High Stock Valuations And Investor Concerns: BofA's Reassuring View

Table of Contents

BofA's Key Arguments Against Excessive Valuation Concerns

BofA's report directly confronts the widespread concern that high stock valuations alone signal an impending market crash. They argue that several fundamental factors support current pricing and mitigate the risk of a significant correction solely based on valuation metrics. These arguments are crucial for investors formulating their investment strategy in the face of market volatility.

-

Strong Corporate Earnings Growth Outlook: BofA points to a robust outlook for corporate earnings growth, driven by factors such as technological innovation and sustained consumer demand. This expectation of future profitability underpins the current high valuations, suggesting they are not entirely unjustified.

-

Low Interest Rates Supporting Higher Valuations: The prolonged period of low interest rates globally has enabled companies to borrow cheaply, boosting investment and fueling growth. These low rates also reduce the opportunity cost of holding equities, supporting higher valuations relative to other asset classes.

-

Positive Long-Term Economic Growth Projections: BofA's analysis incorporates positive long-term economic growth projections, suggesting a sustained environment conducive to strong corporate performance and higher stock prices. This positive outlook for the global economy supports their bullish assessment of the market.

-

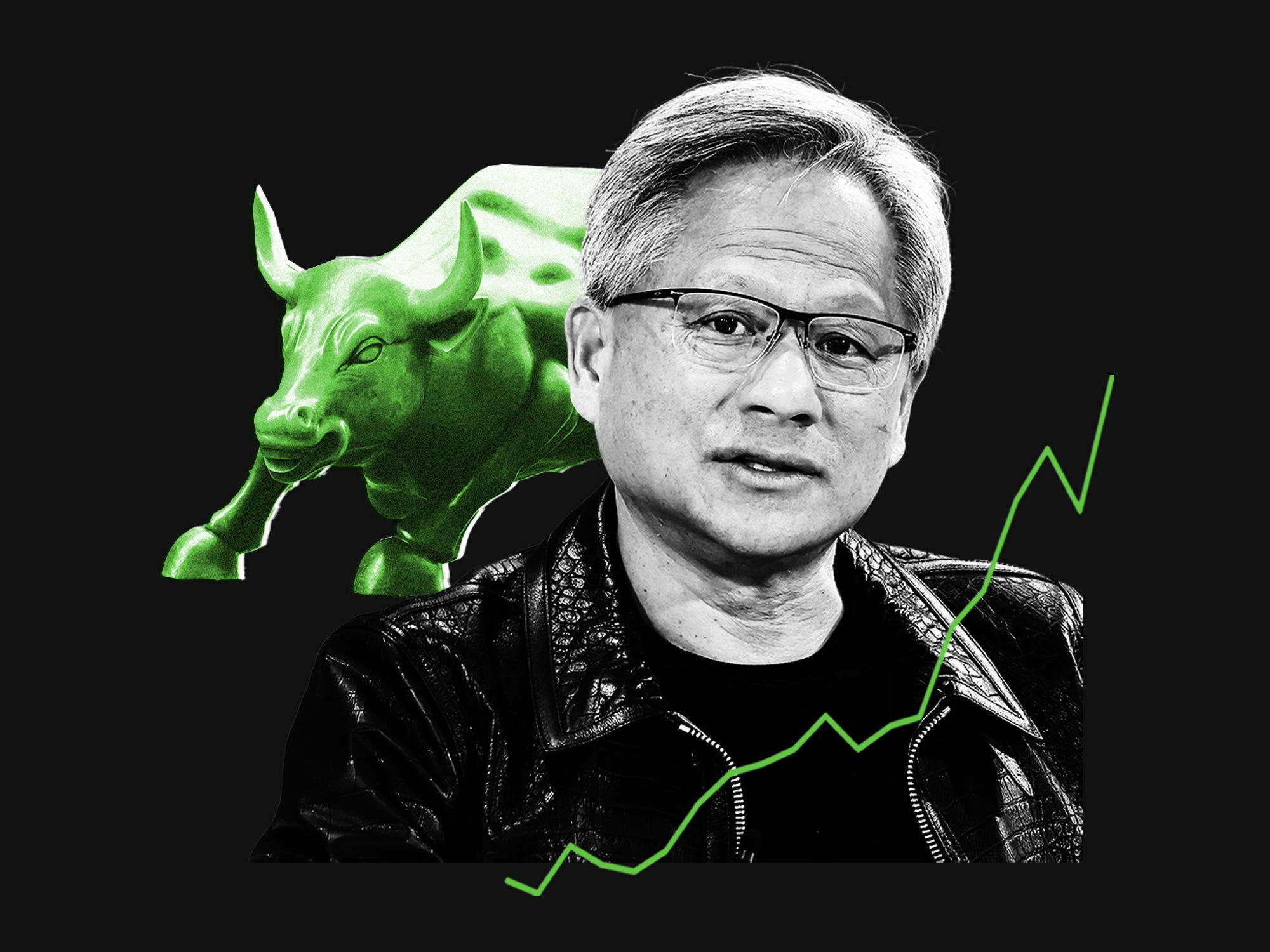

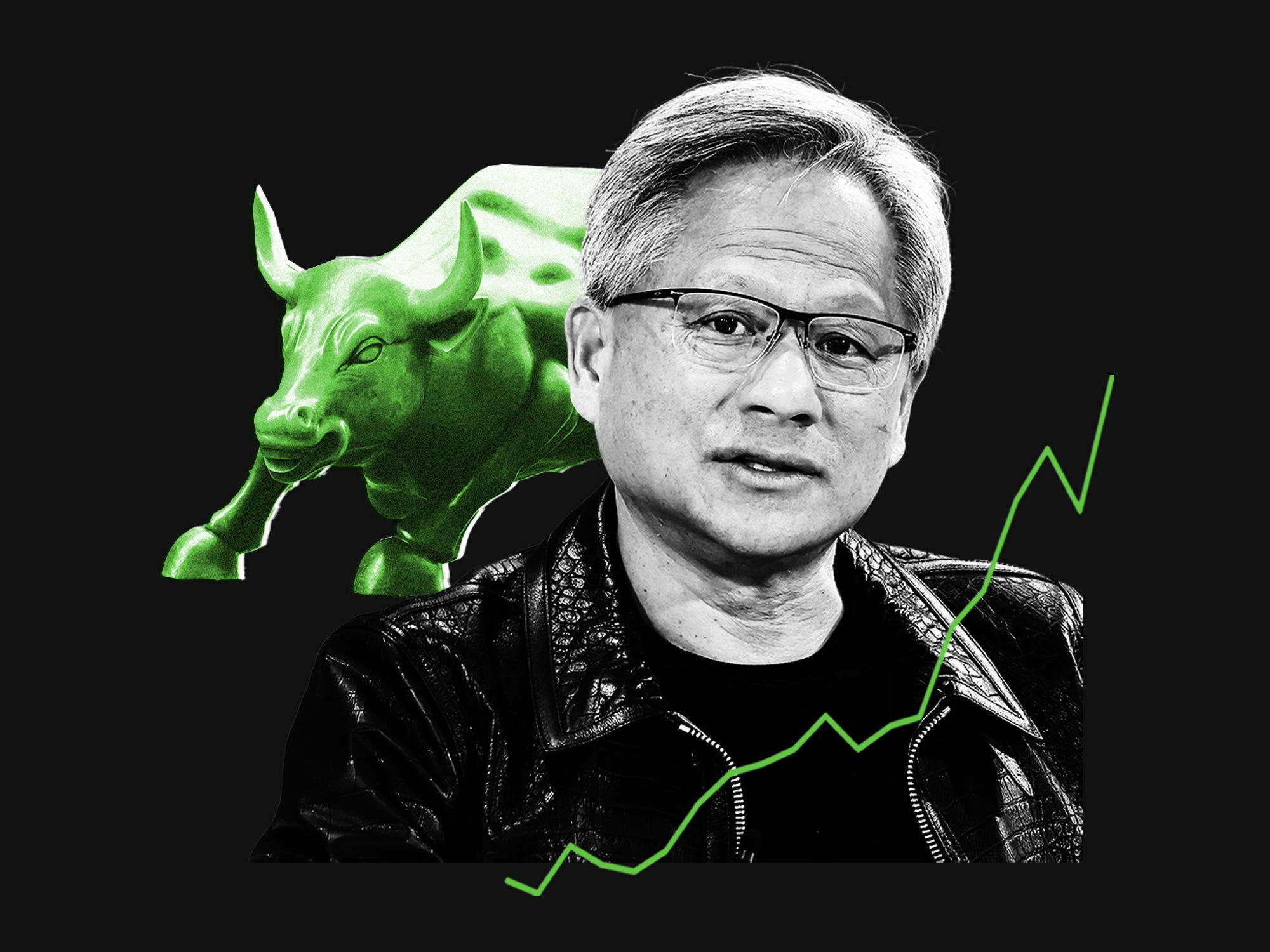

Technological Advancements Driving Innovation and Growth: The ongoing technological revolution, particularly in areas like artificial intelligence and cloud computing, is driving significant innovation and growth across multiple sectors. BofA highlights this as a key factor supporting higher valuations in technology and related industries.

-

Strategic Comparison to Previous Periods of High Valuations: The report strategically compares the current market conditions to previous periods in history where high valuations were also observed, demonstrating that high valuations alone have not always preceded significant market corrections. This historical context is vital in assessing the current situation.

