How Late Student Loan Payments Impact Your Credit

Table of Contents

Understanding the Credit Reporting Process for Student Loans

Your student loan payment history is a significant factor influencing your credit score. Credit bureaus, namely Equifax, Experian, and TransUnion, are the primary credit reporting agencies that collect and compile this information. Understanding how these agencies handle student loan reporting is vital.

- Reporting Timelines: Your lender reports your payment activity monthly to these credit bureaus. A delinquency is typically reported after 30 days of a missed payment. This negative mark will remain on your credit report for seven years, significantly impacting your creditworthiness. The impact is magnified with multiple missed payments.

- Information Included: The information reported includes the amount of your loan, your payment history (including late payments), and the loan's status (current, delinquent, or defaulted). Accuracy is crucial; dispute any errors immediately with both your lender and the credit bureaus.

The Severity of Late Student Loan Payments on Your Credit Score

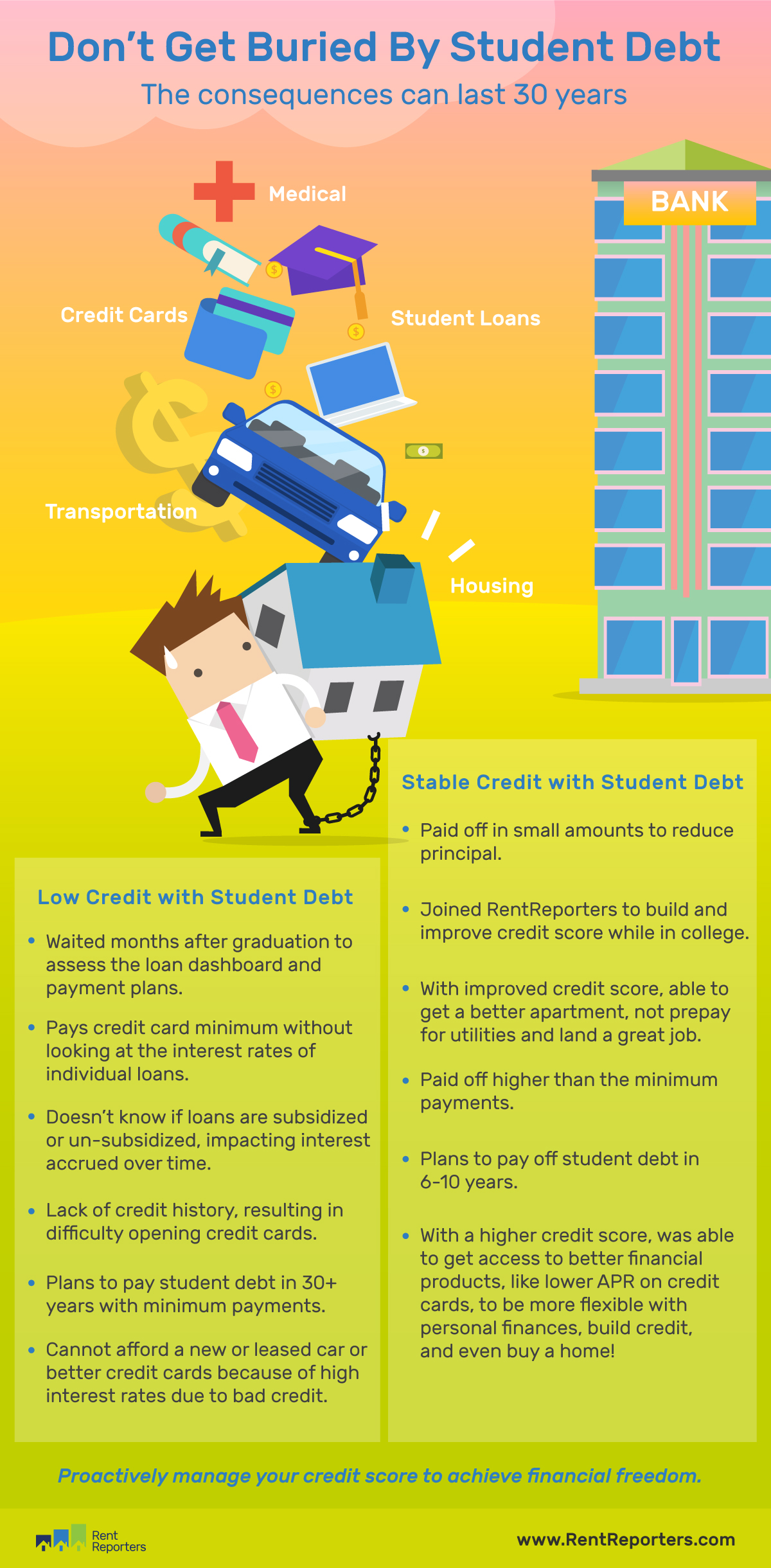

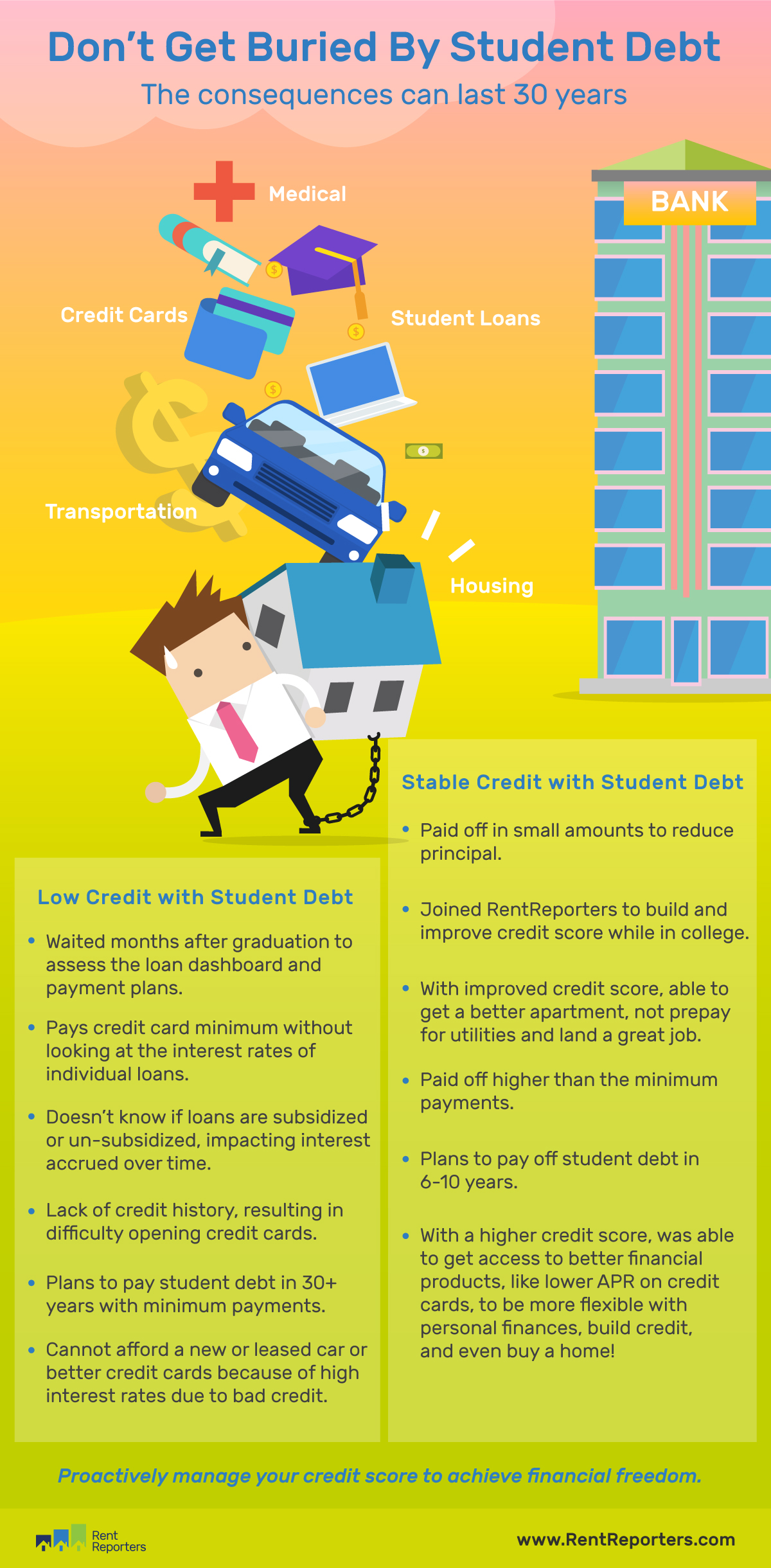

The impact of late student loan payments on your FICO score (and other credit scores) is substantial. Even a single late payment can negatively affect your creditworthiness, leading to a lower credit score. The severity increases with the frequency and duration of late payments.

- Points Deducted: The exact number of points deducted varies depending on your credit history, but even a minor delinquency can result in a significant drop. Repeated late payments cause much more severe score drops, potentially hindering your ability to secure future loans with favorable interest rates.

