High-Yield Dividend Investing: A Simple Approach To Strong Returns

Table of Contents

Understanding High-Yield Dividend Stocks

High-yield dividend investing focuses on companies that pay out a substantial portion of their earnings as dividends to shareholders. Understanding the key concepts is crucial for success.

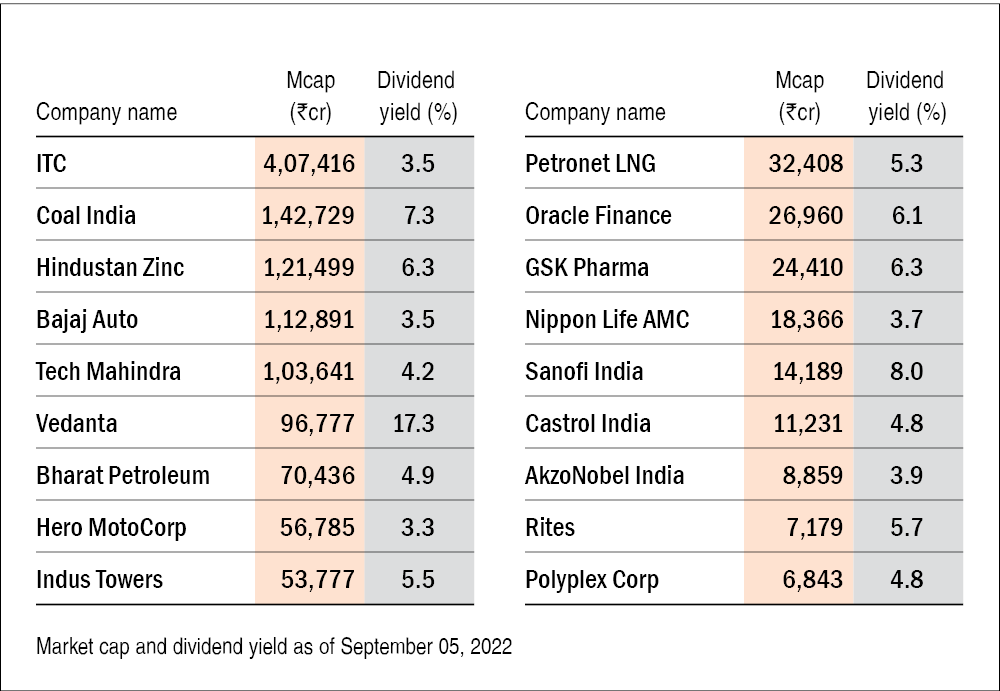

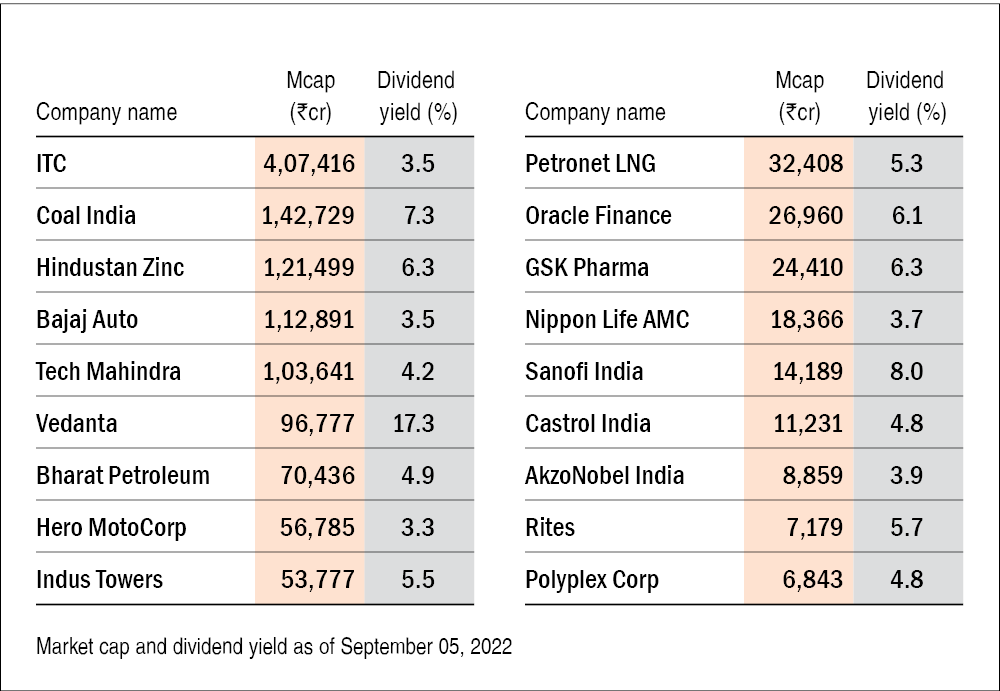

Defining Dividend Yield

Dividend yield represents the annual dividend per share relative to the share price. It's calculated as: (Annual Dividend per Share / Share Price) * 100%. A higher yield indicates a larger dividend payout relative to the stock's cost. However, it's crucial to remember that a high dividend yield doesn't automatically equate to a high total return.

