Grayscale's XRP ETF Filing: Impact On XRP Price And Market Dominance Over Bitcoin

Table of Contents

Potential Impact of Grayscale's XRP ETF Filing on XRP Price

The approval of Grayscale's XRP ETF could trigger a seismic shift in the XRP market, primarily due to several key factors:

Increased Institutional Investment: An ETF listing provides a regulated and easily accessible entry point for institutional investors – hedge funds, pension funds, and other large financial institutions – who may have previously been hesitant to directly invest in cryptocurrencies. This influx of capital could dramatically increase demand, driving up the XRP price.

- Examples: BlackRock, Fidelity, and other major players could significantly increase their XRP holdings through an ETF.

- Historical precedent: The launch of Bitcoin ETFs has historically led to significant price increases in Bitcoin. Similar effects are anticipated for XRP.

- Price Projections: While precise predictions are impossible, analysts suggest a substantial price increase is highly probable, potentially reaching double or triple digits depending on market conditions and overall adoption.

Increased Liquidity and Trading Volume: Currently, XRP trading volume, while substantial, is not as high as Bitcoin's. An ETF would dramatically increase liquidity by making XRP more accessible to a wider range of investors through traditional brokerage platforms.

- Pre- and Post-ETF Volume: A comparison of XRP trading volumes before and after the potential ETF approval would showcase a significant increase, potentially mirroring the impact seen with other crypto ETFs.

- Impact on Volatility: While increased volume can initially increase volatility, long-term, it generally leads to greater price stability due to increased market depth.

Regulatory Certainty and Market Sentiment: SEC approval of Grayscale's XRP ETF would be a significant endorsement, signaling regulatory acceptance of XRP and boosting market confidence. This positive sentiment could further propel XRP's price.

- Current Regulatory Landscape: The regulatory uncertainty surrounding cryptocurrencies has often been a deterrent for institutional investment. ETF approval would alleviate much of this uncertainty.

- SEC Decisions and Market Sentiment: Past SEC decisions have had a significant impact on the cryptocurrency market, demonstrating the authority's influence on investor sentiment.

- Past ETF Approvals: Examining the positive market responses following previous ETF approvals in other asset classes provides a valuable insight into the potential impact on XRP.

Grayscale's XRP ETF Filing and Bitcoin's Market Dominance

The success of Grayscale's XRP ETF could have profound implications for Bitcoin's dominance in the cryptocurrency market:

XRP's Potential to Gain Market Share: Increased institutional investment and improved liquidity could allow XRP to significantly increase its market capitalization, potentially eating into Bitcoin's market share.

- Current Market Capitalization: A comparison of XRP's and Bitcoin's current market caps highlights the potential for significant growth for XRP.

- Market Share Shift Scenarios: Several scenarios, ranging from moderate to significant market share gains for XRP, are possible depending on several factors, including overall market sentiment and technological developments.

- Factors Contributing to XRP's Growth: XRP's speed, low transaction fees, and focus on cross-border payments are key factors contributing to its potential for growth.

Competition and Innovation in the Crypto Market: The increased attention and investment in XRP, fueled by the ETF, could stimulate innovation and competition within the broader crypto ecosystem.

- Innovative Projects Using XRP: Highlighting projects utilizing XRP's capabilities, such as RippleNet, showcases the technology's versatility and potential for future applications.

- Technological Comparison: Comparing XRP's technology to Bitcoin's reveals different strengths and weaknesses, illustrating how both cryptocurrencies can co-exist and contribute to the broader ecosystem.

- Multi-Currency Crypto Ecosystem: The emergence of a multi-currency ecosystem where different cryptocurrencies cater to various needs is a likely outcome, with XRP and Bitcoin potentially playing significant roles.

Risks and Challenges: It's crucial to acknowledge potential risks. SEC rejection, ongoing market volatility, and competition from other cryptocurrencies could hinder XRP's growth.

- Negative Scenarios: Explore potential negative outcomes, such as SEC rejection, a prolonged bear market, or the emergence of a more competitive cryptocurrency.

- Risk Mitigation Strategies: Discuss how potential risks can be mitigated, focusing on diversification and careful risk management strategies.

- Factors Hindering XRP's Growth: Identify potential obstacles, such as regulatory hurdles in specific jurisdictions, and technological limitations.

