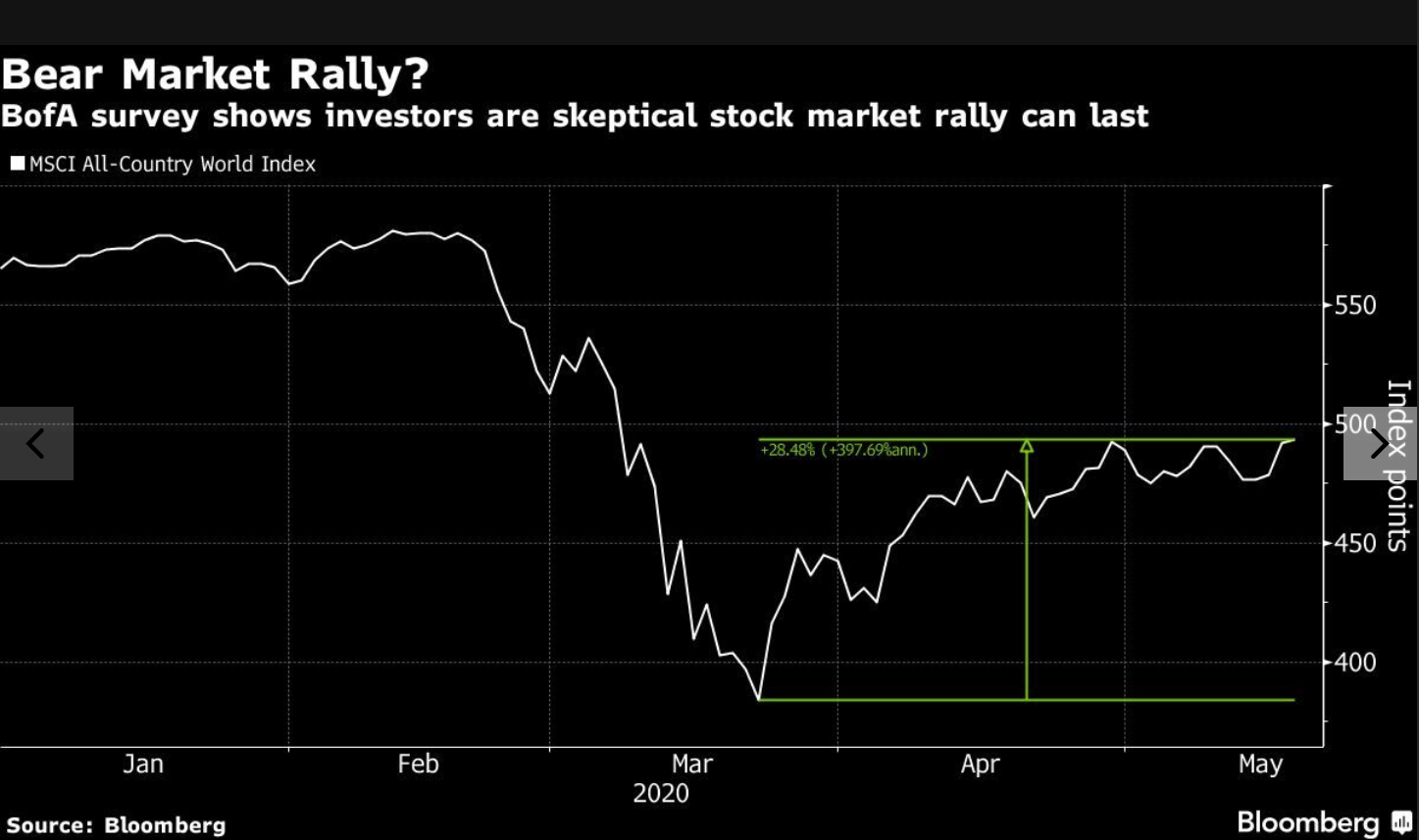

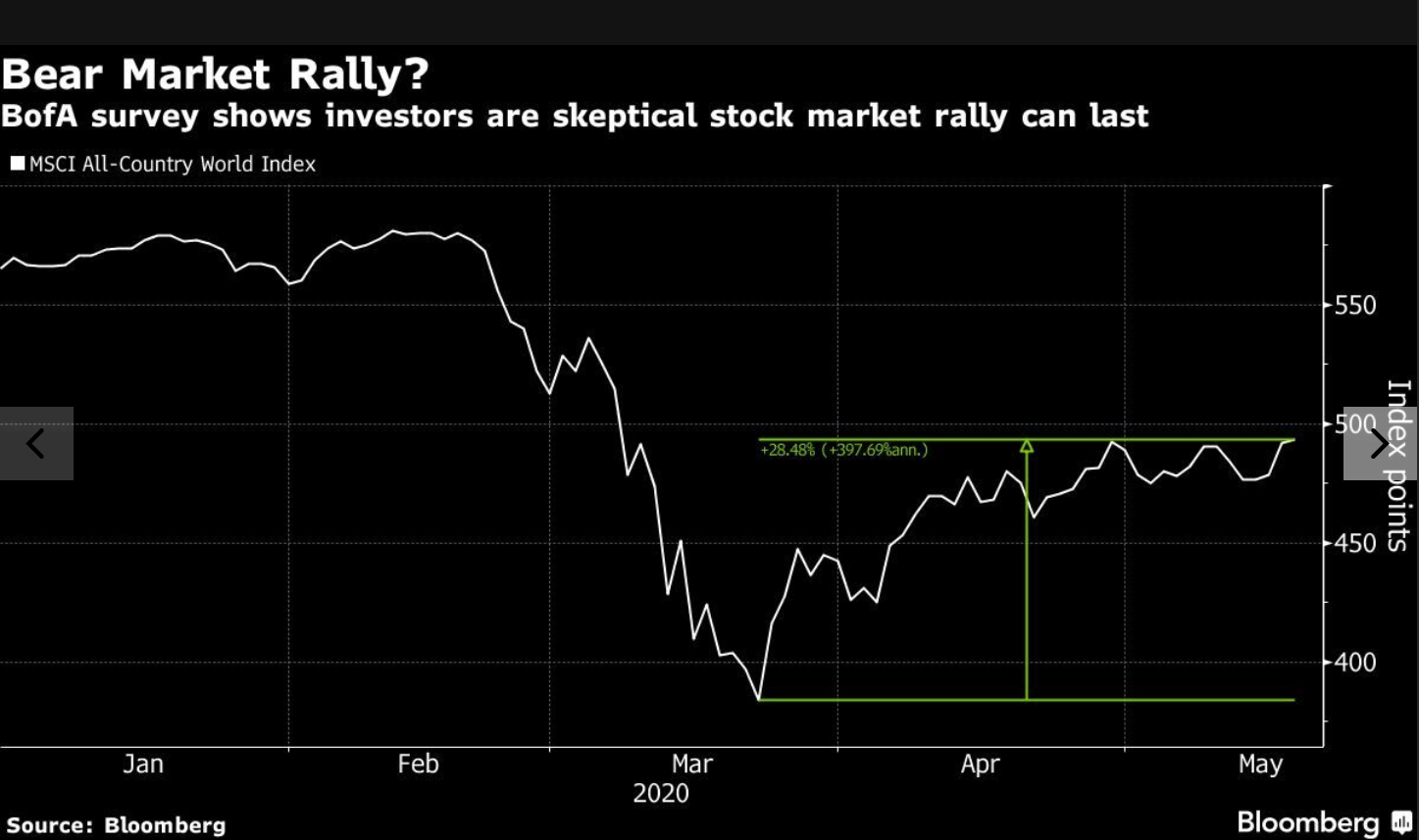

High Stock Market Valuations: BofA Explains Why Investors Shouldn't Panic

Table of Contents

BofA's Rationale: Understanding the Current Market Environment

Bank of America, a major player in the financial world, offers a nuanced view of the current market. While acknowledging the elevated valuations, BofA maintains a cautiously optimistic stance, neither fully bullish nor bearish. Their analysis considers a multitude of economic indicators and long-term growth projections. This considered outlook suggests that while caution is prudent, outright panic is unwarranted.

- Economic Indicators: BofA closely monitors inflation rates, interest rate adjustments by central banks (like the Federal Reserve), and GDP growth figures to gauge the overall economic health and its impact on market valuations. They acknowledge that persistently high inflation could negatively impact markets, but also believe that current levels are not necessarily a harbinger of immediate doom.

- Sectoral Analysis: BofA's reports often highlight specific sectors they deem overvalued (possibly those experiencing rapid growth spurts with inflated expectations) and others they consider undervalued (potentially offering long-term opportunities with currently suppressed prices). This granular approach allows investors to tailor their strategies accordingly.

