How Will QBTS Stock Perform After The Next Earnings Announcement?

Table of Contents

Analyzing Past QBTS Earnings Reports

Examining past QBTS earnings reports reveals crucial trends in revenue growth, earnings per share (EPS), and other key financial metrics. Understanding these historical trends provides a baseline for predicting future performance and assessing the company's overall financial health. Analyzing these reports allows investors to identify consistent patterns or significant deviations from expectations and their subsequent impact on the stock price.

-

Compare Q1 2023 EPS to Q4 2022 EPS: A comparison of these figures reveals the quarter-over-quarter growth (or decline) in earnings. A significant increase could signal positive momentum, while a decrease may warrant further investigation.

-

Analyze revenue growth rate year-over-year: Examining the year-over-year revenue growth helps assess the sustainability of QBTS's business model and its ability to generate consistent sales. High and consistent growth is generally a positive indicator.

-

Discuss any significant changes in profitability margins: Changes in gross profit margin, operating margin, and net profit margin are vital indicators of QBTS's efficiency and ability to control costs. Improving margins suggest increased profitability and potential for higher earnings in the future. Analyzing these margins in conjunction with revenue growth provides a comprehensive picture of QBTS's financial performance. Keywords used here include QBTS earnings report, QBTS financial performance, QBTS EPS, and QBTS revenue growth.

