Home Buying Strategies For Individuals With Student Loan Debt

Table of Contents

Assessing Your Financial Situation

Before diving into the home-buying process, a thorough assessment of your financial health is crucial. This involves analyzing your income, expenses, and, most importantly, your student loan payments. Understanding your current financial standing will determine your affordability and eligibility for a mortgage.

A key factor lenders consider is your debt-to-income ratio (DTI). Your DTI is the percentage of your gross monthly income that goes towards debt payments, including student loans, credit cards, and car loans. A lower DTI generally improves your chances of mortgage approval and secures better interest rates. Aim for a DTI below 43%, though the ideal is even lower.

To lower your DTI, explore options for reducing your monthly student loan payments. This might involve refinancing your loans at a lower interest rate or enrolling in an income-driven repayment plan, such as an IBR or PAYE plan, which adjusts your payments based on your income. Remember, while these plans may extend your repayment period, they can significantly reduce your monthly burden, improving your DTI.

- Create a detailed budget: Track every penny of income and expenses to identify areas where you can save.

- Obtain a credit report and score: Check for errors and understand your current creditworthiness. A higher credit score usually means more favorable loan terms.

- Research and compare student loan refinancing options: Explore different lenders and interest rates to find the best deal.

- Consider an income-driven repayment plan: If refinancing isn't feasible, these plans can make your monthly payments more manageable.

Improving Your Credit Score

A strong credit score is paramount when applying for a mortgage. Lenders use your credit score to assess your credit risk. A higher score translates to better interest rates and more favorable loan terms. Even small improvements can make a big difference in your monthly mortgage payments over the life of the loan.

Student loan payments can positively impact your credit score, demonstrating responsible debt management. However, consistently late payments or high credit utilization can significantly hurt your score.

Strategies for improving your credit score include:

- Pay all bills on time and in full: This is the single most important factor affecting your credit score.

- Keep credit utilization low (ideally under 30%): This is the percentage of your available credit that you're using.

- Monitor your credit report regularly for errors: Dispute any inaccuracies promptly.

- Consider credit repair services if necessary: These services can help you address negative items on your report.

Saving for a Down Payment and Closing Costs

Securing a sufficient down payment and setting aside funds for closing costs are critical steps in the home-buying process. While it might seem daunting with existing student loan debt, consistent saving is key.

Saving while managing student loan payments requires discipline. Start by creating a dedicated savings account for your down payment. Explore high-yield savings accounts or investment options to maximize your returns. Cutting unnecessary expenses, such as eating out less or finding cheaper entertainment options, can significantly boost your savings. Consider a side hustle to supplement your income.

Don't overlook the possibility of down payment assistance programs. Many local and national programs offer grants or low-interest loans to help first-time homebuyers with their down payments, especially those with student loan debt.

- Create a dedicated savings account: This helps you track progress and stay motivated.

- Explore high-yield savings accounts or investment options: Grow your savings faster.

- Cut unnecessary expenses: Identify areas where you can reduce spending.

- Research down payment assistance programs: Explore available options in your area.

Choosing the Right Mortgage

With student loan debt, selecting the right mortgage is crucial. Several options cater to borrowers with varying financial situations. FHA loans, for instance, often require lower down payments than conventional loans, making them attractive to those with limited savings. USDA loans are another option for rural properties, also offering favorable terms. Conventional loans are more traditional, but may require a higher down payment and better credit score.

Carefully compare interest rates and fees from multiple lenders before making a decision. A slightly higher interest rate can significantly impact your monthly payments over the life of the loan.

- Shop around and compare mortgage rates: Don't settle for the first offer you receive.

- Understand the terms and conditions: Read the fine print carefully.

- Consider FHA loans or USDA loans: Explore options with lower down payment requirements.

- Consult with a mortgage broker: They can help you navigate the different mortgage options.

Working with a Real Estate Agent

A skilled real estate agent can be invaluable, especially for first-time homebuyers navigating the complexities of the market alongside student loan debt. They can provide expert guidance on finding the right property within your budget, negotiating offers, and managing the entire home-buying process.

Openly communicate your financial situation, including your student loan debt, with your agent. They can help you identify properties that align with your affordability and provide referrals to lenders and other relevant resources.

- Find a real estate agent with experience working with first-time homebuyers.

- Clearly communicate your financial situation to your agent.

- Ask for recommendations on lenders and other home-buying resources.

Achieving Your Homeownership Dreams Despite Student Loan Debt

Buying a home while managing student loan debt is achievable. By carefully assessing your financial situation, improving your credit score, saving diligently for a down payment, choosing the right mortgage, and working with a knowledgeable real estate agent, you can turn your dream of homeownership into a reality. Remember, effective home buying strategies for student loan borrowers require planning, discipline, and a proactive approach. Start planning your journey today and explore the options available to you. For further assistance, use our mortgage calculator [link to a mortgage calculator]. Take the first step toward successful home buying with student loan debt!

