How Brexit Is Affecting UK Luxury Exports To The EU

Table of Contents

Increased Customs Procedures and Costs

The post-Brexit environment has introduced significant hurdles for UK luxury exports to the EU, primarily through increased customs procedures and associated costs. These challenges impact everything from processing times to the final price paid by European consumers.

Complex Documentation and Delays

Exporting luxury goods to the EU now requires significantly more paperwork than before Brexit. Businesses must navigate a complex web of documentation, including:

- Certificates of Origin: Verifying the origin of goods to determine applicable tariffs.

- Customs Declarations: Detailed information about the goods being shipped, their value, and the importer and exporter.

- Sanitary and Phytosanitary Certificates: For certain goods, proving they meet specific health and safety standards.

This increased administrative burden leads to several significant problems:

- Increased processing times: Customs checks are more thorough and time-consuming, leading to delays.

- Potential for delays at border control: Incorrect or incomplete documentation can result in goods being held up at the border, causing significant disruptions.

- Higher administrative costs for businesses: The need for specialized expertise and software to manage customs declarations adds to operational expenses.

Delays are particularly problematic for perishable luxury goods, such as high-end chocolates or certain types of flowers, and time-sensitive deliveries, such as those required for high-fashion collections during seasonal launches. These delays can lead to spoilage, missed deadlines, and significant financial losses for exporters.

New Tariffs and Duties

Brexit has also introduced new tariffs and duties on many luxury goods exported from the UK to the EU. These additional costs are substantial and directly impact the price competitiveness of UK luxury brands within the EU market.

- Higher prices for consumers in the EU: These added costs are often passed on to the consumer, reducing demand.

- Reduced competitiveness of UK luxury brands: Facing higher prices than their EU competitors, UK brands risk losing market share.

- Potential loss of market share: Continued price increases may force consumers to opt for alternative brands from within the EU.

The impact on profit margins for luxury exporters is significant. Strategies to mitigate these increased costs include absorbing some of the added expense to maintain price competitiveness, implementing price adjustments to offset the new tariffs, or exploring alternative markets outside the EU.

Supply Chain Disruptions

Brexit has caused significant disruptions to the supply chains of UK luxury goods exporters, impacting both logistics and sourcing.

Logistics and Transportation Challenges

Moving goods across the border between the UK and the EU has become significantly more complex and expensive post-Brexit.

- Increased shipping times: Border checks and increased paperwork add to transit times.

- Higher transportation fees: The added administrative burden and logistical complexities increase transportation costs.

- Potential for stock shortages: Delays and disruptions can lead to shortages of luxury goods in the EU market.

Many UK luxury brands rely on just-in-time delivery models to minimize warehousing costs. Brexit has severely impacted the effectiveness of these models, making it harder to meet demand and maintain inventory levels. As a result, businesses are exploring alternative transportation routes, investing in warehousing facilities closer to the EU market, or adopting more robust inventory management strategies.

Impact on Sourcing and Manufacturing

Brexit also presents challenges to the sourcing of raw materials and manufacturing processes for many UK luxury brands.

- Increased costs for imported raw materials: Tariffs and increased transportation costs on imported materials impact production costs.

- Difficulties in finding skilled labor: Post-Brexit immigration restrictions might affect the availability of skilled workers needed for luxury goods production.

- Potential relocation of manufacturing facilities: Some brands might consider relocating parts of their production to the EU to avoid tariffs and streamline logistics.

The impact on the "Made in Britain" label is notable. While this label remains a significant selling point for many luxury brands, Brexit necessitates careful consideration of the cost-benefit analysis of maintaining UK-based production versus relocating manufacturing to benefit from easier access to the EU market.

Adapting to New Regulations

Navigating the regulatory landscape is another significant challenge for UK luxury exporters post-Brexit.

EU Product Standards and Compliance

Meeting EU product regulations and standards is now more complex and costly.

- Cost of compliance with new regulations: Businesses must invest in adapting their products and processes to meet updated EU standards.

- Need for specialized expertise: Understanding and complying with these regulations requires specialized knowledge and legal advice.

