How To Interpret The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

The Amundi MSCI World II UCITS ETF USD Hedged Dist is a popular investment choice offering diversified exposure to global equities. However, understanding its Net Asset Value (NAV) is crucial for informed decision-making. This guide will break down how to interpret the NAV of this specific ETF, helping you understand its performance and make better investment choices. We'll explore what NAV means, how it applies to this particular ETF, where to find the data, and finally, how to use this information to improve your investment strategy.

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the intrinsic value of an Exchange-Traded Fund (ETF)'s underlying assets. For ETFs like the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV is calculated by subtracting the fund's total liabilities from its total assets and then dividing by the number of outstanding shares. Simply put:

NAV = (Total Assets - Total Liabilities) / Number of Outstanding Shares

It's vital to understand the difference between NAV and the market price of an ETF. The market price fluctuates throughout the trading day, influenced by supply and demand. The NAV, on the other hand, is calculated at the end of each trading day and reflects the true value of the ETF's holdings. This difference can create arbitrage opportunities for savvy investors.

- NAV represents the intrinsic value of the ETF's holdings. This is the true value of the assets the ETF owns.

- Market price fluctuates throughout the trading day. This price is determined by market forces of buy and sell orders.

- Understanding the relationship between NAV and market price helps gauge potential investment opportunities. A significant deviation might present an arbitrage opportunity.

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Specifically

The "USD Hedged" aspect of the Amundi MSCI World II UCITS ETF is key to understanding its NAV. This means the fund employs strategies to mitigate the risk of currency fluctuations between the base currency of the underlying assets and the US dollar. This hedging helps to reduce volatility in the NAV for US dollar-based investors.

The ETF invests in a globally diversified portfolio of equities, mirroring the MSCI World Index. Its NAV is therefore directly influenced by the performance of these underlying assets across various sectors and geographies. A rise in the value of the companies within the index will generally lead to a rise in the ETF's NAV, and vice versa.

- Impact of currency hedging on NAV stability: Hedging reduces the impact of currency exchange rate movements on the NAV.

- How changes in the underlying assets (MSCI World Index) affect the NAV: Positive performance in the MSCI World Index translates to a higher NAV.

- Importance of considering the expense ratio's impact on the NAV over time: The expense ratio gradually reduces the NAV over time.

Where to Find the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Accessing the NAV for the Amundi MSCI World II UCITS ETF USD Hedged Dist is straightforward. Several reliable sources provide real-time and historical data:

- Amundi's official website: The fund manager's website is the primary source for accurate and up-to-date information.

- Major financial news websites (e.g., Bloomberg, Yahoo Finance): These platforms usually provide detailed ETF information, including NAV data.

- Your brokerage account platform: Most brokerage accounts display the current NAV of your held ETFs.

Using NAV to Make Informed Investment Decisions

The NAV is a powerful tool for informed investment decisions. By analyzing NAV trends over time, you can assess the long-term performance of the ETF. Comparing the NAV to the market price can reveal potential buying or selling opportunities. However, it's crucial to consider other factors alongside NAV, such as the expense ratio and trading volume.

- Analyzing NAV trends over time: Identifying upward or downward trends provides insights into the ETF's performance.

- Comparing NAV to market price to spot discrepancies: Significant differences might indicate arbitrage opportunities.

- Using NAV in conjunction with other investment metrics for a holistic view: Don't rely solely on NAV; consider other performance indicators for a complete picture.

Conclusion

This guide has provided a comprehensive explanation of how to interpret the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist. Understanding the NAV, its components, and how it's affected by various factors is crucial for making informed investment decisions. Regularly monitor the NAV of your Amundi MSCI World II UCITS ETF USD Hedged Dist and other investments to stay informed about their performance and make smart investment choices. Learn more about interpreting Net Asset Values (NAVs) and successfully managing your ETF portfolio.

