Honeywell's $2.4 Billion Acquisition Of Johnson Matthey's Catalyst Technologies: A Deep Dive

Table of Contents

Strategic Rationale Behind Honeywell's Acquisition

Honeywell's acquisition of Johnson Matthey's catalyst technologies is a strategic masterstroke aligning perfectly with its overarching growth strategy.

Honeywell's Growth Strategy: Embracing Sustainable Technologies

Honeywell is aggressively expanding its presence in the sustainable technologies sector, aiming to become a leader in providing emission reduction solutions. This acquisition significantly boosts their capabilities in this crucial area. The company sees substantial growth potential in clean energy and environmental technologies, a market projected to experience explosive growth in the coming years. This move strengthens their commitment to:

- Developing innovative emission control technologies.

- Expanding their portfolio of sustainable products and services.

- Meeting increasing global demand for cleaner energy solutions.

Synergies and Market Position: A Powerful Combination

The acquisition creates significant synergies between Honeywell's existing portfolio and Johnson Matthey's advanced catalyst technologies. This integration is expected to:

- Expand Honeywell's market share in the catalyst technology sector, making them a major player.

- Enhance their competitiveness by offering a broader range of high-performance catalysts.

- Improve operational efficiencies through economies of scale and shared resources.

- Unlock cross-selling opportunities within Honeywell's diverse customer base.

Technological Advantages: Advanced Catalysts for Diverse Applications

Johnson Matthey boasts a leading-edge portfolio of catalyst technologies with applications across various sectors. This acquisition brings Honeywell access to:

- Automotive catalysts: Cutting-edge emission control catalysts for gasoline and diesel vehicles, crucial for meeting stringent global emissions standards.

- Chemical catalysts: High-performance catalysts used in various chemical processes, enhancing efficiency and reducing waste.

- Other specialized catalysts: Solutions for diverse applications including refining, petrochemicals, and other industrial processes.

Financial Benefits: A Solid Investment for Long-Term Growth

Honeywell anticipates significant financial returns from this investment. The acquisition is expected to:

- Drive substantial revenue growth in the coming years.

- Improve overall profitability and financial performance.

- Offer attractive returns on investment (ROI) in the long term.

- Position Honeywell for continued growth and leadership in the evolving catalyst market.

Johnson Matthey's Catalyst Technologies Portfolio: A Closer Look

Johnson Matthey was a recognized leader in the catalyst technology industry before the acquisition, possessing a diverse and highly innovative portfolio.

Types of Catalysts: A Wide Range of Solutions

The acquired portfolio includes a wide array of catalyst technologies, including:

- Three-way catalysts (TWCs) for automotive emission control.

- Diesel oxidation catalysts (DOCs) for reducing diesel emissions.

- Selective catalytic reduction (SCR) catalysts for NOx reduction in diesel engines.

- Various specialized catalysts for chemical and industrial applications.

Market Leadership: A Strong Reputation for Innovation

Johnson Matthey held a strong market position, known for its:

- High-quality products.

- Technological expertise.

- Strong customer relationships.

- Commitment to research and development (R&D).

Technological Innovation: A Legacy of Breakthroughs

Johnson Matthey’s history is marked by continuous innovation, holding numerous patents and developing groundbreaking technologies in the field of catalysis. This includes advancements in:

- Catalyst design and manufacturing processes.

- Material science for improved catalyst performance.

- Sustainable catalyst development, reducing environmental impact.

Impact and Future Implications of the Acquisition

The Honeywell acquisition has significant implications for the catalyst market and beyond.

Competition in the Catalyst Market: Shifting Dynamics

The acquisition will undoubtedly reshape the competitive landscape of the catalyst market, leading to:

- Increased consolidation within the industry.

- Potential adjustments in pricing and market strategies from competitors.

- A heightened focus on innovation and technological advancements.

Environmental Impact: Driving Towards a Greener Future

This acquisition is expected to contribute positively to environmental sustainability by:

- Accelerating the development and adoption of cleaner technologies.

- Reducing greenhouse gas emissions from various sources.

- Supporting global efforts to combat climate change.

Future Growth Opportunities: Expanding Horizons

Honeywell anticipates several future growth opportunities from this acquisition, including:

- Developing new catalyst technologies for emerging applications.

- Expanding into new geographic markets.

- Leveraging synergies to create innovative solutions for a wide range of industries.

Regulatory Landscape: Navigating the Changing Environment

The regulatory landscape for catalyst technologies is constantly evolving, with stricter emissions standards being implemented globally. This acquisition positions Honeywell to:

- Meet and exceed increasingly stringent environmental regulations.

