High Stock Market Valuations: BofA's Case For Investor Confidence

Table of Contents

BofA's Bullish Outlook: Underlying Economic Strength

BofA's positive outlook on the stock market, despite high valuations, rests on a foundation of robust economic fundamentals. Their analysis points to several key factors supporting continued growth and justifying current market prices.

-

Strong Corporate Earnings Growth: Despite high stock market valuations, corporate earnings have remained surprisingly resilient. Many companies are exceeding expectations, demonstrating strong profitability and efficient operations. This suggests that current valuations, while high, are not entirely detached from underlying performance. High earnings translate to strong economic growth and signal continued investor confidence.

-

Positive Economic Indicators: Several key economic indicators support BofA's bullish stance. Low unemployment rates indicate a healthy labor market, boosting consumer spending and overall economic activity. Strong consumer spending, in turn, fuels further corporate growth and revenue. This positive feedback loop contributes to higher stock valuations and continued investor confidence.

-

Robust Innovation and Technological Advancements: BofA emphasizes the role of technological innovation in driving economic growth. Breakthroughs in various sectors, from artificial intelligence to renewable energy, are creating new opportunities and fueling significant investment, justifying higher valuations for companies at the forefront of these advancements. This innovative spirit contributes to high stock market valuations and supports investor confidence in long-term growth.

-

Strong Sector Performance: BofA highlights specific sectors, such as technology and healthcare, as particularly strong performers, exhibiting robust growth and contributing significantly to overall market valuations. These sectors are characterized by high innovation, consistent demand, and strong future growth potential.

Addressing Valuation Concerns: A Deeper Dive into Metrics

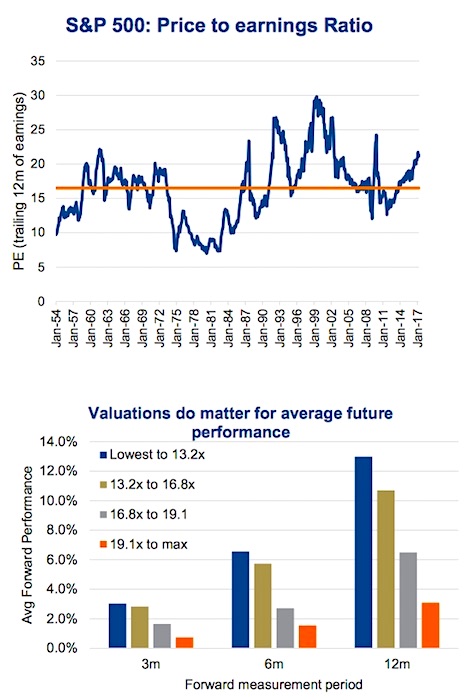

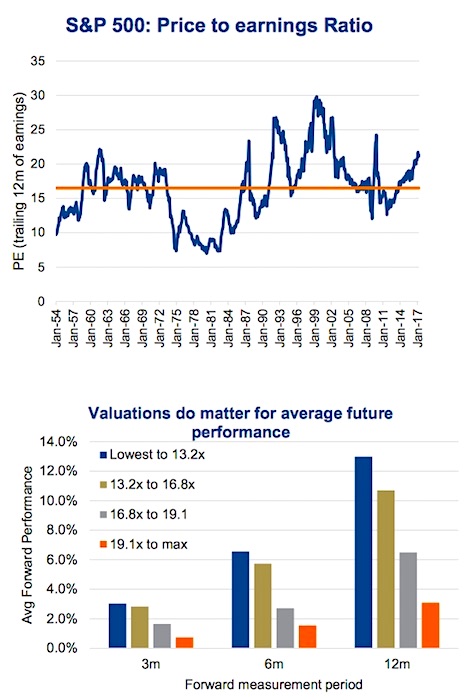

The concern surrounding high stock market valuations often centers on traditional metrics like the Price-to-Earnings (P/E) ratio. A high P/E ratio can suggest that stocks are overvalued relative to their earnings. However, BofA's analysis counters these concerns by considering several factors.

