High Stock Valuations: Why BofA Believes Investors Shouldn't Worry

Table of Contents

BofA's Rationale: Strong Corporate Earnings and Growth Prospects

BofA's core argument rests on the strength of corporate earnings and the promising growth prospects for many sectors. They contend that current high stock valuations are justified by robust fundamentals, not just speculative exuberance. This means that the high prices reflect real value and future potential.

- Evidence of robust corporate profit margins: Many companies are reporting surprisingly strong profit margins, exceeding analyst expectations. This indicates efficient operations and pricing power, supporting higher valuations.

- Examples of sectors showing significant growth potential: The technology, healthcare, and renewable energy sectors, among others, continue to demonstrate substantial growth potential, driving investor interest and justifying higher stock prices.

- Specific economic indicators supporting their outlook: Positive economic indicators, such as strong consumer spending and continued business investment, further bolster BofA's optimistic outlook. These indicators suggest a healthy economic environment that can sustain high stock valuations.

The Role of Low Interest Rates in Supporting High Stock Valuations

Historically low interest rates play a significant role in the current high stock valuation environment. These low rates influence investor behavior by making equities a more attractive investment compared to low-yielding bonds.

- Inverse relationship between interest rates and stock valuations: When interest rates are low, the return on bonds is reduced, making stocks, with their potential for higher returns, more appealing to investors. This increased demand pushes stock prices higher.

- Attractiveness of equities compared to low-yielding bonds: With bond yields remaining subdued, investors are seeking higher returns in the stock market, further contributing to high valuations. This is a key driver of the current market dynamics.

- Potential future interest rate scenarios and their impact: While interest rates are expected to rise gradually, BofA's analysis suggests that this increase is likely to be manageable and shouldn't trigger a dramatic market correction. A gradual rise allows the market to adapt.

Addressing Inflation Concerns and their Impact on Stock Prices

Inflation is a legitimate concern for investors, as rising prices can erode corporate profits and impact stock valuations. However, BofA's analysis suggests that current inflationary pressures are relatively manageable.

- BofA's perspective on the manageable nature of inflation: BofA believes that current inflation is largely transitory and that central banks have the tools to control it without causing a significant economic slowdown.

- How companies are adapting to inflationary pressures: Many companies are successfully adapting to inflationary pressures by implementing pricing strategies and streamlining their operations to maintain profitability.

- Sectors that are less susceptible to inflation: Certain sectors, such as technology and essential goods, are often less vulnerable to inflation, offering investors more resilient investment options during inflationary periods.

Long-Term Investment Perspective: Why a Patient Approach is Recommended

BofA strongly advocates for a long-term investment strategy. They believe that focusing on long-term growth potential, rather than reacting to short-term market fluctuations, is crucial for achieving financial success.

- Benefits of riding out short-term market volatility: Historically, the stock market has proven its resilience, recovering from temporary setbacks. A long-term perspective allows investors to weather short-term market volatility and benefit from long-term growth.

- Historical performance of the stock market over the long term: The stock market has delivered significant returns over the long term, despite experiencing periodic corrections. This historical data supports the argument for a long-term investment approach.

- Diversification as a key risk mitigation strategy: Diversifying your portfolio across different asset classes and sectors can help mitigate risk and reduce the impact of market volatility. This strategy is essential for long-term investment success.

Conclusion: Navigating High Stock Valuations with Confidence

BofA's analysis suggests that while high stock valuations are a reality, they are not necessarily a cause for immediate concern. Strong corporate earnings, low interest rates (within a manageable context), and a considered approach to inflationary pressures all contribute to a more nuanced view of the current market. Understanding high stock valuations requires a long-term investment perspective, emphasizing the importance of patience and a well-diversified portfolio. Managing high stock valuation risks involves understanding the underlying fundamentals and focusing on long-term growth potential. Navigating high stock valuations effectively requires a balanced approach, combining careful analysis with a strategic, patient investment strategy. Seek professional financial advice if you have concerns about your investment strategy in this environment.

