High Stock Market Valuations: Why BofA Thinks Investors Shouldn't Panic

Table of Contents

BofA's Rationale Behind a Bullish Outlook Despite High Valuations

BofA's optimistic stance on the market, even with current high stock market valuations, rests on several key pillars. Their analysis points towards a continued period of growth, supported by robust corporate performance and a favorable economic climate.

-

Strong Corporate Earnings Growth Projections: BofA's analysts predict continued strong earnings growth for many companies. This sustained profitability, they argue, justifies, at least partially, the elevated stock prices. The projections are based on factors like increased consumer spending and global economic recovery.

-

Low Interest Rates Supporting Equity Markets: The persistently low interest rate environment continues to support equity markets. With bonds yielding relatively low returns, investors are more inclined to seek higher returns in the stock market, contributing to the higher valuations. This low-interest rate environment is expected to continue for the foreseeable future, according to BofA's economic forecasts.

-

Continued Technological Innovation Driving Growth in Specific Sectors: Technological advancements are fueling growth in key sectors, particularly in technology, healthcare, and renewable energy. These sectors often command premium valuations due to their high growth potential. BofA identifies several promising companies within these sectors, contributing to their positive outlook.

-

Positive Economic Indicators: Several positive economic indicators, including a falling unemployment rate and rising consumer confidence, support BofA's bullish outlook. These signals suggest a healthy and growing economy capable of supporting current stock prices, despite the high stock market valuations.

Addressing the Concerns of High Price-to-Earnings Ratios (P/E)

A common concern among investors is the elevated Price-to-Earnings (P/E) ratios. These ratios, which compare a company's stock price to its earnings per share, are currently higher than historical averages for many companies. However, BofA contends that this isn't necessarily a cause for alarm.

-

Comparison of Current P/E Ratios to Historical Averages, Considering Context: While current P/E ratios are high compared to historical averages, BofA argues that these comparisons should consider the context. Factors such as low interest rates and the strong earnings growth mentioned earlier can justify higher valuations. A simple comparison without context can be misleading.

-

Explanation of Factors Influencing Current High P/E Ratios: The low-interest rate environment is a significant factor contributing to the high P/E ratios. Investors are willing to pay more for future earnings when the cost of borrowing is low, thereby inflating valuations.

-

Specific Sectors with Particularly High Valuations: Some sectors, like technology, are characterized by particularly high valuations. BofA acknowledges these elevated valuations but emphasizes the strong growth prospects in these sectors, arguing that the high P/E ratios might be justified given their future potential.

The Importance of Long-Term Investing in a Volatile Market

Despite the current high stock market valuations, BofA emphasizes the crucial role of long-term investing. Short-term market fluctuations should not dictate investment decisions.

-

Risks Associated with Short-Term Trading Decisions: Short-term trading based on market volatility often leads to emotional decisions and potentially poor investment outcomes.

-

Benefits of a Diversified Portfolio: A well-diversified portfolio across different asset classes is essential to mitigate the risks associated with market volatility. This diversification helps reduce the impact of underperformance in any single sector.

-

Historical Performance of Long-Term Stock Investments: Historically, long-term investments in the stock market have generated significant returns despite periods of volatility and high stock market valuations.

-

Recommendations for Long-Term Investors: BofA recommends that long-term investors maintain a disciplined approach, sticking to their investment strategy and avoiding knee-jerk reactions to short-term market movements.

Alternative Investment Strategies for Managing Risk

Investors concerned about high stock market valuations can consider alternative strategies to manage risk.

-

Diversification into Bonds or Other Asset Classes: Diversifying into less volatile assets like bonds can help to balance risk and reduce overall portfolio volatility.

-

Dollar-Cost Averaging: Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals, can help mitigate the risk of investing a lump sum at a market peak.

-

Value Investing: Value investing, which focuses on identifying undervalued companies, can offer opportunities to profit even in a market with high stock market valuations.

Navigating High Stock Market Valuations – A Call to Action

BofA's analysis suggests that while high stock market valuations are a valid concern, they are not necessarily a reason for panic. The strong corporate earnings, low interest rates, and technological innovation create a supportive backdrop for continued market growth. However, maintaining a long-term perspective and a diversified investment portfolio remains crucial. Understanding high stock valuations and their impact on your portfolio is key. Don't let concerns about high stock market valuations paralyze you. Make informed decisions based on a long-term strategy and professional guidance to manage high stock market valuations effectively and navigate the current market effectively. Consider seeking professional financial advice tailored to your specific circumstances and risk tolerance to help you effectively manage your investments in this environment of high stock market valuations.

