High Stock Market Valuations: A BofA Analyst's Take

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's analysts have expressed a cautious outlook on current stock market valuations, leaning towards a neutral-to-bearish stance. While acknowledging the strong performance of the market, they highlight concerns about the sustainability of these high levels. Their assessment relies heavily on several key valuation metrics:

- Price-to-Earnings Ratio (P/E): BofA's analysis likely shows that the current P/E ratio for the broader market, particularly for specific sectors, is significantly higher than its historical average. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, indicating potentially overvalued stocks.

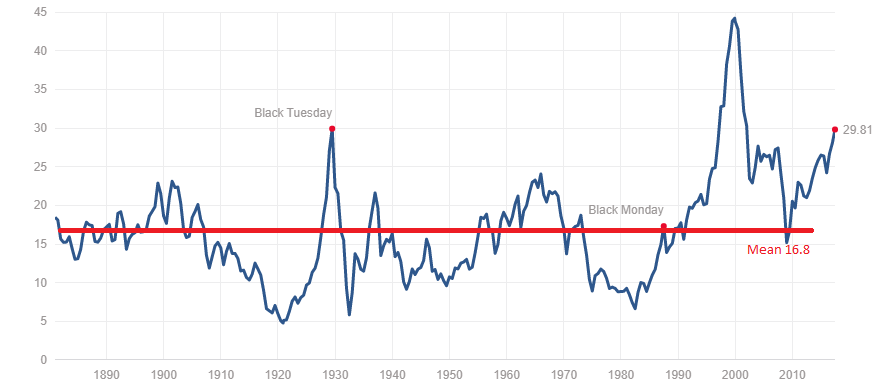

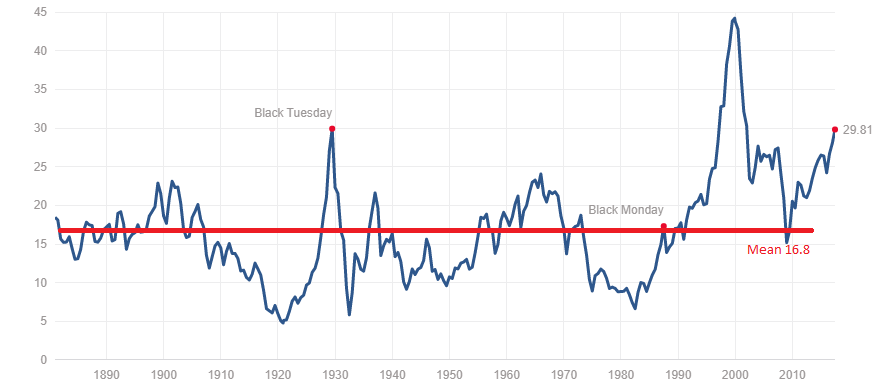

- Shiller P/E (Cyclically Adjusted Price-to-Earnings Ratio): This metric, which smooths out short-term earnings fluctuations, provides a longer-term perspective on valuations. BofA's assessment likely compares the current Shiller P/E to its historical range to determine whether current valuations are significantly above or below average.

- Sector-Specific Valuations: BofA's analysis likely identifies specific sectors, such as technology or consumer discretionary, which are deemed overvalued based on their P/E ratios and other metrics. Conversely, they may point out undervalued sectors where investment opportunities may exist.

Bullet Points:

- BofA might report a current S&P 500 P/E ratio significantly above its long-term average, suggesting overvaluation.

- The Shiller P/E ratio may also be elevated, reinforcing concerns about high valuations.

- Specific sectors, like technology, may be highlighted as significantly overvalued, while others, such as energy or financials, may be deemed relatively undervalued by BofA.

Underlying Factors Contributing to High Valuations

Several macroeconomic factors contribute to the current high stock market valuations:

- Low Interest Rates: Prolonged periods of low interest rates have made bonds less attractive, pushing investors towards higher-yielding assets like stocks. This increased demand drives up stock prices.

