Grim Retail Sales: A Sign Of Rate Cuts To Come?

Table of Contents

Declining Consumer Spending: A Deeper Dive into Grim Retail Sales Figures

The most recent data reveals a concerning trend. Retail sales experienced a [insert specific percentage]% decline in [Month, Year], compared to [previous period – e.g., the same month last year or the previous quarter]. This represents a [description of the decline - e.g., sharper than expected drop, the worst performance in X years]. The impact wasn't evenly distributed; specific sectors suffered disproportionately. For instance, the clothing sector saw a [percentage]% drop, while electronics sales fell by [percentage]%.

- Specific percentage decline in retail sales: [Insert precise figure and source].

- Comparison to previous year's figures: [Insert comparative data and source].

- Specific geographical areas most impacted: [Mention regions with the most significant declines and any regional disparities].

- Highlight any surprising data points: [Mention any unexpected trends or anomalies in the data].

Several factors likely contributed to this downturn. Persistently high inflation continues to erode purchasing power, leaving consumers with less disposable income. The previous cycle of interest rate hikes has also likely dampened consumer confidence, making people more hesitant to spend. The combination of these factors is creating a perfect storm for weak retail sales.

The Correlation Between Retail Sales and Interest Rate Decisions

Retail sales figures are a crucial economic indicator, closely monitored by central banks worldwide. Consumer spending accounts for a significant portion of GDP, making it a reliable gauge of overall economic health. Weak retail sales often signal a slowing economy, prompting central banks to consider monetary policy adjustments, such as interest rate cuts. These cuts aim to stimulate economic activity by making borrowing cheaper and encouraging investment and spending.

- Historical examples of rate cuts following periods of weak retail sales: [Provide specific historical examples and links to supporting data].

- Explain the mechanisms by which rate cuts stimulate the economy: [Explain how lower interest rates impact borrowing, investment, and consumer spending].

- Mention the potential risks of rate cuts (e.g., inflation): [Discuss the potential downsides of rate cuts, particularly the risk of exacerbating inflation].

Historically, there's a demonstrable correlation between sustained periods of grim retail sales and subsequent interest rate cuts. However, this is not an automatic response; central banks consider various factors before making such decisions.

Alternative Explanations for Grim Retail Sales – Beyond Rate Cuts

While weakening economic conditions are a significant contributor to the current grim retail sales figures, it's important to consider other factors. These include:

- Supply chain disruptions: Lingering supply chain issues continue to impact the availability and pricing of goods.

- Changes in consumer behavior (e.g., shift to services): Consumers may be shifting spending from goods to services, impacting retail sales figures.

- Geopolitical factors: Global events, such as the war in Ukraine, can significantly impact consumer confidence and spending.

- Seasonal factors: Some declines might be attributed to seasonal variations in consumer spending.

Attributing the decline solely to a slowing economy might be an oversimplification; a holistic view of all contributing factors is necessary.

