Hernando, Mississippi: Preparing For The Impact Of Income Tax Elimination

Table of Contents

Potential Economic Benefits of Income Tax Elimination in Hernando

The elimination of income tax in Mississippi could inject a powerful stimulant into Hernando's economy. This tax reform could unlock several key benefits:

-

Increased disposable income: Residents would have more money in their pockets, leading to a surge in consumer spending at local businesses. This increased spending would benefit retailers, restaurants, and other service providers throughout Hernando.

-

Attraction of new businesses and investment opportunities: A more competitive tax environment would make Hernando a more attractive location for businesses seeking to relocate or expand. This influx of investment could create diverse economic opportunities and stimulate further growth.

-

Potential for job creation: New businesses and increased investment often translate into job creation across various sectors, including retail, hospitality, construction, and potentially even advanced manufacturing, benefiting Hernando's workforce.

-

Increased property values: Improved economic activity, fueled by increased investment and consumer spending, could drive up property values, benefiting homeowners and real estate investors alike.

-

Enhanced competitiveness: Hernando's competitive advantage would be significantly enhanced compared to neighboring areas that still maintain income taxes, attracting both residents and businesses seeking a more favorable tax environment.

Supporting Paragraph: The retail sector in Hernando could experience a particularly strong boost, with increased consumer spending driving sales and potentially leading to the expansion of existing businesses or the attraction of new retail chains. Similarly, the hospitality sector, including restaurants and hotels, could see increased tourism and local patronage. The town's existing initiatives to promote economic development, such as [mention any specific local initiatives], could be significantly amplified by the elimination of income tax.

Potential Economic Challenges of Income Tax Elimination in Hernando

While the potential economic benefits are substantial, income tax elimination also presents significant challenges that must be carefully addressed:

-

Potential reduction in state and local government revenue: The loss of income tax revenue could create a substantial budget shortfall for the state and local governments, potentially impacting funding for essential services like schools, infrastructure maintenance, and public safety.

-

Potential increase in the cost of goods and services: The elimination of income tax might lead to increased reliance on other tax sources, such as sales taxes. This could result in increased prices for goods and services, potentially offsetting some of the benefits of increased disposable income, especially for lower-income households.

-

Increased strain on social programs: Reduced government revenue could lead to cuts in funding for vital social programs, potentially impacting access to healthcare, education, and other essential services for vulnerable populations.

-

Challenges for budgeting and financial planning: Individuals and families will need to adjust their budgets and financial planning strategies to account for potential changes in income, expenses, and the availability of public services.

-

Increased reliance on property taxes: To compensate for lost income tax revenue, local governments might increase reliance on property taxes, potentially disproportionately impacting lower-income homeowners.

Supporting Paragraph: Hernando's schools and infrastructure maintenance programs are particularly vulnerable to budget cuts. The town's current budget allocation for these services needs to be carefully reviewed to anticipate and mitigate the impact of reduced income tax revenue. Strategies to mitigate these challenges could include exploring alternative revenue streams, implementing cost-saving measures, and seeking additional state or federal funding.

Financial Planning Strategies for Hernando Residents

Navigating the potential economic shifts requires proactive financial planning:

-

Develop a comprehensive budget: Create a detailed budget that accounts for potential changes in income and expenses. Consider scenarios with both increased and decreased disposable income to prepare for various outcomes.

-

Explore saving and investment strategies: Implement diverse saving and investment strategies to build financial security for the future, considering options like high-yield savings accounts, retirement plans, and diversified investment portfolios.

-

Diversify investments: Don't put all your eggs in one basket. Diversify your investments to spread risk and potentially maximize returns, considering a mix of stocks, bonds, and other asset classes.

-

Consult a financial advisor: Seeking professional financial advice is crucial. A qualified financial advisor can help you develop a personalized financial plan that considers your specific circumstances and goals in the new tax environment.

-

Review estate planning documents: Review and update your will, trusts, and other estate planning documents to account for potential changes in tax laws and ensure your wishes are properly reflected.

Supporting Paragraph: Numerous online resources, including the IRS website (irs.gov) and reputable financial planning organizations, offer valuable tools and information to help you improve your financial literacy and make informed decisions. Consider taking advantage of free workshops or seminars offered in your community to enhance your financial planning skills.

Impact on Hernando's Real Estate Market

The elimination of income tax could significantly impact Hernando's real estate market:

-

Potential increase in property values: Increased demand from new residents and businesses, fueled by economic growth, could drive up property values.

-

Increased real estate investment opportunities: The more favorable tax environment could attract real estate investors, leading to increased competition and potentially higher property prices.

-

Impact on housing affordability: Rising property values might reduce the affordability of housing for some segments of the population, potentially creating challenges for first-time homebuyers.

-

Changes in the rental market: Increased demand for rental properties could lead to higher rents, potentially impacting affordability for renters.

-

Monitoring market trends: Closely monitoring market trends and adapting real estate strategies accordingly is vital for both buyers and sellers.

Supporting Paragraph: The commercial real estate market in Hernando could see particularly significant growth, with businesses seeking to take advantage of the improved tax environment and increased consumer spending. However, it's crucial to carefully analyze market trends and potential risks before making any significant real estate investment decisions.

Conclusion

Income tax elimination in Mississippi presents a dual-faceted challenge and opportunity for Hernando. While it offers the potential for substantial economic growth and increased disposable income, it also necessitates careful financial planning and adaptation to potential changes in public services and the cost of living. Understanding these potential effects is crucial for residents and businesses to prepare proactively for the future.

