Grants And Loans For Eco-Friendly Small Businesses

Table of Contents

Government Grants for Eco-Friendly Businesses

Government grants for green businesses represent a significant opportunity for funding. Federal, state, and local governments offer numerous programs focused on environmental sustainability and green initiatives. These grants can provide crucial capital for your eco-friendly small business, helping you cover startup costs, expand operations, or implement innovative sustainable practices.

Overview of Funding Opportunities: Many government agencies dedicate resources to supporting environmentally conscious businesses. The specifics vary by location and agency. For instance, the Environmental Protection Agency (EPA) offers grants focused on pollution prevention and environmental technology. State-level departments of environmental protection often have their own grant programs catering to local green businesses. Municipalities frequently offer incentives and grants to promote sustainable practices within their communities.

Examples of Specific Grant Programs: (Note: Links to specific grant programs would be included here, but since this is a text-based response, I can't provide live links. You would need to research current programs offered by agencies such as the EPA, SBA, and your state/local government.) These programs often focus on areas like renewable energy, waste reduction, sustainable agriculture, and green building technologies.

Eligibility Criteria: Eligibility criteria vary widely depending on the specific grant. Common requirements include:

- Business type (e.g., sole proprietorship, LLC, corporation)

- Location (often limited to specific states, regions, or municipalities)

- Revenue (often capped at a certain level)

- Demonstrated environmental impact (evidence of sustainable practices and positive environmental contribution)

Tips for Writing a Compelling Grant Application:

- Clearly articulate your business's mission and its environmental impact.

- Develop a detailed and realistic budget.

- Provide strong financial projections showcasing the potential for growth and sustainability.

- Highlight your team's expertise and experience in the relevant field.

- Submit a professional and well-written application, free of grammatical errors.

Key Requirements for Grant Applications:

- Comprehensive business plan

- Detailed financial projections (income statements, cash flow projections)

- Environmental impact assessment demonstrating the positive environmental effects of your business.

Loans Specifically Designed for Green Businesses

Beyond grants, securing loans specifically designed for green businesses provides another crucial funding avenue. Many financial institutions recognize the growing importance of sustainable businesses and offer specialized loan programs with favorable terms.

Specialized Loan Programs: Banks and credit unions increasingly offer loans tailored to the needs of eco-friendly businesses. These programs often come with lower interest rates or more flexible repayment terms compared to traditional small business loans.

SBA Green Loans: The Small Business Administration (SBA) plays a significant role in supporting small businesses, including those with a focus on sustainability. They offer loan programs that can be utilized for green initiatives, often offering favorable terms and lower interest rates. (Again, a link to the SBA website's relevant section would be included here in a live article).

Advantages and Disadvantages of Different Loan Types:

- Term Loans: Offer a fixed amount of money for a specific purpose with a set repayment schedule. Advantages: Predictable payments. Disadvantages: Can be inflexible if your needs change.

- Lines of Credit: Allow you to borrow money as needed up to a pre-approved limit. Advantages: Flexibility. Disadvantages: Interest rates can fluctuate.

Typical Interest Rates and Repayment Terms: Interest rates and repayment terms vary significantly depending on the lender, the loan amount, and your creditworthiness. It's crucial to compare offers from multiple lenders before committing to a loan.

Lenders Known for Supporting Green Initiatives: (A list of lenders with a proven track record of supporting green businesses would be included here. This would require up-to-date research.)

Impact Investing and Venture Capital for Eco-Friendly Startups

For eco-friendly startups, impact investing and venture capital represent powerful alternative funding sources. Impact investors prioritize both financial returns and positive social and environmental impact. Venture capitalists with a focus on sustainability are increasingly investing in promising green businesses.

Securing Funding from Impact Investors: Impact investors typically look for businesses with a strong social or environmental mission, a scalable business model, and a strong management team. The due diligence process is thorough, often involving detailed assessments of the business's environmental and social impact.

Benefits and Challenges:

- Benefits: Access to significant capital, strategic guidance from experienced investors, and enhanced credibility within the sustainable business community.

- Challenges: Higher scrutiny of your business model and environmental impact, potential for loss of control over certain aspects of your business.

Examples of Firms Focused on Impact Investing in Green Technologies: (A list of example firms would be placed here, requiring ongoing research to stay current.)

Finding and Applying for Grants and Loans

Finding the right funding for your eco-friendly small business requires a strategic approach. Utilizing available resources and understanding the application process are key to success.

Resources for Researching Funding Opportunities:

- Government websites (EPA, SBA, state and local government agencies)

- Online databases specializing in green business funding

- Business incubators and accelerators focused on sustainability

- Networking within the green business community

Strategies for Identifying Matching Grants and Loans:

- Clearly define your business needs and funding requirements.

- Research grants and loans relevant to your industry and geographic location.

- Carefully review eligibility criteria before applying.

Step-by-Step Guide to the Application Process:

- Gather all required documentation (business plan, financial statements, environmental impact assessment, etc.)

- Complete the application form thoroughly and accurately.

- Submit your application by the deadline.

- Follow up with the funding organization as needed.