- Strong Corporate Earnings (Historically): While corporate earnings have shown some recent weakness, historically strong earnings in many sectors fueled investor confidence and contributed to higher valuations.

- Inflationary Pressures: Inflation can influence stock valuations in complex ways. While it might initially boost earnings for some companies, it can also increase interest rates, potentially dampening future stock growth. BofA's analysis likely weighs these competing effects.

- Geopolitical Risks: Geopolitical uncertainties, such as trade wars or international conflicts, can impact investor sentiment and market volatility. During periods of uncertainty, investors may seek the perceived safety of established companies, pushing up valuations.

Risks Associated with High Stock Market Valuations

Investing in a highly valued market carries significant risks:

- Market Correction or Crash: High valuations often precede market corrections or crashes, as investors realize the market is overvalued, triggering a sell-off.

- Lower Potential for Future Returns: Stocks purchased at high valuations have a lower probability of generating high returns compared to those purchased at lower valuations.

- Vulnerability to Economic Shocks: A highly valued market is more susceptible to negative economic shocks, like rising interest rates or a recession, leading to sharp price declines.

- BofA's Specific Concerns: BofA's analysts might highlight specific risks, such as the potential for a rapid increase in interest rates or a slowdown in corporate earnings growth as particularly threatening to the current high valuations.

BofA's Investment Recommendations for High Valuation Environments

Given the high valuations, BofA's recommendations likely emphasize a cautious approach:

- Sector Selection: Favoring value stocks over growth stocks, focusing on companies with strong fundamentals and relatively low valuations.

- Diversification: A well-diversified portfolio across various asset classes and sectors helps mitigate risk.

- Asset Allocation: Adjusting asset allocation to reduce exposure to potentially overvalued equities and increase exposure to less correlated assets.

- Risk Management: Implementing robust risk management strategies, including stop-loss orders and diversification, to limit potential losses.

Alternative Investment Opportunities

Considering the high stock market valuations, investors should consider alternative investment options:

- Bonds and Fixed-Income Securities: Bonds offer a more stable, predictable return than stocks, providing a counterbalance to the riskier equity market.

- Real Estate: Real estate investments can provide diversification and potential for long-term capital appreciation.

- Commodities: Commodities, such as gold or oil, can act as an inflation hedge and offer diversification benefits.

- Other Alternatives: Other alternative assets, such as private equity or hedge funds, might be considered, although they usually come with higher fees and less liquidity.

Making Informed Decisions in a High Stock Market Valuation Environment

BofA's analysis indicates that current stock market valuations are elevated, presenting both opportunities and risks. Understanding the underlying factors driving these valuations, as well as the potential risks, is crucial for investors. A well-diversified portfolio and a robust investment strategy, tailored to your risk tolerance and financial goals, are essential when navigating a market characterized by high stock market valuations. For more detailed analysis and investment recommendations, consult BofA's research reports or seek professional financial advice. Remember, understanding high stock market valuations is key to making smart investment choices in the current market. [Link to relevant BofA resources here].

Featured Posts

-

20

Apr 26, 2025

20

Apr 26, 2025 -

Explore Orlando 7 Exciting Restaurants Beyond Disney In 2025

Apr 26, 2025

Explore Orlando 7 Exciting Restaurants Beyond Disney In 2025

Apr 26, 2025 -

Nepo Babies Inherited Fame And The Oscars After Party Debate

Apr 26, 2025

Nepo Babies Inherited Fame And The Oscars After Party Debate

Apr 26, 2025 -

New Business Hot Spots Across The Nation An Interactive Map

Apr 26, 2025

New Business Hot Spots Across The Nation An Interactive Map

Apr 26, 2025 -

Ajax Vs Az Enhanced Security Measures For Upcoming Match

Apr 26, 2025

Ajax Vs Az Enhanced Security Measures For Upcoming Match

Apr 26, 2025