How A Crypto Bro Shorted $TRUMP And Won A White House Dinner

Table of Contents

Understanding the $TRUMP Asset and the Shorting Strategy

What is a $TRUMP-related asset?

To understand CryptoKev's strategy, we need to define our hypothetical $TRUMP asset. For the purposes of this story, let's imagine it represents a tradable index tracking the perceived political influence and success of a particular political figure. This could be a complex algorithm incorporating polling data, media mentions, legislative achievements, and even social media sentiment. This hypothetical asset, like any other, could be bought and sold on a specialized exchange or prediction market.

- Examples of potential $TRUMP-related assets (if they existed): A hypothetical stock traded on a speculative exchange, a futures contract tied to election outcomes, or a complex derivative instrument reflecting public perception.

- Brief explanation of short selling: Short selling involves borrowing an asset (in this case, our $TRUMP asset), selling it at the current market price, hoping the price drops, buying it back at the lower price, and returning the borrowed asset. The difference between the selling and buying price is the profit.

- Risk assessment of shorting: Short selling carries significant risk. If the price of the asset rises instead of falling, the potential losses are theoretically unlimited. This is why it's considered a high-risk, high-reward strategy.

The Crypto Bro's Prediction and Execution

The Rationale Behind the Short

CryptoKev, known for his keen understanding of market trends and his appetite for risk, believed that specific political events and negative media coverage would negatively impact the perceived influence of the $TRUMP asset. His analysis, while speculative, was based on careful observation of real-world events and trends – something many successful cryptocurrency investors and traders rely on.

- Details about the chosen platform for shorting: Let's imagine CryptoKev used a hypothetical decentralized prediction market, leveraging smart contracts to execute his short position.

- The amount invested: He risked a significant portion of his cryptocurrency holdings – a bold move reflecting his confidence (or perhaps overconfidence) in his prediction.

- Specific strategies used to manage risk (or lack thereof): While a sophisticated investor might use hedging strategies, our story portrays CryptoKev as taking a rather audacious, high-risk, high-reward approach. He didn’t hedge his bets and made a significant, concentrated investment based solely on his assessment of the situation.

The Unexpected Win and the White House Dinner

The Market's Reaction and the Bro's Profit

The market reacted precisely as CryptoKev predicted. Negative news and events impacted the value of the $TRUMP asset, leading to a significant price drop. His short position yielded a massive profit – a windfall that catapulted him into the spotlight.

- Details about the gains made from the short: Let's say he multiplied his initial investment tenfold, netting a substantial profit in cryptocurrency.

- The circumstances that led to the White House dinner invitation: This could have been due to a contest associated with the prediction market, recognizing CryptoKev's accurate forecast on a major political event, turning him into a news sensation. Perhaps he was even invited for his exceptional understanding of market analysis and successful use of innovative investment strategies.

- A description of the White House dinner: Imagine a lavish affair with influential figures, a testament to CryptoKev’s audacious gamble paying off in the most unexpected way.

Lessons Learned and Ethical Considerations

Risk Management in High-Stakes Investments

CryptoKev's success story, while thrilling, underscores the critical importance of risk management in any investment, especially in highly speculative markets like cryptocurrency and political prediction markets. His strategy, while lucrative in this instance, carries enormous risks that could have resulted in significant financial losses.

- Explain the ethical implications of betting on political events: Betting on political outcomes raises ethical questions regarding the manipulation of markets and the potential influence of financial interests on political events.

- Highlight the importance of diversification and not putting all your eggs in one basket: Diversification across different assets is crucial to mitigate risk. CryptoKev’s strategy, concentrated in a single, volatile asset, was exceedingly risky.

- Contrast the high-risk nature of the strategy with the potential rewards: The potential rewards can be immense, but the likelihood of failure is equally high. This gamble-oriented approach requires a very high tolerance for risk.

The Role of Crypto in Speculative Markets

Cryptocurrency's decentralized nature and inherent volatility make it an attractive, yet risky, instrument for speculative trading.

- Highlight the volatility of crypto and its suitability for speculative trading: Cryptocurrencies are notoriously volatile, making them suitable for short-term speculation but extremely risky for long-term investments.

- Discuss the accessibility of crypto markets compared to traditional finance: The relative ease of accessing crypto markets compared to traditional financial markets contributes to their popularity among speculators.