-

Low Interest Rates and Future Earnings: BofA argues that historically low interest rates justify higher valuations. Low borrowing costs incentivize investment, leading to increased corporate earnings potential in the future. This expectation of future growth helps rationalize currently high P/E ratios.

-

Alternative Valuation Metrics: Instead of solely relying on P/E ratios, BofA employs alternative valuation metrics, such as discounted cash flow analysis, which consider the time value of money and future cash flows. These methods often paint a more nuanced picture of a company's true value, mitigating concerns about high P/E ratios.

-

Strong Fundamentals: BofA points to specific examples of companies with seemingly high valuations but incredibly strong fundamentals – consistent revenue growth, high profit margins, and substantial competitive advantages. These examples demonstrate that high market capitalization doesn't always equate to overvaluation.

The Role of Interest Rates and Monetary Policy

Current interest rate environments play a crucial role in influencing stock market valuations and investor behavior.

-

Low Interest Rates and Risk Appetite: Low interest rates reduce the cost of borrowing, encouraging investment in riskier assets like stocks. This increased demand pushes up stock prices and contributes to higher valuations.

-

Future Interest Rate Hikes (or Cuts): The Federal Reserve's monetary policy decisions significantly impact stock market valuations. Potential interest rate hikes can lead to decreased investment and lower stock prices, while interest rate cuts can have the opposite effect. BofA's analysis carefully considers the potential impact of future monetary policy changes on market performance.

-

BofA's Monetary Policy Considerations: BofA incorporates projections of future interest rate changes into its valuation models. This forward-looking approach provides a more comprehensive assessment of the market's future trajectory and helps mitigate risks associated with changes in monetary policy.

Long-Term Growth Prospects and Strategic Investment

BofA's report emphasizes the importance of considering long-term growth prospects when assessing current stock market valuations.

-

Growth Sectors: The report identifies several sectors poised for substantial long-term growth, including technology, healthcare, and renewable energy. These sectors offer attractive investment opportunities despite current high valuations.

-

Strategic Investment Recommendations: BofA provides specific recommendations for strategic investment, advising investors to focus on companies with strong fundamentals, robust growth potential, and a clear competitive advantage. This focus on quality over short-term price fluctuations is crucial for long-term success.

-

Long-Term Investment Horizon: The report stresses the importance of adopting a long-term investment strategy. Fluctuations in the short term should not overshadow the potential for significant returns over the long haul. A long-term investment horizon allows investors to ride out short-term market volatility and benefit from sustained growth.

Conclusion: Navigating High Stock Market Valuations with Confidence

BofA's analysis provides compelling reasons for investor confidence, even amidst high stock market valuations. Their findings highlight underlying economic strength, a need for a reassessment of traditional valuation metrics, and the crucial role of interest rates and monetary policy. Based on their insights, high stock market valuations don't necessarily signal an impending market downturn. Don't let high stock market valuations deter you. Learn more about BofA's findings and build a confident investment strategy today, focusing on long-term growth and strategic asset allocation. Remember to diversify your portfolio and consider seeking professional financial advice tailored to your individual circumstances and risk tolerance when navigating these high stock market valuations.

Featured Posts

-

Understanding High Stock Market Valuations Bof As Analysis

May 20, 2025

Understanding High Stock Market Valuations Bof As Analysis

May 20, 2025 -

Transformation Numerique En Cote D Ivoire Le Ivoire Tech Forum 2025

May 20, 2025

Transformation Numerique En Cote D Ivoire Le Ivoire Tech Forum 2025

May 20, 2025 -

Giakoymakis Mls Analyontas Tin Pithanotita Epistrofis

May 20, 2025

Giakoymakis Mls Analyontas Tin Pithanotita Epistrofis

May 20, 2025 -

Presidentielle Cameroun 2032 Macron Referendum Et Strategies Politiques

May 20, 2025

Presidentielle Cameroun 2032 Macron Referendum Et Strategies Politiques

May 20, 2025 -

O Noua Generatie In Familia Schumacher Prima Poza Cu Nepotelul

May 20, 2025

O Noua Generatie In Familia Schumacher Prima Poza Cu Nepotelul

May 20, 2025