How To Interpret The NAV Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Understanding Net Asset Value (NAV)

-

What is NAV? The Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, all divided by the number of outstanding shares. Simply put, it's the per-share value of the ETF. Daily NAV fluctuations are key indicators of investment performance. For the Amundi Dow Jones Industrial Average UCITS ETF, understanding these fluctuations is crucial for assessing your investment's health.

-

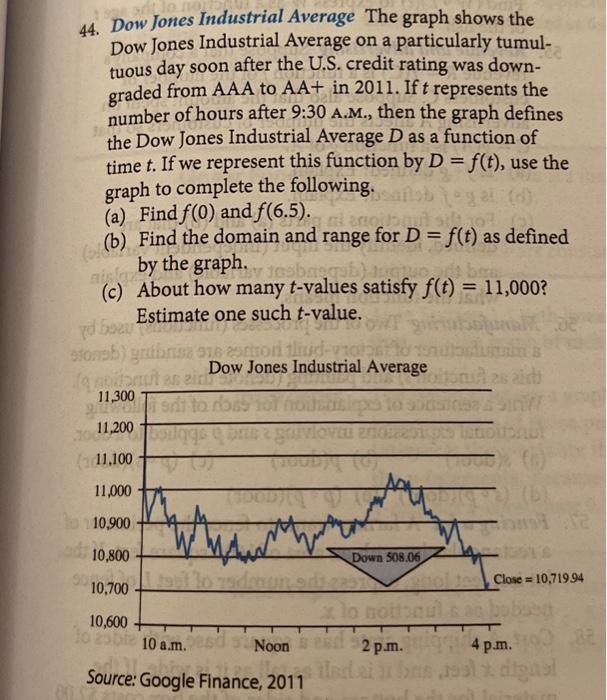

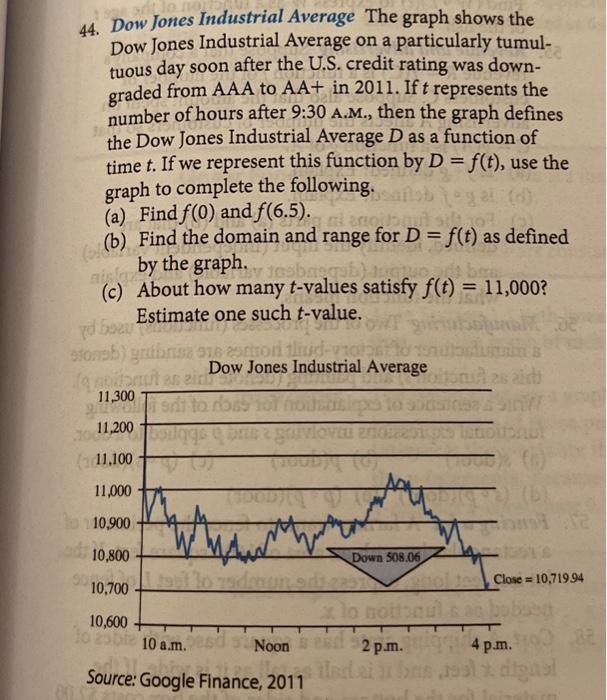

How is NAV calculated for the Amundi Dow Jones Industrial Average UCITS ETF? This ETF tracks the Dow Jones Industrial Average (DJIA). Therefore, its NAV directly reflects the combined value of its holdings in the 30 constituent companies. This value is then adjusted for various factors, including management expenses, transaction costs, and any currency conversions (as the ETF might hold assets in multiple currencies). The calculation involves converting the value of each holding to the ETF's base currency, which is likely EUR.

-

Factors Affecting NAV: Several factors influence the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF. These include:

- Changes in the prices of the underlying 30 Dow Jones Industrial Average components. A rise in the DJIA generally leads to a higher NAV, and vice versa.

- Currency fluctuations: If the ETF holds assets in currencies other than its base currency (EUR), exchange rate movements will impact the NAV.

- ETF management fees: These fees, deducted from the ETF's assets, directly affect the NAV. A higher expense ratio will generally result in a slightly lower NAV.

- Dividend distributions: When the ETF distributes dividends, the NAV will typically decrease by the amount of the dividend per share.

Accessing the Amundi Dow Jones Industrial Average UCITS ETF NAV

-

Where to find the NAV: The Amundi Dow Jones Industrial Average UCITS ETF's NAV is usually published daily by Amundi, the ETF provider. You can find this information on:

- Amundi's official website: Look for sections on ETF details, fund factsheets, or pricing information.

- Financial news websites: Major financial news sources often provide real-time or delayed NAV data for ETFs.

- Your brokerage account platform: Most brokerage accounts display the current NAV (or the most recently available NAV) of your holdings.

-

Understanding Data Presentation: The NAV is typically presented as a currency amount per share (usually EUR for this ETF). Always pay close attention to the currency used to avoid confusion and ensure accurate calculations if your account uses a different currency. You may need to perform currency conversions to accurately assess your returns in your home currency.

-

Regular vs. Real-time NAV: Real-time NAV updates aren't always available. You'll usually find the previous day's closing NAV or the most recent calculated value. This is particularly true for ETFs that are not actively traded throughout the day.

Using NAV to Analyze Performance and Make Investment Decisions

-

Tracking Performance: Regularly monitoring the NAV over time helps assess the ETF's performance against its benchmark, the Dow Jones Industrial Average, and other comparable ETFs. A consistent upward trend generally signals positive performance.

-

Comparing to Benchmark: Compare the NAV's movement to the Dow Jones Industrial Average's movement to gauge the effectiveness of the ETF's tracking. Minor discrepancies are expected due to management fees and other operating costs. Significant deviations, however, might warrant further investigation.

-

Buy and Sell Decisions: While NAV shouldn't be the sole factor in buy/sell decisions, it’s a crucial metric to consider alongside broader market trends and your investment goals. Your risk tolerance and investment timeframe should also influence your decisions.

-

Analyzing NAV alongside other metrics: Don't solely rely on NAV. Consider the ETF's expense ratio, trading volume, and historical performance data in conjunction with your NAV analysis for a holistic view of the investment's prospects. A low expense ratio is generally desirable.

Conclusion:

Interpreting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF involves understanding its calculation, accessibility, and its role in your investment strategy. By consistently monitoring the NAV and combining it with other key performance indicators, you can make informed decisions regarding your investment in this popular ETF. Remember to regularly check the Amundi Dow Jones Industrial Average UCITS ETF NAV and other relevant metrics for effective investment management. Understanding the NAV is a crucial step in managing your investment in the Amundi Dow Jones Industrial Average UCITS ETF successfully.

Featured Posts

-

Horoscopo Completo Semana Del 4 Al 10 De Marzo De 2025 Para Todos Los Signos Zodiacales

May 24, 2025

Horoscopo Completo Semana Del 4 Al 10 De Marzo De 2025 Para Todos Los Signos Zodiacales

May 24, 2025 -

Joe Jonas And The Unexpected Marital Dispute His Response

May 24, 2025

Joe Jonas And The Unexpected Marital Dispute His Response

May 24, 2025 -

Protest Der Essener Taxifahrer Verkehrsbehinderungen Und Reaktionen Der Stadt

May 24, 2025

Protest Der Essener Taxifahrer Verkehrsbehinderungen Und Reaktionen Der Stadt

May 24, 2025 -

Discover The Best New R And B Leon Thomas Flo And More

May 24, 2025

Discover The Best New R And B Leon Thomas Flo And More

May 24, 2025 -

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025

Imcd N V Shareholders Approve All Resolutions At Annual General Meeting

May 24, 2025