HMRC's Crackdown On Side Hustle Tax Evasion: What You Need To Know

Table of Contents

Understanding Your Tax Obligations with a Side Hustle

Many people undertake side hustles without fully understanding their tax responsibilities. Let's clarify what constitutes a "side hustle" in the eyes of HMRC and the reporting requirements involved.

Defining a "Side Hustle" for Tax Purposes

HMRC defines any additional income-generating activity outside of your main employment as a "side hustle," encompassing a broad range of activities. This includes: freelancing, consultancy work, the gig economy (Uber, Deliveroo, etc.), online selling (Etsy, eBay), property rental, and even dividend income from investments. Essentially, if you're earning money outside your primary employment, it's likely to be considered a side hustle and subject to tax.

Different Types of Side Hustle Income and Reporting Requirements

The tax implications of your side hustle depend heavily on the type of income generated. Here’s a breakdown:

-

Freelancing/Consulting: You're generally considered self-employed and need to report your income and allowable expenses through self-assessment. Accurate record-keeping is paramount.

-

Gig Economy Work (Uber, Deliveroo, etc.): These platforms often report your earnings directly to HMRC, so accurate record-keeping of expenses is crucial to minimise your tax liability.

-

Online Selling (Etsy, eBay): You need to calculate your profit (sales minus costs of goods sold and allowable expenses) and declare this as income.

-

Rental Income: This is treated separately and requires specific reporting through the relevant sections of your self-assessment tax return.

Record Keeping for Side Hustle Income

Meticulous record-keeping is essential to avoid HMRC penalties. Keep detailed records of all income and expenses. Consider using:

- Digital accounting software: Xero, FreeAgent, QuickBooks offer streamlined record-keeping and reporting.

- Spreadsheets: A well-organized spreadsheet can suffice for simpler side hustles.

- Receipts: Keep all receipts for expenses to support your claims.

HMRC's Methods for Detecting Side Hustle Tax Evasion

HMRC is increasingly sophisticated in its methods for identifying undeclared income. They are leveraging technology and data analysis to a greater extent than ever before.

Data Matching and Analysis

HMRC uses powerful data-matching techniques. They compare your self-assessment tax return with information from banks, payment platforms (like PayPal and Stripe), online marketplaces (like Amazon and eBay), and even social media activity to identify inconsistencies and potential tax evasion.

Tax Audits and Investigations

If HMRC suspects undeclared income, they may conduct a tax audit or investigation. This involves a thorough examination of your financial records and can result in significant penalties if irregularities are found.

Informant Schemes and Whistleblowing

HMRC also utilizes informant schemes and whistleblowing to uncover tax evasion. Individuals who report tax evasion can receive financial rewards.

Avoiding HMRC Penalties and Ensuring Compliance

Proactive tax planning is crucial to avoid HMRC penalties associated with side hustle tax.

Registering for Self-Assessment

If your side hustle income exceeds certain thresholds, you must register for self-assessment. This allows you to accurately report your income and claim allowable expenses.

Accurate Tax Returns

Submitting accurate and timely self-assessment tax returns is paramount. Ensure all income streams are declared correctly and expenses are properly documented.

Seeking Professional Tax Advice

Consulting a tax advisor or accountant can provide invaluable personalized guidance. They can help you navigate complex tax regulations, optimize your tax position, and ensure compliance.

Understanding Penalties for Non-Compliance

Penalties for non-compliance can be severe and include:

- Late filing penalties: Significant fines for late submission of tax returns.

- Interest charges: Interest accrues on unpaid tax.

- Criminal prosecution: In serious cases, criminal prosecution can result in imprisonment.

Conclusion: Stay Compliant and Avoid HMRC's Side Hustle Tax Crackdown

HMRC's crackdown on side hustle tax evasion is intensifying. The consequences of non-compliance – ranging from significant financial penalties to criminal prosecution – are substantial. Proactive tax planning, accurate record-keeping, and timely submission of self-assessment tax returns are crucial for avoiding HMRC's scrutiny. Review your tax obligations, seek professional advice if needed, and ensure full compliance with HMRC regulations regarding your side hustle income to avoid side hustle tax penalties. For further guidance, refer to the official HMRC website for resources on self-assessment and side hustle tax compliance. Don't let your side hustle become a tax headache – take control of your tax affairs today.

