High Stock Market Valuations: BofA's Case For Why Investors Shouldn't Panic

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Bear Market Signal

BofA's analysts argue that current high stock market valuations, while undeniably high, don't automatically signal an impending bear market. Their reasoning rests on several key pillars:

-

Low interest rates justify higher Price-to-Earnings (P/E) ratios. Lower borrowing costs allow companies to invest more readily, boosting earnings and supporting higher valuations. Historically low interest rates have played a significant role in influencing investor sentiment and justifying premium valuations.

-

Robust corporate earnings growth supports current valuations. Strong corporate earnings reports demonstrate the underlying health and profitability of many companies, providing a fundamental justification for current stock prices. BofA's analysis likely points to specific sectors experiencing significant growth, further supporting this argument.

-

Strong economic fundamentals suggest continued growth potential. Positive economic indicators, such as GDP growth projections and employment figures, suggest continued growth, fostering a positive outlook for stock market performance and sustaining high valuations. BofA's research probably includes projections for continued GDP growth, strengthening their argument against immediate panic. For example, BofA might cite a projected GDP growth of X% for the next year.

-

Data-driven support: BofA's report likely includes specific data points and projections to support these arguments. This could include projected earnings per share (EPS) growth, forward P/E ratios compared to historical averages, and other relevant metrics. These specifics add credibility and weight to their analysis.

Understanding the Factors Contributing to High Stock Market Valuations

Several interconnected factors have contributed to the current high stock market valuations:

-

Impact of quantitative easing (QE) and low interest rate policies. Years of loose monetary policy by central banks, including extensive quantitative easing programs, have injected significant liquidity into the market, driving up asset prices, including stocks.

-

Role of technological innovation and disruption in driving growth. Rapid technological advancements, particularly in sectors like artificial intelligence and biotechnology, have fueled significant growth and created new investment opportunities, contributing to higher valuations. This rapid innovation often comes with higher risk, but also higher potential reward.

-

Influence of global economic recovery and emerging markets. The ongoing recovery from the pandemic, coupled with the growth potential of emerging markets, has created a positive global economic backdrop, boosting investor confidence and supporting higher valuations. This global recovery is uneven, however, posing both opportunities and risks.

-

Counterarguments and BofA's response: It's crucial to acknowledge counterarguments. Some might argue that these valuations are unsustainable bubbles. BofA likely addresses these concerns by highlighting the strong fundamentals and the potential for continued growth despite the high valuations.

Long-Term Investment Strategies in a High-Valuation Market

Navigating a market with high stock market valuations requires a strategic approach:

-

Benefits of diversification across asset classes. Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) can mitigate risk and potentially improve returns. This reduces exposure to market fluctuations within any single asset class.

-

Strategies for identifying undervalued stocks in a high-valuation market. While the overall market may be expensive, some individual stocks may still be undervalued. Thorough fundamental analysis is essential for identifying these opportunities. Value investing strategies become increasingly important during periods of high valuations.

-

Importance of a long-term investment approach to weather market fluctuations. High valuations often lead to volatility. A long-term investment horizon allows investors to ride out short-term market fluctuations and benefit from long-term growth. This is arguably the most crucial element for successful investing.

-

The risks of short-term trading decisions based solely on valuation concerns. Making impulsive trading decisions based solely on valuation anxieties can be detrimental. A well-defined investment plan is crucial to avoid emotional decision-making.

Risks and Potential Downsides: Addressing Concerns about High Stock Market Valuations

While BofA's analysis suggests a cautious optimism, acknowledging potential risks is essential:

-

The risk of a market correction or downturn. High valuations inherently increase the risk of a significant market correction or even a bear market. This is an inherent risk that cannot be completely eliminated.

-

Potential impact of rising interest rates on valuations. Rising interest rates can negatively impact valuations by increasing borrowing costs for companies and making bonds more attractive compared to stocks. This is a key factor to watch closely.

-

Geopolitical risks and their potential effect on the market. Unforeseen geopolitical events can trigger market volatility and impact valuations. Geopolitical uncertainty is always a factor influencing global markets.

-

BofA's risk assessment: BofA’s report likely addresses these concerns, perhaps by outlining scenarios and suggesting strategies to mitigate these risks.

Navigating High Stock Market Valuations – A Call to Action

BofA's analysis suggests that while high stock market valuations are a legitimate concern, they don't automatically signal imminent disaster. Their argument rests on strong corporate earnings, low interest rates, and positive economic fundamentals. However, understanding the context of these high valuations and acknowledging the potential risks is crucial.

Remember, a balanced and informed approach to investing is key. Don't let fear dictate your decisions. Conduct thorough research, consider BofA's insights (link to BofA report, if available), and build a robust, long-term investment strategy tailored to your risk tolerance and financial goals. Proper diversification and a long-term perspective are essential for successfully navigating high stock market valuations.

