GPB Capital Founder David Gentile Convicted: Details Of The 7-Year Sentence

Table of Contents

Keywords: David Gentile, GPB Capital, 7-year sentence, conviction, fraud, investment fraud, securities fraud, prison sentence, financial crime, Gentile conviction details.

The founder of GPB Capital, David Gentile, has received a seven-year prison sentence, a significant outcome following his conviction on multiple charges of fraud. This extensive article delves into the specifics of the case, outlining the charges, the trial process, and the far-reaching implications of this legal decision for investors and the financial industry as a whole. The David Gentile conviction serves as a stark warning about the devastating consequences of financial crimes.

The Charges Against David Gentile

The indictment against David Gentile detailed a complex scheme involving multiple serious charges. These charges highlight the multifaceted nature of the alleged fraud perpetrated against investors.

Securities Fraud

The core of the case rested on allegations of securities fraud. Gentile was accused of systematically misleading investors about GPB Capital's financial health and the performance of its portfolio companies. This involved:

- Misrepresenting portfolio company performance: Gentile and his associates allegedly presented inflated performance figures to lure investors, concealing significant losses and operational difficulties within GPB Capital's various ventures.

- Inflating asset values: Court documents suggest that the value of GPB Capital's assets was artificially inflated to attract further investments, creating a false impression of the company's financial strength and stability.

- Omitting material information: Investors were reportedly not fully informed about crucial aspects of GPB Capital's operations, including significant risks and potential conflicts of interest.

Wire Fraud

The wire fraud charges stemmed from the use of interstate communication to facilitate the fraudulent scheme. This included:

- Deceptive email solicitations: Gentile and his associates allegedly used emails to solicit investments, employing misleading and false statements to entice potential investors.

- Facilitating fraudulent transactions across state lines: The use of wire transfers and electronic communications to move funds across state lines formed the basis of the wire fraud charges.

Conspiracy

Gentile was also charged with conspiracy, reflecting his alleged collaboration with others in perpetrating the fraudulent activities. While specifics regarding other individuals involved may still be under seal or subject to ongoing investigations, the conspiracy charge underscores the collaborative nature of the alleged scheme.

The Trial and Conviction

The trial involved a significant amount of evidence presented by the prosecution, leading to Gentile's ultimate conviction.

Key Evidence Presented

The prosecution's case relied heavily on:

- Testimony from former employees: Several former employees of GPB Capital provided firsthand accounts of the alleged fraudulent practices, detailing the inner workings of the scheme and Gentile's role in it.

- Forensic accounting reports: Independent forensic accountants presented detailed reports revealing significant discrepancies in GPB Capital's financial records, supporting the allegations of misrepresentation and fraud.

- Email correspondence: Emails exchanged between Gentile, his associates, and investors provided compelling evidence of the deceptive practices employed to solicit investments.

The Defense's Arguments

Gentile's defense team argued that any misrepresentations were unintentional or due to misunderstandings of complex financial information. They also challenged the credibility of some of the prosecution witnesses. However, these arguments were ultimately unsuccessful in swaying the jury.

The Verdict and Sentencing

The jury found David Gentile guilty on all counts. The judge sentenced him to seven years in prison, a significant punishment reflecting the severity of the crimes. Additional penalties, such as fines and restitution to victims, may also be imposed.

The Impact of the Conviction

The conviction of David Gentile carries significant implications for both investors and the financial industry as a whole.

Impact on Investors

The conviction brings a measure of justice to the investors who suffered significant financial losses due to GPB Capital's fraudulent activities. While the seven-year sentence won't necessarily restore their financial losses, it signals the legal system's commitment to holding perpetrators of investment fraud accountable. Victims may explore avenues for restitution through civil lawsuits or other legal mechanisms.

Impact on the Financial Industry

The Gentile conviction serves as a cautionary tale for the financial industry, highlighting the critical importance of regulatory compliance and robust investor protection measures. It underscores the need for increased transparency and accountability in investment management.

Future Legal Proceedings

The legal ramifications of the GPB Capital scandal may continue to unfold. Further investigations and potential lawsuits may be anticipated, impacting other individuals or entities associated with the firm.

Conclusion

The seven-year prison sentence handed down to David Gentile marks a significant conclusion to a major investment fraud case. The severity of the charges – including securities fraud, wire fraud, and conspiracy – underlines the масштаб of the alleged scheme and the damage inflicted on investors. The case serves as a powerful reminder of the importance of due diligence and the need for robust investor protection. Stay informed about the ongoing repercussions of the David Gentile case and learn how to protect your investments from similar fraudulent schemes. Learn more about protecting yourself from investment fraud by visiting [link to relevant resource].

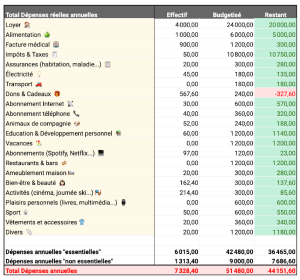

Economiser Planifier Un Budget Efficace

Economiser Planifier Un Budget Efficace

New Song Suggests Jessica Simpsons Marriage To Eric Johnson Faced Infidelity

New Song Suggests Jessica Simpsons Marriage To Eric Johnson Faced Infidelity

Premiera Jay Kelly I Nea Komodia Me Toys Tzortz Kloynei Kai Antam Santler

Premiera Jay Kelly I Nea Komodia Me Toys Tzortz Kloynei Kai Antam Santler

Tom Cruise Still Owes Tom Hanks 1 Will He Ever Pay Up

Tom Cruise Still Owes Tom Hanks 1 Will He Ever Pay Up

Henry Cavill In Talks For Marvels Nova Series Fact Or Fiction

Henry Cavill In Talks For Marvels Nova Series Fact Or Fiction