Featured Posts

-

The Enduring Appeal Of Agatha Christies Poirot A Critical Analysis

May 20, 2025

The Enduring Appeal Of Agatha Christies Poirot A Critical Analysis

May 20, 2025 -

Solo Travel Is It Right For You A Practical Guide

May 20, 2025

Solo Travel Is It Right For You A Practical Guide

May 20, 2025 -

Cote D Ivoire La Bcr Effectue Des Descentes Inopinees Dans Les Marches D Abidjan

May 20, 2025

Cote D Ivoire La Bcr Effectue Des Descentes Inopinees Dans Les Marches D Abidjan

May 20, 2025 -

Schumacher Viaja De Mallorca A Suiza En Helicoptero Visita A Su Nieta

May 20, 2025

Schumacher Viaja De Mallorca A Suiza En Helicoptero Visita A Su Nieta

May 20, 2025 -

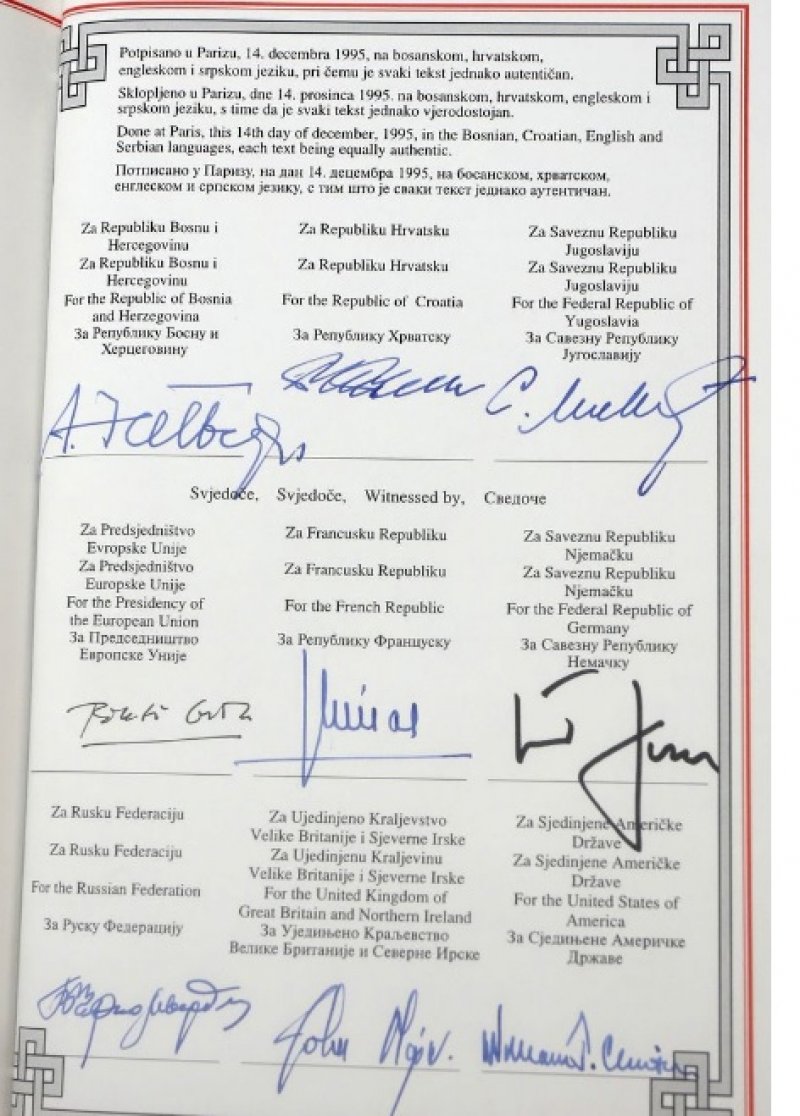

Sta Tadic Misli O Opasnostima Rusenja Daytonskog Sporazuma

May 20, 2025

Sta Tadic Misli O Opasnostima Rusenja Daytonskog Sporazuma

May 20, 2025