HMRC Tax Codes: Understanding Your New Savings-Related Code

Table of Contents

What are HMRC Tax Codes?

HMRC tax codes are essential numbers assigned by Her Majesty's Revenue and Customs (HMRC) to determine the amount of Income Tax deducted from your salary, pension, or other income sources. They act as a vital link between your personal circumstances and your tax liability. The code dictates how much tax your employer or pension provider deducts at source, ensuring the correct amount is paid throughout the tax year. Different tax codes exist to cater to various situations. For example, an emergency tax code might be applied initially if HMRC doesn't have all your details, while a BR code indicates a different tax calculation method.

- Tax codes dictate the amount of Income Tax deducted from your salary or other income. This ensures a regular payment towards your overall tax liability.

- They are based on your personal allowances and other relevant financial information, including your earnings, savings income, and any tax reliefs you're entitled to.

- Changes to your circumstances (e.g., savings income increase) can lead to a new tax code. This reflects the updated tax implications of your altered financial situation.

- Understanding your tax code prevents underpayment or overpayment of tax. Accurate tax codes ensure you pay the correct amount, avoiding penalties for underpayment or unnecessary deductions.

Identifying Your Savings-Related Tax Code

Locating your tax code is straightforward. You can find it on your payslip, usually in a clearly marked section, or by accessing your HMRC online account. Your P60, which summarizes your income and tax details for the previous tax year, also displays your tax code. Savings-related tax codes often include letters as suffixes, indicating the inclusion of savings income in the calculation. For example, a code like 1257L might indicate a lower tax code due to savings interest. The numbers represent your personal allowance, and the letter indicates adjustments for specific income sources.

- Your tax code is usually found on your payslip or via your HMRC online account. Regularly checking your payslip is a good habit to ensure accuracy.

- Specific letters or numbers in your tax code may indicate the inclusion of savings income. These letters and numbers provide valuable information about your tax calculation.

- Understanding the breakdown of your tax code allows you to verify its accuracy. This enables you to identify any potential discrepancies early on.

- Contact HMRC if you suspect an error in your savings-related tax code. Don't hesitate to reach out to HMRC if you need clarification or suspect a mistake.

Impact of Savings on Your Tax Code

Interest earned from savings accounts is generally considered taxable income. However, the Personal Savings Allowance (PSA) provides tax relief for a certain amount of savings interest. This allowance varies depending on your income tax band, meaning you can earn a specific amount of interest tax-free. The impact on your tax code depends on the level of interest earned against your PSA. If you exceed your PSA, your tax code will usually reflect the additional tax payable on the excess interest. Different savings products, such as Individual Savings Accounts (ISAs), are treated differently for tax purposes; ISAs, for example, offer tax-free growth and withdrawals.

- Interest earned on savings is generally taxable income. This means it's added to your other income to determine your overall tax liability.

- The Personal Savings Allowance (PSA) allows a certain amount of savings interest to be tax-free. This reduces your tax burden on savings interest.

- Taxable savings income is added to your other income to determine your overall tax liability. Your total taxable income dictates your tax bracket and overall tax payment.

- High-interest savings may require adjustments to your tax code. If your savings interest exceeds your PSA significantly, HMRC may adjust your tax code accordingly.

Understanding and Correcting Errors in Your Savings-Related Tax Code

It's crucial to regularly check your tax code for accuracy. Any discrepancies should be reported to HMRC promptly. You can do this through their online portal, by phone, or by post. Providing accurate information prevents tax disputes and potential penalties. Keeping detailed records of your savings interest and all financial documents is essential for supporting any corrections needed.

- Check your tax code regularly for accuracy. This proactive approach helps to identify and rectify any errors quickly.

- If you find an error, contact HMRC immediately to correct it. Prompt action avoids potential issues and penalties.

- Keep records of all your savings and interest earned. This documentation is vital in resolving any discrepancies.

- Failure to correct errors can lead to penalties. Addressing inaccuracies promptly avoids potential financial consequences.

