Hudson Bay Company Receives Court Approval For Extended Creditor Protection

Table of Contents

Details of the Court Approval

The court granted HBC an extended period of creditor protection, specifically [Insert Number] months, allowing the company crucial time to implement its restructuring strategy. This approval was granted by the [Insert Court Name], following a thorough review of HBC's financial situation and proposed restructuring plan. The court's approval is not without conditions; key stipulations include [Insert Specific Conditions imposed by the court, e.g., regular reporting requirements, limitations on executive compensation].

During this creditor protection period, HBC will undertake several key actions aimed at strengthening its financial position. This process will involve:

- Negotiations with Creditors: HBC will engage in intensive negotiations with its creditors to renegotiate debt terms and achieve a consensual restructuring agreement.

- Development of a Restructuring Plan: A comprehensive restructuring plan will be developed, outlining specific strategies for cost reduction, operational efficiency improvements, and potential asset sales.

- Potential Asset Sales: To raise capital and reduce debt, HBC may consider the sale of non-core assets or underperforming business units.

- Operational Changes: The company is likely to implement significant operational changes, potentially including store closures, layoffs, or a shift in its business model to adapt to the evolving retail environment.

Impact on HBC's Creditors

The creditor protection significantly impacts HBC's creditors. While it provides a pathway for potential repayment, it also means a delay in receiving payments. The exact outcome for creditors will depend on the success of the restructuring plan and the terms negotiated with HBC. Creditors will likely receive a portion of their outstanding debt, possibly through a combination of cash payments and equity in the restructured company. The terms of the repayment plan, the timing of payments and the overall recovery rate remain uncertain. Some creditors have voiced concerns regarding the extended timeframe and the potential for reduced recovery rates, highlighting the inherent risks associated with debt restructuring.

HBC's Future and Restructuring Strategy

HBC's restructuring strategy will likely focus on several key areas: streamlining operations to improve efficiency, reducing its overall debt burden, and adapting its business model to better compete in the modern retail landscape. This may involve a greater emphasis on e-commerce, the closure of underperforming stores, and a renewed focus on key product categories. The success of this restructuring hinges on several factors, including the ability to secure favorable terms with creditors, effectively implement operational changes, and regain consumer confidence. The long-term impact on HBC's brand image and market position will depend on the effectiveness of its turnaround strategy. A successful restructuring could strengthen the brand and enhance its market share, while failure could lead to further decline and potentially even liquidation.

Market Reaction and Analyst Opinions

The news of the extended creditor protection has resulted in a [Insert Description of Market Reaction – e.g., mixed reaction, slight dip in stock prices, cautious optimism] in the stock market. Financial analysts have offered a range of opinions, with some expressing cautious optimism about HBC's prospects, highlighting the potential for a successful turnaround. Others have voiced concerns about the challenges ahead, emphasizing the risks involved in the restructuring process. [Insert quotes from financial analysts]. The overall sentiment is one of uncertainty, with the company’s future success dependent on the effective execution of its restructuring plan.

Conclusion: The Future of Hudson's Bay Company After Creditor Protection

The court's decision granting extended creditor protection to HBC represents a crucial, albeit risky, step in the company's efforts to address its financial challenges. The implications are significant, impacting HBC’s creditors through delayed payments and potential for partial repayment, as well as influencing the company's future direction and its place in the market. The success of HBC's restructuring efforts will determine whether the company can emerge stronger from this period or face further difficulties. The next few months will be critical in determining the ultimate outcome. To stay informed about further developments regarding the Hudson's Bay Company's financial restructuring and creditor protection plans, be sure to follow leading financial news sources. Learn more about the implications of extended creditor protection for Hudson's Bay Company by staying updated on relevant news and analysis.

Featured Posts

-

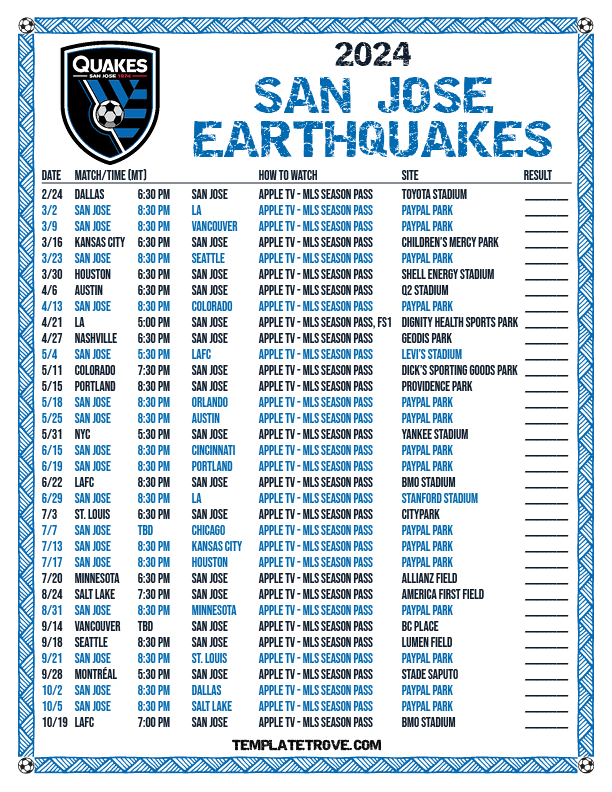

Pre Match Analysis A Deep Dive Into The San Jose Earthquakes

May 16, 2025

Pre Match Analysis A Deep Dive Into The San Jose Earthquakes

May 16, 2025 -

Crystal Palace Vs Nottingham Forest Minuto A Minuto Y Resumen Del Partido

May 16, 2025

Crystal Palace Vs Nottingham Forest Minuto A Minuto Y Resumen Del Partido

May 16, 2025 -

Ver Roma Monza En Directo Guia Completa

May 16, 2025

Ver Roma Monza En Directo Guia Completa

May 16, 2025 -

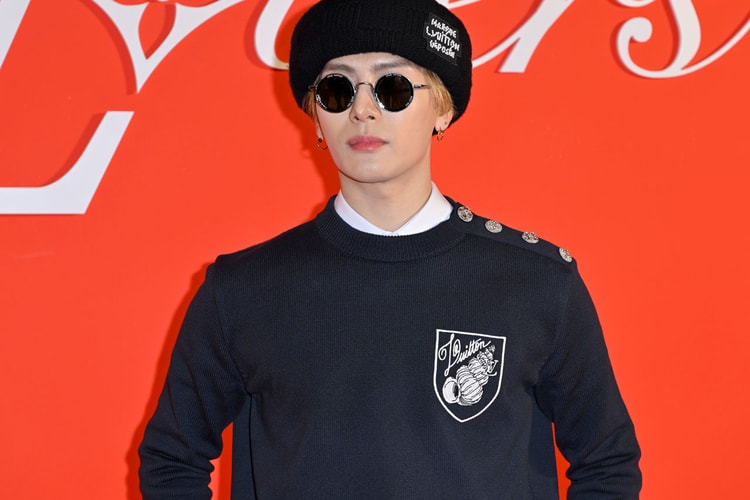

Kid Cudi Joopiter Auction A Collectors Guide

May 16, 2025

Kid Cudi Joopiter Auction A Collectors Guide

May 16, 2025 -

Portugal Derrota A Belgica 1 0 Resumen Del Encuentro Y Goles

May 16, 2025

Portugal Derrota A Belgica 1 0 Resumen Del Encuentro Y Goles

May 16, 2025