare Fees

May 09, 2025 -

Wynne And Joannas Maritime Mishap All At Sea

May 09, 2025

Wynne And Joannas Maritime Mishap All At Sea

May 09, 2025 -

Champions League Semi Finals Barcelona Inter Arsenal Psg Dates

May 09, 2025

Champions League Semi Finals Barcelona Inter Arsenal Psg Dates

May 09, 2025 -

Participer A Une Collecte De Cheveux A Dijon

May 09, 2025

Participer A Une Collecte De Cheveux A Dijon

May 09, 2025