How Norway's Top Investor Is Addressing Trump-Era Trade Wars

Table of Contents

Diversification Strategies: A Multifaceted Approach to Mitigating Risk

The cornerstone of this investor's success in the face of the Trump-era trade wars was a robust diversification strategy, spreading risk across multiple avenues. This multifaceted approach minimized the impact of any single trade dispute or policy shift.

Geographic Diversification: Reducing Reliance on Specific Regions Impacted by Trade Disputes

Over-reliance on specific regions vulnerable to trade disputes presents significant risk. To mitigate this, Norway's top investor reduced exposure to areas heavily impacted by tariffs, opting for a more geographically balanced portfolio.

- Investing in emerging markets less affected by tariffs: This includes exploring opportunities in Southeast Asia, Africa, and Latin America, regions less directly involved in the US-China trade tensions.

- Increased investment in Asian markets: While the US-China trade war caused significant disruption, the investor selectively invested in Asian markets demonstrating strong internal growth and less susceptibility to external pressures.

- Reduced exposure to US and EU markets (depending on specific investor actions): This strategic recalibration involved shifting a portion of the portfolio away from regions facing the brunt of trade disputes.

Geographic diversification minimizes the impact of trade restrictions on a single region, creating a more resilient investment portfolio capable of weathering trade storms.

Sector Diversification: Spreading Investments Across Various Industries to Reduce Vulnerability

Concentrating investments in a single sector amplifies the risk of sector-specific downturns. A diversified approach across different industries is crucial in navigating economic uncertainty.

- Investment in technology and renewable energy: These sectors are often viewed as less susceptible to immediate trade impacts and offer potential for long-term growth.

- Increased investment in sectors less susceptible to trade disputes (e.g., healthcare, domestic services): These sectors typically experience less volatility during international trade conflicts.

- Reduced exposure to manufacturing sectors heavily impacted by tariffs: This strategic shift aimed to minimize losses stemming from tariff-related price increases and market disruptions.

Diversifying across sectors ensures resilience, as weakness in one sector can be offset by strength in others. This strategy provides a buffer against unforeseen economic shocks.

Currency Diversification: Protecting Against Fluctuations in Exchange Rates Stemming from Trade Wars

Trade wars often lead to currency volatility. Norway's top investor actively managed currency risk to safeguard against exchange rate fluctuations.

- Using hedging strategies: This involves employing financial instruments to offset potential losses from currency movements.

- Investing in assets denominated in various currencies: This distributes risk across multiple currencies, reducing the impact of fluctuations in any single currency.

- Minimizing exposure to USD-denominated assets: This approach reduces vulnerability to the dollar's potential volatility during periods of trade tension.

Mitigating currency risk is paramount during periods of trade volatility. A diversified currency strategy is a crucial component of a successful investment approach.

Risk Management: Proactive Measures for Uncertain Times

Beyond diversification, proactive risk management was crucial to navigating the Trump-era trade wars. This involved anticipating and mitigating potential threats.

Enhanced Due Diligence: Rigorous Assessment of Geopolitical Risks and Potential Trade Impacts

Thorough analysis of geopolitical risks and potential trade impacts was vital. The investor implemented a robust due diligence process:

- Comprehensive analysis of potential tariff impacts: This involved assessing the likely effect of tariffs on various investments.

- Scenario planning for various trade outcomes: This approach anticipated multiple scenarios, preparing for various trade war developments.

- Closer monitoring of political and economic developments: This ensured a proactive response to changing global dynamics.

Comprehensive risk assessment is crucial in minimizing potential losses and making informed investment decisions during periods of trade uncertainty.

Strategic Partnerships: Collaborating with Businesses and Organizations to Navigate Trade Challenges

Collaboration was a key element of the investor's risk management strategy.

- Forming strategic alliances with international companies: This creates opportunities for shared risk mitigation and resource pooling.

- Engaging in lobbying efforts to influence trade policies: While not directly an investment strategy, influencing policy positively impacts the investment landscape.

- Developing supply chain resilience strategies: Diversifying supply chains minimizes reliance on vulnerable regions or single suppliers.

Strategic partnerships provide access to valuable information, resources, and influence, strengthening resilience during uncertain times.

