High Stock Market Valuations: A BofA Analyst's Take For Investors

Table of Contents

BofA's Current Assessment of Stock Market Valuations

BofA regularly publishes market analyses, providing detailed assessments of stock market valuations. Their reports utilize a range of valuation metrics, including the Price-to-Earnings ratio (P/E), market capitalization, and other key indicators to gauge the overall health and potential risks within the market. While specific numerical data changes frequently, BofA's methodology generally involves comparing current valuations to historical averages, considering economic forecasts, and analyzing individual sector performance.

- BofA's Overall Assessment: (Note: This section requires current data from a recent BofA report. Replace the placeholder with the actual assessment. Example: "Recent BofA reports suggest that while certain sectors are exhibiting elevated valuations, the overall market is currently deemed to be moderately overvalued compared to historical averages.")

- Sector-Specific Valuations: (Note: This section requires current data from a recent BofA report. Example: "Technology stocks, particularly within the growth segment, continue to show high valuations. Conversely, some cyclical sectors, such as energy, may present more attractive valuations relative to their potential for future earnings.")

- BofA's Valuation Methodology: BofA employs a multi-faceted approach incorporating fundamental analysis, examining factors such as earnings growth, dividend payouts, and balance sheet strength. They also consider technical analysis, looking at market trends and momentum. This combined approach allows for a more comprehensive understanding of current market conditions.

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the currently elevated stock market valuations. Understanding these dynamics is crucial for informed investment decisions.

- Impact of Low Interest Rates: Historically low interest rates have made borrowing cheaper for companies, fueling investment and growth. Simultaneously, lower interest rates reduce the attractiveness of fixed-income investments, driving capital into the stock market, thereby increasing demand and pushing valuations higher.

- Inflation's Influence: Inflation erodes the purchasing power of money. While moderate inflation can be positive for economic growth, high inflation creates uncertainty and can negatively impact corporate earnings, potentially dampening investor sentiment. BofA’s analysts closely monitor inflation indicators to assess their impact on stock valuations.

- Corporate Earnings Growth: Strong corporate earnings growth is a major driver of stock market valuations. When companies consistently outperform expectations, investor confidence increases, leading to higher stock prices. However, slower than expected earnings growth can quickly shift the market sentiment.

- Investor Sentiment and Risk Appetite: Investor sentiment plays a significant role. Optimism tends to drive valuations higher, while pessimism can lead to corrections. Risk appetite, which refers to the willingness of investors to take on risk for higher potential returns, also directly affects valuations. A high-risk appetite often correlates with higher valuations.

Investment Strategies in a High-Valuation Environment

Navigating a market with high stock market valuations necessitates a well-defined investment strategy focused on risk management and diversification.

- Risk Management Strategies: In a high-valuation environment, risk management takes on even greater importance. Diversification across different asset classes (stocks, bonds, real estate) is crucial to mitigate potential losses. Defensive investing, focusing on companies with stable earnings and lower volatility, can be a prudent approach.

- Value vs. Growth Investing: The choice between value and growth investing depends on individual risk tolerance and investment horizon. Value investing seeks undervalued companies with potential for future growth, while growth investing focuses on companies experiencing rapid expansion, often at higher valuations. BofA's analysis can help investors determine which approach aligns better with their specific circumstances.

- Asset Allocation: Regularly reviewing and adjusting asset allocation is crucial. This involves periodically reassessing the proportion of your portfolio invested in different asset classes to ensure it continues to align with your financial goals and risk tolerance.

- Sector-Specific Opportunities: Despite the overall high valuations, certain sectors may present more attractive opportunities than others. BofA's sector-specific analyses can identify potentially undervalued or high-growth sectors within the market.

The Importance of Long-Term Investing

Market fluctuations are inevitable. Short-term volatility is normal, and focusing solely on short-term movements can be detrimental to long-term financial goals. A long-term investment strategy, coupled with patience and a disciplined approach, helps weather market cycles and achieve long-term financial success. Maintaining a clear understanding of your financial goals and aligning your investment strategy accordingly is paramount.