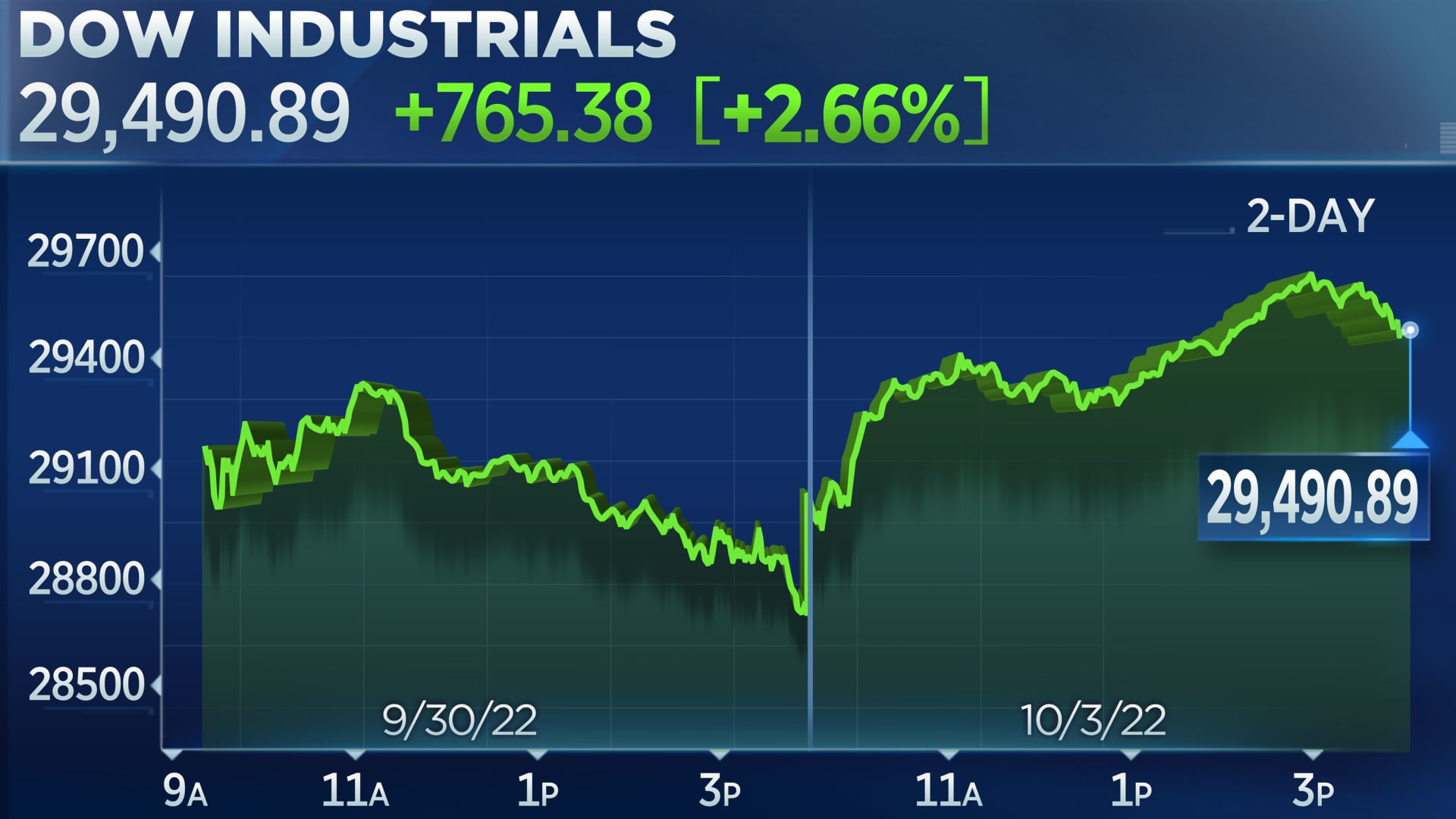

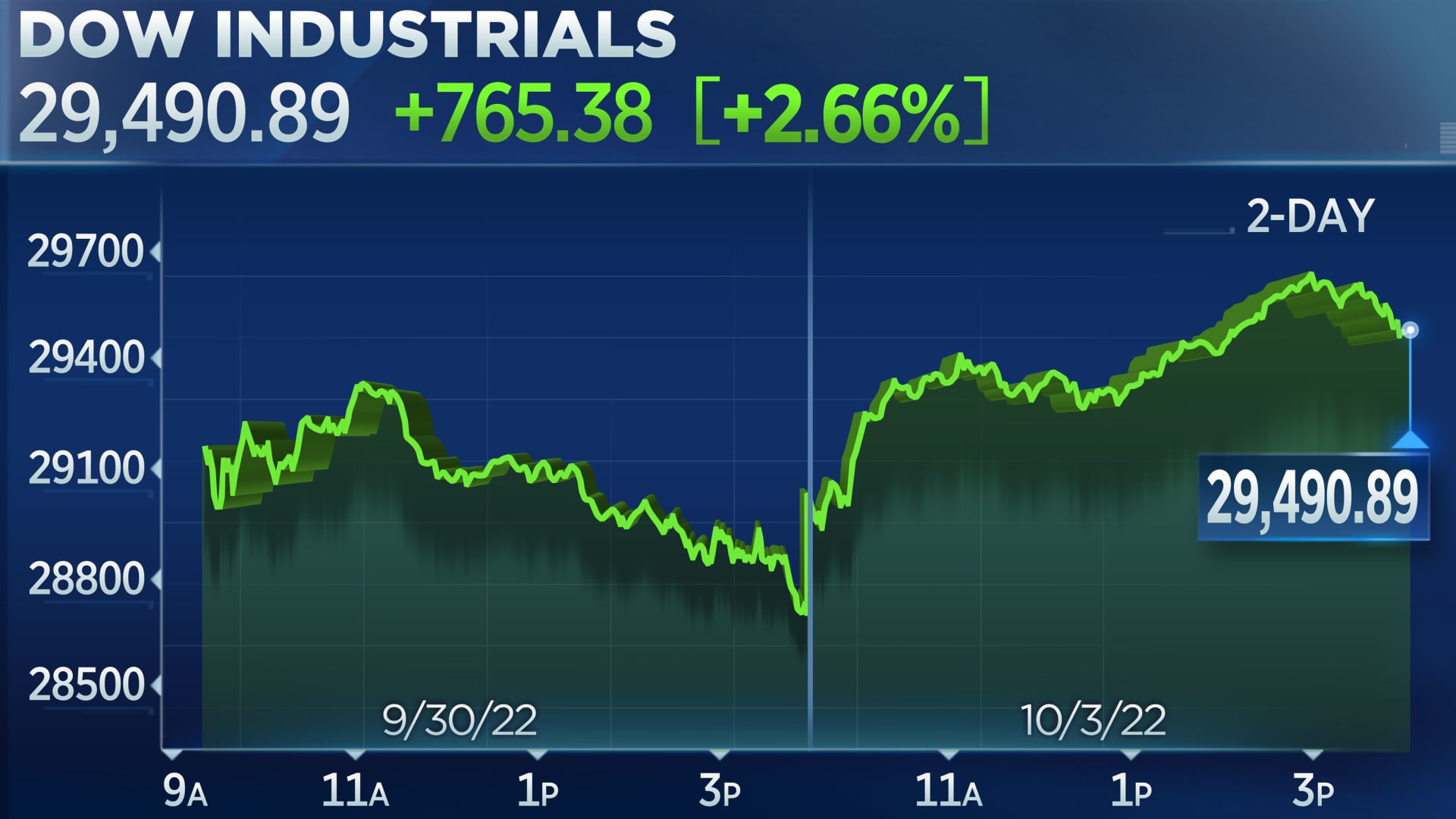

Assessing the Current Market Conditions and Their Impact on QBTS

The overall market sentiment significantly impacts QBTS stock performance. A bullish market generally supports higher stock prices, while a bearish market often leads to declines. Furthermore, the performance of QBTS's competitors within the same sector influences its relative position and attractiveness to investors. Macroeconomic factors such as interest rates and inflation also play a crucial role.

