House Republicans Outline Key Features Of Trump's Tax Proposals

Table of Contents

House Republicans have recently released a detailed outline of key features within Donald Trump's proposed tax reforms. This plan, if enacted, would significantly reshape the US tax code, impacting everything from individual income taxes to corporate rates. This article breaks down the core components of the Republican proposal, examining potential benefits, drawbacks, and the overall economic implications. Understanding the intricacies of Trump's tax proposals is crucial for both individuals and businesses.

Individual Income Tax Changes

The proposed changes to individual income taxes are a cornerstone of Trump's tax plan, aiming to simplify the system and provide tax relief for many Americans.

Proposed Bracket Changes

The Republican plan proposed significant alterations to the individual income tax brackets. While specific percentages may vary depending on the final legislation, the general aim was to reduce the number of brackets and lower the overall tax rates.

- Reduction in the highest bracket: A reduction in the top marginal tax rate was a key feature, aiming to stimulate investment and economic growth. The exact percentage reduction would depend on the final version of the legislation.

- Potential elimination of certain brackets: Consolidating the number of tax brackets was another proposed change, aiming to simplify the tax code and make it easier for taxpayers to understand.

- Example: A high-income earner previously paying a 39.6% tax rate might see their rate reduced to, say, 35%, resulting in substantial tax savings. Conversely, those in lower income brackets might see minimal or no change. These scenarios need to be assessed using the final numbers to understand the total impact.

Standard Deduction and Exemptions

The plan proposed significant changes to the standard deduction and personal exemptions.

- Increased standard deduction amounts: A substantially increased standard deduction would benefit many taxpayers, particularly those with lower incomes who may not itemize deductions.

- Elimination of personal exemptions: Eliminating personal exemptions, while offset by the increased standard deduction, could impact families differently. Families with multiple dependents might experience a net loss or gain depending on their financial situation.

- Net effect: The combined effect of increased standard deductions and the elimination of exemptions aimed for simplification, but its impact varied significantly based on individual circumstances.

Child Tax Credit Modifications

Modifications to the child tax credit were also proposed.

- Increased credit amount: The proposed plan included an increase in the amount of the child tax credit per child.

- Expanded eligibility criteria (if applicable): Depending on the final version, eligibility requirements might have been expanded to include more families.

- Impact on families: This alteration would provide substantial tax relief to families with children, assisting with childcare and other expenses.