Conclusion

BofA's analysis provides valuable insight into the complexities of high stock market valuations. Understanding the interplay of factors like interest rates, inflation, and corporate earnings is crucial. By employing strategies such as diversification, risk management, and a disciplined approach to asset allocation, investors can navigate these uncertain times. Remember, staying informed on high stock market valuations is key. Consult with a financial advisor and conduct thorough research before making any investment decisions. Learn more about navigating high stock market valuations and develop a robust strategy to manage high stock market valuations to achieve your financial objectives.

Featured Posts

-

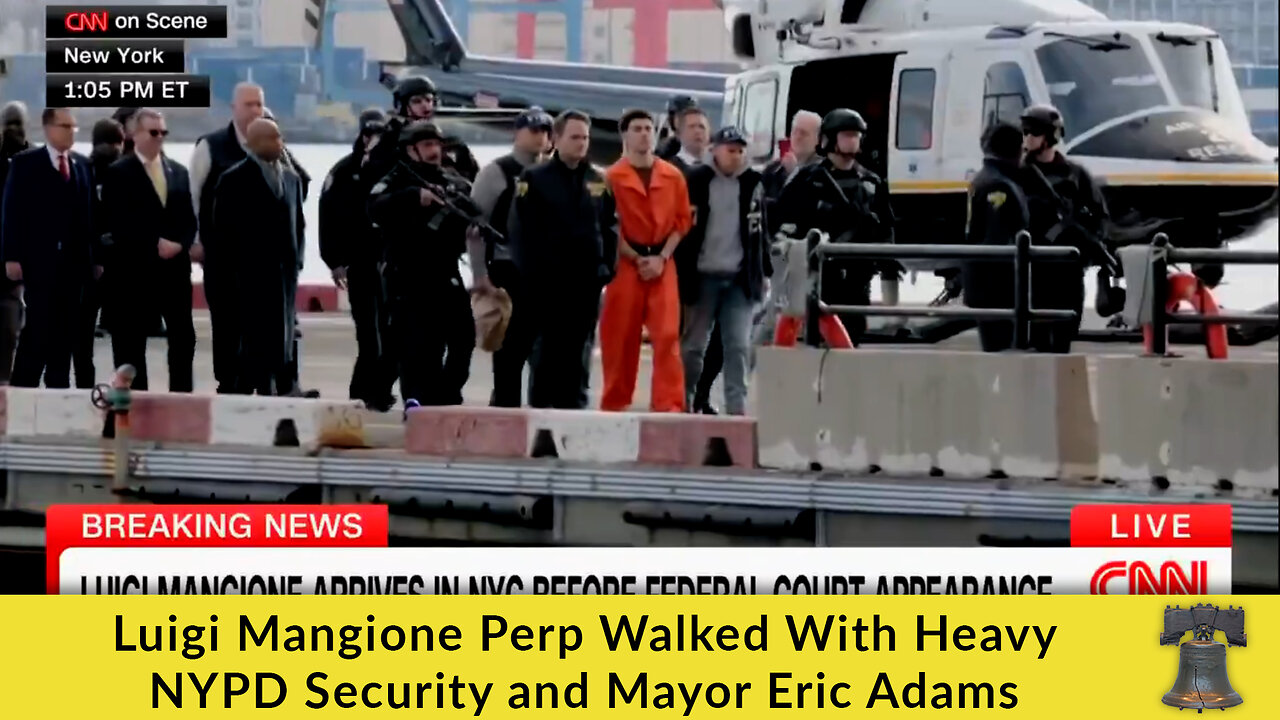

Crypto Kidnapping Case Nypd Detective From Mayor Adams Security Detail Under Investigation

May 31, 2025

Crypto Kidnapping Case Nypd Detective From Mayor Adams Security Detail Under Investigation

