High Stock Market Valuations: Why BofA Believes Investors Shouldn't Worry

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Problem

Understanding BofA's Bullish Outlook on High Valuations: BofA's analysts maintain a relatively optimistic outlook, citing several key factors that mitigate the risks associated with elevated stock prices. Their reports consistently emphasize the importance of considering the broader economic context rather than focusing solely on valuation metrics.

- Low interest rates supporting higher valuations: Historically low interest rates allow companies to borrow money cheaply, fueling investment and boosting earnings, which supports higher stock valuations. This reduces the discount rate applied to future cash flows, making equities more attractive.

- Strong corporate earnings growth offsetting valuation concerns: Robust corporate earnings growth, fueled by factors such as technological innovation and economic recovery, can justify seemingly high price-to-earnings ratios. Companies are delivering strong performance, justifying investor premiums.

- Technological innovation driving future growth and justifying premiums: The rapid pace of technological advancement continues to disrupt industries, creating significant growth opportunities and justifying higher valuations for innovative companies positioned to capitalize on these trends. Investors are willing to pay a premium for companies leading these technological advancements.

- Long-term economic growth projections: BofA's economic forecasts suggest sustained long-term growth, supporting their belief that high stock market valuations are sustainable in the long run. These projections factor in various global economic indicators and trends.

Analyzing the Factors Behind High Stock Market Valuations

Dissecting the Drivers of Elevated Stock Prices: Several factors contribute to the current landscape of high stock market valuations. Understanding these drivers is crucial for informed investment decisions.

- Quantitative easing and monetary policy: Central banks' quantitative easing programs and accommodative monetary policies have injected significant liquidity into the financial system, driving up asset prices, including equities. This abundant liquidity has increased demand for assets.

- Increased demand from retail and institutional investors: A surge in retail investor participation, alongside continued investment from institutional players, fuels demand, pushing prices higher. The rise of online brokerage platforms has increased accessibility to the stock market.

- Supply chain improvements and economic recovery: Easing supply chain constraints and a strengthening global economic recovery contribute to increased corporate profitability and investor optimism, both of which contribute to higher stock valuations. Improved logistics and production efficiency bolster corporate earnings.

- Government stimulus and infrastructure spending: Government stimulus packages and investments in infrastructure projects boost economic activity, fostering corporate growth and supporting higher equity valuations. This injection of capital stimulates economic expansion.

Mitigating Risks Associated with High Valuations

Strategies for Navigating a Potentially Volatile Market: While BofA's outlook is optimistic, acknowledging potential risks is crucial. High valuations do increase the potential for market corrections.

- Diversification of investment portfolio: A well-diversified portfolio across different asset classes (stocks, bonds, real estate, etc.) reduces the overall risk associated with high stock market valuations. This reduces the impact of any single asset class underperforming.

- Strategic asset allocation: A carefully crafted asset allocation strategy balances risk and return based on individual investor risk tolerance and financial goals. This tailoring considers the investor's specific circumstances and timeframe.

- Focus on long-term investment horizons: Maintaining a long-term investment perspective helps to weather short-term market volatility and ride out potential corrections. Long-term investors are less susceptible to short-term market fluctuations.

- Regular portfolio rebalancing: Periodically rebalancing the investment portfolio to maintain the desired asset allocation helps manage risk and capitalize on market opportunities. Rebalancing ensures the portfolio remains aligned with the investor's strategy.

BofA's Predictions and Recommendations for Investors

BofA's Outlook and Investment Guidance: BofA's analysts generally predict continued, albeit potentially slower, economic growth. While acknowledging the possibility of market corrections, they maintain a positive long-term outlook.

- Specific sectors BofA recommends: BofA often highlights sectors poised for growth, such as technology, healthcare, and sustainable energy, as attractive investment opportunities. Their recommendations are based on in-depth sector analysis and growth projections.

- Investment strategies for different risk tolerances: BofA tailors its investment advice to investors' risk profiles, recommending more conservative strategies for risk-averse investors and potentially higher-risk strategies for those with a higher risk tolerance. This ensures the advice is appropriate to each investor's circumstance.

- Importance of a long-term perspective: BofA consistently emphasizes the importance of taking a long-term view when investing in the stock market. Short-term fluctuations should not dictate long-term investment decisions.

- Recommended actions for investors based on their risk profiles: BofA provides guidance on specific actions investors should take based on their individual circumstances, financial goals, and risk tolerance levels. This guidance can include adjusting asset allocation or diversifying investments.

Conclusion: Navigating High Stock Market Valuations with Confidence

BofA's analysis suggests that while high stock market valuations are a valid concern, they are not necessarily a cause for panic. Factors like low interest rates, strong corporate earnings, technological innovation, and positive long-term economic growth projections support their optimistic outlook. By understanding these factors and employing effective risk management strategies like diversification and strategic asset allocation, investors can navigate this market with confidence. Don't let high stock market valuations deter you from pursuing your investment goals. Understand the nuances of high stock market valuations and learn how to navigate high stock market valuations effectively. Further research into BofA's reports and market analyses can provide additional insights to help you make informed investment decisions.