- Proactively adapt to future regulatory changes.

- Offer compliant and cutting-edge solutions to its customers.

Conclusion: Analyzing Honeywell's Strategic Investment in Catalyst Technologies

Honeywell's acquisition of Johnson Matthey's catalyst technologies is a strategically significant move, strengthening its position in the sustainable technology sector and driving long-term growth. By acquiring a leading player with a strong portfolio of innovative catalyst technologies, Honeywell has significantly enhanced its capabilities in emission reduction and clean energy solutions. This acquisition promises substantial financial returns, improved market share, and significant contributions to environmental sustainability. To learn more about Honeywell's catalyst technology and its implications for the future of clean energy, explore the company's website and stay updated on their ongoing developments in this crucial sector. Explore the future of catalyst technologies and the role Honeywell will play in shaping it.

Featured Posts

-

The A Real Pain Role Eric Andre Explains His Casting Decisions

May 23, 2025

The A Real Pain Role Eric Andre Explains His Casting Decisions

May 23, 2025 -

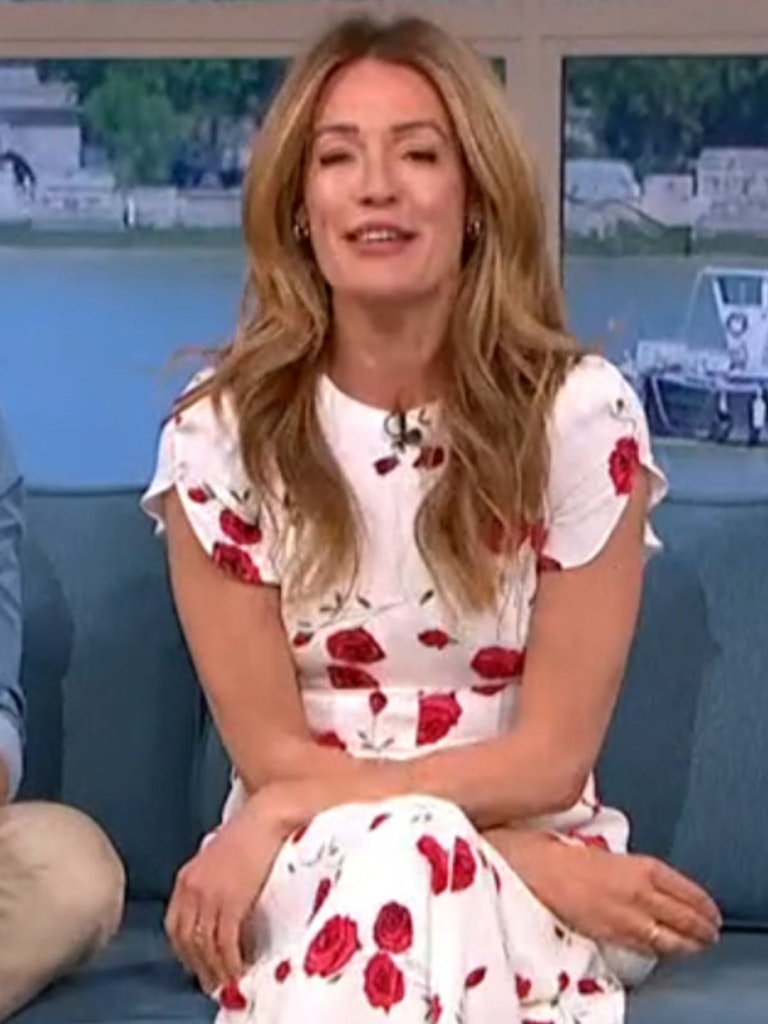

Wardrobe Glitch For Cat Deeley Minutes Before This Morning Broadcast

May 23, 2025

Wardrobe Glitch For Cat Deeley Minutes Before This Morning Broadcast

May 23, 2025 -

Is The Pilbara A Wasteland Rio Tinto And Andrew Forrest Clash Over Minings Impact

May 23, 2025

Is The Pilbara A Wasteland Rio Tinto And Andrew Forrest Clash Over Minings Impact

May 23, 2025 -

Briefs Key Elements And How To Use Them Effectively

May 23, 2025

Briefs Key Elements And How To Use Them Effectively

May 23, 2025 -

Sharjahs Affordable Rentals A Case Study Of A Familys Successful Move

May 23, 2025

Sharjahs Affordable Rentals A Case Study Of A Familys Successful Move

May 23, 2025