- High dividend yield doesn't automatically equal high total return: Total return considers both dividend income and share price appreciation. A stock with a high yield but declining share price might offer lower total returns than a stock with a moderate yield and significant price appreciation.

- Analyzing dividend payout ratios is essential: The payout ratio (dividends paid / net income) shows what percentage of earnings a company distributes as dividends. A sustainably high dividend yield requires a healthy payout ratio that doesn't jeopardize the company's future growth and financial stability. A high payout ratio might signal future dividend cuts.

Identifying Reliable High-Yield Dividend Stocks

Finding stable, high-yielding companies requires careful analysis. Here's how to approach it:

- Look for companies with a long history of consistent dividend payments: A track record of consistent dividend payouts, even during economic downturns, indicates financial strength and a commitment to returning value to shareholders. Look for companies with a history of increasing dividends over time, demonstrating sustainable growth.

- Analyze financial statements to assess the company's financial health and dividend sustainability: Examine key metrics like debt-to-equity ratio, free cash flow, and earnings per share (EPS) to determine the company's ability to maintain its dividend payments. A strong balance sheet and consistent profitability are crucial indicators.

- Consider using screening tools and resources: Many online brokerage platforms and financial websites offer screening tools that allow you to filter stocks based on dividend yield, payout ratio, and other financial metrics. This can significantly streamline your search for potential high-yield dividend investments.

Building a Diversified High-Yield Dividend Portfolio

Diversification is paramount in mitigating risk and maximizing returns in high-yield dividend investing.

The Importance of Diversification

Don't put all your eggs in one basket! Spreading your investments across various sectors and industries reduces the impact of any single company's underperformance.

- Diversify across sectors and industries: Investing in companies from different sectors (e.g., technology, healthcare, consumer staples) reduces your overall portfolio volatility. If one sector underperforms, others might compensate.

- Consider geographic diversification: Investing in companies from different countries can further reduce risk and potentially access higher yields in emerging markets. However, be aware of currency fluctuations and international investment risks.

Portfolio Construction Strategies

Several approaches exist for building a successful high-yield dividend portfolio:

- Value investing: Focus on undervalued companies with high dividend yields, anticipating price appreciation as the market recognizes their true worth.

- Growth investing: Prioritize companies with strong growth potential and increasing dividend payouts. These companies may offer a combination of income and capital appreciation.

- Income investing: Concentrate on companies with consistently high dividend yields, prioritizing current income generation over significant capital appreciation. This is a more conservative strategy.

Managing Your High-Yield Dividend Investments

Ongoing management is crucial for long-term success in high-yield dividend investing.

Regular Portfolio Review and Rebalancing

Consistent monitoring and adjustments are vital.

- Regularly review financial news and company announcements: Stay informed about market conditions and any developments that might impact your investments.

- Rebalance your portfolio periodically: Rebalancing involves adjusting your asset allocation to maintain your desired proportions across different sectors and companies. This helps to capture profits from outperformers and re-invest in underperformers, creating a balanced approach.

Reinvesting Dividends for Compounding Growth

Reinvesting dividends accelerates wealth creation through the power of compounding.

- DRIPs (Dividend Reinvestment Plans): Many companies offer DRIPs, allowing you to automatically reinvest your dividends to purchase more shares.

- The power of compounding: Even small dividends, consistently reinvested, can generate significant returns over the long term due to the compounding effect. For example, reinvesting dividends annually can significantly boost returns over a 20-year period.

Tax Implications of Dividend Income

Dividend income is generally taxable. Consult a financial advisor to understand the tax implications in your specific jurisdiction. Tax-advantaged accounts like retirement plans can help mitigate some tax burdens.

Conclusion

High-yield dividend investing provides a powerful pathway towards building long-term wealth and generating a steady stream of passive income. By understanding the principles of selecting reliable companies, diversifying your portfolio, and managing your investments effectively, you can significantly improve your chances of success. Remember to conduct thorough research, consider your risk tolerance, and, if needed, seek advice from a qualified financial advisor before making any investment decisions. Start building your high-yield dividend portfolio today and embark on your journey to financial freedom with a well-structured approach to high-yield dividend investing.

Featured Posts

-

Uruguay Laicidad Y El Cambio De Nombre De Semana Santa A Semana De Turismo

May 11, 2025

Uruguay Laicidad Y El Cambio De Nombre De Semana Santa A Semana De Turismo

May 11, 2025 -

Yankees Diamondbacks April 1 3 Injured Players Update

May 11, 2025

Yankees Diamondbacks April 1 3 Injured Players Update

May 11, 2025 -

Esta Adaptacao De Quadrinhos De Stallone Merece Mais Reconhecimento

May 11, 2025

Esta Adaptacao De Quadrinhos De Stallone Merece Mais Reconhecimento

May 11, 2025 -

Two Celtics Players Shatter Expectations With 40 Point Games

May 11, 2025

Two Celtics Players Shatter Expectations With 40 Point Games

May 11, 2025 -

2025 Mtv Movie And Tv Awards Officially Cancelled

May 11, 2025

2025 Mtv Movie And Tv Awards Officially Cancelled

May 11, 2025