Hengrui Pharma Receives Green Light For Hong Kong Share Sale

Table of Contents

Details of the Hong Kong Share Sale

The Hengrui Pharma Hong Kong share sale represents a substantial offering, poised to inject significant capital into the company. While precise details may still be emerging, key aspects of the share sale are anticipated to include:

- Total shares offered: [Number - Replace with actual number once available]

- Expected price range: [Price Range - Replace with actual price range once available]

- Underwriters: [List Underwriters - Replace with actual underwriters once available]

- Listing date: [Date - Replace with actual date once available]

- Funds Raised: [Estimated Amount - Replace with estimated amount once available]

The successful execution of this share sale will hinge on the careful coordination of several financial institutions acting as underwriters. Their experience and market knowledge are crucial in ensuring a smooth and successful listing on the Hong Kong Stock Exchange (HKEX). The final share price will ultimately be determined by market forces and investor demand during the offering period.

Strategic Implications for Hengrui Pharma

Hengrui Pharma's decision to list in Hong Kong carries significant strategic weight. This move represents more than just a capital injection; it's a deliberate step towards becoming a truly global player in the pharmaceutical industry. Key strategic implications include:

- Increased access to international capital: Listing on the HKEX opens doors to a vast pool of international investors, providing access to capital for further research, development, and expansion.

- Enhanced brand visibility and reputation: A successful listing on a prominent exchange like the HKEX elevates Hengrui Pharma's brand visibility and reputation internationally, attracting further business collaborations and partnerships.

- Strengthened competitive position: The infusion of capital and increased international recognition allows Hengrui Pharma to compete more effectively against global pharmaceutical giants.

- Opportunities for collaborations and partnerships: Access to a broader network of investors and industry players facilitates collaborations and partnerships, accelerating innovation and market penetration.

Impact on the Hong Kong Stock Market

The Hengrui Pharma Hong Kong share sale is expected to create considerable ripples across the Hong Kong Stock Exchange. The potential impacts are far-reaching:

- Increased trading volume and liquidity: The addition of a significant player like Hengrui Pharma will undoubtedly boost trading volume and liquidity within the HKEX, attracting more investors and enhancing market efficiency.

- Attracting further investment into the Hong Kong pharmaceutical sector: Hengrui Pharma's presence serves as a beacon, attracting further investment in the burgeoning Hong Kong pharmaceutical sector, fostering innovation and growth.

- Potential boost to the overall market index: The influx of investment and increased trading activity related to the Hengrui Pharma IPO has the potential to positively impact the overall market index of the HKEX.

- Opportunities for investors seeking exposure to the Chinese pharmaceutical market: The listing presents a unique opportunity for investors to gain exposure to the rapidly growing Chinese pharmaceutical market, one of the fastest-growing sectors globally.

Potential Risks and Challenges

While the Hengrui Pharma Hong Kong share sale offers considerable potential, it’s crucial to acknowledge potential risks and challenges:

- Market Volatility: Global market fluctuations can impact investor sentiment and the share price.

- Regulatory Risks: Navigating regulatory hurdles in both China and Hong Kong could present unforeseen challenges.

- Competition: Intense competition within the global pharmaceutical industry necessitates strategic agility and innovation.

- Economic Factors: Macroeconomic factors, such as global economic downturns, can influence the success of the share sale and subsequent performance.

Conclusion

Hengrui Pharma's successful Hong Kong share sale marks a significant milestone for the company, propelling its global expansion strategy and presenting a substantial investment opportunity. The listing is set to invigorate the Hong Kong Stock Exchange, drawing further investment into the pharmaceutical sector and enhancing Hong Kong's standing as a global financial hub. The strategic advantages for Hengrui Pharma are considerable, ranging from increased capital access to enhanced brand recognition and solidified global competitiveness. However, navigating potential risks associated with market volatility and regulatory compliance will be crucial for the company's long-term success. Stay informed about the exciting developments surrounding the Hengrui Pharma Hong Kong share sale and its potential impact on the global pharmaceutical landscape. Learn more about this important development by following reputable financial news sources and the Hengrui Pharma website.