Featured Posts

-

Stock Market Rally Rockwell Automation Leads Post Earnings Jump

May 17, 2025

Stock Market Rally Rockwell Automation Leads Post Earnings Jump

May 17, 2025 -

Increased Phone Repair Costs Are Trump Tariffs To Blame

May 17, 2025

Increased Phone Repair Costs Are Trump Tariffs To Blame

May 17, 2025 -

Review Of Mirax Casino A Premier Online Casino In Ontario For 2025

May 17, 2025

Review Of Mirax Casino A Premier Online Casino In Ontario For 2025

May 17, 2025 -

Mhrjan Aljzayr Alsynmayy Ykrm Almkhrj Allyby Sbry Abwshealt

May 17, 2025

Mhrjan Aljzayr Alsynmayy Ykrm Almkhrj Allyby Sbry Abwshealt

May 17, 2025 -

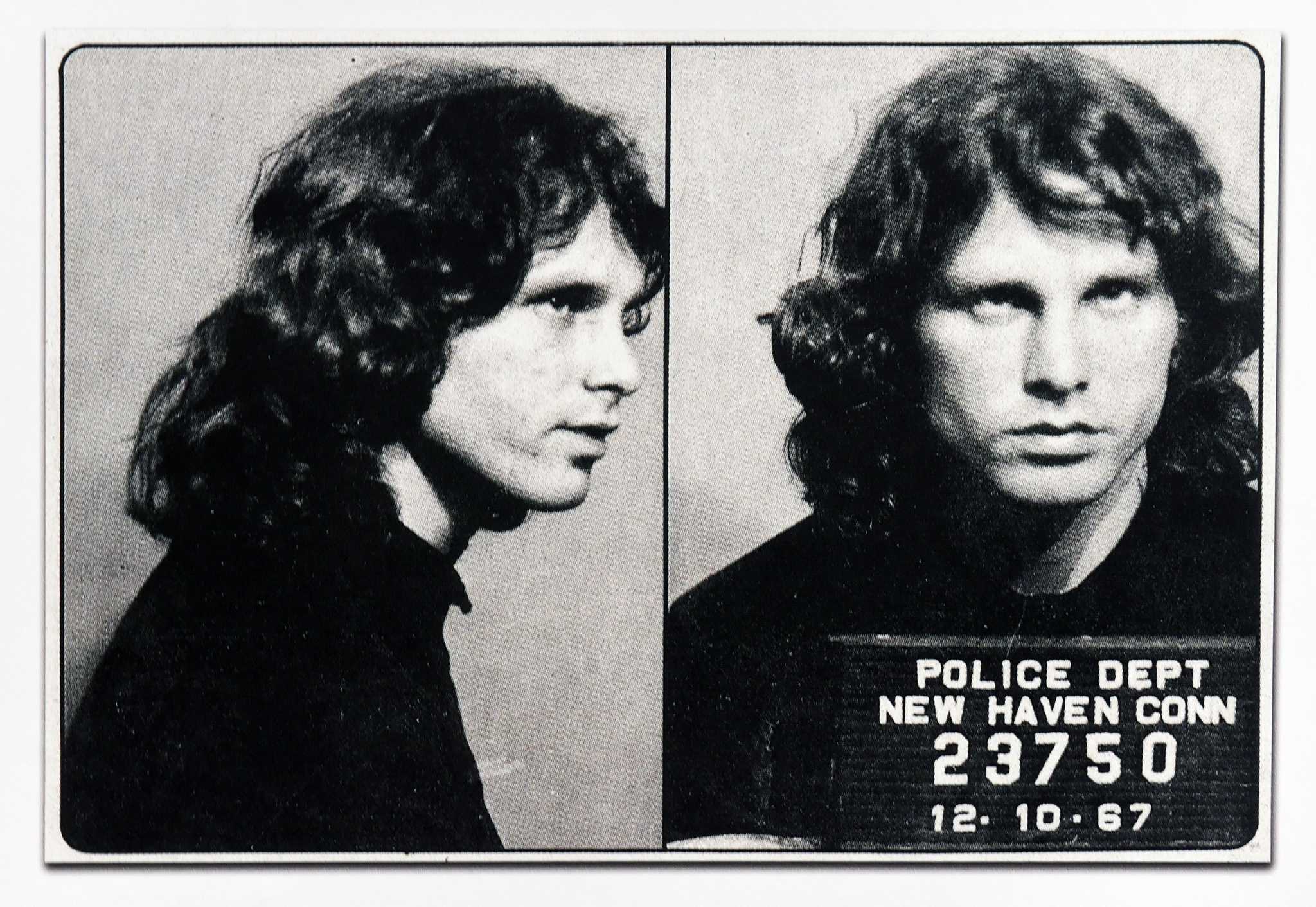

Is Jim Morrison Still Alive A New York Maintenance Man Conspiracy

May 17, 2025

Is Jim Morrison Still Alive A New York Maintenance Man Conspiracy

May 17, 2025