Conclusion:

Grayscale's XRP ETF filing presents a significant opportunity for XRP, potentially boosting its price substantially and challenging Bitcoin's market dominance. The potential for increased institutional investment, higher liquidity, and improved market sentiment are all compelling reasons for optimism. However, it's essential to acknowledge the inherent risks. The outcome will depend significantly on SEC approval and overall market conditions. Stay updated on Grayscale's XRP ETF filing and its potential effects on the cryptocurrency market. Follow the developments around Grayscale's XRP ETF to make informed investment decisions. Learn more about the potential impact of Grayscale's XRP ETF filing on your investments. The implications of Grayscale's XRP ETF filing are far-reaching and deserve close monitoring.

Featured Posts

-

Analiza Konklawe Wg Ks Sliwinskiego Rola Mediow I Wybor Papieza

May 07, 2025

Analiza Konklawe Wg Ks Sliwinskiego Rola Mediow I Wybor Papieza

May 07, 2025 -

Sondaz Zaufanie Polakow Do Dzialan Trumpa Wobec Ukrainy Wyniki Zaskakuja

May 07, 2025

Sondaz Zaufanie Polakow Do Dzialan Trumpa Wobec Ukrainy Wyniki Zaskakuja

May 07, 2025 -

Keanu Reeves On John Wick 5 The Latest News And Updates

May 07, 2025

Keanu Reeves On John Wick 5 The Latest News And Updates

May 07, 2025 -

Celtics Collapse 4 Key Takeaways From Cavs Upset

May 07, 2025

Celtics Collapse 4 Key Takeaways From Cavs Upset

May 07, 2025 -

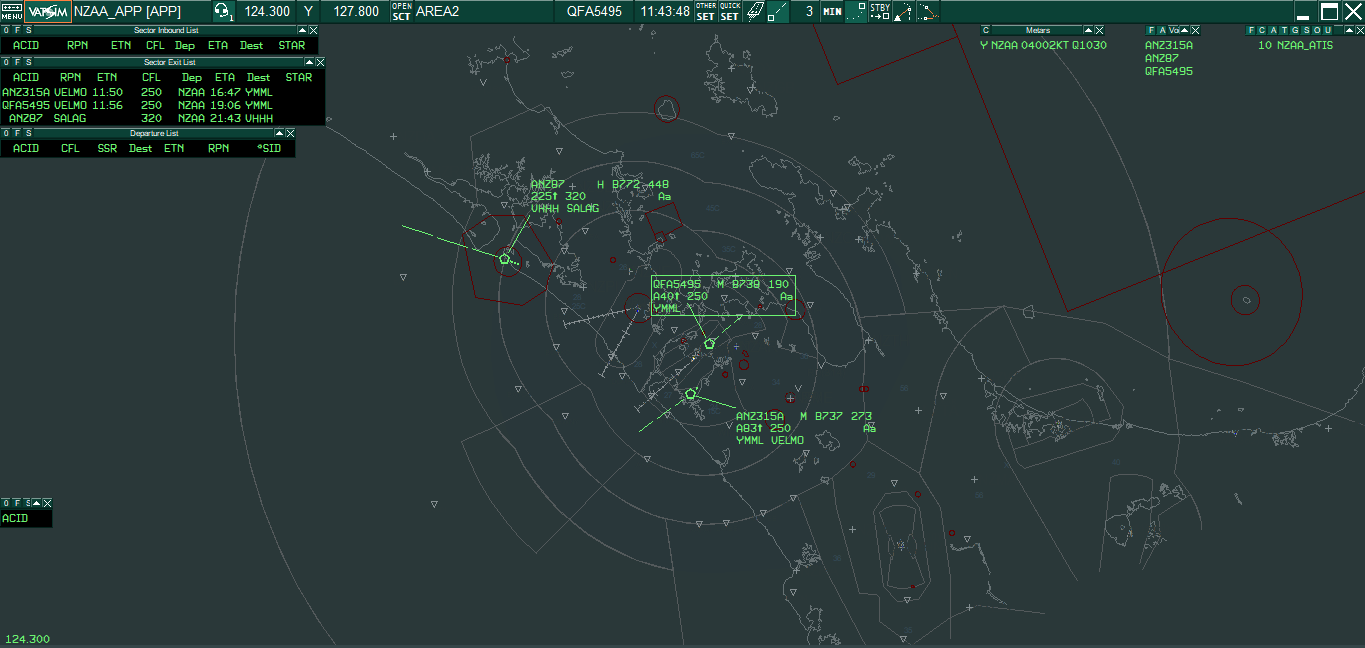

Improving Air Traffic Control Overcoming The I Dont Know Where You Are Challenge

May 07, 2025

Improving Air Traffic Control Overcoming The I Dont Know Where You Are Challenge

May 07, 2025