What to Expect: Predictions and Market Outlook Following Grim Retail Sales

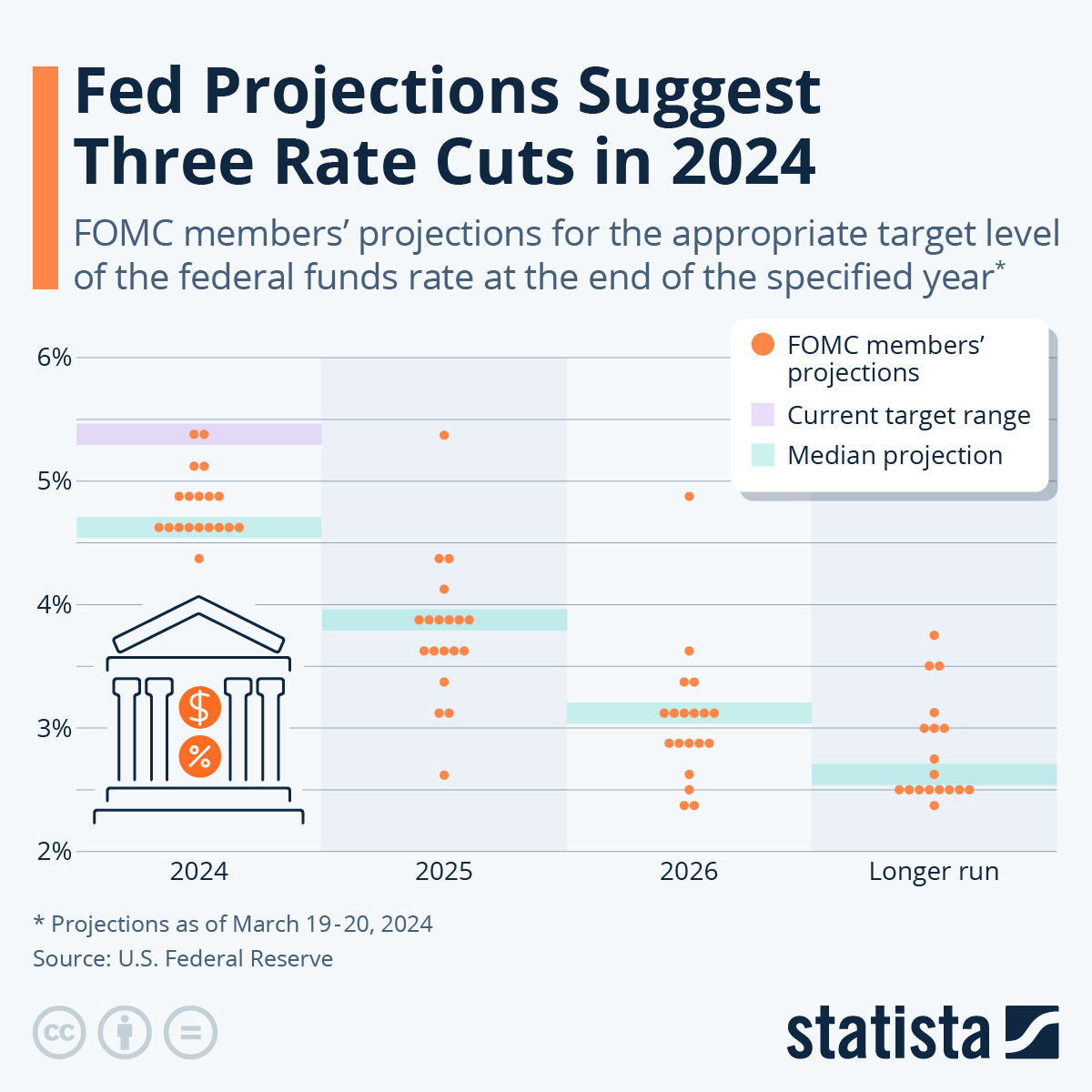

Predicting the future is inherently uncertain, but based on current trends, several scenarios are plausible. Analysts are divided on the likelihood of near-term rate cuts. Some predict that central banks will remain cautious, prioritizing inflation control. Others believe that the grim retail sales figures, coupled with other weakening economic indicators, will pressure central banks to ease monetary policy, potentially leading to rate cuts in the coming months.

- Analyst predictions for future rate cuts: [Summarize predictions from reputable sources].

- Potential impact on inflation: [Discuss the potential impact of rate cuts or a lack thereof on inflation].

- Potential impact on stock market: [Discuss how the situation might affect stock market performance].

- Potential impact on unemployment: [Analyze the potential impact on employment figures].

The impact of these grim retail sales figures will likely ripple through the economy, affecting various sectors and influencing investor sentiment.

Conclusion: Grim Retail Sales and the Probability of Rate Cuts – A Call to Action

The current grim retail sales figures present a complex economic picture. While a strong correlation exists between weak retail sales and subsequent interest rate cuts historically, other factors significantly influence central bank decisions. Understanding these interwoven factors is crucial for navigating the current market uncertainty. Whether or not central banks respond with rate cuts will depend on a careful assessment of inflation, employment, and overall economic health.

