Home Depot Earnings: Disappointing Results, Tariff Guidance Maintained

Table of Contents

Disappointing Revenue and Earnings Per Share (EPS):

Home Depot's Q[Quarter] 2024 financial results showcased a significant deviation from analysts' predictions. The reported revenue and earnings per share (EPS) figures fell short of expectations, signaling a slowdown in the home improvement sector. This underperformance is a notable shift from previous quarters and raises concerns about the company's future growth trajectory. Several factors contributed to this shortfall.

- Specific revenue figures and year-over-year comparison: [Insert actual revenue figures here, e.g., "Revenue reached $XX billion, a decrease of X% compared to the same period last year."] This represents a substantial decline and highlights the weakening demand within the home improvement market.

- EPS figures and year-over-year comparison: [Insert actual EPS figures here, e.g., "EPS came in at $X.XX, a decrease of X% year-over-year."] This demonstrates a considerable drop in profitability, reflecting challenges in managing costs and maintaining profit margins.

- Analysis of the difference between actual and expected results: The difference between the actual and expected revenue and EPS figures reveals a significant gap, suggesting that market analysts overestimated the company's performance during this period. This discrepancy is likely due to unforeseen economic headwinds and changes in consumer behavior.

- Mention of any specific product categories that underperformed: [Insert details of underperforming categories, e.g., "Sales in lumber and building materials were particularly weak, indicating a slowdown in large-scale construction projects."] This points to the specific areas where Home Depot needs to refocus its strategies.

Impact of Tariffs on Home Depot's Business:

The ongoing trade tensions and associated tariffs continue to significantly impact Home Depot's business. While the company maintained its tariff guidance, the effects on pricing, product availability, and profitability remain substantial. The imposition of tariffs on imported lumber and other building materials has increased costs, squeezing profit margins.

- Explanation of Home Depot's tariff mitigation strategies (if any): [Discuss strategies employed by Home Depot to offset the tariff impact, e.g., "Home Depot has explored sourcing materials from alternative markets and implemented cost-cutting measures."] These strategies aim to mitigate, but not fully eliminate, the negative effects.

- Impact on specific product lines affected by tariffs: [Identify specific product lines most affected, e.g., "Lumber, certain types of appliances, and imported tools experienced significant price increases due to tariffs."] This demonstrates a direct link between trade policies and product pricing.

- Analysis of how the tariffs are affecting pricing and consumer behavior: [Analyze the impact of tariff-induced price increases on consumer behavior. E.g., "Higher prices have led to decreased demand for some products, causing a ripple effect throughout the supply chain."] This highlights the challenge of balancing costs and maintaining sales volumes.

- Discussion about the company's future outlook regarding tariff impact: [Discuss the company's projections and plans concerning the ongoing impact of tariffs, including any expectation of changes in trade policy or mitigation efforts.] This provides insight into the company’s long-term strategy and preparedness.

Overall Economic Conditions and Consumer Spending:

Home Depot's performance is inextricably linked to broader economic conditions and consumer spending patterns. The current economic climate, characterized by [mention relevant economic indicators, e.g., "rising interest rates and slowing GDP growth"], has dampened consumer confidence and reduced spending on discretionary items, including home improvement projects.

- Discussion of relevant economic indicators (e.g., GDP growth, consumer confidence index): [Cite specific economic data and explain their influence on Home Depot's financial results.] This provides crucial context for understanding the company's performance.

- Analysis of the housing market's influence on Home Depot's sales: [Analyze the impact of trends in the housing market, such as new home construction and existing home sales, on Home Depot's sales figures.] The housing market directly influences demand for Home Depot's products.

- Commentary on the impact of consumer spending trends on home improvement projects: [Discuss the shift in consumer spending priorities, with consumers potentially prioritizing essential purchases over home improvement projects.] This explains the decreased demand for Home Depot's products.

Future Outlook and Guidance:

Home Depot's guidance for future quarters provides insights into the company's expectations and strategic initiatives. [Insert details of the company's guidance, including projected revenue and EPS.] The company's outlook reflects the challenges posed by the current economic climate and the ongoing impact of tariffs. This outlook is crucial for investors to assess the future value of Home Depot stock.

Conclusion:

Home Depot's Q[Quarter] 2024 earnings report revealed disappointing results, falling short of expectations. The company's performance was negatively impacted by lower-than-anticipated consumer spending, driven by broader economic factors and the ongoing effects of tariffs. While Home Depot maintained its tariff guidance, the company faces significant headwinds. Understanding these factors is crucial for analyzing future Home Depot earnings reports and assessing the potential impact on the stock market. Stay informed about future Home Depot earnings announcements and their impact on the stock market. Follow our website for continued analysis and insights into Home Depot earnings and the broader home improvement sector. Learn more about how to interpret future Home Depot earnings reports by subscribing to our newsletter.

Featured Posts

-

Aex Abn Amro Wint Terrein Na Publicatie Kwartaalcijfers

May 22, 2025

Aex Abn Amro Wint Terrein Na Publicatie Kwartaalcijfers

May 22, 2025 -

Paris Nouvelle Scene Pour La Talentueuse Stephane

May 22, 2025

Paris Nouvelle Scene Pour La Talentueuse Stephane

May 22, 2025 -

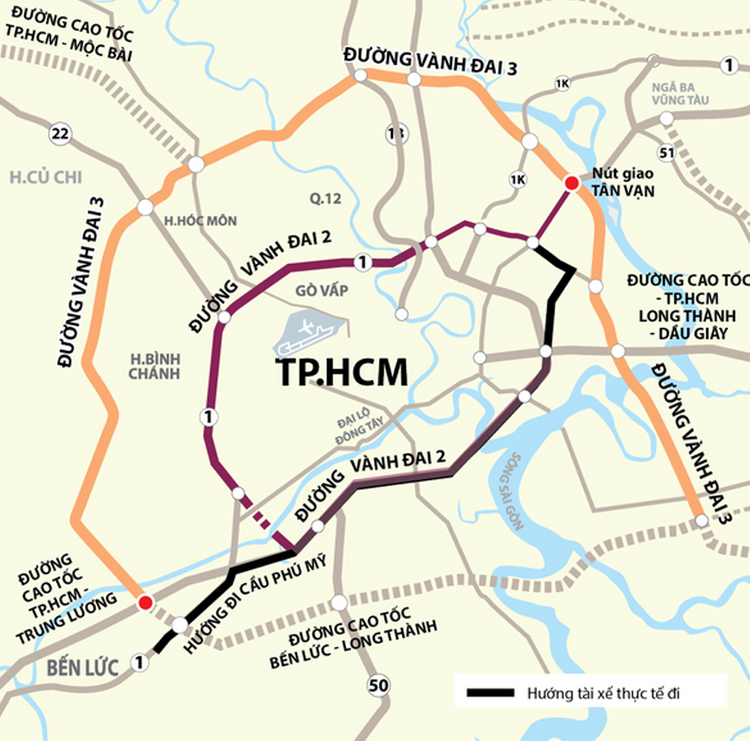

Xay Dung Ket Noi Tp Hcm Long An 7 Vi Tri Chien Luoc

May 22, 2025

Xay Dung Ket Noi Tp Hcm Long An 7 Vi Tri Chien Luoc

May 22, 2025 -

Distributie De Vis Pe Netflix Un Nou Serial Care Promite Mult

May 22, 2025

Distributie De Vis Pe Netflix Un Nou Serial Care Promite Mult

May 22, 2025 -

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025