High Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

BofA's Current Valuation Assessment

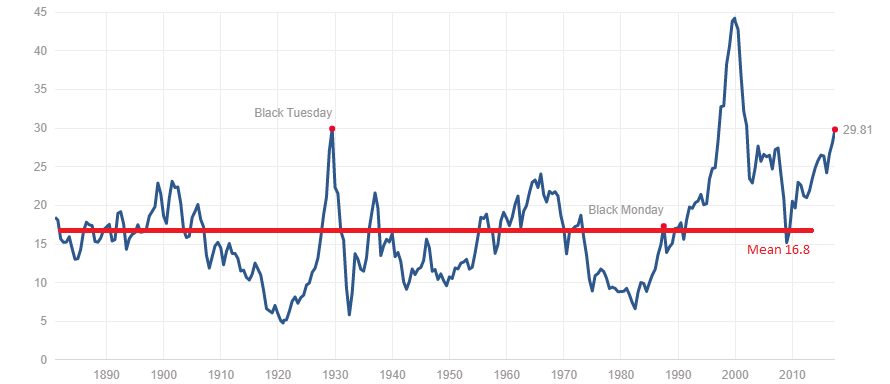

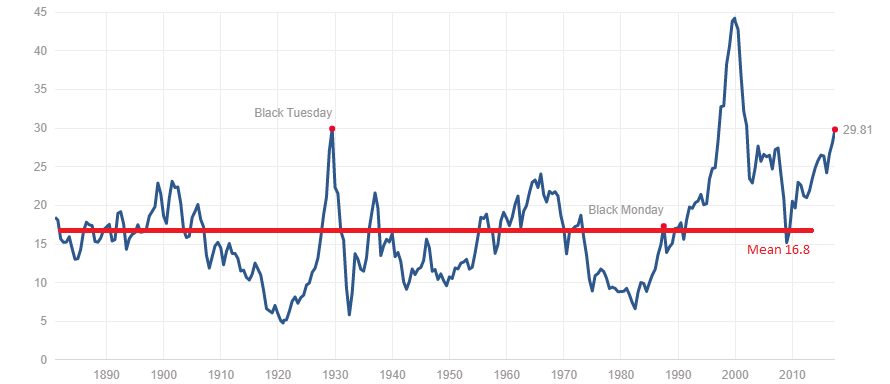

BofA's recent assessment suggests that current stock market valuations are elevated compared to historical averages. While not necessarily indicating a market bubble, the firm highlights a level of caution warranted for investors. BofA uses several key metrics, including Price-to-Earnings (P/E) ratios and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio), to gauge market valuations. These metrics compare current stock prices to company earnings, considering historical inflation-adjusted earnings to provide a longer-term perspective.

- Indices Analyzed: BofA's analysis typically encompasses major indices like the S&P 500 and the Nasdaq Composite, providing a broad overview of the US equity market. They may also consider international indices depending on the specific report.

- Discrepancies from Historical Averages: BofA's reports often highlight discrepancies between current valuation metrics and historical averages. These discrepancies can be significant, suggesting that current prices may not be fully justified by traditional fundamental analysis.

- Justification by Economic Fundamentals: BofA's conclusion typically acknowledges the strong influence of factors like low interest rates and robust corporate earnings on current valuations. However, they often caution that these factors may not fully justify the current elevated levels, leaving room for potential market corrections.

Factors Contributing to High Stock Market Valuations

Several factors, according to BofA's research and general market analysis, contribute to the current high stock market valuations:

- Low Interest Rate Environment and Stock Market: The prolonged period of low interest rates has pushed investors towards riskier assets like equities, driving up demand and valuations. A low interest rate environment stock market often sees increased investment in higher-yielding alternatives.

- Strong Corporate Earnings Growth and Stock Market: Robust corporate earnings growth, particularly in certain sectors, has supported higher stock prices. This strong corporate earnings growth fuels investor confidence and higher valuations.

- Government Stimulus and Market Sentiment: Government stimulus packages, aimed at boosting economic activity, have injected significant liquidity into the market, further contributing to higher valuations and improved market sentiment.