Stay informed about the evolving economic landscape and the impact of grim retail sales on interest rate decisions. Follow [your website/publication] for the latest updates and analysis on this critical economic indicator, including further insights into weak retail sales and declining consumer spending in the slowing retail sector.

Featured Posts

-

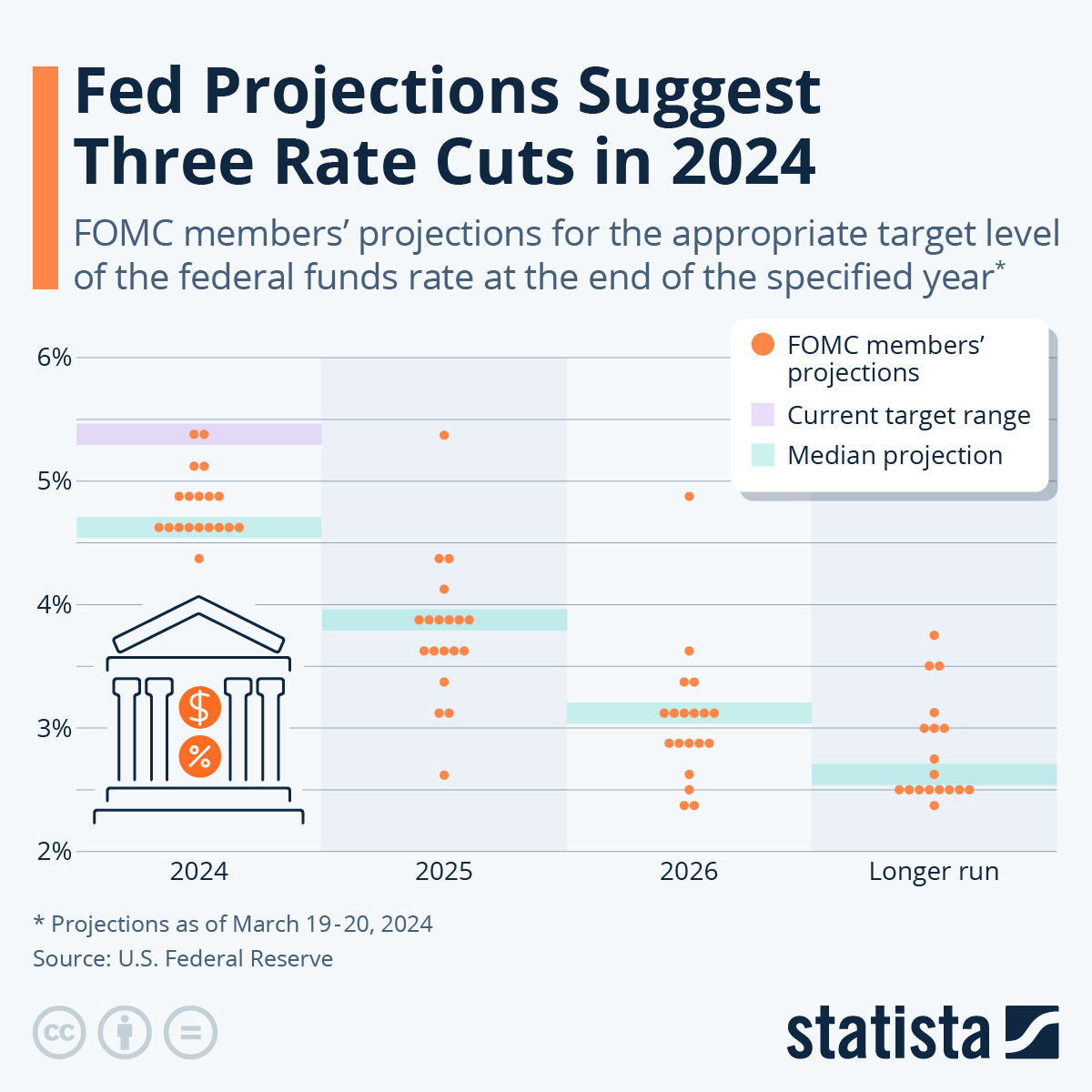

Nascar Jack Link 500 Props And Best Bets Talladega Superspeedway 2025 Predictions