Featured Posts

-

Canadian Tariffs Dows Alberta Megaproject Suffers Significant Delays

Apr 29, 2025

Canadian Tariffs Dows Alberta Megaproject Suffers Significant Delays

Apr 29, 2025 -

New Study Minnesota Immigrant Workers Transitioning To Higher Paying Roles

Apr 29, 2025

New Study Minnesota Immigrant Workers Transitioning To Higher Paying Roles

Apr 29, 2025 -

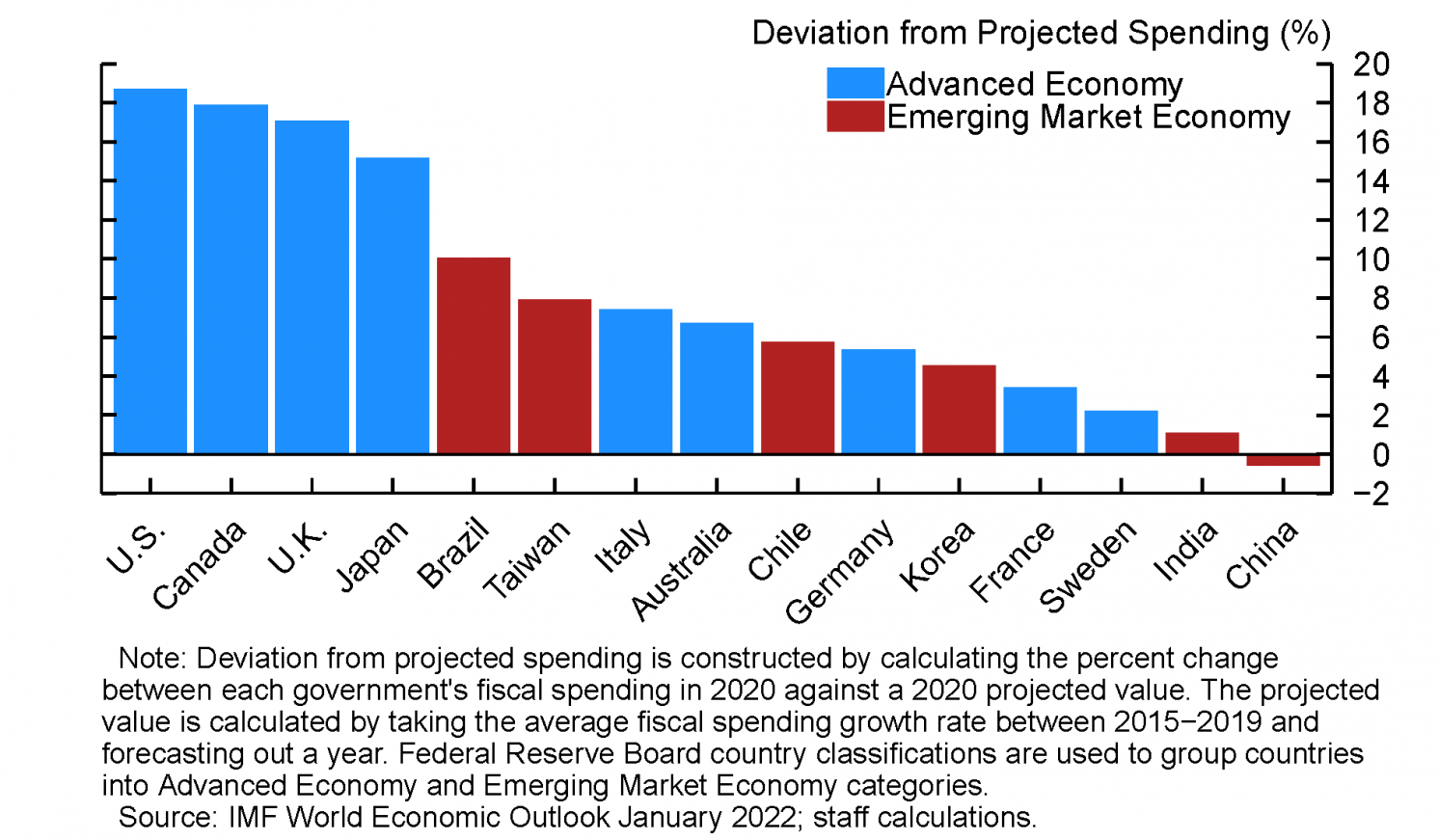

Ecb Lingering Pandemic Fiscal Support Fuels Inflation