- Technological Advancements and Tech Stock Valuations: Technological advancements, particularly in areas like artificial intelligence and cloud computing, have fueled significant growth in the technology sector, leading to elevated valuations for tech stocks.

- Inflation and Future Valuations: The impact of inflation is a critical consideration. High inflation can erode corporate earnings and reduce the future value of investments, potentially impacting valuations negatively.

Potential Risks Associated with High Valuations

BofA’s analysis points out several risks associated with the current high stock market valuations:

- Increased Market Volatility and Stock Market Correction Risks: High valuations often correlate with increased market volatility, making the market more susceptible to sharp corrections or crashes. A stock market correction is a significant decline in the market's overall value.

- Higher Likelihood of Capital Losses: If valuations fall, investors face a higher likelihood of experiencing capital losses. This risk increases with higher initial valuations.

- Impact of Rising Interest Rates on Stock Market: Rising interest rates can negatively impact stock prices, as higher borrowing costs reduce corporate profitability and make bonds a more attractive investment. Interest rate hikes and the stock market often have an inverse relationship.

- Potential for a Stock Market Bubble: While not explicitly stated as a current reality, BofA's analysis may caution about the potential for a stock market bubble, given the extended period of high valuations and other contributing factors. The risk of a stock market bubble is a serious consideration in a high valuation environment.

Mitigating Investment Risks in a High-Valuation Market

BofA's implicit advice, and common wisdom in high valuation markets, suggests several strategies to mitigate investment risks:

- Portfolio Diversification Strategies: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors can help reduce overall portfolio risk.

- Value Investing Strategies: Focusing on value investing, which involves identifying undervalued companies with strong fundamentals, can help reduce the impact of market corrections.

- Long-Term Investment Horizon: Maintaining a long-term investment horizon allows you to ride out short-term market fluctuations and benefit from the long-term growth potential of the market.

- Alternative Investments in a Portfolio: Consideration of alternative investments, such as private equity or commodities, can provide diversification and potentially higher returns, but also carry higher risk.

Opportunities in a High Valuation Market

Even in a market with high valuations, opportunities exist:

- Identifying Undervalued Sectors or Companies: Careful analysis can reveal undervalued sectors or companies that may offer attractive investment opportunities. Fundamental analysis is key here.

- Growth Stock Investing: Growth stocks with strong fundamentals and a long-term growth trajectory can still deliver significant returns despite high overall market valuations. Growth stock investing requires careful selection.

- Companies with Robust Balance Sheets: Companies with strong balance sheets are better positioned to withstand economic downturns and market corrections, making them potentially safer investments.

- Dividend Stocks Investing: Dividend-paying stocks can provide a stable stream of income, even in a volatile market, potentially mitigating the impact of valuation fluctuations.

Conclusion

BofA's analysis provides crucial insights into the current high stock market valuations, highlighting both potential risks and opportunities. While elevated valuations necessitate a cautious approach, informed investors can utilize diversification strategies and focus on strong fundamentals to navigate this market effectively. Understanding the factors driving these valuations, as well as the potential risks, is key to making sound investment decisions. Don't neglect the implications of high stock market valuations – conduct thorough research and develop a robust investment strategy that aligns with your risk tolerance.

Featured Posts

-

Kme Vedjegy Garancia A Kivalo Minosegre A Tanyerodon

May 03, 2025

Kme Vedjegy Garancia A Kivalo Minosegre A Tanyerodon

May 03, 2025 -

The Ongoing Struggle Within Reform Uk A Breakdown Of The Conflict

May 03, 2025

The Ongoing Struggle Within Reform Uk A Breakdown Of The Conflict

May 03, 2025 -

Liverpools Contract Strategy For Mo Salah A Risky Gamble

May 03, 2025

Liverpools Contract Strategy For Mo Salah A Risky Gamble

May 03, 2025 -

Free Cowboy Bebop Cosmetics In Fortnite A Limited Time Offer

May 03, 2025

Free Cowboy Bebop Cosmetics In Fortnite A Limited Time Offer

May 03, 2025 -

Justice Department Ends Louisiana School Desegregation Order A New Chapter

May 03, 2025

Justice Department Ends Louisiana School Desegregation Order A New Chapter

May 03, 2025