Jenson Fw 22 Extended A Deeper Look At The Collection

Jenson Fw 22 Extended A Deeper Look At The Collection

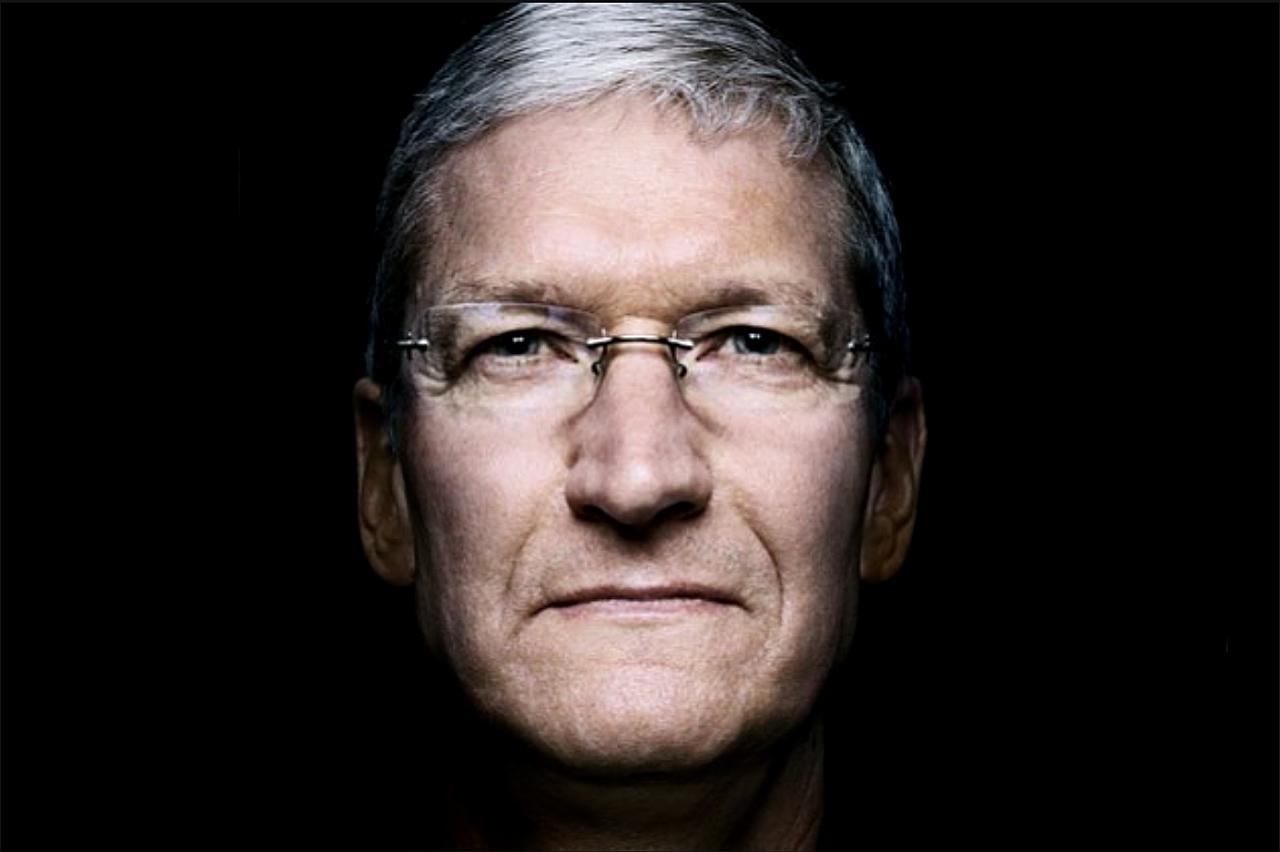

Apples Ceo Faces Headwinds Examining Tim Cooks Recent Struggles

Apples Ceo Faces Headwinds Examining Tim Cooks Recent Struggles

Deconstructing The Hells Angels Image

Deconstructing The Hells Angels Image

The Hells Angels Motorcycle Club History Structure And Activities

The Hells Angels Motorcycle Club History Structure And Activities

Fcm Legende Lars Fuchs Dankbarkeit Fuer Den Bundesliga Traum

Fcm Legende Lars Fuchs Dankbarkeit Fuer Den Bundesliga Traum