Featured Posts

-

Eva Longorias Hottest Photos Celebrating Her 50th Birthday

May 13, 2025

Eva Longorias Hottest Photos Celebrating Her 50th Birthday

May 13, 2025 -

Gatsbys Inspirations Exploring The Real Men Behind The Fictional Character

May 13, 2025

Gatsbys Inspirations Exploring The Real Men Behind The Fictional Character

May 13, 2025 -

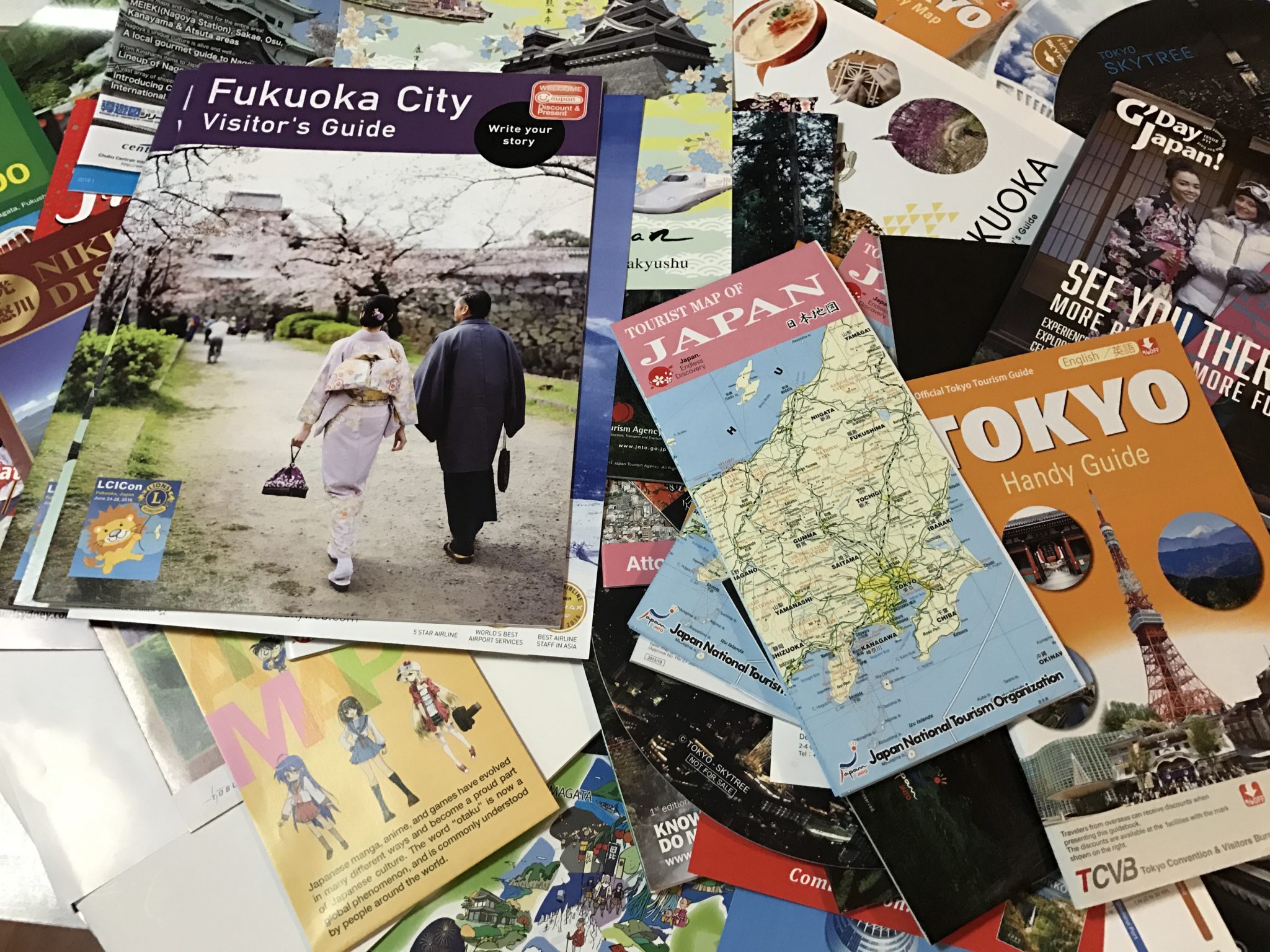

Planning Your Springwatch In Japan A Cherry Blossom Itinerary

