Harvard And Yale: House Plan Slams Elite Universities With Higher Endowment Taxes

Table of Contents

The Proposed House Plan: Details and Objectives

The proposed House plan targets universities with endowments exceeding a certain threshold (the exact figure is still under debate). It proposes a tiered tax system, with higher tax rates applied to endowments surpassing progressively larger amounts. The stated objectives of this legislation are multifaceted, primarily focusing on:

- Increased Funding for Public Education: Proponents argue that taxing large university endowments could generate substantial revenue to be redirected towards underfunded public schools and colleges, leveling the playing field for students from less privileged backgrounds.

- Addressing Wealth Inequality: The plan aims to tackle the growing disparity between the wealthiest universities and under-resourced public institutions. It seeks to redistribute some of the immense wealth accumulated by elite universities to address societal inequalities.

Key provisions of the proposed plan include:

- A progressive tax rate, starting at a certain percentage for endowments above a specified threshold and increasing for larger endowments.

- Potential exemptions or reduced rates for endowments dedicated to specific research initiatives or scholarships.

- Dedicated funding streams for public education initiatives, ensuring transparency in the utilization of collected revenue.

Impact on Harvard and Yale's Financial Resources

The financial impact of the House plan on Harvard and Yale would be substantial. Both universities rely heavily on their endowments for operating budgets, financial aid, research initiatives, and campus infrastructure improvements. A significant endowment tax could drastically alter their financial landscape.

- Financial Aid: Reduced endowment income could directly impact financial aid programs, potentially limiting access to higher education for low-income students.

- Research Initiatives: Funding for cutting-edge research projects and faculty salaries could be severely curtailed, hindering scientific advancements and academic excellence.

- Campus Infrastructure: Deferred maintenance or cancelled improvement projects could affect the quality of the learning environment.

Considering the size of their endowments, even a relatively modest tax rate could translate into billions of dollars in lost revenue annually. This would necessitate significant budgetary adjustments and potentially lead to difficult choices regarding resource allocation.

Arguments For and Against the House Plan

The proposed House plan on endowment taxation has generated a polarized debate, with strong arguments on both sides.

Proponents' Arguments

Supporters of the plan emphasize the moral imperative of addressing wealth inequality in higher education. They argue that:

- Taxing large endowments is a fair way to redistribute wealth and increase funding for public institutions that serve a broader population.

- It promotes fairer access to higher education, leveling the playing field for students regardless of their socioeconomic background.

- The revenue generated can be used to improve the quality of education at all levels.

Opponents' Arguments

Opponents raise concerns about the potential negative ramifications of the plan, arguing that:

- It could severely hamper research and educational programs at elite universities, impacting innovation and scholarship.

- It might discourage private philanthropy, reducing future donations and impacting long-term financial stability.

- It might have unintended consequences for the broader economy, potentially affecting investment strategies and job creation.

Potential Alternatives and Long-Term Implications

Several alternative approaches exist to address wealth inequality in higher education without resorting to potentially detrimental endowment taxes. These include:

- Increased government funding for public colleges and universities.

- Targeted grants and scholarships for underprivileged students.

- Incentivizing universities to increase transparency and accountability in their endowment management.

The long-term implications of the House plan remain uncertain. However, it could significantly alter the landscape of higher education, potentially impacting fundraising, research output, and the overall accessibility of elite universities. The impact on charitable giving and the future relationship between universities and private philanthropy deserves careful consideration.

The Future of Endowment Taxation for Harvard, Yale, and Beyond

This analysis reveals the complex implications of the proposed House plan on endowment taxation. Its provisions, potential impact on institutions like Harvard and Yale, and the arguments surrounding its implementation highlight a critical discussion about higher education funding and wealth inequality. The future of endowment tax reform will undoubtedly shape the accessibility, affordability, and research capacity of universities for decades to come. We urge readers to research the House plan further, engage in informed discussions, and contact their representatives to voice their opinions on endowment taxation and its effects on institutions like Harvard and Yale. Understanding the impact of endowment taxes on Ivy League universities and the broader higher education landscape is crucial for shaping responsible policy decisions.