Conclusion

Understanding your HMRC tax code, particularly the elements relating to savings, is crucial for managing your finances effectively. By carefully reviewing your tax code and utilizing the resources provided by HMRC, you can ensure accurate tax payments and avoid potential penalties. Don't hesitate to contact HMRC if you have any questions or require clarification regarding your HMRC tax codes or savings-related tax code. Take control of your tax affairs today!

Featured Posts

-

Michael Kors Partners With Amazon And Suki Waterhouse For Luxury Collection

May 20, 2025

Michael Kors Partners With Amazon And Suki Waterhouse For Luxury Collection

May 20, 2025 -

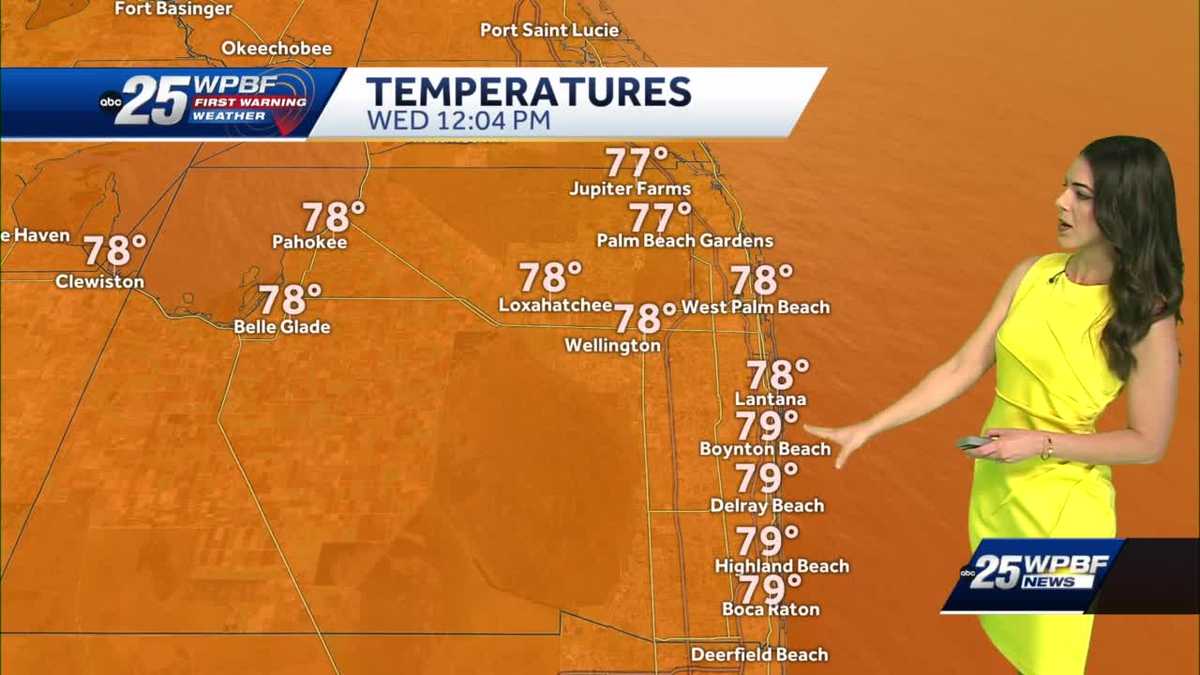

Finding The Perfect Breezy And Mild Climate For Your Next Trip

May 20, 2025

Finding The Perfect Breezy And Mild Climate For Your Next Trip

May 20, 2025 -

Soap Star Susan Luccis Prank On Michael Strahan

May 20, 2025

Soap Star Susan Luccis Prank On Michael Strahan

May 20, 2025 -

Nagelsmann Selects Goretzka For Germanys Nations League Campaign

May 20, 2025

Nagelsmann Selects Goretzka For Germanys Nations League Campaign

May 20, 2025 -

Diplomatie Bilaterale Le President Mahama A Abidjan Pour Une Visite D Amitie Et De Travail

May 20, 2025

Diplomatie Bilaterale Le President Mahama A Abidjan Pour Une Visite D Amitie Et De Travail

May 20, 2025