May 13, 2025

Planning Your Springwatch In Japan A Cherry Blossom Itinerary

May 13, 2025 -

Sporne Iz Ave Marinike Tepi Reaktsi E I Posleditse Za Natsionalni Savet Roma

May 13, 2025

Sporne Iz Ave Marinike Tepi Reaktsi E I Posleditse Za Natsionalni Savet Roma

May 13, 2025 -

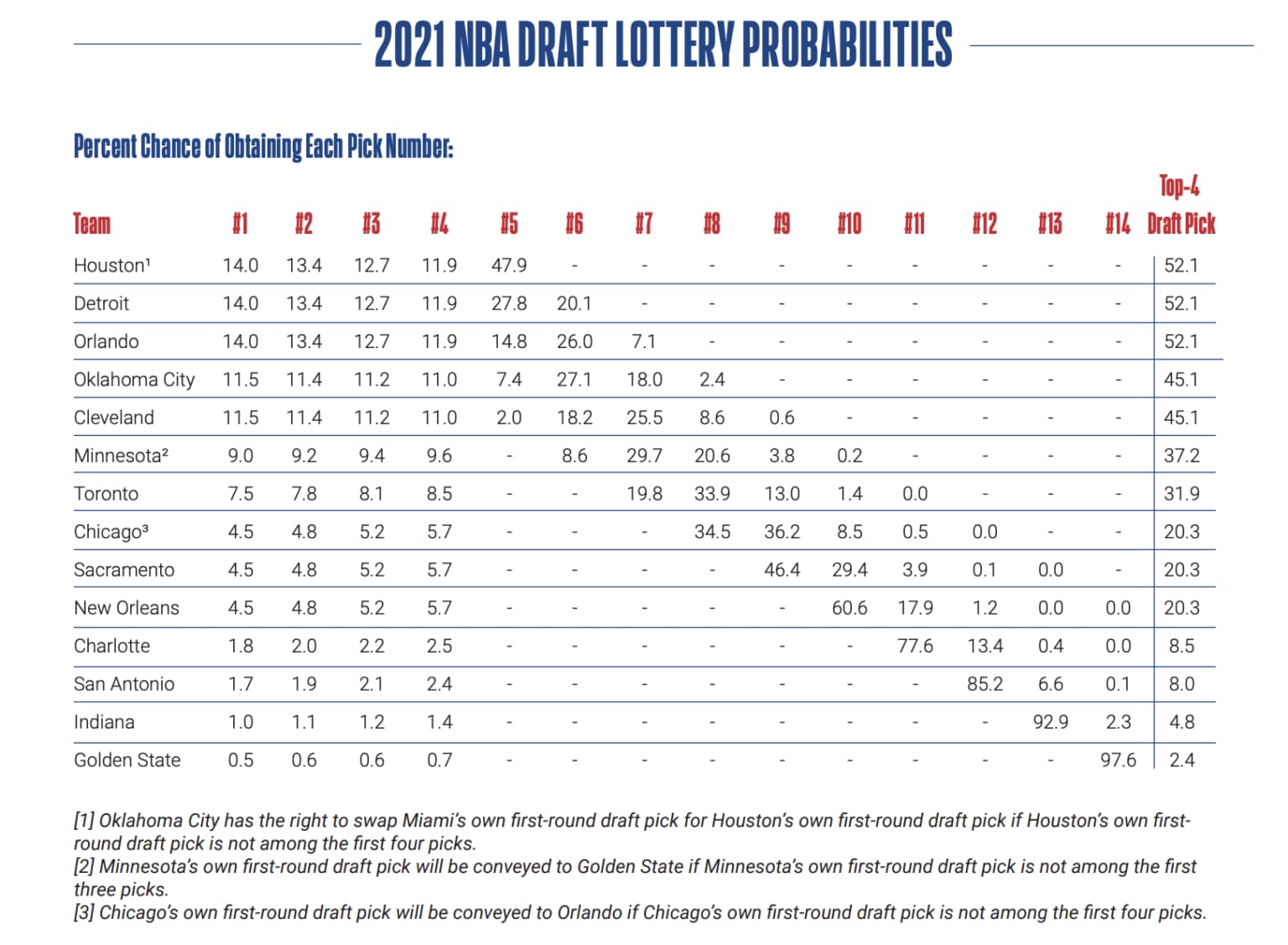

Espns Revamped Nba Draft Lottery Coverage Whats Changed

May 13, 2025

Espns Revamped Nba Draft Lottery Coverage Whats Changed

May 13, 2025