High Stock Valuations: BofA's Argument For Investor Calm

Table of Contents

BofA's Rationale: Why High Stock Valuations Aren't Necessarily a Red Flag

BofA's analysis suggests that current high stock valuations aren't necessarily a cause for immediate alarm. Their perspective hinges on several key factors, indicating a more nuanced picture than a simple "overvalued" label suggests.

The Role of Low Interest Rates

Historically low interest rates play a crucial role in justifying higher Price-to-Earnings (P/E) ratios and influencing overall stock valuations.

- Inverse Relationship: Lower interest rates make borrowing cheaper for companies, boosting investment and profitability. This, in turn, supports higher stock prices. Conversely, high interest rates make borrowing expensive, slowing economic growth and potentially depressing stock valuations.

- Quantitative Easing (QE): Central banks' QE programs injected significant liquidity into the market, further driving up asset prices, including stocks. This increased liquidity lowers borrowing costs and encourages investment.

- Historical Precedents: Numerous historical periods demonstrate a correlation between low interest rates and elevated stock valuations. Examining past economic cycles reveals that periods of low interest rates often coincide with higher P/E ratios without necessarily leading to immediate market crashes.

Strong Corporate Earnings and Profitability

BofA highlights the strength of corporate earnings as a significant mitigating factor against concerns about high valuations. Solid earnings growth provides a fundamental justification for current stock prices.

- Robust Earnings Growth: Data indicates consistent growth in corporate earnings across various sectors, demonstrating strong underlying economic fundamentals. This robust growth is a key support for current valuations.

- Profitable Sectors: Specific sectors, such as technology and healthcare, have shown exceptionally strong profitability, contributing significantly to overall market performance and justifying higher valuations within those sectors.

- Future Performance Implications: The sustained strength in corporate earnings suggests a positive outlook for future stock performance. This positive outlook helps to counterbalance concerns about potentially inflated valuations.

Long-Term Growth Potential

BofA's assessment considers the long-term economic growth outlook, arguing that this potential justifies current valuations.

- Positive Growth Projections: BofA's analysts project continued, albeit potentially slower, economic growth in the coming years. These projections are based on various factors, including technological innovation and global economic expansion.

- Growth Drivers: Technological advancements, emerging markets growth, and ongoing innovation in various sectors continue to drive long-term economic expansion and support higher valuations.

- Valuation Justification: The expectation of sustained long-term growth helps to justify the current level of stock valuations. Investors are willing to pay a premium for companies expected to deliver strong returns over the long term.

Addressing Investor Concerns: Counterarguments to Common Worries

While BofA presents a relatively optimistic outlook, they acknowledge legitimate investor concerns. Let's examine some common worries and BofA's counterarguments.

Market Volatility and Correction Risks

Market volatility is inherent, and the possibility of corrections always exists.

- Historical Corrections: History shows that market corrections are normal and typically of limited duration. They are a natural part of the market cycle.

- BofA's Perspective on Corrections: BofA analysts acknowledge the risk of a correction but don't foresee a catastrophic market crash. Their models suggest a relatively moderate correction is more probable than a significant downturn.

- Diversification as a Strategy: Diversifying your investment portfolio is crucial to mitigate risk associated with market volatility and potential corrections.

Inflationary Pressures and Their Impact

Inflation is a significant concern for investors.

- Inflation Forecasts: BofA's inflation forecasts suggest a gradual increase, likely manageable by central bank actions. Their models incorporate various factors to predict inflation's impact on the economy and stock market.

- Mitigating Inflationary Pressures: Companies often employ strategies to mitigate inflationary pressures, such as raising prices or increasing efficiency. These strategies help protect profit margins.

- Impact on Future Earnings: While inflation can affect earnings, BofA's analysis suggests that the impact on future earnings growth will likely be moderate.

Geopolitical Risks and Uncertainty

Global events introduce uncertainty into the market.

- Geopolitical Event Impacts: Specific geopolitical events, such as trade wars or international conflicts, can significantly influence stock prices. BofA's analysis incorporates assessments of these risks.

- Incorporating Geopolitical Risks: BofA's valuation models account for geopolitical risks, making adjustments to reflect potential impacts. This helps provide a more realistic and comprehensive valuation.

- Long-Term Investment Strategy: A long-term investment strategy is crucial to weather short-term shocks caused by geopolitical uncertainty. Long-term investors are generally less affected by short-term market fluctuations.

Conclusion

BofA's analysis suggests that while high stock valuations are a valid concern, they aren't necessarily a signal for immediate panic. Their arguments center on the impact of low interest rates, strong corporate earnings, and long-term growth potential. They also acknowledge and address potential risks, including market volatility, inflation, and geopolitical uncertainty. While market risks remain inherent, a balanced and informed approach, incorporating diversification and long-term considerations, is key. Further research into BofA's market analysis is recommended, and consulting a financial advisor is crucial to create a personalized investment strategy tailored to your risk tolerance and financial goals. Remember to carefully evaluate your own risk tolerance before making any investment decisions related to high stock valuations.

