How To Interpret Net Asset Value (NAV) For The Amundi Dow Jones Industrial Average UCITS ETF (Dist)

Table of Contents

What is NAV and How is it Calculated for the Amundi Dow Jones Industrial Average UCITS ETF (Dist)?

Defining NAV in Detail

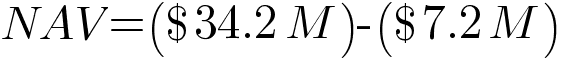

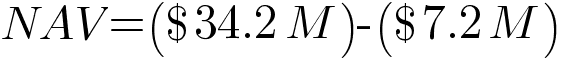

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF (Dist), this calculation reflects the total value of its holdings. Since this ETF tracks the Dow Jones Industrial Average, its assets primarily consist of shares in the 30 constituent companies of that index.

- Assets: This includes the market value of all the stocks held within the ETF, mirroring the composition of the Dow Jones Industrial Average.

- Liabilities: This encompasses relatively minor expenses such as management fees and other operational costs.

- Outstanding Shares: This is the total number of ETF shares currently held by investors.

The formula is straightforward: NAV = (Total Assets - Total Liabilities) / Number of Outstanding Shares. It's important to note that currency fluctuations can impact the NAV, especially if the ETF holds assets denominated in currencies other than the one in which the NAV is calculated. Understanding the Net Asset Value calculation is key to grasping the true value of your investment.

Accessing the Daily NAV

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is usually simple. You can typically access this information through several channels:

- Amundi Website: The official Amundi website is the most reliable source for the daily NAV.

- Financial News Websites: Many reputable financial news websites and data providers (like Bloomberg or Yahoo Finance) will display the ETF price, including the NAV, for major ETFs.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV and historical data.

The Amundi NAV is typically updated at the end of each trading day, reflecting the closing prices of the underlying assets. Knowing where to find NAV is essential for consistent monitoring.

Interpreting NAV Changes for the Amundi Dow Jones Industrial Average UCITS ETF (Dist)

Factors Affecting NAV Fluctuations

The primary driver of NAV fluctuations for the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is the performance of the underlying Dow Jones Industrial Average stocks. If the index rises, the NAV typically rises as well, and vice versa. Other factors influencing NAV include:

- Market Movements: Positive or negative market sentiment impacting the Dow Jones Industrial Average directly affects the value of the constituent stocks and thus the ETF's NAV.

- Dividends: When the companies in the Dow Jones Industrial Average pay dividends, the ETF receives these dividends, which usually increase the NAV (though there might be a slight temporary dip due to the ex-dividend date).

- Expenses: Management fees and other operating expenses reduce the ETF's assets and thus slightly decrease the NAV. However, this effect is usually minor compared to market movements. Understanding NAV fluctuation is crucial for managing expectations.

NAV vs. Market Price

While the NAV represents the intrinsic value of the ETF, the market price is the price at which the ETF is actually traded on the exchange. These two figures might differ slightly due to several factors:

- Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) creates a spread that can cause a temporary deviation from the NAV.

- Trading Volume: High trading volume generally leads to a closer alignment between market price and NAV, whereas low trading volume can cause larger discrepancies. Understanding the relationship between NAV vs market price is vital.

Using NAV for Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF (Dist)

Monitoring NAV for Long-Term Growth

Tracking the NAV over time is essential for assessing the long-term performance of your investment in the Amundi Dow Jones Industrial Average UCITS ETF (Dist). By analyzing historical NAV, you can:

- Assess the ETF's growth trajectory.

- Measure your investment returns.

- Compare performance against benchmarks.

Regularly reviewing your investment performance through the lens of the NAV provides valuable insights into the success of your investment strategy and the overall market trends.

NAV and Investment Strategies

While NAV is not the sole determinant of investment timing, it can inform certain strategies:

- Dollar-Cost Averaging: Investing a fixed amount at regular intervals regardless of the NAV can mitigate the risk of buying high and selling low.

- Buy Low, Sell High (with caution): While theoretically appealing, relying solely on NAV to buy low sell high can be challenging due to market volatility and other factors.

Remember that market timing is difficult, and using NAV alone for investment decisions may be insufficient. Other factors need to be considered alongside NAV data when implementing your chosen investment strategy.

Conclusion: Mastering Net Asset Value for Informed Investing

Understanding Net Asset Value is fundamental for informed investing in ETFs like the Amundi Dow Jones Industrial Average UCITS ETF (Dist). By regularly monitoring the NAV, understanding its calculation, and recognizing the factors that influence its fluctuations, you can gain valuable insights into your investment's performance and make more strategic decisions. Remember to regularly monitor the NAV of your Amundi Dow Jones Industrial Average UCITS ETF (Dist) holdings and conduct further research as needed to optimize your investment strategy. Mastering Net Asset Value leads to making informed investment decisions.

Featured Posts

-

Frankfurt Stock Market Update Dax Climbs Record In Sight

May 24, 2025

Frankfurt Stock Market Update Dax Climbs Record In Sight

May 24, 2025 -

Fellow Anchors Address Absence Of Today Show Colleague

May 24, 2025

Fellow Anchors Address Absence Of Today Show Colleague

May 24, 2025 -

7 Eleven Partners With Odd Burger For Nationwide Vegan Food Distribution

May 24, 2025

7 Eleven Partners With Odd Burger For Nationwide Vegan Food Distribution

May 24, 2025 -

Concern Grows As Sheinelle Jones Remains Absent From The Today Show

May 24, 2025

Concern Grows As Sheinelle Jones Remains Absent From The Today Show

May 24, 2025 -

Low Gas Prices Expected For Memorial Day Weekend Travel

May 24, 2025

Low Gas Prices Expected For Memorial Day Weekend Travel

May 24, 2025