May 31, 2025 -

March 30 2025 Nyt Mini Crossword Answers And Helpful Hints

May 31, 2025

March 30 2025 Nyt Mini Crossword Answers And Helpful Hints

May 31, 2025 -

Revolutionizing Voice Assistant Development Open Ais New Tools

May 31, 2025

Revolutionizing Voice Assistant Development Open Ais New Tools

May 31, 2025 -

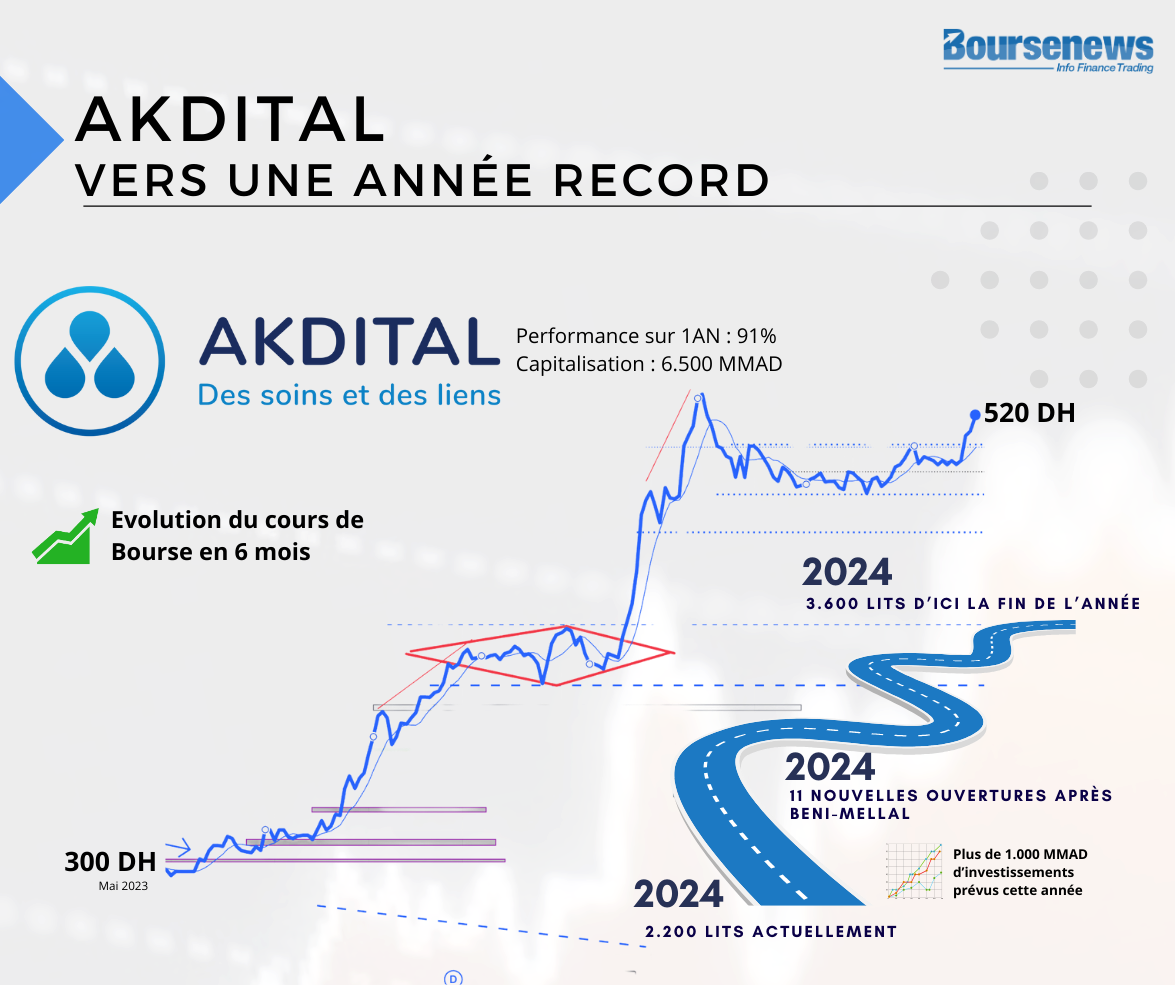

Sanofi Perspectives De Croissance Et Valeur En Bourse Selon Loeil Du Loup De Zurich

May 31, 2025

Sanofi Perspectives De Croissance Et Valeur En Bourse Selon Loeil Du Loup De Zurich

May 31, 2025 -

Nyt Mini Crossword Puzzle Solutions Saturday May 3rd

May 31, 2025

Nyt Mini Crossword Puzzle Solutions Saturday May 3rd

May 31, 2025