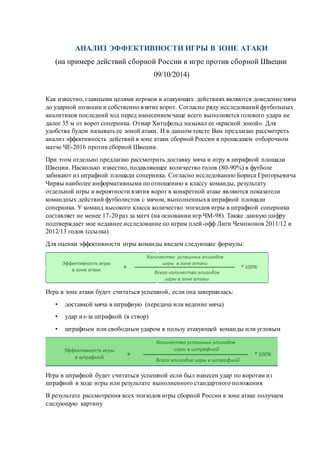

High Stock Valuations And Investor Concerns: BofA's Perspective

Table of Contents

BofA's Assessment of Current Market Conditions

Elevated Price-to-Earnings Ratios and Their Implications

BofA's analysis reveals that many sectors are currently exhibiting elevated Price-to-Earnings (P/E) ratios. This indicates that investors are paying a premium for earnings, suggesting potentially overvalued stocks in some areas.

- Technology: BofA notes particularly high P/E ratios within the technology sector, driven by high growth expectations but also potential for future slowdown.

- Consumer Discretionary: Companies in the consumer discretionary sector also show elevated valuations, reflecting consumer spending but carrying risk with potential interest rate increases.

- Energy: While energy stocks have benefited from high commodity prices, BofA cautions that valuations may not fully reflect the cyclical nature of the energy market.

These high P/E ratios present several potential risks:

- Market Corrections: Overvalued sectors are more susceptible to sharp price corrections if investor sentiment shifts.

- Reduced Returns: High purchase prices mean lower potential returns unless earnings significantly exceed expectations.

- Increased Volatility: Stocks with high P/E ratios tend to experience greater price fluctuations.

Understanding these risks is crucial for informed investment decisions. Careful analysis of individual company performance and sector trends is essential when dealing with high P/E ratio stocks. The keywords "Price-to-Earnings ratio," "P/E ratio," "sector valuation," and "market risk" are key to understanding BofA's concerns.

Interest Rate Hikes and Their Effect on Stock Valuations

BofA emphasizes the inverse relationship between interest rates and stock valuations. Rising interest rates increase borrowing costs for companies, potentially hindering growth and reducing future earnings. Higher rates also make bonds a more attractive investment, diverting capital away from the stock market.

BofA's predictions regarding future interest rate movements are crucial for assessing market risk. While the exact trajectory remains uncertain, BofA’s projections influence investor sentiment and consequently, stock prices. Continued rate hikes are expected to put downward pressure on stock valuations, especially in sectors sensitive to interest rate changes. Keywords like "interest rate hikes," "monetary policy," "inflation," and "stock price impact" accurately reflect this analysis.

Economic Growth Forecasts and Their Influence on Stock Prices

BofA’s economic growth projections are vital in understanding their outlook on stock valuations. The bank considers various scenarios, including robust growth and a potential economic slowdown.

- Robust Growth Scenario: In a scenario of strong economic growth, higher corporate earnings would support current valuations, although the risk of overvaluation remains.

- Slowdown Scenario: A slowdown in economic growth or a recession could significantly impact corporate earnings and lead to lower stock prices, potentially creating a market correction.

These contrasting scenarios highlight the uncertainty inherent in current market conditions. Investors should carefully consider BofA's projections and understand how different economic outcomes could affect their portfolios. Keywords such as "economic growth," "GDP growth," "recession risk," and "investor sentiment" capture the essence of this analysis.

Investor Concerns Highlighted by BofA

Volatility and Market Corrections

BofA acknowledges the heightened market volatility and highlights the increased likelihood of market corrections. Several factors contribute to this volatility:

- High inflation

- Rising interest rates

- Geopolitical uncertainty

BofA suggests strategies for mitigating risk during these turbulent times, including:

- Portfolio diversification: Spreading investments across different asset classes and sectors to reduce the impact of any single event.

- Defensive positioning: Shifting towards less volatile investments.

- Hedging strategies: Employing financial instruments to protect against potential losses.

The keywords "market correction," "market volatility," "risk management," and "portfolio diversification" are fundamental to understanding BofA's approach to managing volatility.

Inflationary Pressures and Their Impact on Earnings

BofA emphasizes the significant impact of inflation on corporate earnings and stock valuations. Rising input costs, from energy to labor, squeeze profit margins, impacting companies' ability to generate earnings growth. BofA recommends closely monitoring inflation data and assessing how individual companies are managing inflationary pressures.

- Strategies for navigating inflation include focusing on companies with strong pricing power and those demonstrating effective cost management.

