High Stock Market Valuations And Investor Concerns: A BofA Analysis

Table of Contents

BofA's Key Findings on High Stock Market Valuations

BofA's analysis paints a picture of a market where current prices may be diverging significantly from historical valuation averages. Their conclusions highlight elevated valuations across numerous sectors, raising valid concerns about potential overvaluation. The report utilizes sophisticated models and methodologies, incorporating a range of valuation metrics to support its findings.

- Elevated P/E Ratios: BofA's research indicates that Price-to-Earnings (P/E) ratios across many sectors are considerably higher than their long-term historical averages, suggesting that stocks might be priced at a premium relative to their earnings potential.

- High Price-to-Sales Ratios: Similarly, Price-to-Sales (P/S) ratios are also elevated, indicating that investors are paying a significant premium for each dollar of revenue generated by companies.

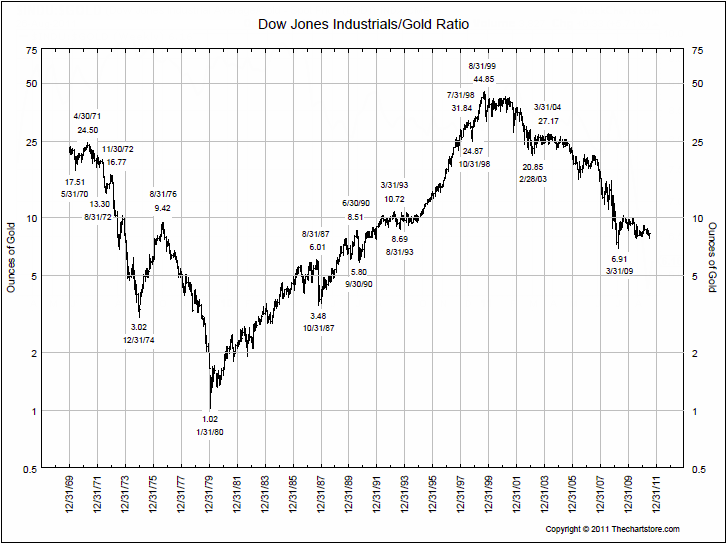

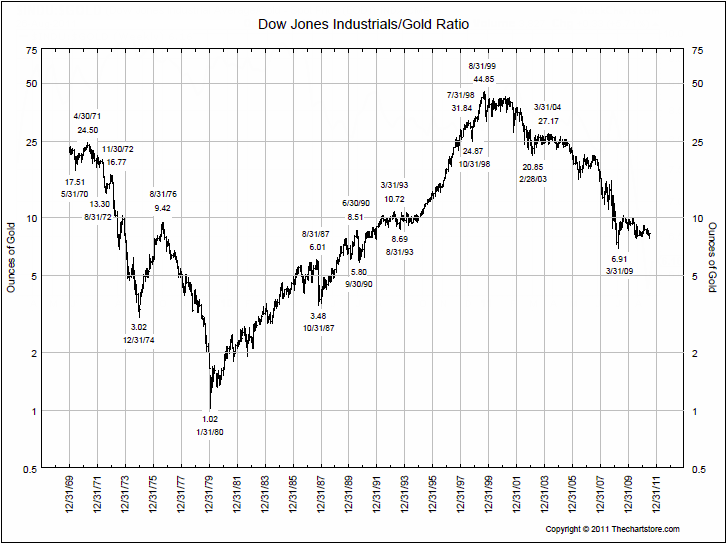

- Shiller PE (CAPE) Ratio: The cyclically adjusted price-to-earnings ratio (CAPE), also known as the Shiller PE, which smooths out earnings fluctuations over a longer period, shows high valuations compared to historical norms, further supporting the concern about high stock market valuations.

- Specific Sector Analysis: BofA's analysis likely delves into specific sectors, highlighting those exhibiting particularly high valuations relative to their growth prospects and risk profiles. This granular analysis provides a more nuanced understanding of the overall market valuation.

BofA's analysis reveals a significant divergence between current market prices and historical valuation averages, raising concerns about the sustainability of current market levels.

Investor Sentiment and Concerns Regarding High Valuations

In light of BofA's findings, investor sentiment is understandably cautious. Many are grappling with the implications of high stock market valuations and the potential risks involved. Specific concerns include:

-

Increased Market Volatility: High valuations often precede periods of increased market volatility and potential corrections. Investors are bracing themselves for the possibility of sharp price declines.