- Impact on Creditworthiness: A lower credit score translates to higher interest rates on future loans (including mortgages, auto loans, and credit cards), making borrowing more expensive. Furthermore, it can affect your ability to rent an apartment, get approved for a job (especially in certain industries), or even secure certain types of insurance.

What Happens When Your Student Loans Go into Default

Student loan default is the most severe consequence of consistent late payments. It occurs when you haven't made a payment for a specific period (typically 9 months). The consequences are far-reaching and extremely damaging to your credit.

- Consequences of Default: Default leads to significantly damaged credit, making it extremely difficult to obtain credit in the future. The government can take strong action, including wage garnishment (a portion of your paycheck is seized), tax refund offset (your tax refund is used to pay the debt), and even legal action.

- Long-Term Effects: Recovering from a student loan default is a lengthy and arduous process. It severely impacts your ability to secure loans, rent an apartment, or even find employment. You might also face increased difficulties in getting a car loan or credit card in the future.

Strategies to Protect Your Credit from Late Student Loan Payments

Protecting your credit from the negative impacts of late student loan payments requires proactive management of your debt. This includes careful financial planning and utilizing available resources.

- Proactive Strategies: Set up automatic payments to ensure timely payments. Creating a realistic budget and sticking to it helps manage expenses and prioritize loan payments. Explore different repayment plans like income-driven repayment plans (IDR) if you're struggling financially.

