Home Sales Collapse: A Crisis In The Real Estate Market

Table of Contents

H2: Rising Interest Rates: The Primary Culprit Behind the Home Sales Collapse

The direct correlation between interest rates and mortgage affordability is undeniable. The sharp increase in interest rates over the past year has significantly impacted the cost of borrowing, making homeownership a far less attainable goal for many. A 2% increase in interest rates can dramatically increase monthly mortgage payments, effectively reducing the purchasing power of potential homebuyers. For example, a $300,000 mortgage with a 3% interest rate has a considerably lower monthly payment than one with a 7% rate, impacting affordability substantially.

- Impact on first-time homebuyers: First-time homebuyers, often relying on smaller down payments and tighter budgets, are particularly vulnerable to these rising costs, pushing homeownership further out of reach.

- Effect on existing homeowners refinancing their mortgages: Many homeowners who were previously considering refinancing their mortgages at lower rates are now facing higher payments or finding it impossible to refinance altogether.

- Comparison of current interest rates to historical averages: Current interest rates are significantly higher than the historical averages seen in recent decades, creating a stark contrast to the low-interest environment that fueled the housing boom in previous years.

H2: Inflation and Economic Uncertainty: Fueling the Real Estate Market Downturn

Inflation is eroding purchasing power, impacting consumer confidence and significantly impacting large purchases like homes. Economic uncertainty, fueled by recessionary fears, is further dampening consumer spending. People are hesitant to commit to significant financial obligations amidst uncertainty about job security and future income.

- Impact of rising inflation on construction costs: Increased material and labor costs due to inflation are driving up the price of new homes, exacerbating the affordability crisis.

- Effect of supply chain disruptions on the availability of homes: Ongoing supply chain issues continue to constrain the construction industry, limiting the supply of new homes and pushing prices even higher.

- Consumer sentiment surveys and their implications for the housing market: Numerous consumer sentiment surveys reveal a significant drop in consumer confidence, directly impacting the demand for homes and contributing to the real estate market downturn.

H2: Inventory Levels and Market Dynamics: Contributing to Falling Home Prices

The current inventory levels of homes on the market are significantly higher than they were during the recent seller's market. This shift in market dynamics—from a seller's market to a buyer's market—is a primary factor driving down home prices. Increased inventory gives buyers more choices and greater negotiating power, resulting in slower sales and price reductions.

- Regional variations in inventory levels: While some regions are experiencing more significant increases in inventory than others, the overall trend indicates a shift toward a buyer's market across much of the country.

- Analysis of the types of properties most affected by the collapse: High-end properties and those in less desirable locations are often the first to experience price reductions in a softening market.

- Comparison of current inventory to pre-pandemic levels: The current inventory levels are still lower than pre-pandemic levels in some areas, but the significant increase compared to the recent seller's market is a crucial factor contributing to the home sales collapse.

H2: Potential Solutions and Future Outlook for the Housing Market

Several potential solutions could help alleviate this crisis. Government interventions, such as targeted tax incentives or adjustments to lending regulations, could stimulate demand. However, the future trajectory of the market remains uncertain. Real estate experts offer varying predictions, with some forecasting a prolonged period of slow growth or even further price declines.

- Potential impact of future interest rate adjustments: Future interest rate adjustments by the Federal Reserve will significantly influence the housing market's future. Further rate hikes could exacerbate the crisis, while rate cuts could provide some relief.

- Predictions for home prices in the coming years: Predictions for future home prices range widely, depending on various economic indicators. However, most forecasts anticipate slower growth at best and potential price corrections in the near future.

- Opportunities for investors in a depressed market: The current market downturn presents opportunities for savvy investors who can identify undervalued properties or navigate the complexities of a buyer's market.

3. Conclusion: Navigating the Home Sales Collapse and Charting a Path Forward

The home sales collapse is a multifaceted crisis driven by a confluence of factors: rising interest rates, inflation, economic uncertainty, and changing market dynamics. The severity of this crisis and its implications for homeowners, buyers, and the economy cannot be overstated. While the future remains uncertain, understanding these factors is crucial to navigating the challenges and potentially identifying opportunities. Stay informed about the ongoing home sales collapse and its impact on the housing market. Consider exploring resources on mortgage rates, economic forecasting, and real estate investment strategies to protect your financial interests. Proactive steps are crucial to successfully navigate this challenging period in the real estate market.

Featured Posts

-

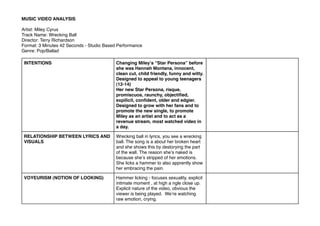

Miley Cyrus Unveils New Visuals For End Of The World Single

May 31, 2025

Miley Cyrus Unveils New Visuals For End Of The World Single

May 31, 2025 -

Padel Courts Coming To Bannatyne Health Club Essex Proposal Details Revealed

May 31, 2025

Padel Courts Coming To Bannatyne Health Club Essex Proposal Details Revealed

May 31, 2025 -

Affaire Depakine Sanofi Face A Des Accusations De Rejets Toxiques

May 31, 2025

Affaire Depakine Sanofi Face A Des Accusations De Rejets Toxiques

May 31, 2025 -

Designing The Good Life A Practical Guide

May 31, 2025

Designing The Good Life A Practical Guide

May 31, 2025 -

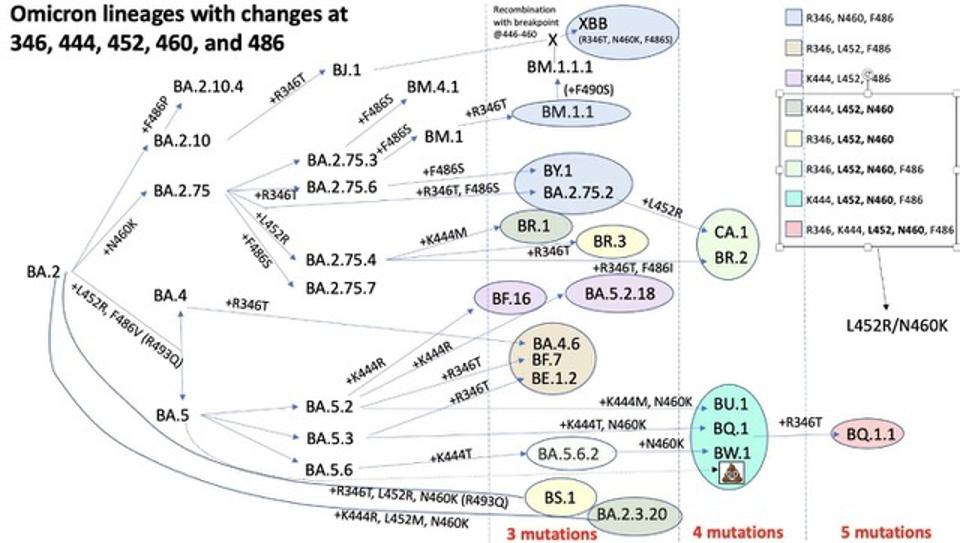

Who New Covid 19 Variant Fueling Case Increases Globally

May 31, 2025

Who New Covid 19 Variant Fueling Case Increases Globally

May 31, 2025