The keywords "inflation," "corporate earnings," "profit margins," and "inflationary pressures" are essential to this analysis.

Geopolitical Risks and Their Influence on Stock Markets

BofA highlights the ongoing geopolitical risks influencing stock market performance. The Russia-Ukraine conflict, tensions in the Taiwan Strait, and other global uncertainties introduce significant market instability. These events can disrupt supply chains, increase commodity prices, and generally create uncertainty about future economic growth. Investors should consider BofA's assessment of these geopolitical risks and their potential consequences when making investment decisions. Keywords like "geopolitical risk," "global uncertainty," "supply chain disruptions," and "market uncertainty" accurately reflect this concern.

Conclusion: Addressing High Stock Valuations and Investor Concerns – A BofA Perspective

BofA's analysis reveals a complex market environment characterized by high stock valuations, rising interest rates, persistent inflation, and significant geopolitical risks. These factors contribute to increased market volatility and heighten investor concerns. While opportunities exist, BofA emphasizes the importance of cautious risk management. Their recommended strategies for navigating these challenges include portfolio diversification, defensive positioning, and close monitoring of economic and geopolitical developments. To learn more about BofA's research and investment strategies for managing high stock valuations and related investor concerns, visit [Link to BofA resources]. Understanding and applying BofA's insights into high stock valuation analysis can improve your investment strategy during this period of market uncertainty.

Featured Posts

-

The Hollywood Strike Understanding The Actors And Writers Demands

May 16, 2025

The Hollywood Strike Understanding The Actors And Writers Demands

May 16, 2025 -

Ovechkin Oboshel Grettski I Leme Rekordnoe Kolichestvo Golov V Pley Off N Kh L

May 16, 2025

Ovechkin Oboshel Grettski I Leme Rekordnoe Kolichestvo Golov V Pley Off N Kh L

May 16, 2025 -

Dodgers Struggling Lefties A Look At The Current Situation And Potential Solutions

May 16, 2025

Dodgers Struggling Lefties A Look At The Current Situation And Potential Solutions

May 16, 2025 -

Padres 2025 Regular Season Broadcast Schedule Announced

May 16, 2025

Padres 2025 Regular Season Broadcast Schedule Announced

May 16, 2025 -

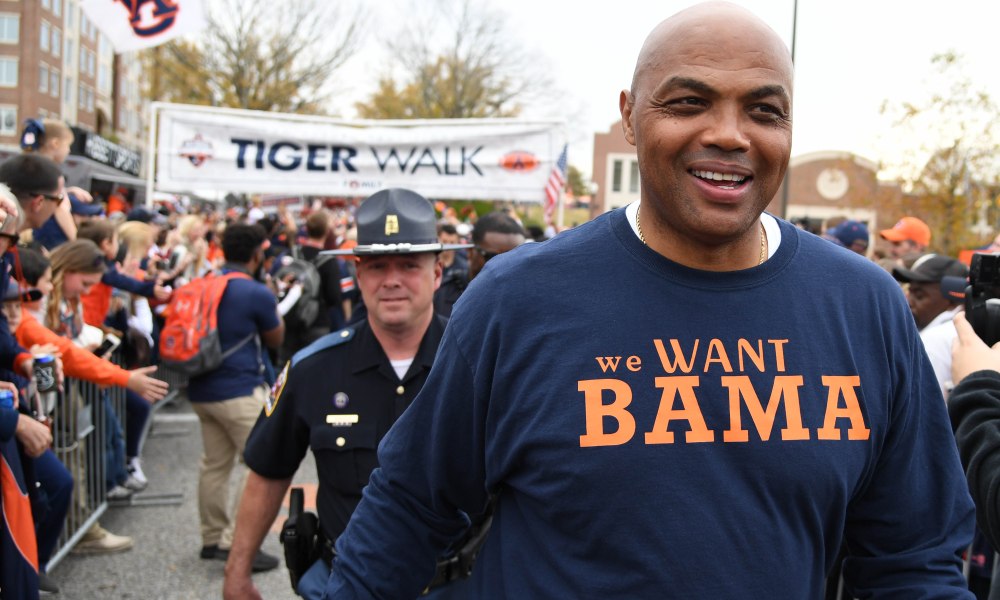

Charles Barkley Predicts The Winner Warriors Timberwolves Playoff Series

May 16, 2025

Charles Barkley Predicts The Winner Warriors Timberwolves Playoff Series

May 16, 2025