Apr 29, 2025

Ecb Lingering Pandemic Fiscal Support Fuels Inflation

Apr 29, 2025 -

Ray Epps Defamation Lawsuit Against Fox News January 6th Allegations

Apr 29, 2025

Ray Epps Defamation Lawsuit Against Fox News January 6th Allegations

Apr 29, 2025 -

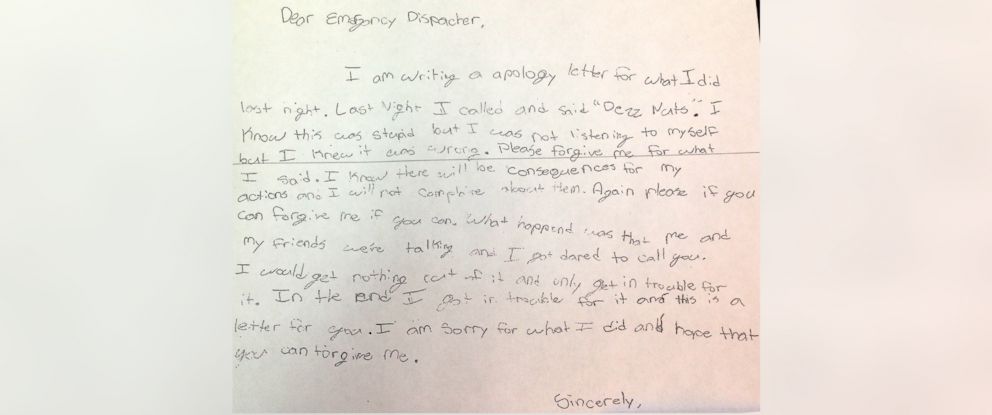

Atlanta Falcons Dcs Sons Apology For Prank Call To Shedeur Sanders

Apr 29, 2025

Atlanta Falcons Dcs Sons Apology For Prank Call To Shedeur Sanders