- Risk of non-compliance and penalties: Failure to comply with EU regulations can result in significant fines and legal repercussions.

Specific EU regulations affecting luxury goods vary widely depending on the product category. For example, cosmetics must meet strict ingredient and labeling requirements, while textiles face stringent quality and safety standards.

Impact on Branding and Marketing

Maintaining brand image and reaching EU consumers requires adapted strategies post-Brexit.

- Changes to marketing strategies: Businesses need to adapt their marketing campaigns to account for new trade barriers and consumer perceptions.

- Adapting to new consumer preferences: Post-Brexit, understanding and responding to the evolving preferences of EU consumers is essential.

- Maintaining brand reputation: Any disruption or delay in delivery can negatively impact a luxury brand's reputation.

Digital marketing and e-commerce play an increasingly crucial role in reaching EU consumers directly, bypassing some of the challenges associated with physical distribution.

Conclusion

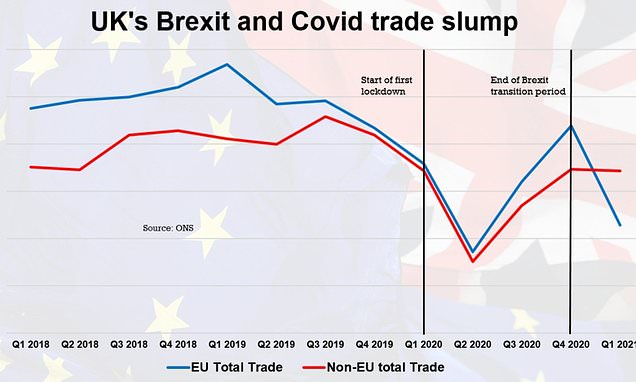

Brexit has presented significant challenges for UK luxury exports to the EU, impacting customs procedures, supply chains, and regulatory compliance. Increased costs, delays, and logistical complexities have forced businesses to adapt and find new strategies to maintain their market share. Understanding the complexities of navigating UK luxury exports to the EU is crucial for the survival and growth of British luxury brands. Investing in effective trade advisory services and staying abreast of evolving regulations are vital steps in maintaining competitiveness in the European market. Learn more about how to successfully manage your UK luxury exports to the EU and overcome these challenges.

Featured Posts

-

Sabalenka Cruises Past Mertens At Madrid Open Reaching Last 16

May 20, 2025

Sabalenka Cruises Past Mertens At Madrid Open Reaching Last 16

May 20, 2025 -

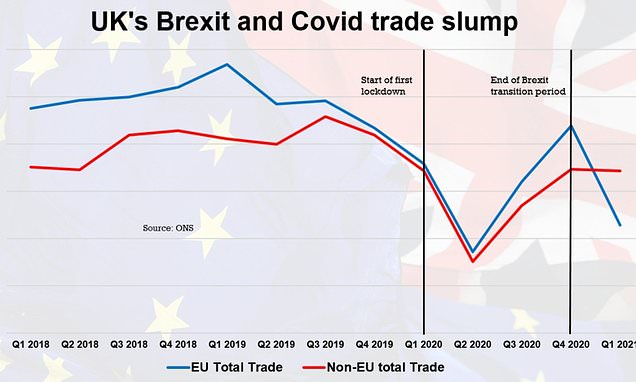

South China Sea Tensions Rise China Pressures Philippines On Missile Deployment

May 20, 2025

South China Sea Tensions Rise China Pressures Philippines On Missile Deployment

May 20, 2025 -

The Problem With Matt Lucas And David Walliams Cliff Richard Project

May 20, 2025

The Problem With Matt Lucas And David Walliams Cliff Richard Project

May 20, 2025 -

Premier League Striker A Target For Man Utd Newcastle Uniteds Interest

May 20, 2025

Premier League Striker A Target For Man Utd Newcastle Uniteds Interest

May 20, 2025 -

Ependyseis Stoys Sidirodromoys Aparaitites Metarrythmiseis Gia Beltiosi

May 20, 2025

Ependyseis Stoys Sidirodromoys Aparaitites Metarrythmiseis Gia Beltiosi

May 20, 2025