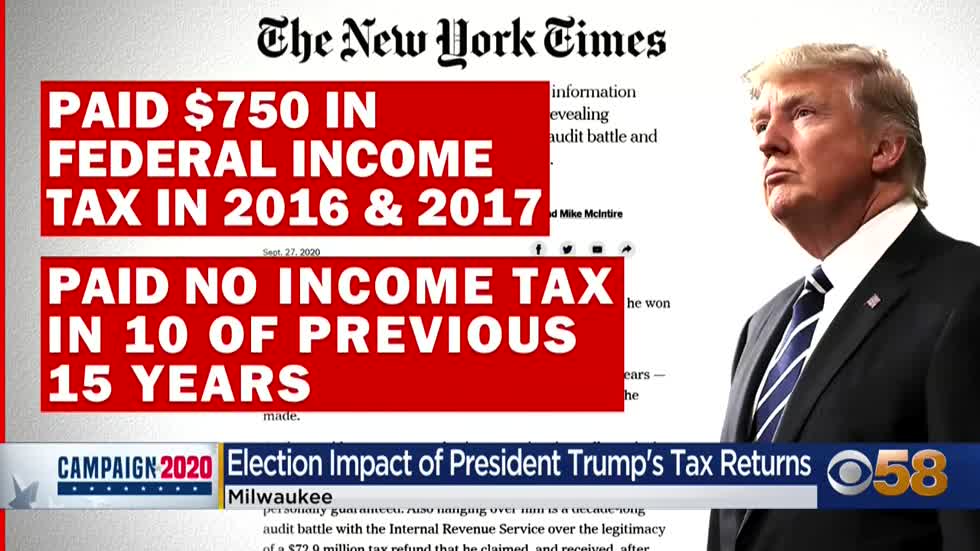

House Approves Amended Trump Tax Bill: What's Changed?

Table of Contents

Key Changes to Individual Income Tax Rates

The amended Trump Tax Bill introduces several modifications to individual income tax rates and related provisions. While the specific details may require careful examination of the official legislation, some key changes impact taxpayers across different income levels. Keywords: Individual Income Tax, Tax Brackets, Standard Deduction, Tax Credits.

- Adjusted Tax Brackets: The bill may adjust existing tax brackets, potentially increasing or decreasing the tax rates for certain income levels. Precise details regarding these adjustments should be consulted in official government publications.

- Standard Deduction Changes: The standard deduction amount might be altered, impacting the number of taxpayers eligible for itemized deductions. This change could significantly affect the tax liability of many individuals. For example, a higher standard deduction could lower the tax burden for some low-to-middle-income families.

- Tax Credit Modifications: Several tax credits may be modified or even eliminated. This includes credits for education, child care, or other dependents. Understanding these changes is vital for accurately calculating your tax liability.

Alterations to Corporate Tax Rates and Deductions

The amended bill also includes changes to the corporate tax rate and associated deductions. These modifications have wide-ranging implications for businesses of all sizes, affecting investment decisions, profitability, and job creation. Keywords: Corporate Tax Rate, Corporate Tax Deductions, Business Tax Reform, Tax Implications for Businesses.

- Revised Corporate Tax Rate: The corporate tax rate itself might be adjusted, either upward or downward, compared to the initial Trump Tax Bill. This will directly impact a corporation's bottom line and potentially influence investment decisions.

- Changes to Depreciation: Modifications to depreciation rules could affect how businesses deduct the cost of assets over time. Changes in depreciation schedules could significantly impact corporate tax liabilities.

- Interest Expense Deductions: Restrictions or changes to interest expense deductions can also influence business investment strategies and profitability. Businesses will need to carefully analyze how these changes impact their financial planning.

Impact on State and Local Tax Deductions (SALT)

The SALT deduction, which allows taxpayers to deduct state and local taxes from their federal income tax, has been a point of contention. The amended Trump Tax Bill likely addresses the SALT deduction, potentially impacting high-tax states disproportionately. Keywords: SALT Deduction, State and Local Taxes, High-Tax States, Tax Deduction Limits.

- Limitations on SALT Deductions: The bill may impose limitations on the amount of SALT deductions, effectively reducing the tax benefits for residents of high-tax states like California, New York, and New Jersey.

- Potential SALT Deduction Elimination: In more extreme scenarios, the SALT deduction might be entirely removed, leading to a considerable increase in the tax burden for individuals residing in high-tax states.

Changes to Estate and Gift Taxes

The amended bill may also introduce changes to estate and gift taxes, affecting wealth transfer and inheritance planning. Keywords: Estate Tax, Gift Tax, Estate Tax Reform, Inheritance Tax.

- Adjusted Exemption Amounts: The exemption amount for estate and gift taxes might be altered, potentially increasing or decreasing the amount of assets that can be transferred tax-free.

- Modified Tax Rates: The tax rates themselves could also be adjusted, impacting the tax liability on larger estates and gifts.

Potential Economic Effects of the Amended Trump Tax Bill

The amended Trump Tax Bill's economic consequences are subject to ongoing debate. The changes to individual and corporate tax rates, combined with modifications to deductions, will have a ripple effect throughout the economy. Keywords: Economic Impact, Tax Policy, Job Growth, Investment, Income Inequality.

- Impact on Job Growth: The changes may stimulate or hinder job growth depending on how businesses respond to the altered tax landscape. Some predict increased investment leading to job creation, while others express concerns about income inequality exacerbating existing economic divides.

- Investment Implications: Changes to corporate tax rates and deductions could influence business investment decisions, leading to either increased capital expenditure or reduced investment.

- Income Inequality: The overall impact on income inequality is uncertain and depends on the specifics of the implemented tax changes. Analyses from various economic think tanks and academic researchers will be crucial in understanding the long-term effects.

