How Nicki Chapman Made £700,000 Investing In A Country Home

Table of Contents

Identifying the Right Property Investment Opportunity

Successful property investment begins with identifying the right property. This involves meticulous research, due diligence, and a keen understanding of the rural property market. Nicki Chapman's success highlights the importance of these initial steps. Key aspects include:

-

Researching undervalued properties in desirable rural locations: Don't just look at asking prices; delve deeper. Research comparable properties, analyze recent sales, and identify properties priced below market value. Look for areas with strong community spirit, good schools, and convenient access to amenities, all factors that boost desirability. Understanding local planning regulations and potential for future development is crucial.

-

Understanding local market trends and future growth potential: Rural property markets can be influenced by various factors, including infrastructure improvements, tourism, and commuter trends. Analyze these factors to identify areas poised for growth. Consider the long-term potential of the location – will it continue to be a desirable area in five, ten, or even twenty years?

-

Conducting thorough due diligence, including surveys and legal checks: This is non-negotiable. Engage qualified professionals to conduct thorough building surveys, identify any potential structural issues, and ensure the legal title is clear. This protects your investment and prevents costly surprises down the line.

-

Assessing the potential for renovation and increasing property value: Identify properties with potential for value-add renovations. This could be anything from a simple kitchen and bathroom upgrade to more extensive structural changes. This is where you can significantly impact the return on your investment. Think about the potential for extensions or updating outdated features.

-

Negotiating a favourable purchase price: Your research and due diligence give you a strong foundation for negotiation. Knowing the true market value allows you to confidently negotiate a price that reflects the property's potential.

The Power of Renovation and Property Enhancement

Renovation is a key element of many successful property investment strategies, including Nicki Chapman's. Smart renovations significantly increase a property's value and appeal to buyers.

-

Strategic renovations to increase property value (e.g., kitchen/bathroom upgrades): Focus on high-impact renovations that yield the best return on investment. Modern kitchens and bathrooms are consistently high on buyers' wish lists.

-

Cost-effective renovation techniques to maximize ROI: Balance quality with cost-effectiveness. Research materials and contractors carefully to get the best value for your money. Prioritise essential upgrades before tackling less impactful ones.

-

Utilizing interior design expertise to enhance appeal: Professional interior design can make a significant difference in a property's presentation and perceived value. It can help you target a specific buyer profile and maximise appeal.

-

Focus on key features that appeal to high-value buyers: Understand your target market. Are you aiming for families, professionals, or retirees? Tailoring your renovation to their preferences will maximise your return.

-

Balancing renovation costs against potential profit margins: Before starting any renovations, create a detailed budget and project the potential increase in property value. Ensure the cost of renovations is significantly less than the anticipated increase in sale price.

Strategic Timing and Market Conditions

Timing is crucial in property investment. Understanding market cycles and buyer demand is essential for maximizing profits.

-

Understanding UK property market cycles and trends: Keep abreast of national and local market trends. Are prices rising or falling? Is there high buyer demand in your target area?

-

Identifying optimal times to buy and sell for maximum profit: Research historical data to understand typical market fluctuations. Buy when prices are low and sell when demand is high.

-

Monitoring buyer demand in the target area: Stay informed about local market dynamics. Is there a shortage of similar properties? Are there a lot of buyers competing for limited inventory?

-

Adapting to market fluctuations and potential risks: The property market can be unpredictable. Develop a contingency plan to adapt to changing conditions and mitigate risks.

-

Effective marketing and sales strategies to attract the right buyers: When it's time to sell, use professional photography, effective online marketing, and a well-written property description to attract buyers.

Learning from Nicki Chapman's Success

Analyzing Nicki Chapman's specific investment strategy provides valuable lessons for aspiring property investors: While the exact details of her purchase and sale timing may not be publicly available, her success underscores the importance of thorough research, strategic renovation, and astute market timing. By focusing on undervalued properties in desirable areas and enhancing them to meet market demand, she capitalized on the potential for significant profit. Her success demonstrates the power of a well-executed investment strategy.

Conclusion

Nicki Chapman's £700,000 profit from her country home investment demonstrates the significant returns achievable through strategic property investment in the UK. By carefully identifying undervalued properties, implementing smart renovations, and timing the market effectively, investors can unlock substantial profits in the rural property market. The key takeaways are thorough research, shrewd renovation, and understanding market conditions.