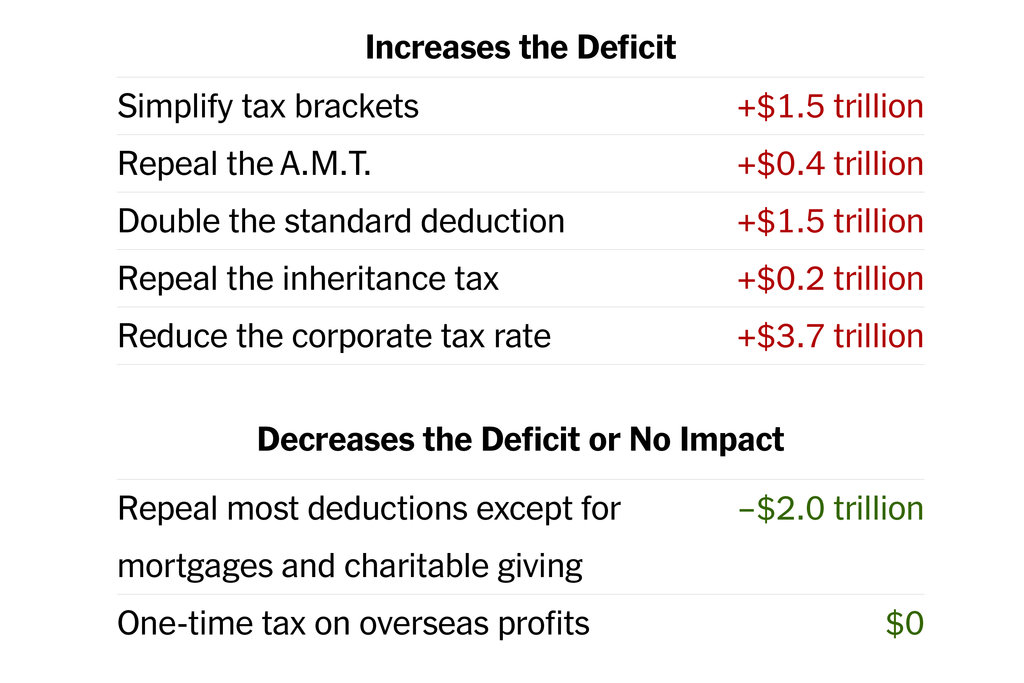

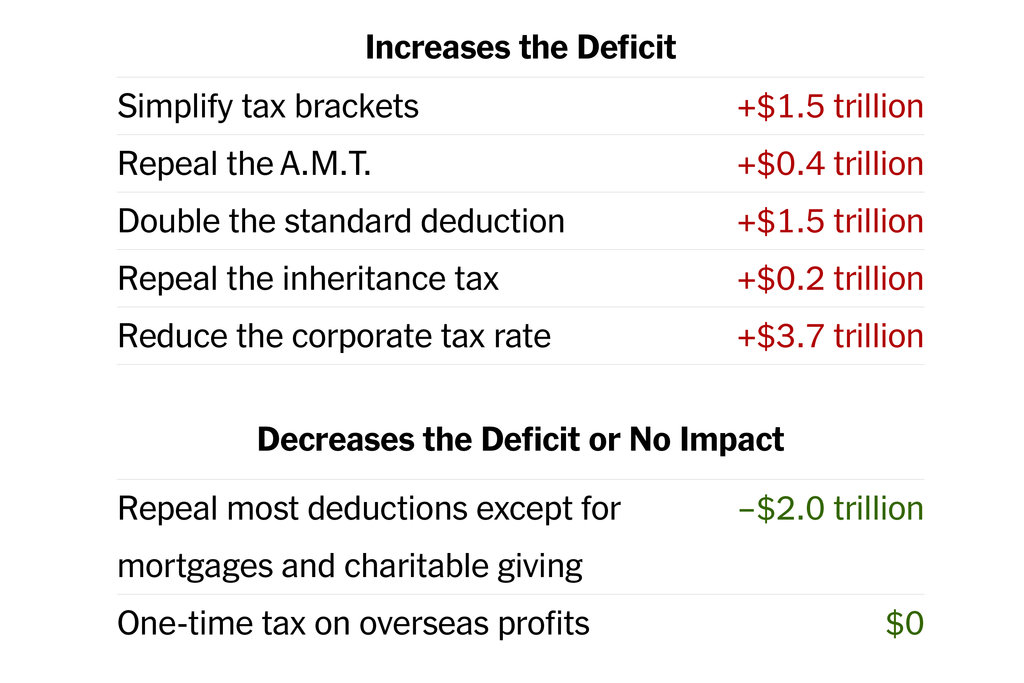

Corporate Tax Rate Reductions

A dramatic reduction in the corporate tax rate was a central element of Trump’s tax plan.

Proposed Corporate Tax Rate

The proposed corporate tax rate reduction from 35% to a significantly lower rate (e.g., 20%) was designed to enhance US business competitiveness globally.

- Specific percentage of the proposed reduction: A reduction of 15 percentage points was proposed, significantly lowering the tax burden on corporations.

- Potential effects on business investment and job creation: Proponents argued this reduction would encourage businesses to invest more, leading to increased job creation and economic growth. This theory remains heavily debated.

Impact on Corporate Tax Revenue

Lowering the corporate tax rate would undoubtedly impact government revenue.

- Estimates of revenue loss (or gain): Initial estimates projected a significant decrease in corporate tax revenue. However, counter-arguments suggested increased economic activity could offset some of this loss.

- Arguments for or against the revenue projections: The debate centered around the extent to which increased economic activity would mitigate the revenue loss from lower corporate tax rates. This remains a topic of ongoing discussion and analysis.

Other Key Provisions

Beyond individual and corporate taxes, other significant provisions were included.

Changes to Pass-Through Entities

The plan addressed the taxation of pass-through entities (S corporations, partnerships, LLCs).

- Specific changes to deduction rules: Modifications were proposed to deduction rules for pass-through entities, affecting small business owners and self-employed individuals.

- Impact on small business profitability: These changes aimed to simplify taxation for small business owners and potentially increase their profitability. However, specific impacts would vary.

Estate Tax Changes

Significant changes to the estate tax were also part of the proposal.

- Changes to the estate tax exemption: An increase in the estate tax exemption or even its complete elimination was considered.

- Potential impact on wealth transfer: This would significantly impact wealth transfer between generations for high-net-worth families.

Conclusion

Trump's tax proposals, as outlined by House Republicans, involved substantial changes to individual income tax brackets, the standard deduction, corporate tax rates, and other key areas. While proponents argued these changes would stimulate economic growth and provide tax relief, critics raised concerns about the potential impact on government revenue and income inequality. The actual impact on different groups varied significantly depending on the specifics implemented.

Call to Action: To stay informed on the latest developments regarding the proposed tax changes and their potential effects on your financial situation, continue following our coverage of Trump's tax proposals and Republican tax reform initiatives. Understanding the intricacies of these proposals is crucial for informed decision-making. #TrumpTaxPlan #TaxReform #HouseRepublicans

Featured Posts

-

Kim Kardashian Recounts Paris Robbery I Thought They Would Kill Me

May 16, 2025

Kim Kardashian Recounts Paris Robbery I Thought They Would Kill Me

May 16, 2025 -

Ovechkin Dostig Rekorda Leme V Pley Off N Kh L Po Zabitym Shaybam

May 16, 2025

Ovechkin Dostig Rekorda Leme V Pley Off N Kh L Po Zabitym Shaybam

May 16, 2025 -

Athletic Club De Bilbao On Vavel Usa The Latest Updates And Analysis

May 16, 2025

Athletic Club De Bilbao On Vavel Usa The Latest Updates And Analysis

May 16, 2025 -

Ai In Football La Ligas Pioneering Approach And Worldwide Influence

May 16, 2025

Ai In Football La Ligas Pioneering Approach And Worldwide Influence

May 16, 2025 -

Auction Of Kid Cudis Personal Items Shatters Expectations

May 16, 2025

Auction Of Kid Cudis Personal Items Shatters Expectations

May 16, 2025