Featured Posts

-

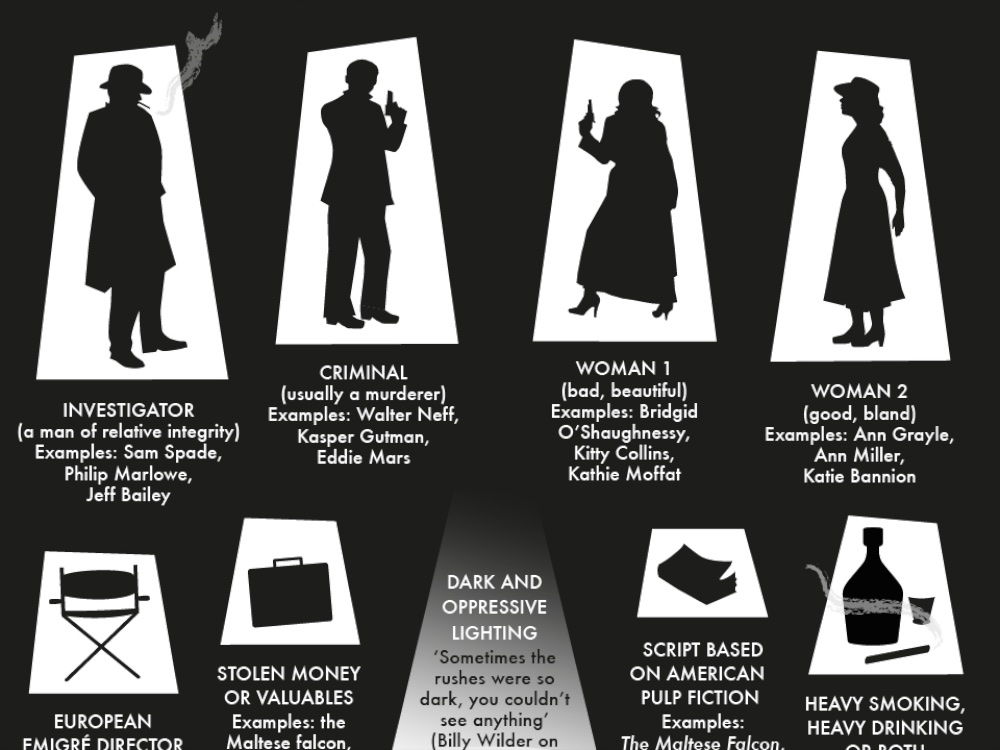

10 Film Noir Movies Guaranteed To Thrill You

May 10, 2025

10 Film Noir Movies Guaranteed To Thrill You

May 10, 2025 -

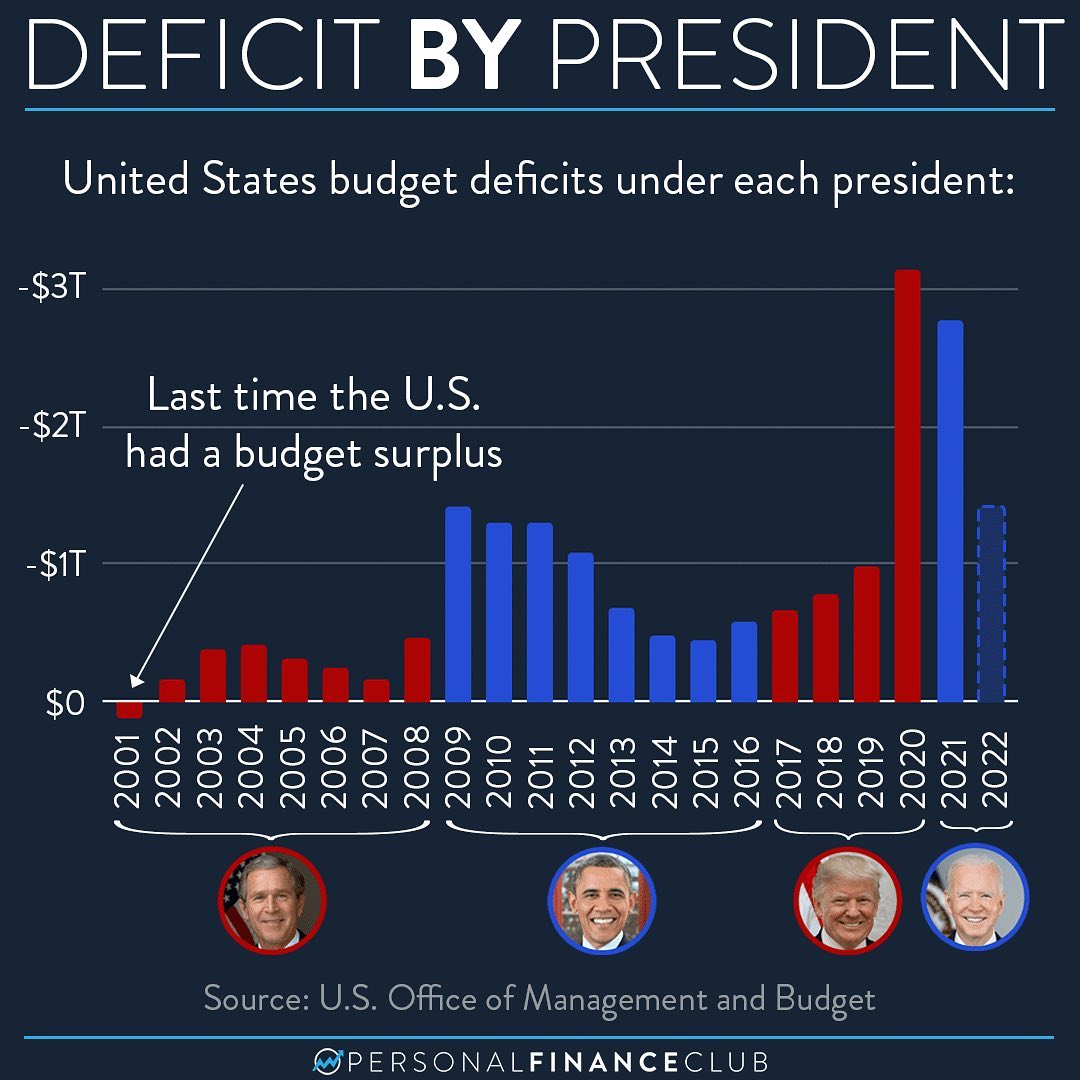

25m Financial Hole For West Ham Addressing The Budget Deficit

May 10, 2025

25m Financial Hole For West Ham Addressing The Budget Deficit

May 10, 2025 -

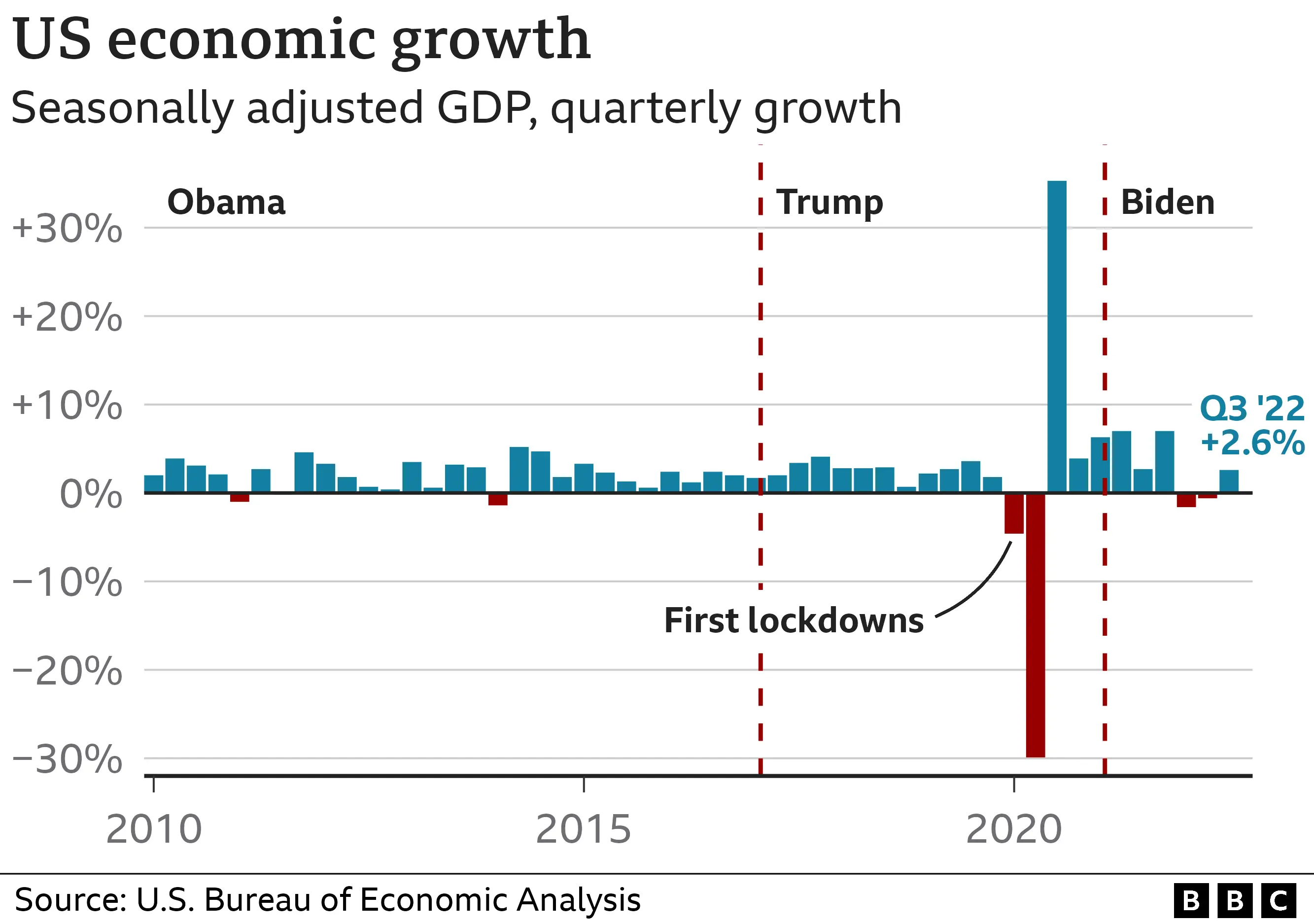

May 8th 2025 Understanding The Trump Presidency Through Day 109

May 10, 2025

May 8th 2025 Understanding The Trump Presidency Through Day 109

May 10, 2025 -

Dozens Of Cars Vandalized In Elizabeth City Apartment Complex Burglaries

May 10, 2025

Dozens Of Cars Vandalized In Elizabeth City Apartment Complex Burglaries

May 10, 2025 -

Unlocking The Nyt Strands Puzzle April 9 2025 Solutions And Strategies

May 10, 2025

Unlocking The Nyt Strands Puzzle April 9 2025 Solutions And Strategies

May 10, 2025