Tips for Increasing Your Chances of Approval:

- Prepare a high-quality business plan.

- Present a clear and compelling case for your business's environmental impact.

- Demonstrate your financial viability and management expertise.

- Submit a well-written and error-free application.

Useful Resources:

- SBA Website (link would be included here)

- (Links to other relevant government agencies and online databases would be included here)

Conclusion

Securing funding is paramount for the success of any eco-friendly small business. This article has highlighted various avenues for obtaining grants and loans, including government programs, specialized lenders, and impact investors. By understanding the eligibility requirements and application processes, you can significantly increase your chances of obtaining the necessary financial support. Don't underestimate the power of strategic planning and thorough application preparation.

Call to Action: Start your search for grants and loans for your eco-friendly small business today! Explore the resources mentioned above and begin building a sustainable and financially successful future. Don't let funding limitations hinder your green initiative – find the right funding and grow your eco-friendly business!

Featured Posts

-

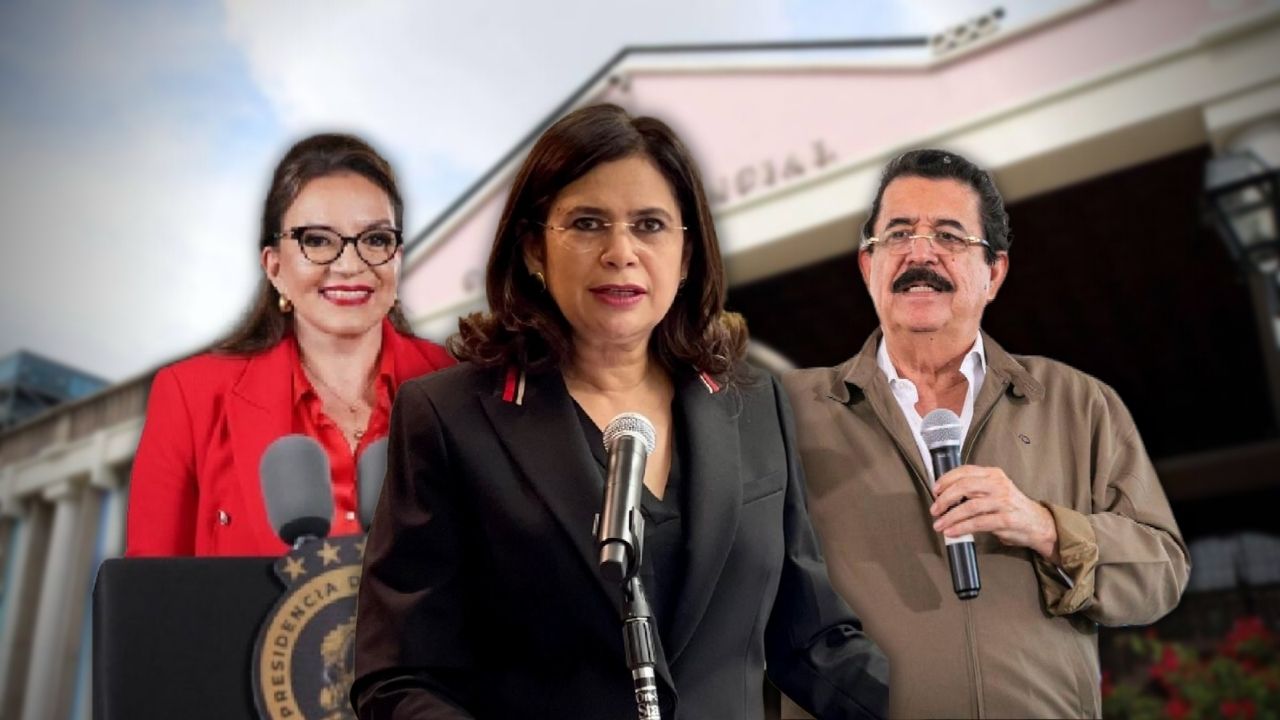

Debate Acalorado Rixi Moncada Y Cossette Lopez Expresan Posturas Opuestas

May 19, 2025

Debate Acalorado Rixi Moncada Y Cossette Lopez Expresan Posturas Opuestas

May 19, 2025 -

Reaccion De Alfonso Arus A La Eleccion De Melody Para Eurovision 2025 En Arusero

May 19, 2025

Reaccion De Alfonso Arus A La Eleccion De Melody Para Eurovision 2025 En Arusero

May 19, 2025 -

Arus No Se Muerde La Lengua Su Opinion Sobre Melody Como Representante De Espana En Eurovision 2025

May 19, 2025

Arus No Se Muerde La Lengua Su Opinion Sobre Melody Como Representante De Espana En Eurovision 2025

May 19, 2025 -

Eurovision 2025 Austrias Jj Takes Victory With Wasted Love

May 19, 2025

Eurovision 2025 Austrias Jj Takes Victory With Wasted Love

May 19, 2025 -

Trump Administrations Impact On Library Funding And Staffing

May 19, 2025

Trump Administrations Impact On Library Funding And Staffing

May 19, 2025