Conclusion: Understanding the Amended Trump Tax Bill's Implications

The amended Trump Tax Bill introduces significant changes to the US tax code, affecting individuals and businesses alike. Understanding these changes – including modifications to individual and corporate tax rates, the SALT deduction, and estate and gift taxes – is essential for effective financial planning. The potential economic consequences, from job growth to income inequality, are far-reaching and require careful consideration. To navigate this complex landscape, seek professional tax advice to understand how the Amended Trump Tax Bill affects your personal or business finances. Consult with a qualified tax professional or explore resources from the IRS website to learn more about the Trump Tax Bill changes and how to best adapt to the new tax environment. Keywords: Tax Planning, Tax Advice, Tax Professional, Trump Tax Bill Implications.

Featured Posts

-

Nfls Tush Push Survives The End Of The Butt Ban

May 23, 2025

Nfls Tush Push Survives The End Of The Butt Ban

May 23, 2025 -

Grand Ole Opry Goes Global First Ever International Broadcast From Londons Royal Albert Hall

May 23, 2025

Grand Ole Opry Goes Global First Ever International Broadcast From Londons Royal Albert Hall

May 23, 2025 -

Secure Cat Deeleys M And S Midi Dress Before Its Gone

May 23, 2025

Secure Cat Deeleys M And S Midi Dress Before Its Gone

May 23, 2025 -

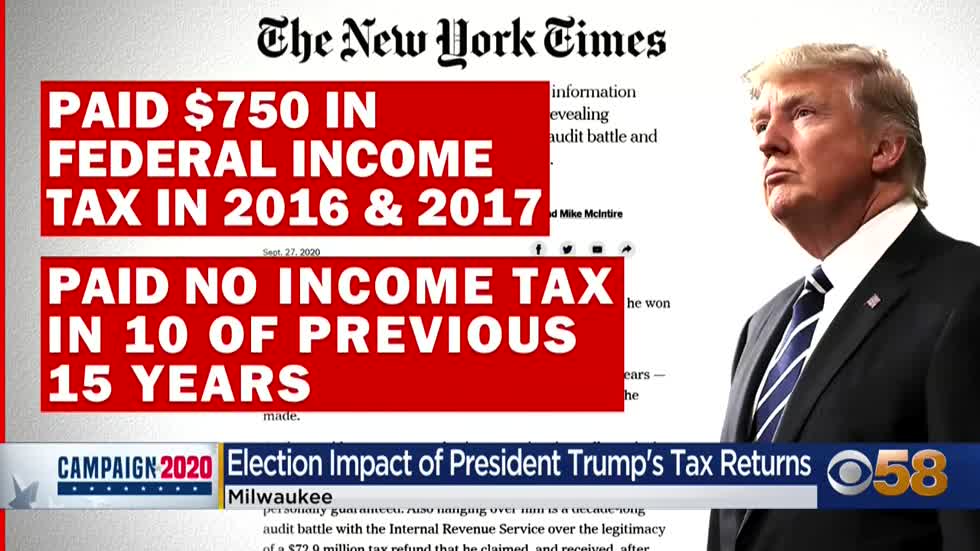

Nyt Mini Sunday Crossword April 6 2025 Complete Solution

May 23, 2025

Nyt Mini Sunday Crossword April 6 2025 Complete Solution

May 23, 2025 -

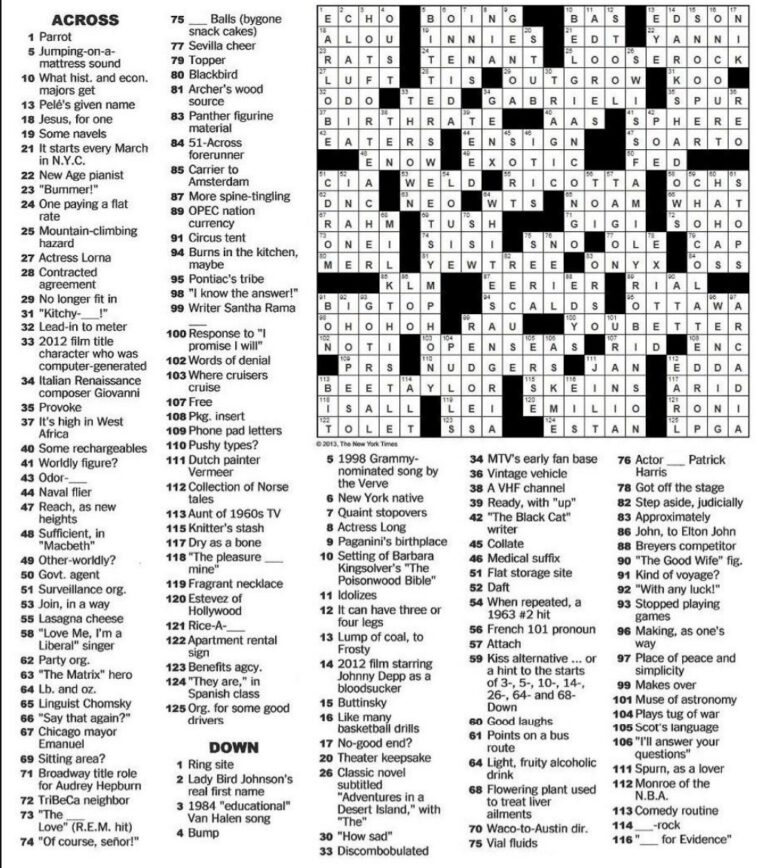

The Karate Kid Part Ii Exploring Mr Miyagis Past And Daniels Growth

May 23, 2025

The Karate Kid Part Ii Exploring Mr Miyagis Past And Daniels Growth

May 23, 2025