Honeywell To Acquire Johnson Matthey's Catalyst Business For $2.4 Billion: Deal Details And Impact

Table of Contents

Deal Overview and Financial Details

The Honeywell Johnson Matthey acquisition encompasses Johnson Matthey's entire catalyst technologies business. The $2.4 billion deal includes all related assets, intellectual property, and personnel involved in the production and sale of these crucial components for emission control. While the exact closing date was [Insert Date if available], the acquisition process involved extensive due diligence and regulatory approvals.

- Assets Included: The sale includes Johnson Matthey's leading technologies in automotive catalysts, including gasoline and diesel oxidation catalysts, particulate filters, and selective catalytic reduction (SCR) systems. This also extends to their industrial catalyst technologies.

- Honeywell's Financing: Honeywell utilized a combination of cash on hand and debt financing to secure the acquisition. Specific details regarding the financial structure are available in [Link to relevant financial reports].

- Regulatory Approvals: The acquisition required approvals from various regulatory bodies worldwide, including [List relevant regulatory bodies, if known]. These approvals were secured within [ timeframe, if known].

- Synergies and Cost Savings: Honeywell anticipates significant synergies and cost savings through integration with its existing performance materials and technologies business. These are expected to manifest through economies of scale in manufacturing, R&D, and supply chain optimization.

Impact on Honeywell's Portfolio and Future Strategy

This acquisition significantly strengthens Honeywell's position in the performance materials and technologies sector, bolstering its capabilities in emission control and clean technology solutions. The Honeywell Johnson Matthey deal positions Honeywell for considerable growth in this crucial market segment.

- Portfolio Expansion: The addition of Johnson Matthey's extensive catalyst portfolio immediately expands Honeywell's offerings in emission control, enhancing its ability to serve the automotive and industrial sectors.

- Increased Market Share: The acquisition grants Honeywell a substantial increase in market share, making it a dominant player in the global catalyst market. This improves its competitive standing against other key players.

- Growth Opportunities: The Honeywell Johnson Matthey integration opens doors to significant growth in emerging markets, particularly those with stringent emission regulations and growing demand for cleaner transportation.

- Integration and Job Implications: Honeywell has outlined plans for integrating Johnson Matthey's operations, aiming for a seamless transition. While some restructuring is anticipated, Honeywell has publicly committed to [state Honeywell’s public stance on job security].

Implications for Johnson Matthey and its Future

The divestiture of its catalyst business allows Johnson Matthey to refocus its resources and strategic priorities. The sale provides significant capital to reinvest in other core areas.

- Rationale for Sale: Johnson Matthey cited its strategic goal to concentrate on its higher-growth areas as the primary reason for divesting its catalyst business.

- Use of Proceeds: The proceeds from the sale will be reinvested in areas such as [list Johnson Matthey’s stated investment priorities]. This will likely accelerate their growth and innovation in these sectors.

- Workforce Impact: The acquisition involved the transfer of employees from Johnson Matthey to Honeywell. Honeywell has [state Honeywell's public commitment regarding the employment of Johnson Matthey’s former employees].

- Future Focus: Post-divestiture, Johnson Matthey will concentrate on its core competencies in [list Johnson Matthey’s core areas of focus]. This strategic shift aims to improve profitability and create long-term sustainable growth.

Market Analysis and Competitive Landscape

The Honeywell Johnson Matthey acquisition significantly alters the competitive landscape of the catalyst market. This consolidation could have implications for pricing, innovation, and the future direction of the industry.

- Increased Competition: The combined entity strengthens competition among the remaining major players, leading to increased pressure to innovate and improve efficiency.

- Market Consolidation: This acquisition is likely to trigger further consolidation within the catalyst market as other companies seek to maintain their competitiveness.

- Impact on Innovation: While initially focused on integration, the acquisition's long-term effects on innovation within the catalyst sector remain to be seen. The combined R&D capabilities may accelerate technological advancements.

- Long-Term Effects: The Honeywell Johnson Matthey acquisition will undoubtedly have long-term impacts on both the automotive and chemical industries, impacting the supply chains and the availability of emission control technologies.

Conclusion

The Honeywell Johnson Matthey acquisition represents a significant consolidation of power in the catalyst market. This deal promises substantial benefits for Honeywell, expanding its presence in a critical sector, while offering Johnson Matthey opportunities for strategic refocusing. The long-term impacts on the industry remain to be seen, but the transaction undoubtedly sets the stage for significant changes in the competitive landscape. The successful integration of Johnson Matthey’s technologies and expertise will be key to realizing the full potential of this significant deal.

Call to Action: Stay informed about the unfolding impact of the Honeywell Johnson Matthey acquisition and its implications for the future of emission control technologies. Follow [Your Website/News Source] for further updates and analysis on this significant industry development. Understanding the intricacies of this Honeywell Johnson Matthey merger is crucial for anyone invested in the automotive or chemical industries.

Featured Posts

-

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U Liderakh

May 23, 2025

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U Liderakh

May 23, 2025 -

Pete Townshend On Zak Starkey The Who Drummers Return

May 23, 2025

Pete Townshend On Zak Starkey The Who Drummers Return

May 23, 2025 -

Can You Still Negotiate After A Best And Final Offer

May 23, 2025

Can You Still Negotiate After A Best And Final Offer

May 23, 2025 -

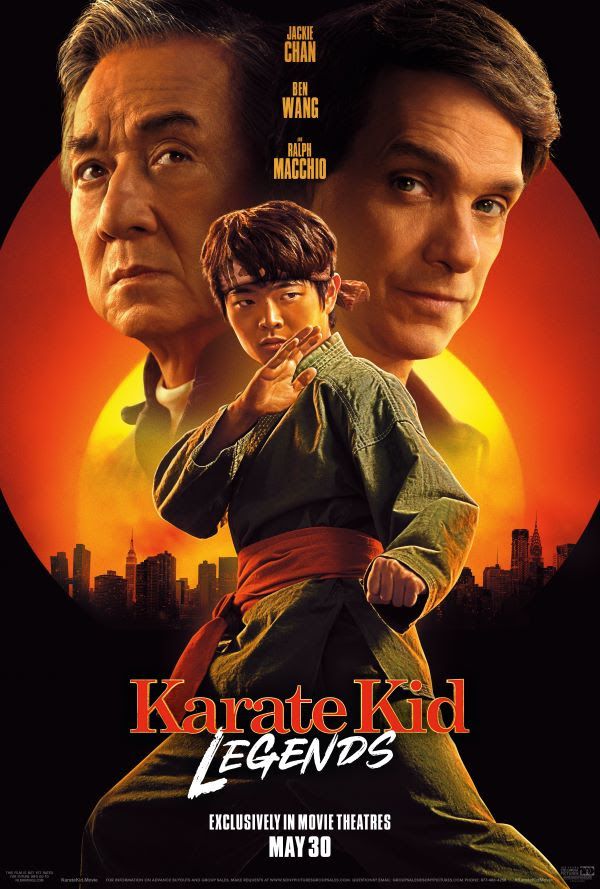

Cobra Kai Unveiling The Netflix Connection To The Karate Kid

May 23, 2025

Cobra Kai Unveiling The Netflix Connection To The Karate Kid

May 23, 2025 -

Is The Pilbara A Wasteland Rio Tinto And Andrew Forrest Clash Over Minings Impact

May 23, 2025

Is The Pilbara A Wasteland Rio Tinto And Andrew Forrest Clash Over Minings Impact

May 23, 2025