Featured Posts

-

Buduschee Bezopasnosti Velikobritaniya I Es Za Stolom Peregovorov

May 13, 2025

Buduschee Bezopasnosti Velikobritaniya I Es Za Stolom Peregovorov

May 13, 2025 -

Islanders Claim First Overall Pick In Nhl Draft Lottery

May 13, 2025

Islanders Claim First Overall Pick In Nhl Draft Lottery

May 13, 2025 -

Natural Fiber Composites Market 2029 Global Market Size Share And Forecast

May 13, 2025

Natural Fiber Composites Market 2029 Global Market Size Share And Forecast

May 13, 2025 -

Negociations Gibraltar Ue Un Accord Post Brexit Tres Proche

May 13, 2025

Negociations Gibraltar Ue Un Accord Post Brexit Tres Proche

May 13, 2025 -

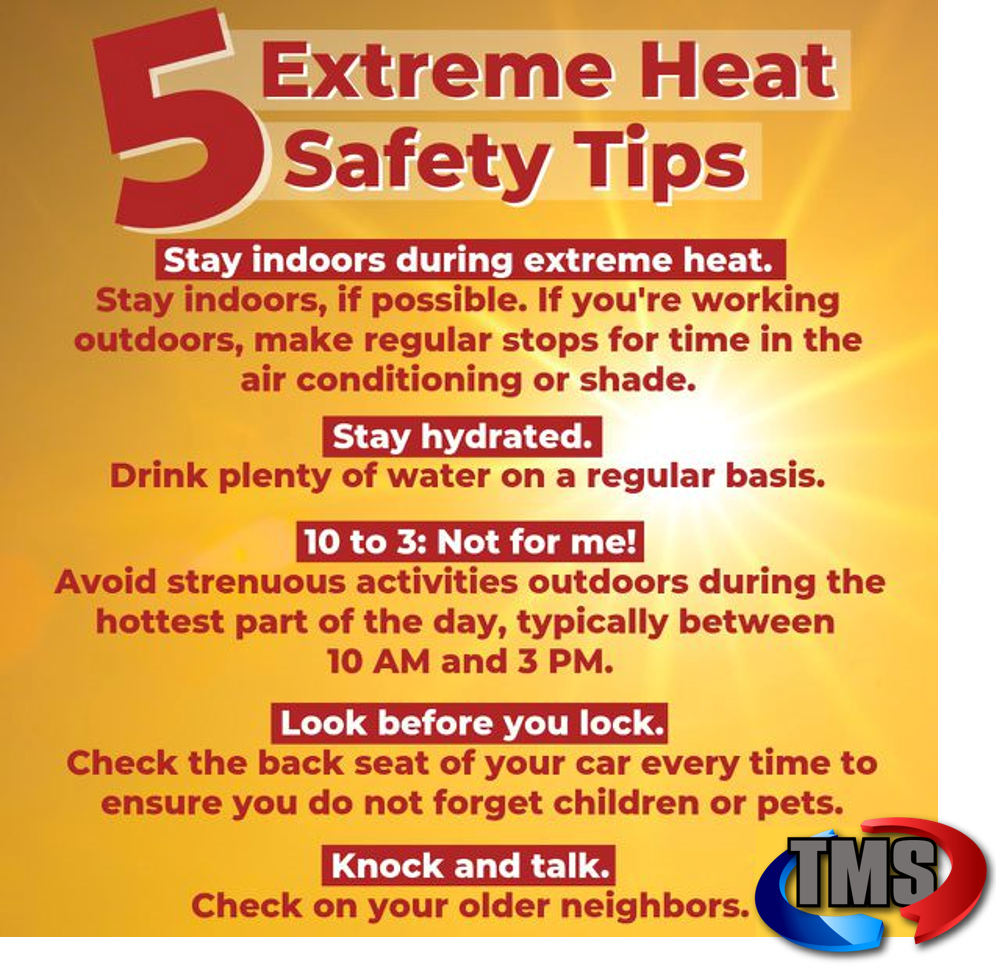

Health Advisory Issued Stay Safe During Extreme Heat

May 13, 2025

Health Advisory Issued Stay Safe During Extreme Heat

May 13, 2025