Apr 28, 2025

Nascar Jack Link 500 Props And Best Bets Talladega Superspeedway 2025 Predictions

Apr 28, 2025 -

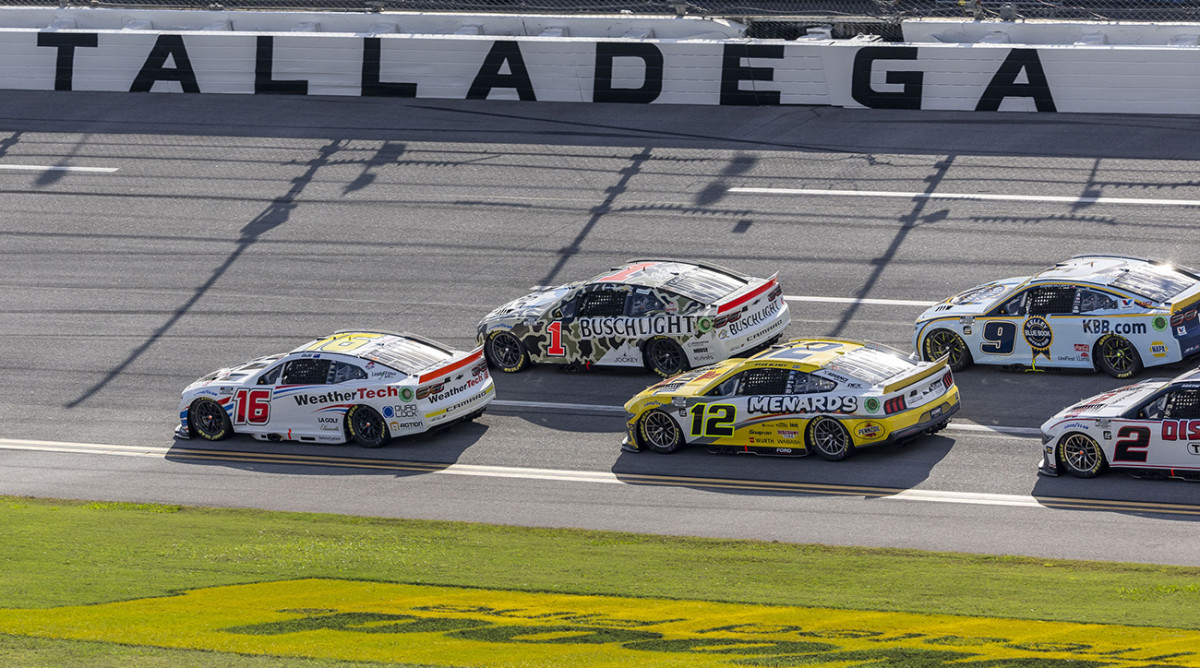

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025

Court Rules On E Bays Liability For Banned Chemicals Under Section 230

Apr 28, 2025 -

Espns Jefferson Decision Jj Redicks Response

Apr 28, 2025

Espns Jefferson Decision Jj Redicks Response

Apr 28, 2025 -

Red Sox 2025 Espns Unexpected Prediction

Apr 28, 2025

Red Sox 2025 Espns Unexpected Prediction

Apr 28, 2025 -

Investigation Reveals Lingering Toxic Chemicals From Ohio Train Derailment

Apr 28, 2025

Investigation Reveals Lingering Toxic Chemicals From Ohio Train Derailment

Apr 28, 2025