Featured Posts

-

Vaccine Study Review Hhss Choice Of David Geier Raises Concerns

Apr 27, 2025

Vaccine Study Review Hhss Choice Of David Geier Raises Concerns

Apr 27, 2025 -

Eqs Pvr Pne Ag Veroeffentlicht Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Eqs Pvr Pne Ag Veroeffentlicht Gemaess Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

German Wind And Solar Expansion Pne Group Receives Permits For Three Projects

Apr 27, 2025

German Wind And Solar Expansion Pne Group Receives Permits For Three Projects

Apr 27, 2025 -

David Geier Vaccine Skeptic Joins Hhs To Analyze Vaccine Research

Apr 27, 2025

David Geier Vaccine Skeptic Joins Hhs To Analyze Vaccine Research

Apr 27, 2025 -

Sam Carraros Five Minute Love Triangle Cameo On Stan A Controversial Appearance

Apr 27, 2025

Sam Carraros Five Minute Love Triangle Cameo On Stan A Controversial Appearance

Apr 27, 2025

Latest Posts

-

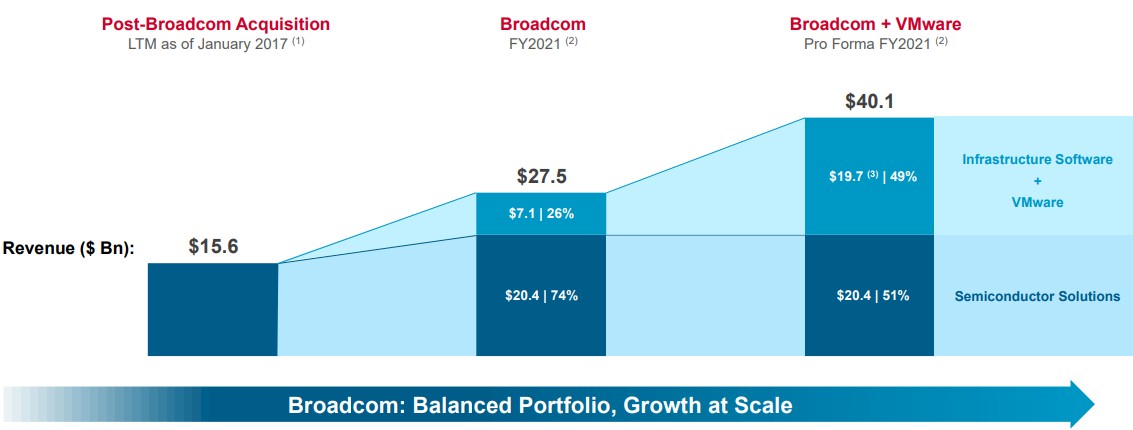

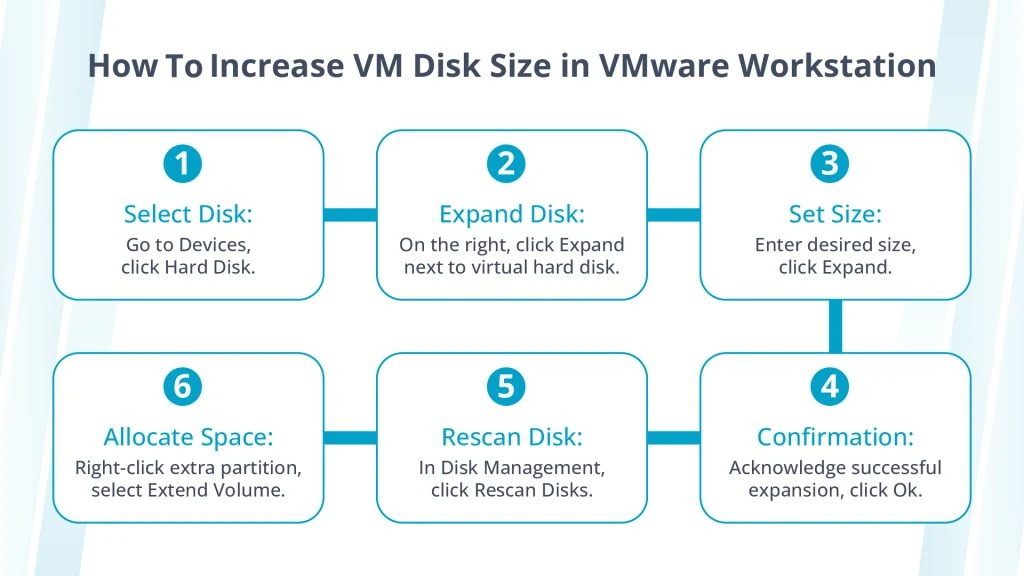

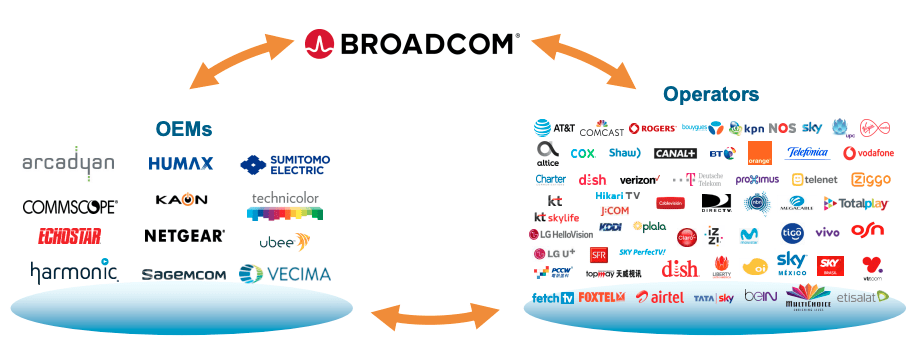

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025 -

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025 -

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Increase

Apr 28, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Increase

Apr 28, 2025