How To Decide If Refinancing Federal Student Loans Is Best For You

Table of Contents

1. Understanding Your Current Federal Student Loan Situation

Before even considering refinancing, you need a clear picture of your current student loan landscape. This involves understanding your loan types, interest rates, and overall repayment burden.

H3: Identify Your Loan Types and Interest Rates:

Knowing the specifics of your federal student loans is paramount. Federal loans come in various forms, including subsidized and unsubsidized loans, as well as Grad PLUS loans. Each loan type may have a different interest rate, significantly impacting your overall repayment cost.

- Step 1: Log in to the National Student Loan Data System (NSLDS) website to access your federal student loan information.

- Step 2: Review your loan documents for detailed information on loan types and interest rates. This information is crucial for comparing refinancing offers later.

- The difference between a 4% interest rate and a 7% interest rate can translate to thousands of dollars in extra interest paid over the life of your loan.

H3: Calculate Your Monthly Payments and Total Loan Cost:

Calculating your current monthly payments and the total cost of your loans (principal plus interest) helps you understand the magnitude of your debt and the potential savings of refinancing.

- Use online loan calculators like those offered by NerdWallet or Bankrate to estimate your monthly payments under various repayment plans.

- Consider the impact of different repayment plans, such as the Standard Repayment Plan, Income-Driven Repayment (IDR) plans (like ICR, PAYE, REPAYE), and Extended Repayment Plan, on your monthly budget and overall loan cost.

H3: Assess Your Current Financial Situation:

Before you even think about applying for refinancing, honestly evaluate your financial health. Lenders will scrutinize your credit score, debt-to-income ratio, and overall financial stability.

- Credit Score: A higher credit score often translates to better interest rates on refinanced loans.

- Debt-to-Income Ratio: Lenders look at your debt relative to your income. A lower ratio generally improves your chances of approval and secures a better rate.

- Income Stability: Demonstrating a stable income stream is crucial for demonstrating your ability to repay the refinanced loan.

- Emergency Savings: Having a financial cushion is essential, especially if unexpected expenses arise.

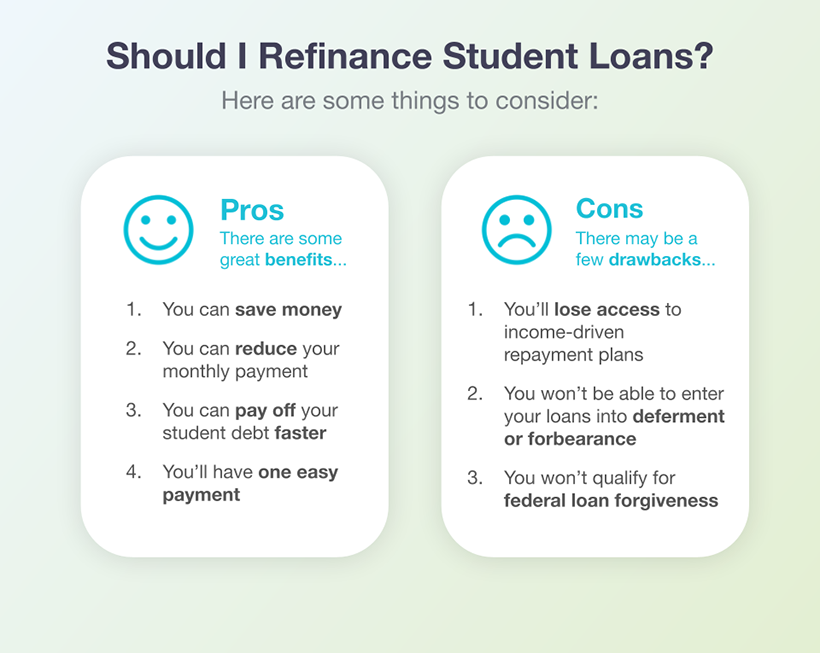

2. Exploring the Benefits and Drawbacks of Refinancing Federal Student Loans

Refinancing your federal student loans can be a double-edged sword. Weighing the potential benefits against the drawbacks is critical.

H3: Potential Benefits of Refinancing:

- Lower Monthly Payments: Refinancing can reduce your monthly payments, freeing up cash flow for other financial goals.

- Lower Interest Rate: Securing a lower interest rate than your current federal loans can save you thousands of dollars in interest over the life of your loan.

- Shorter Repayment Term: A shorter repayment term means you'll pay off your loans faster, ultimately saving on interest. However, this will result in higher monthly payments.

H3: Potential Drawbacks of Refinancing:

- Loss of Federal Student Loan Benefits: Refinancing typically means losing access to crucial federal benefits like income-driven repayment plans, deferment and forbearance options, and potential loan forgiveness programs. This is a major consideration.

- Higher Interest Rates (if credit is poor): If your credit score is low, you may not qualify for a lower interest rate, or worse, end up with a higher one.

- Impact on Credit Score: The application process for refinancing can temporarily impact your credit score.

3. Comparing Refinancing Offers from Different Lenders

Don't settle for the first offer you see! Shop around and compare offers from multiple lenders.

H3: Shopping Around for the Best Rates:

- Compare Interest Rates: Focus on the Annual Percentage Rate (APR), which includes interest and fees.

- Consider Fees: Pay attention to origination fees, prepayment penalties, and other associated costs.

- Check Lender Reputation: Research lenders' reputation and customer reviews before making a decision.

- Explore Different Repayment Options: Compare the total cost and monthly payments under different repayment terms.

H3: Understanding the Fine Print:

Before you sign anything, meticulously read the terms and conditions. Pay close attention to:

- Prepayment Penalties: These are fees charged if you pay off your loan early.

- Origination Fees: These are upfront fees charged by the lender.

4. When Refinancing Federal Student Loans Might NOT Be the Best Option

Refinancing isn't always the best answer. Consider these scenarios:

- Eligibility for Income-Driven Repayment (IDR) Plans: If you qualify for an IDR plan, refinancing could cost you significantly more in the long run by removing this crucial benefit.

- Potential for Loan Forgiveness Programs: Some professions qualify for loan forgiveness programs through the federal government. Refinancing would eliminate this possibility.

Conclusion:

Deciding whether to refinance federal student loans requires careful consideration of your current financial situation, loan details, and potential benefits and drawbacks. Carefully weigh the pros and cons, compare offers from multiple lenders, and thoroughly understand the terms and conditions before making a decision. Make an informed decision about refinancing your federal student loans today! Learn more about the process of refinancing federal student loans and find the best option for your financial needs.

Featured Posts

-

Davenport City Council Approves Apartment Building Demolition

May 17, 2025

Davenport City Council Approves Apartment Building Demolition

May 17, 2025 -

Best No Verification Casinos With Instant Payouts 7 Bit Casino Review

May 17, 2025

Best No Verification Casinos With Instant Payouts 7 Bit Casino Review

May 17, 2025 -

Aews Josh Alexander Exclusive Interview On Don Callis And His Wrestling Path

May 17, 2025

Aews Josh Alexander Exclusive Interview On Don Callis And His Wrestling Path

May 17, 2025 -

Generalka Srbije Pred Evrobasket Detaljan Pregled Utakmice U Bajernovoj Dvorani

May 17, 2025

Generalka Srbije Pred Evrobasket Detaljan Pregled Utakmice U Bajernovoj Dvorani

May 17, 2025 -

Knicks Pistons Game Ends In Controversy Over Officials Missed Call

May 17, 2025

Knicks Pistons Game Ends In Controversy Over Officials Missed Call

May 17, 2025