Regulatory Compliance: Ensuring Adherence to Evolving Trade Regulations and Compliance Protocols

Staying abreast of constantly evolving trade regulations is crucial for compliance.

- Staying updated on trade regulations and policy changes: This required continuous monitoring of international trade legislation.

- Implementing robust compliance systems: This ensured adherence to all applicable regulations and minimized legal risk.

- Seeking expert advice on international trade law: Accessing specialist knowledge helps navigate complex legal frameworks.

Compliance minimizes legal and financial risks, securing long-term investment stability and profitability.

Long-Term Vision: Maintaining a Sustainable Investment Approach

A long-term perspective, focused on sustainable and innovative approaches, underpinned the investor's strategy.

Sustainable Investments: Focusing on Environmentally and Socially Responsible Investments for Long-Term Growth

Sustainability was integrated into the investment strategy.

- Investing in companies with strong ESG (Environmental, Social, and Governance) profiles: This approach aligned investments with long-term sustainability goals.

- Supporting businesses committed to sustainable practices: This prioritizes companies committed to ethical and environmental responsibility.

- Reducing exposure to environmentally damaging industries: This aligns with a broader commitment to responsible investing.

Sustainable investment strategies promote long-term resilience and contribute to a more responsible and sustainable global economy.

Technological Advancements: Leveraging Technological Innovation to Adapt to Changing Market Conditions

Embracing technology was key to adapting to market disruptions.

- Investing in disruptive technologies: This positioned the investor to benefit from technological advancements.

- Adopting data analytics and AI for risk management: These technologies enhanced the precision and efficiency of risk assessment.

- Utilizing automation to optimize supply chains: This improved efficiency and resilience of supply chains.

Technological innovation enhances adaptability and creates opportunities for growth in a dynamic global market.

Focus on Innovation: Supporting Businesses and Industries Driving Innovation and Economic Growth

Supporting innovation drives long-term economic resilience.

- Investing in research and development: This fosters innovation and creates future growth opportunities.

- Supporting start-ups and entrepreneurs: This cultivates innovation and supports emerging industries.

- Focusing on sectors with high growth potential: This ensures exposure to dynamic sectors with future growth potential.

A focus on innovation ensures long-term competitiveness and resilience within a rapidly changing global landscape.

Conclusion

Norway's top investor successfully navigated the uncertainties of the Trump-era trade wars through a combination of diversification, proactive risk management, and a long-term vision focused on sustainability and innovation. Their strategies highlight the importance of adapting to global economic shifts and underscore the need for robust investment plans that account for unpredictable international trade policies. By learning from their approach, other investors can better prepare for future economic uncertainties and strengthen their investment portfolios. To learn more about navigating global trade complexities and developing effective investment strategies, continue your research on successful approaches to managing Trump-era trade wars and similar global economic challenges.

Featured Posts

-

Public Reaction To Lizzos Comparison Of Britney Spears And Janet Jackson

May 05, 2025

Public Reaction To Lizzos Comparison Of Britney Spears And Janet Jackson

May 05, 2025 -

Corinthians Vence Al Novorizontino 0 1 Resumen Y Goles

May 05, 2025

Corinthians Vence Al Novorizontino 0 1 Resumen Y Goles

May 05, 2025 -

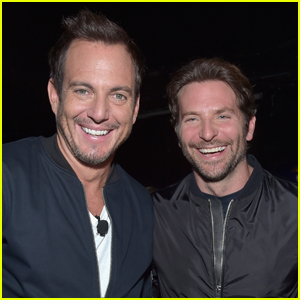

Nyc Late Night Shoot Bradley Cooper And Will Arnetts Is This Thing On Production Photos

May 05, 2025

Nyc Late Night Shoot Bradley Cooper And Will Arnetts Is This Thing On Production Photos

May 05, 2025 -

Sieben Im Rennen Chefsache Kuert Deutschlands Esc Teilnehmer 2025

May 05, 2025

Sieben Im Rennen Chefsache Kuert Deutschlands Esc Teilnehmer 2025

May 05, 2025 -

Sydney Sweeneys Euphoria Wedding Dress Filming After Split From Jonathan Davino

May 05, 2025

Sydney Sweeneys Euphoria Wedding Dress Filming After Split From Jonathan Davino

May 05, 2025