HMRC Child Benefit Warning: Messages You Shouldn't Ignore

Table of Contents

Understanding HMRC Child Benefit Communication Channels

HMRC uses various methods to contact recipients about their Child Benefit. Understanding these channels is crucial to identifying genuine communications and avoiding scams. Knowing where to look for updates and how to spot a fake message can save you significant stress and potential financial loss.

-

Online Account Messages: Regularly check your HMRC online account for updates, changes, and any important notifications. This is often the primary method of communication. Logging in regularly is the best way to stay on top of any changes to your Child Benefit payments or eligibility. You can access your account via the GOV.UK website.

-

Email Notifications: HMRC may send emails regarding Child Benefit. However, be wary of phishing scams – always verify the sender's email address. Legitimate HMRC emails will come from a government email address and will never ask for your password or banking details.

-

Postal Mail: Important notifications, particularly regarding changes to your payments or eligibility, are often sent by post. While less common than online updates, you should still be aware that important communications may arrive this way.

-

Phone Calls: HMRC rarely initiates contact via phone regarding Child Benefit, so be extremely cautious of unsolicited calls claiming to be from HMRC about your Child Benefit. If you receive such a call, do not provide any personal information.

Warning Signs: Messages Demanding Immediate Action

Legitimate HMRC communications will rarely demand immediate action or threaten legal consequences without a clear explanation and prior correspondence. Be wary of messages that:

-

Demand immediate payment or personal information via untrusted channels. HMRC will never ask for your banking details or payment information via email, text, or an unofficial website.

-

Threaten arrest or legal action without prior correspondence. HMRC will generally send several warnings before taking such drastic measures.

-

Contain grammatical errors or suspicious links. Official HMRC communications are professionally written and will not contain spelling or grammatical mistakes.

-

Request login details outside of the official HMRC website. Always access your HMRC online account directly through the official GOV.UK website. Never click on links in suspicious emails or text messages. Look for a secure https connection when logging into your account.

Key Messages Requiring Your Attention

Some HMRC messages require prompt action to avoid interruptions in your Child Benefit payments or eligibility issues. These include:

-

Requests for information updates: Keep your contact details and personal information up to date on your HMRC online account. Failure to do so may result in delays or interruptions to your payments.

-

Eligibility reviews: Respond promptly to any requests for information to confirm your continued eligibility for Child Benefit. These reviews are essential to ensure you continue to receive the benefit.

-

Payment changes: Be aware of any changes to your payment schedule or amount and understand the reasons behind them. Contact HMRC directly if you have questions about any changes to your payments.

How to Verify the Authenticity of HMRC Messages

Always verify the authenticity of HMRC messages by checking your online account or contacting HMRC directly through official channels. Never click on suspicious links or respond to emails or texts that request personal information. To verify a message, you should:

- Check your HMRC online account: This is the most reliable way to confirm the authenticity of a message.

- Contact HMRC directly: Use the official HMRC phone number or website to confirm any information you've received.

- Never share personal information: Do not provide your bank details, national insurance number, or other sensitive information unless you are certain you are communicating with a legitimate HMRC representative.

Conclusion

Staying informed about HMRC Child Benefit communications is vital to avoid potential penalties and ensure continuous payments. Regularly checking your online account, being aware of the warning signs of fraudulent messages, and verifying communication through official channels are crucial steps. Ignoring important messages regarding your Child Benefit can have serious consequences, including delays in payments and potential penalties. Take action today – log into your HMRC online account and review any pending notifications related to your Child Benefit payments. Remember to be vigilant against phishing attempts and only interact with HMRC through official channels. Don't ignore those crucial HMRC Child Benefit messages!

Featured Posts

-

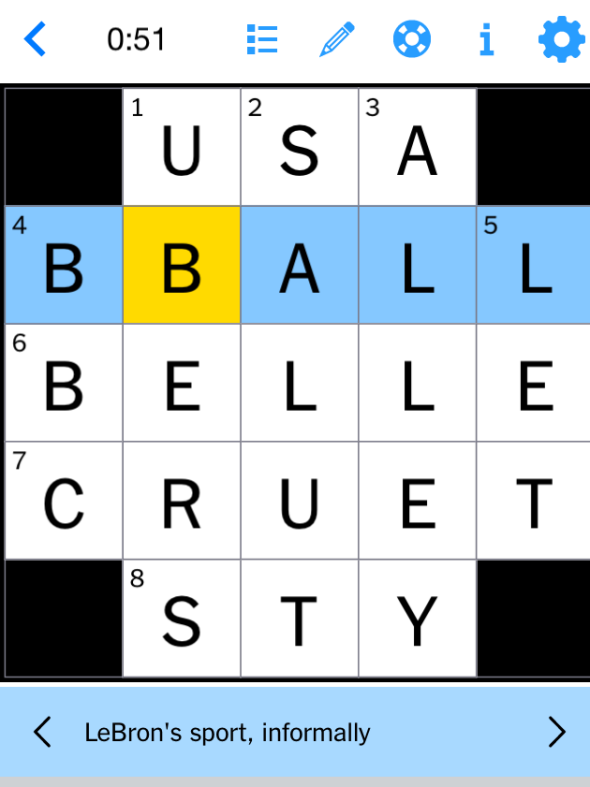

Find The Answers Nyt Mini Crossword April 25

May 20, 2025

Find The Answers Nyt Mini Crossword April 25

May 20, 2025 -

Investing In Quantum Computing Stocks A 2025 Market Overview Rigetti Ion Q And Beyond

May 20, 2025

Investing In Quantum Computing Stocks A 2025 Market Overview Rigetti Ion Q And Beyond

May 20, 2025 -

Typhon Missile System Us Army Expands Pacific Deployment

May 20, 2025

Typhon Missile System Us Army Expands Pacific Deployment

May 20, 2025 -

Huuhkajat Saavatko Kaellmanista Uuden Maalintekotaituri

May 20, 2025

Huuhkajat Saavatko Kaellmanista Uuden Maalintekotaituri

May 20, 2025 -

Going Solo Planning Your Independent Travel Adventure

May 20, 2025

Going Solo Planning Your Independent Travel Adventure

May 20, 2025