-

Rising Interest Rates: The Federal Reserve's actions on interest rates significantly impact stock valuations. Higher interest rates increase borrowing costs for companies, potentially slowing growth and impacting earnings, leading to lower stock prices. This is a major concern linked to high stock market valuations.

-

Unsustainable Growth in Certain Sectors: Some sectors are experiencing rapid growth, fueled by speculation and potentially unsustainable trends. This raises concerns about the long-term viability of these high valuations.

-

Increased Trading Volume in Defensive Sectors: Investor anxiety is reflected in the increased trading volume seen in sectors traditionally viewed as safer havens during market downturns.

-

Growing Skepticism Among Institutional Investors: Surveys show a growing number of institutional investors expressing skepticism regarding future market performance, reflecting the widespread concern about high stock market valuations.

-

Concerns About a Potential Market Bubble: Fears of a potential market bubble are fueling increased caution, leading some investors to adopt a more defensive posture.

Potential Implications of High Stock Market Valuations

The consequences of sustained high stock market valuations can be significant, both in the short-term and long-term. Several scenarios are possible:

-

Market Correction: A significant market correction could lead to substantial portfolio losses for investors. This is a realistic possibility given the elevated valuations.

-

Sustained Bull Market: It's possible, albeit less likely given current circumstances, that the market could continue its upward trajectory, albeit at a slower pace.

-

Soft Landing: A soft landing scenario involves a gradual deceleration of growth, leading to a moderate adjustment in valuations without a significant market crash.

-

Reduced Long-Term Returns: Sustained high valuations could ultimately result in reduced long-term returns for investors as the market eventually adjusts to more sustainable levels.

-

Mispricing of Risk: High valuations may signal a mispricing of risk within the market, potentially leading to unexpected volatility and losses.

Strategies for Navigating High Stock Market Valuations

Navigating the challenges presented by high stock market valuations requires a proactive and strategic approach. Investors should consider the following:

-

Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) can help mitigate risk and reduce the impact of potential market corrections.

-

Value Investing: Focusing on value investing strategies, which involve identifying undervalued companies with strong fundamentals, can potentially offer better long-term returns.

-

Risk Management: Implementing a robust risk management strategy, including setting stop-loss orders and diversifying your portfolio, is crucial to mitigate potential losses.

-

Portfolio Rebalancing: Regularly rebalancing your portfolio to maintain your desired asset allocation helps ensure you're not overly exposed to any single asset class.

-

Shifting Allocations: Consider shifting allocations towards undervalued assets or defensive sectors that tend to perform relatively well during market downturns.

-

Careful Due Diligence: Conduct thorough due diligence before making any investment decisions. Understand the risks associated with each investment and ensure it aligns with your overall financial goals.

Conclusion: High Stock Market Valuations and Investor Concerns: A BofA Perspective

BofA's analysis underscores the significant concerns surrounding high stock market valuations. Elevated P/E ratios, high price-to-sales ratios, and the Shiller PE ratio all point to a market potentially vulnerable to a correction. Investor sentiment reflects these concerns, with anxieties about volatility, rising interest rates, and unsustainable growth fueling caution. Understanding the implications of high stock market valuations is crucial for informed investing. Staying updated on market trends, conducting thorough due diligence, and implementing sound risk management strategies are paramount. Remember, careful consideration of your investment strategy is crucial in light of these high stock market valuations.

Featured Posts

-

Best Family Cruises 5 Top Rated Lines Reviewed

May 01, 2025

Best Family Cruises 5 Top Rated Lines Reviewed

May 01, 2025 -

Flaminia Risalita In Classifica Ora Seconda

May 01, 2025

Flaminia Risalita In Classifica Ora Seconda

May 01, 2025 -

Zodiac Predictions For April 17 2025 Your Daily Horoscope

May 01, 2025

Zodiac Predictions For April 17 2025 Your Daily Horoscope

May 01, 2025 -

The Big Deal New Cruise Ship Features For 2025

May 01, 2025

The Big Deal New Cruise Ship Features For 2025

May 01, 2025 -

Eleven Years Since The Louisville Tornado Lessons Learned And Community Resilience

May 01, 2025

Eleven Years Since The Louisville Tornado Lessons Learned And Community Resilience

May 01, 2025