- Seeking Help: Contact your lender immediately if you anticipate difficulty making a payment. They might offer forbearance or deferment options to temporarily reduce or suspend payments. If you're facing significant financial challenges, consider professional credit counseling to create a personalized debt management plan. Credit repair services might also be an option if you've already incurred damage to your credit score.

Conclusion

Late student loan payments have significant and long-lasting consequences for your credit score and overall financial health. Understanding how the credit reporting system works and proactively managing your student loan debt are crucial to protecting your credit. Even a single late payment can have a ripple effect, impacting your financial future. Don't let late student loan payments damage your credit. Take control of your student loan repayment today by exploring different repayment options and establishing a sound financial plan. Learn more about how to protect your credit from the impact of late student loan payments and improve your financial future. Take charge of your financial well-being and avoid the detrimental effects of student loan delinquency.

Featured Posts

-

J Jocytes Sugrizimas I Lietuvos Rinktine Laukiama Europos Cempionato

May 17, 2025

J Jocytes Sugrizimas I Lietuvos Rinktine Laukiama Europos Cempionato

May 17, 2025 -

Find Out When Murderbot Starring Alexander Skarsgard Premieres On Streaming

May 17, 2025

Find Out When Murderbot Starring Alexander Skarsgard Premieres On Streaming

May 17, 2025 -

Cassie And Alex Fine Red Carpet Photos From The Mob Land Premiere

May 17, 2025

Cassie And Alex Fine Red Carpet Photos From The Mob Land Premiere

May 17, 2025 -

Rabota V Dubae Rukovodstvo Dlya Rossiyan 2025

May 17, 2025

Rabota V Dubae Rukovodstvo Dlya Rossiyan 2025

May 17, 2025 -

Alcaraz Propusta Finale Barcelone Zbog Povrede Rune Favorit

May 17, 2025

Alcaraz Propusta Finale Barcelone Zbog Povrede Rune Favorit

May 17, 2025