Featured Posts

-

Peppa Pigs Parents Throw Gender Reveal Party A New Baby Is On The Way

May 22, 2025

Peppa Pigs Parents Throw Gender Reveal Party A New Baby Is On The Way

May 22, 2025 -

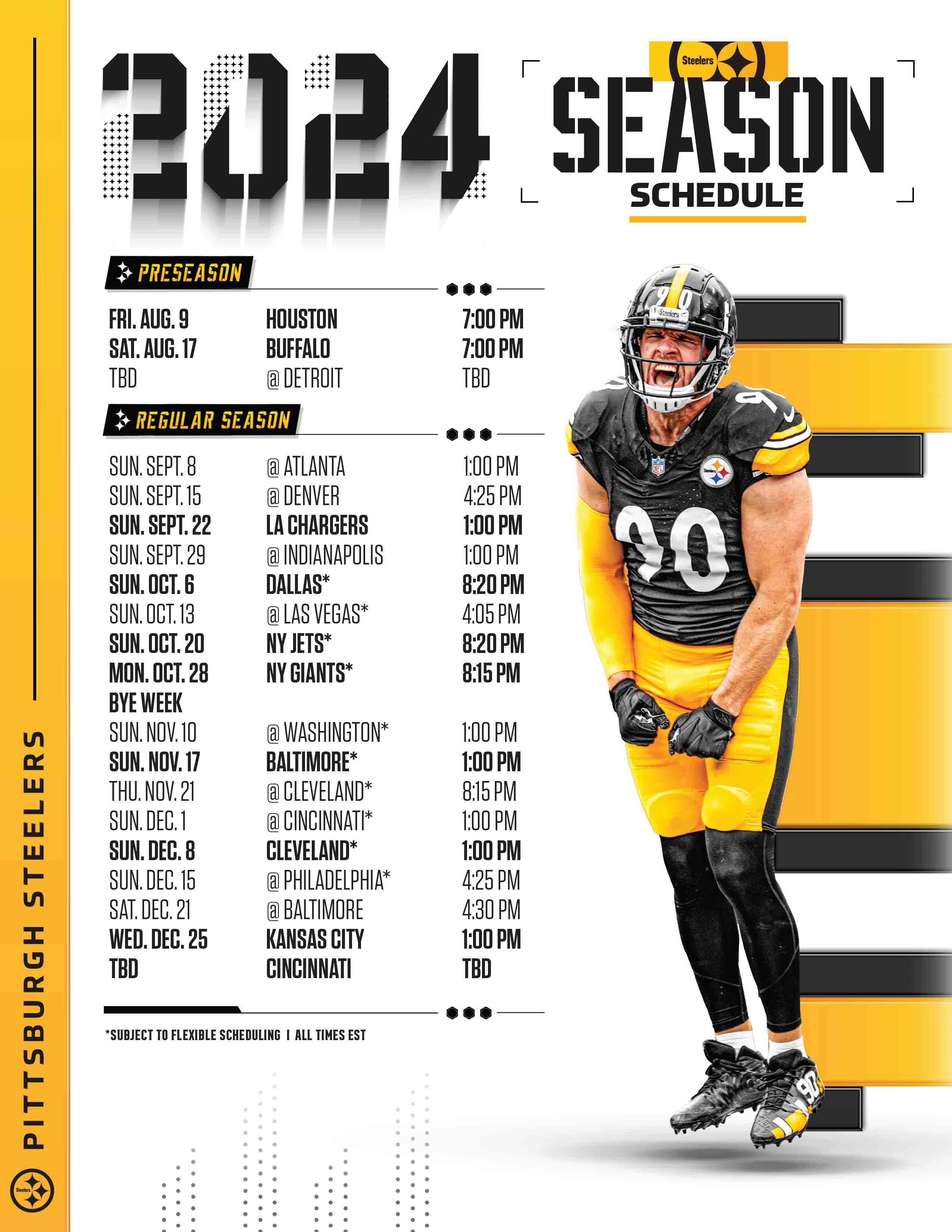

Projected Pittsburgh Steelers Schedule For 2025

May 22, 2025

Projected Pittsburgh Steelers Schedule For 2025

May 22, 2025 -

Wtt Star Contender Chennai India Sets New Record With 19 Paddlers

May 22, 2025

Wtt Star Contender Chennai India Sets New Record With 19 Paddlers

May 22, 2025 -

Testez Vos Connaissances Sur La Loire Atlantique

May 22, 2025

Testez Vos Connaissances Sur La Loire Atlantique

May 22, 2025 -

Capturing Cannes The Enduring Legacy Of The Traverso Family

May 22, 2025

Capturing Cannes The Enduring Legacy Of The Traverso Family

May 22, 2025