Call to Action: Ready to replicate Nicki Chapman's success and explore the lucrative world of country home investment? Begin your research today and discover the potential for high returns in the UK property market. Start your journey to building wealth through smart property investments.

Featured Posts

-

Escape To The Countryside Making The Move A Success

May 24, 2025

Escape To The Countryside Making The Move A Success

May 24, 2025 -

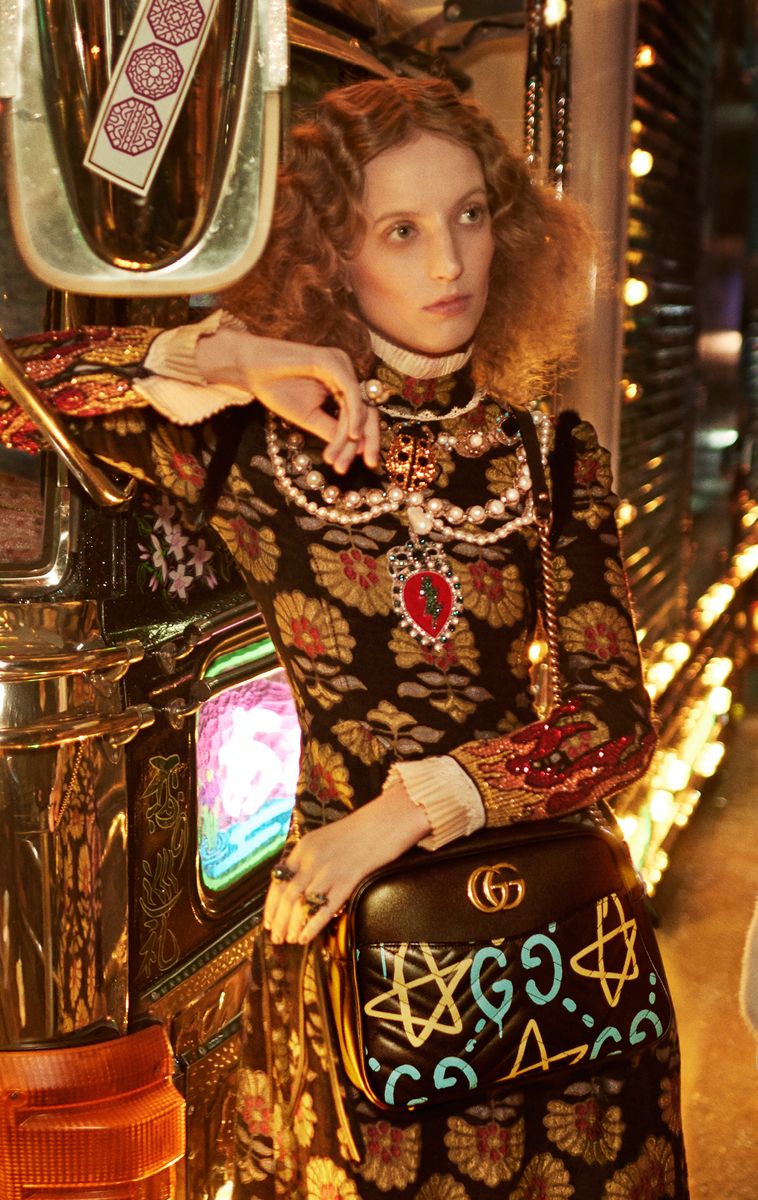

Demna Gvasalia The Designer Reshaping Gucci

May 24, 2025

Demna Gvasalia The Designer Reshaping Gucci

May 24, 2025 -

The Sean Penn Woody Allen Connection A Me Too Case Study

May 24, 2025

The Sean Penn Woody Allen Connection A Me Too Case Study

May 24, 2025 -

Khto Vigraye Yevrobachennya 2025 Prognoz Konchiti Vurst

May 24, 2025

Khto Vigraye Yevrobachennya 2025 Prognoz Konchiti Vurst

May 24, 2025 -

Top 5 Zodiac Signs Positive Horoscope On April 14 2025

May 24, 2025

Top 5 Zodiac Signs Positive Horoscope On April 14 2025

May 24, 2025