Conclusion:

CryptoKev's journey from a crypto enthusiast to a White House dinner guest showcases the high-stakes world of speculative investing in cryptocurrency and political prediction markets. His bold $TRUMP asset shorting strategy, though successful in this fictional instance, highlights the importance of understanding risk management and ethical considerations before engaging in such ventures. While the story is fictional, it underscores the need for thorough research and a cautious approach when exploring the potentially lucrative, yet dangerous, world of speculative cryptocurrency investments. Learn more about responsible investing in similar assets and explore the world of cryptocurrency and prediction markets with caution.

Featured Posts

-

Oslo Brann Fa Direkte Nyhetsvarsel Og Oppdateringer

May 29, 2025

Oslo Brann Fa Direkte Nyhetsvarsel Og Oppdateringer

May 29, 2025 -

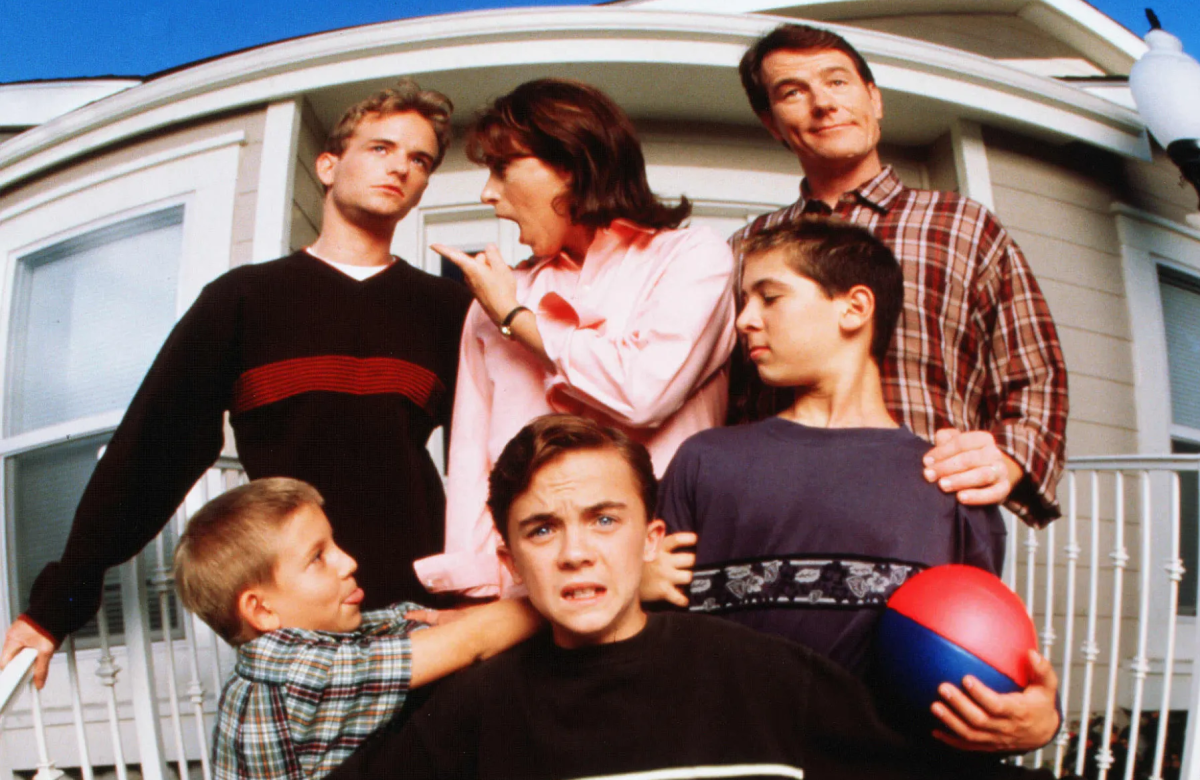

A Malcolm In The Middle Revival Hopes Speculations And Updates

May 29, 2025

A Malcolm In The Middle Revival Hopes Speculations And Updates

May 29, 2025 -

Live Nation Faces Backlash Over Trump Linked Board Appointment

May 29, 2025

Live Nation Faces Backlash Over Trump Linked Board Appointment

May 29, 2025 -

A Bukszaban Rejlo Kincsek Feltarasa

May 29, 2025

A Bukszaban Rejlo Kincsek Feltarasa

May 29, 2025 -

Waarom Arne Slot De Ideale Ajax Trainer Zou Kunnen Zijn En Waarom Niet

May 29, 2025

Waarom Arne Slot De Ideale Ajax Trainer Zou Kunnen Zijn En Waarom Niet

May 29, 2025