Call to Action: Stay informed about the unfolding impact of income tax elimination on Hernando, Mississippi, and actively engage in planning for the future to secure your financial well-being and contribute to the continued prosperity of our community. Seek professional advice as needed regarding your financial situation and real estate planning. Understanding the nuances of this significant tax reform is key to navigating its impact effectively.

Featured Posts

-

Intencion U Error Seis Enlaces Revelan El Estado Del Sitio Web Del Cne

May 19, 2025

Intencion U Error Seis Enlaces Revelan El Estado Del Sitio Web Del Cne

May 19, 2025 -

Subystem Issue Causes Blue Origin Rocket Launch Cancellation

May 19, 2025

Subystem Issue Causes Blue Origin Rocket Launch Cancellation

May 19, 2025 -

Parg Confirmed For Eurovision In Concert 2025 Armenias Eurovision Entry

May 19, 2025

Parg Confirmed For Eurovision In Concert 2025 Armenias Eurovision Entry

May 19, 2025 -

Where And When Is Eurovision Song Contest 2025 Taking Place

May 19, 2025

Where And When Is Eurovision Song Contest 2025 Taking Place

May 19, 2025 -

Jennifer Lawrences Husband Cooke Maroney The Art Worlds Hot Dad

May 19, 2025

Jennifer Lawrences Husband Cooke Maroney The Art Worlds Hot Dad

May 19, 2025

Latest Posts

-

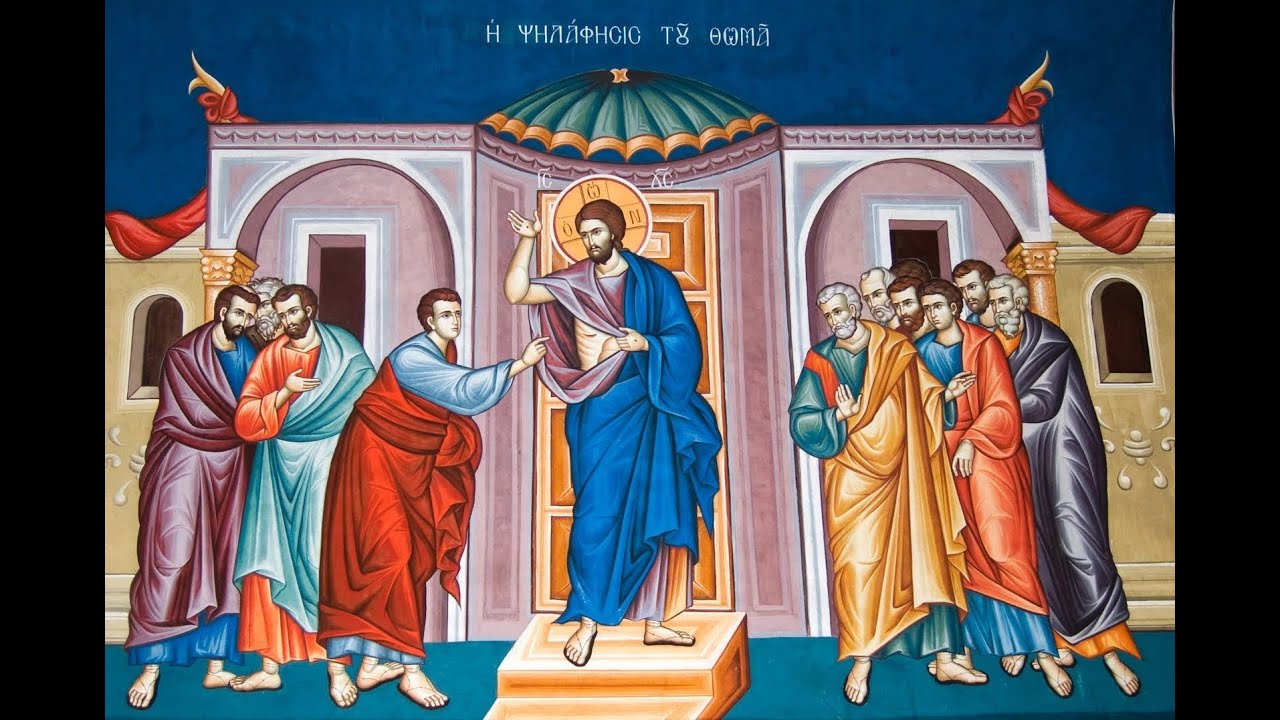

I Kyriaki Toy Antipasxa Sta Ierosolyma Mia T Hriskeytiki Kai Politismiki Empeiria

May 19, 2025

I Kyriaki Toy Antipasxa Sta Ierosolyma Mia T Hriskeytiki Kai Politismiki Empeiria

May 19, 2025 -

I Teleti Toy Ieroy Niptiros Sta Ierosolyma Istoria Kai Simasia

May 19, 2025

I Teleti Toy Ieroy Niptiros Sta Ierosolyma Istoria Kai Simasia

May 19, 2025 -

Eortasmos Tis Kyriakis Toy Antipasxa Sta Ierosolyma Odigos Programmatismoy

May 19, 2025

Eortasmos Tis Kyriakis Toy Antipasxa Sta Ierosolyma Odigos Programmatismoy

May 19, 2025 -

Taksidi Stin Kyriaki Toy Antipasxa Sta Ierosolyma Plirofories And Symvoyles

May 19, 2025

Taksidi Stin Kyriaki Toy Antipasxa Sta Ierosolyma Plirofories And Symvoyles

May 19, 2025 -

Kyriaki Toy Antipasxa Sta Ierosolyma Istoria Paradoseis Kai Ekdiloseis

May 19, 2025

Kyriaki Toy Antipasxa Sta Ierosolyma Istoria Paradoseis Kai Ekdiloseis

May 19, 2025