-

Analyze the current state of the broader market: Is the overall market trending upwards or downwards? A strong market generally benefits most stocks, while a weak market can negatively impact even strong companies.

-

Compare QBTS's performance to competitors: How does QBTS's performance compare to its key competitors? Outperforming competitors suggests strong competitive advantage and potential for future growth.

-

Analyze the impact of inflation on QBTS's pricing strategy: Inflation can impact QBTS's pricing power and profitability. The company's ability to manage inflation and maintain profitability is a crucial factor to consider. Keywords for this section include QBTS stock market analysis, QBTS competitors, market conditions, macroeconomic factors, and QBTS stock valuation.

Future Growth Projections and QBTS's Strategic Initiatives

QBTS's future growth plans and strategic initiatives are critical in assessing its potential for future profitability. New product launches, expansions into new markets, or strategic partnerships can significantly impact future earnings. The effectiveness of the company's management team in executing its strategy is also a key factor.

-

Analyze projected revenue growth for the next year: What are the company's projections for revenue growth? Are these projections realistic and achievable, given current market conditions and the company's capabilities?

-

Discuss potential new product launches: Does QBTS have any new products in its pipeline? Successful new product launches can significantly boost revenue and profitability.

-

Evaluate management's track record: Does the management team have a proven track record of success? A strong and experienced management team increases the likelihood of successful execution of the company's strategic plans. Keywords here include QBTS future growth, QBTS strategic initiatives, QBTS management, QBTS product pipeline, and QBTS expansion plans.

Risks and Uncertainties Affecting QBTS Stock Performance

Several risks and uncertainties could negatively impact QBTS's financial results and stock price. Identifying and assessing these risks is crucial for investors. These risks could be related to competition, regulation, macroeconomic factors, or geopolitical events.

-

List potential competitive threats: Who are QBTS's main competitors? What are their strengths and weaknesses? How might increased competition impact QBTS's market share and profitability?

-

Discuss regulatory risks: Are there any regulatory changes that could negatively impact QBTS's business? Changes in regulations can significantly affect a company's operations and profitability.

-

Evaluate the impact of geopolitical uncertainty: Geopolitical instability can have a significant impact on global markets and affect QBTS's business. Understanding potential geopolitical risks is crucial for assessing the overall risk profile of QBTS stock. Keywords: QBTS stock risks, QBTS investment risks, QBTS regulatory risks, QBTS competitive landscape.

Conclusion

This analysis of past performance, current market conditions, future growth projections, and potential risks provides a framework for understanding how QBTS stock might perform after the next earnings announcement. While predicting the future is impossible, careful consideration of these factors can help investors make more informed decisions.

Call to Action: Stay informed about QBTS's upcoming earnings announcement and continue to monitor key financial indicators to track the performance of QBTS stock. Further research into QBTS's financial reports and market analysis can provide a more comprehensive understanding. Remember, investing in QBTS stock involves inherent risks.

Featured Posts

-

Todays Nyt Mini Crossword Answers March 20 2025

May 20, 2025

Todays Nyt Mini Crossword Answers March 20 2025

May 20, 2025 -

Get Suki Waterhouses Baby Doll Inspired Spring Makeup

May 20, 2025

Get Suki Waterhouses Baby Doll Inspired Spring Makeup

May 20, 2025 -

March 15 Nyt Mini Crossword Answers

May 20, 2025

March 15 Nyt Mini Crossword Answers

May 20, 2025 -

Wayne Gretzkys Loyalty Questioned Amidst Trump Tariffs And Statehood Comments

May 20, 2025

Wayne Gretzkys Loyalty Questioned Amidst Trump Tariffs And Statehood Comments

May 20, 2025 -

Mourinho Tadic Ve Dzeko Taktiksel Analiz Ve Kritik Degerlendirme

May 20, 2025

Mourinho Tadic Ve Dzeko Taktiksel Analiz Ve Kritik Degerlendirme

May 20, 2025