Grayscale's XRP ETF Filing: Impact On XRP Price And Potential Record High

Table of Contents

Understanding Grayscale's XRP ETF Filing

An ETF, or Exchange-Traded Fund, is an investment fund traded on stock exchanges, much like stocks. ETFs offer investors diversified exposure to an underlying asset class, in this case, XRP. Their significance lies in providing easier access and increased liquidity compared to directly investing in the cryptocurrency itself. Grayscale, a prominent digital currency asset manager, has a history of successfully launching Bitcoin and Ethereum investment products, significantly influencing the crypto space's institutional adoption. Their XRP ETF filing represents a significant step toward bringing XRP to a wider, more mainstream audience. This filing entails navigating complex regulatory hurdles, primarily with the Securities and Exchange Commission (SEC), and involves a potentially lengthy approval process.

-

Potential Benefits of an XRP ETF:

- Increased liquidity: Easier buying and selling of XRP.

- Accessibility: Opens XRP investment to a broader range of investors, including institutional investors.

- Regulatory Compliance: Provides a regulated framework for XRP investment.

-

Challenges and Regulatory Uncertainties:

- SEC approval: The SEC's stance on crypto ETFs is crucial for approval. Past rejections of similar filings highlight the regulatory uncertainty.

- Market Volatility: The inherent volatility of the cryptocurrency market poses a challenge.

- Regulatory Scrutiny: XRP itself has faced regulatory scrutiny, potentially impacting the ETF application.

Potential Impact on XRP Price

Historically, ETF approvals have often correlated with significant price increases in the underlying asset. The approval of an XRP ETF could trigger a surge in demand, leading to increased trading volume and potentially pushing the XRP price significantly higher. Several price scenarios are possible:

-

Conservative Prediction: A moderate increase reflecting gradual institutional adoption.

-

Moderate Prediction: A substantial price jump fueled by increased investor interest and trading volume.

-

Optimistic Prediction: A dramatic price surge, potentially reaching levels unseen before.

-

Factors Driving XRP Price Up:

- Increased institutional investment: Large-scale investments by institutions would boost demand.

- Increased adoption: Wider acceptance by businesses and individuals for payments and other uses.

-

Factors Limiting Price Increases:

- Regulatory uncertainty: Rejection or delays by the SEC could dampen investor enthusiasm.

- Market volatility: Broader market downturns could impact XRP's price regardless of the ETF.

- Competition: The presence of other cryptocurrencies could limit XRP's price appreciation.

Reaching a Record High: Is it Possible?

XRP has experienced significant price fluctuations throughout its history. To reach a new all-time high, several factors would need to align: a positive regulatory environment, widespread adoption of XRP, and continued technological advancements within the XRP Ledger. This scenario is possible but not guaranteed.

-

Potential Catalysts for a Record High:

- Positive regulatory news: Favorable SEC rulings or other regulatory approvals.

- Widespread adoption: Increased usage of XRP in cross-border payments and other applications.

- Technological advancements: Improvements to the XRP Ledger's speed, scalability, and efficiency.

-

Challenges Preventing a Record High:

- Market downturns: A broader crypto market crash could significantly impact XRP's price.

- Negative news: Negative publicity or legal challenges could harm investor confidence.

- Competition: Strong competition from other cryptocurrencies could limit XRP's growth.

Investing in XRP and Managing Risk

Investing in cryptocurrencies like XRP carries significant risk. Price volatility is inherent, and losses can be substantial. Responsible investment strategies are crucial:

-

Mitigating Investment Risk:

- Diversification: Spreading investments across various assets to reduce risk.

- Dollar-cost averaging: Investing a fixed amount regularly regardless of price fluctuations.

-

Due Diligence:

- Thorough research: Understanding XRP's technology, market position, and regulatory landscape.

- Staying updated on market trends: Monitoring news and market analysis to make informed decisions.

- Consulting with a financial advisor: Seeking professional guidance before making significant investments.

Conclusion:

Grayscale's XRP ETF filing is a monumental event with the potential to significantly impact the XRP market. While regulatory hurdles remain, the possibility of a substantial price increase, potentially reaching a record high, is real. Thorough due diligence and a responsible approach to investment are crucial. Stay informed about the latest developments concerning the XRP ETF and its implications. Continue researching and learning more about the XRP ETF to make informed investment decisions.