Featured Posts

-

Police Chief Investigated Over Tweet On Chris Rock

Apr 30, 2025

Police Chief Investigated Over Tweet On Chris Rock

Apr 30, 2025 -

Dagskrain I Dag T Hrir Leikir I Bestu Deildinni

Apr 30, 2025

Dagskrain I Dag T Hrir Leikir I Bestu Deildinni

Apr 30, 2025 -

69th Eurovision Song Contest Your Guide To Betting And Predictions 2025

Apr 30, 2025

69th Eurovision Song Contest Your Guide To Betting And Predictions 2025

Apr 30, 2025 -

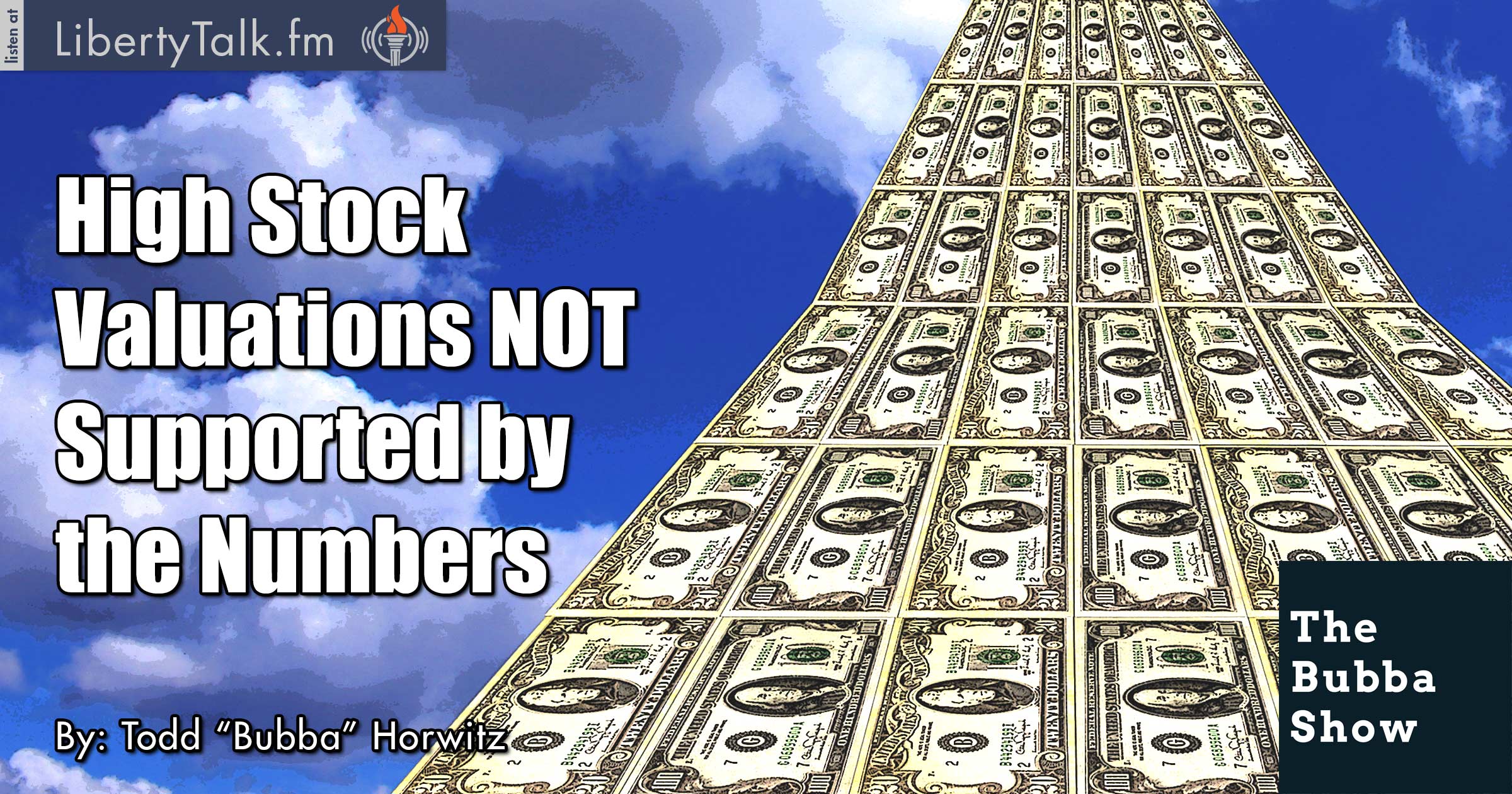

Unveiling The Key Michael Jordan Fast Facts

Apr 30, 2025

Unveiling The Key Michael Jordan Fast Facts

Apr 30, 2025 -

Updated Yate Train Timetables Bristol And Gloucester Connections

Apr 30, 2025

Updated Yate Train Timetables Bristol And Gloucester Connections

Apr 30, 2025