- BofA Research: The firm regularly publishes detailed research reports and analyses, readily accessible on their website, providing in-depth insights into their market predictions and investment recommendations. Consulting these resources is crucial for a well-informed investment strategy.

Low Interest Rates and Their Impact on Valuations

Low interest rates are a significant factor contributing to high stock market valuations. The relationship is inversely proportional: lower rates generally lead to higher valuations. This is because low rates decrease the opportunity cost of investing in stocks.

- Time Value of Money: Low interest rates reduce the time value of money. This means the present value of future earnings is higher when discount rates (related to interest rates) are low. Investors are therefore willing to pay more for future earnings streams, resulting in higher price-to-earnings (P/E) ratios.

- Discount Rate Effect: A lower discount rate, linked to low interest rates, increases the present value of future cash flows from a company. This higher present value makes stocks appear more attractive, pushing up their prices.

- Historical Context: Comparing the current low-interest rate environment to historical data reveals a clear correlation: periods of low rates have often been associated with higher stock valuations and extended bull markets. However, it is crucial to remember that past performance doesn't guarantee future results.

Long-Term Growth Prospects: A Look Beyond the Current Volatility

Despite current high valuations, the long-term growth prospects for many sectors remain promising. Technological advancements, especially in areas like artificial intelligence, renewable energy, and biotechnology, are poised to drive substantial future growth.

- Technological Innovation: The continued advancement in technology fuels innovation and productivity gains, fostering economic expansion and corporate profitability. These advancements create new opportunities across various industries, leading to future growth regardless of current market valuations.

- Emerging Markets and Industries: Emerging markets and industries (such as sustainable energy solutions, space exploration, or advanced materials) offer substantial potential for growth, even amidst market uncertainties. These sectors often have longer runways to growth.

- Diversification's Importance: Diversifying your investment portfolio across different asset classes, sectors, and geographies is critical to mitigating risk associated with high stock market valuations. This prevents overexposure to any one particular area.

Identifying Potential Risks and Mitigation Strategies

While the long-term outlook may be positive, it's crucial to acknowledge potential risks associated with high valuations. A balanced approach recognizes these risks and implements appropriate mitigation strategies.

- Inflationary Pressures: Persistent high inflation can erode corporate profits and diminish investor confidence, potentially leading to a market correction.

- Rising Interest Rates: Increases in interest rates make borrowing more expensive for businesses and can impact stock valuations negatively.

- Geopolitical Instability: Geopolitical events and uncertainties can inject volatility into markets.

- Risk Management through Diversification: Strategic diversification across various asset classes and sectors is a vital tool for managing risk. A well-diversified portfolio reduces the impact of negative events on the overall investment.

- A Well-Defined Investment Plan: Having a clearly defined investment plan with long-term goals, risk tolerance, and a clear understanding of your financial situation is paramount to navigating high stock market valuations effectively.

Navigating High Stock Market Valuations – A Call to Action

BofA's perspective, coupled with an understanding of interest rates and long-term growth potential, suggests that while high stock market valuations require careful consideration, they do not automatically signal impending doom. Long-term investing and strategic diversification remain cornerstones of effective investment strategies. To manage high stock market valuations effectively, conduct thorough research, consult with a qualified financial advisor, and develop a personalized investment strategy tailored to your risk tolerance and financial goals. Understand high stock market valuations and invest wisely despite high stock market valuations. The potential for future growth remains significant, but a rational, informed approach is crucial for navigating this dynamic market successfully.

Featured Posts

-

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And Other Highlights

May 24, 2025

Glastonbury 2025 A Lineup Analysis Charli Xcx Neil Young And Other Highlights

May 24, 2025 -

Sheinelle Jones Update Return To The Today Show And Health Status

May 24, 2025

Sheinelle Jones Update Return To The Today Show And Health Status

May 24, 2025 -

Kharkovschina Svadebniy Den Pochti 40 Par Zaklyuchili Brak Foto

May 24, 2025

Kharkovschina Svadebniy Den Pochti 40 Par Zaklyuchili Brak Foto

May 24, 2025 -

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025 -

How Joe Jonas Defused A Couples Fight Over Him

May 24, 2025

How Joe Jonas Defused A Couples Fight Over Him

May 24, 2025