Featured Posts

-

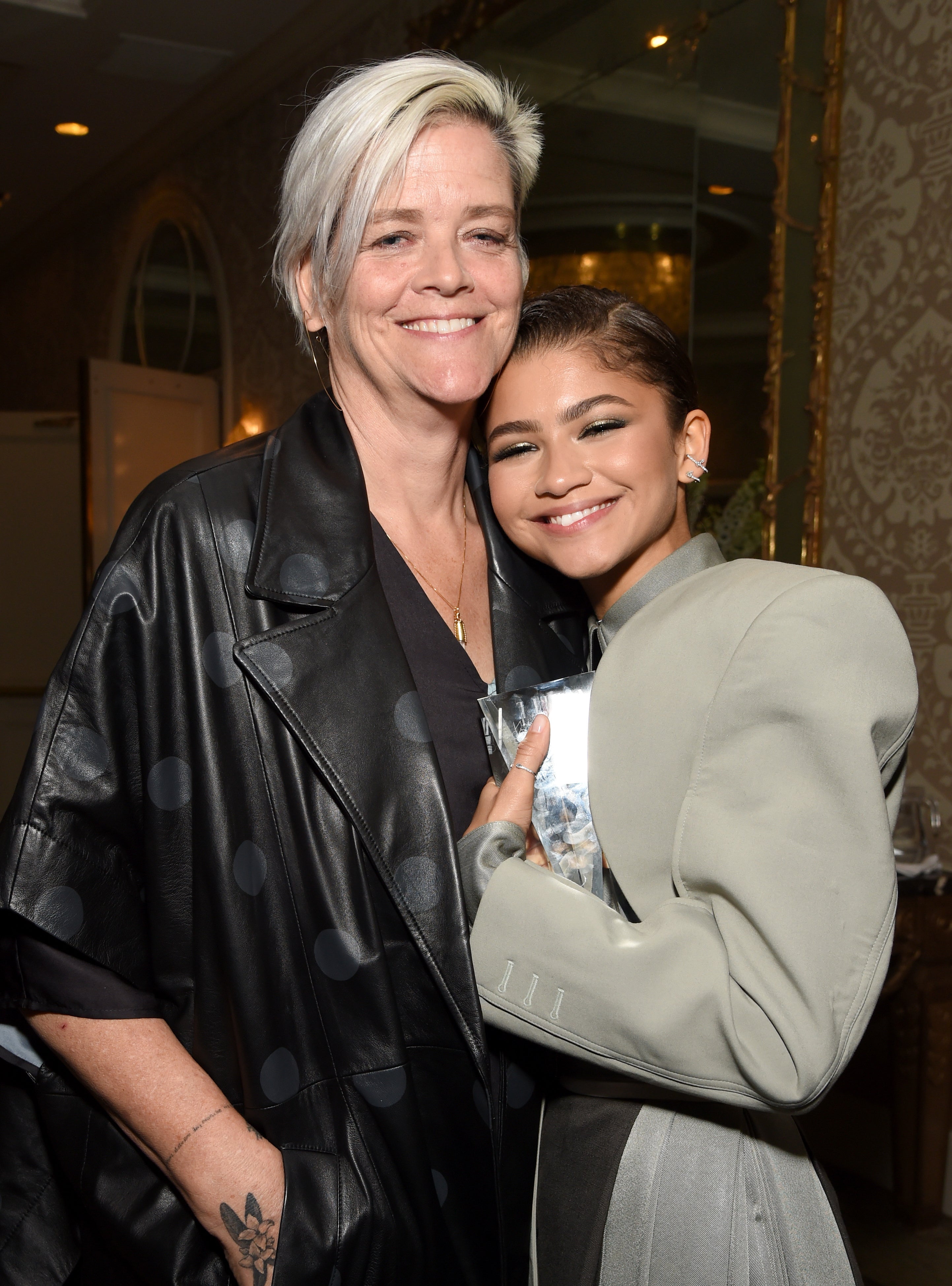

The Breadwinner Zendaya Balancing Career And Family Ties

May 07, 2025

The Breadwinner Zendaya Balancing Career And Family Ties

May 07, 2025 -

Analysis The Carney Trump White House Encounter And Its Implications

May 07, 2025

Analysis The Carney Trump White House Encounter And Its Implications

May 07, 2025 -

Steelers Face Losing George Pickens Before 2026 Insider Report

May 07, 2025

Steelers Face Losing George Pickens Before 2026 Insider Report

May 07, 2025 -

A Caveat To Randles Season Positive Implications For The Timberwolves

May 07, 2025

A Caveat To Randles Season Positive Implications For The Timberwolves

May 07, 2025 -

John Wick 5 Forget The High Table A More Grounded Mission

May 07, 2025

John Wick 5 Forget The High Table A More Grounded Mission

May 07, 2025