Apr 29, 2025

Latest Posts

-

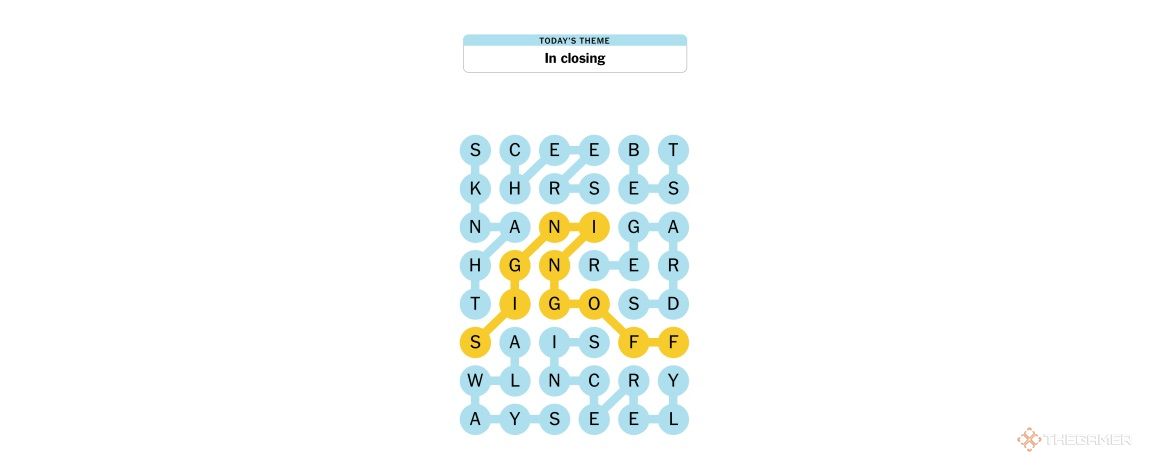

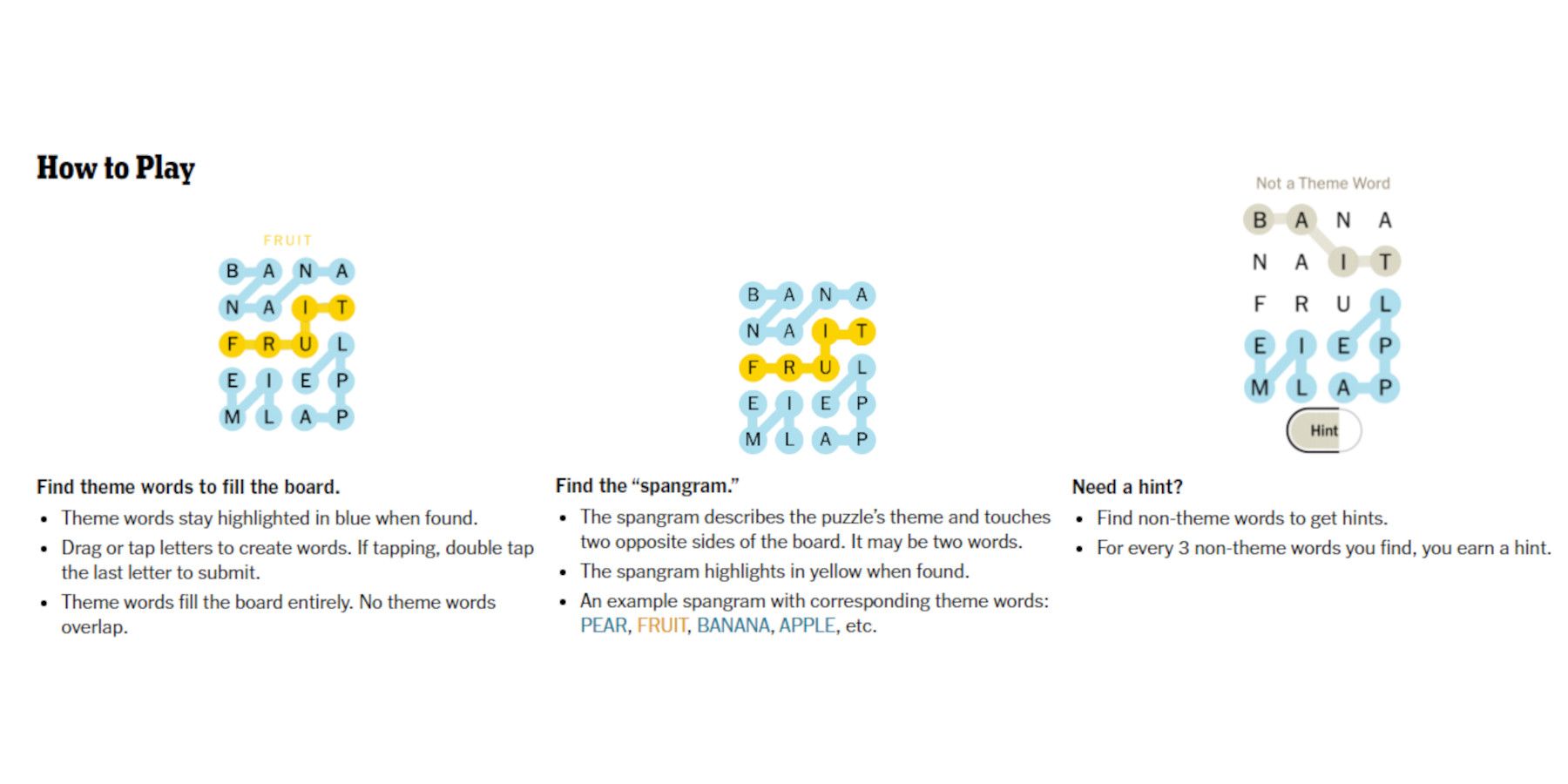

Complete Guide To Nyt Strands April 3 2025 Solutions

Apr 29, 2025

Complete Guide To Nyt Strands April 3 2025 Solutions

Apr 29, 2025 -

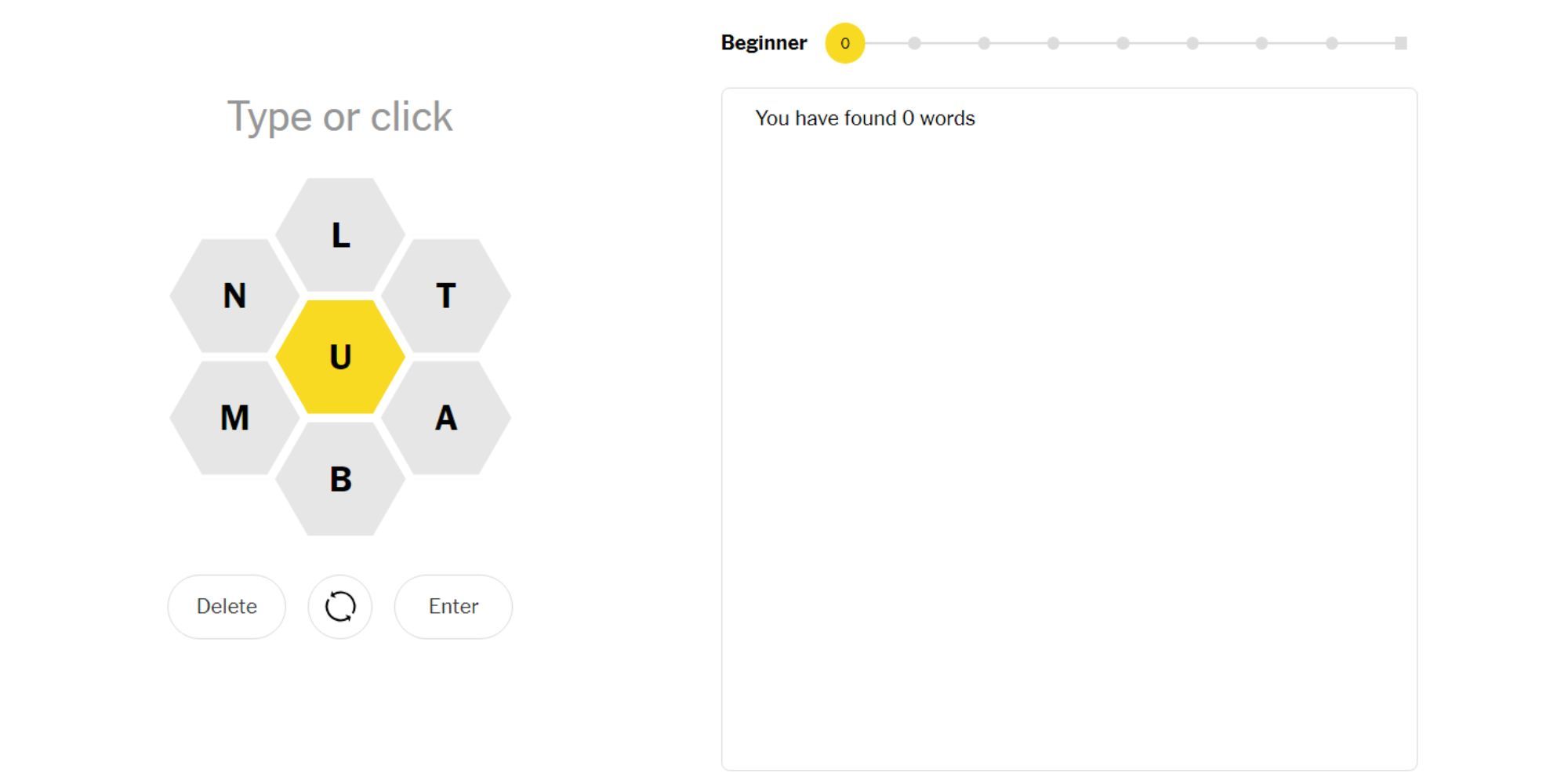

February 26th Nyt Spelling Bee Puzzle Answers And Strategies

Apr 29, 2025

February 26th Nyt Spelling Bee Puzzle Answers And Strategies

Apr 29, 2025 -

Nyt Strands Puzzle Hints And Answers For March 3 2025

Apr 29, 2025

Nyt Strands Puzzle Hints And Answers For March 3 2025

Apr 29, 2025 -

Nyt Strands Answers And Spangram For April 3 2025

Apr 29, 2025

Nyt Strands Answers And Spangram For April 3 2025

Apr 29, 2025 -

Nyt Spelling Bee Solution And Clues For February 26th Puzzle 360

Apr 29, 2025

Nyt Spelling Bee Solution And Clues For February 26th Puzzle 360

Apr 29, 2025