Analyzing the Current Economic Landscape and its Impact on Stock Prices

Understanding the macroeconomic backdrop is crucial in evaluating BofA's optimistic stance. Several key factors contribute to their assessment:

-

Inflation Levels and their Impact on Valuations: While inflation is a concern, BofA's analysis likely incorporates projections for inflation's trajectory and its potential impact on corporate profitability and interest rates. A controlled inflation rate wouldn't necessarily derail the positive outlook.

-

Federal Reserve Policy and its Effects on Interest Rates: The Federal Reserve's monetary policy plays a pivotal role. BofA's outlook probably factors in the anticipated path of interest rate adjustments and their impact on economic growth and corporate borrowing costs.

-

Global Economic Growth and its Influence on Stock Markets: Global economic growth remains a significant driver. BofA's assessment likely incorporates projections for global GDP growth, considering its influence on corporate earnings and investor sentiment.

-

Geopolitical Risks and their Potential Effect on Investment Decisions: Geopolitical uncertainties always pose a risk. BofA's analysis might include a risk assessment considering potential disruptions from global events, impacting investor confidence and market stability.

-

Specific Economic Indicators Supporting BofA's Thesis: The report likely uses supporting economic indicators such as GDP growth figures, employment data, and consumer confidence indices to bolster its positive outlook. These data points would be crucial in justifying their optimistic assessment.

BofA's Recommended Investment Strategies for Navigating High Valuations

Given the current market conditions, BofA's suggested investment strategies are crucial for investors:

-

Sector-Specific Investment Opportunities: BofA likely identifies specific sectors poised for outsized growth, suggesting opportunities within those sectors to potentially mitigate the risks of high valuations in other areas.

-

Emphasis on Long-Term Investment Horizons: A long-term perspective is key, as short-term market fluctuations are less significant for long-term investors. BofA likely advocates for patience and a long-term investment strategy.

-

Importance of Diversification within a Portfolio: Diversification across different asset classes and sectors is crucial in mitigating overall portfolio risk. BofA's strategy likely emphasizes the importance of a well-diversified portfolio.

-

Strategies for Managing Risk in a Potentially Volatile Market: Risk management remains paramount. BofA's recommendations would likely include strategies to manage and reduce overall portfolio risk in a potentially volatile market.

-

Advice on Specific Asset Classes: BofA likely provides guidance on allocating capital across different asset classes, such as equities, bonds, and potentially alternative investments, tailored to varying risk tolerances.

Counterarguments and Potential Risks

It's essential to acknowledge potential counterarguments to BofA's optimistic view:

-

Risks Associated with High Price-to-Earnings Ratios: High P/E ratios can indicate overvaluation, increasing the risk of a price correction if earnings fail to meet expectations.

-

Potential for Interest Rate Hikes Impacting Valuations: Interest rate hikes, even gradual ones, can impact valuations by increasing borrowing costs for companies and reducing the attractiveness of equities relative to bonds.

-

Uncertainty Surrounding Future Economic Growth: Economic forecasts are inherently uncertain. Unexpected economic slowdowns or recessions could significantly impact stock valuations.

-

Geopolitical Instability as a Potential Market Disruptor: Unexpected geopolitical events can trigger market volatility and negatively impact investor sentiment, leading to price corrections.

-

The Limitations of BofA's Analysis and its Potential Biases: Any analysis, including BofA's, has inherent limitations and potential biases. It’s crucial to critically evaluate their findings and consider other perspectives.

High Stock Valuations and Investor Concerns: A Balanced Perspective

BofA's report offers a reassuring perspective on high stock valuations, emphasizing strong earnings growth, low interest rates, and positive long-term economic projections. However, it's crucial to acknowledge the potential risks associated with high valuations, including the potential for interest rate hikes, economic slowdowns, and geopolitical uncertainties. A balanced perspective considers both the optimistic and pessimistic scenarios. Developing a well-diversified investment strategy tailored to your risk tolerance is paramount. Assess your portfolio's exposure to high valuations, develop a robust strategy to navigate high stock valuations, and understand the risks and rewards of investing in today's market. Conduct thorough research, consult a financial advisor, and develop a comprehensive investment plan to effectively manage high stock valuations and investor concerns in the current market.

Featured Posts

-

Scouting Report Strengths And Weaknesses Of Michael Lorenzen

Apr 23, 2025

Scouting Report Strengths And Weaknesses Of Michael Lorenzen

Apr 23, 2025 -

Bfm Bourse Du 24 Fevrier Recapitulatif Complet Des Actualites Boursieres

Apr 23, 2025

Bfm Bourse Du 24 Fevrier Recapitulatif Complet Des Actualites Boursieres

Apr 23, 2025 -

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

Apr 23, 2025

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

Apr 23, 2025 -

Near Miss Woman And Children Avoid Manhole Blast

Apr 23, 2025

Near Miss Woman And Children Avoid Manhole Blast

Apr 23, 2025 -

Cortes Gem Reds Losing Streak Extended To Three Games

Apr 23, 2025

Cortes Gem Reds Losing Streak Extended To Three Games

Apr 23, 2025