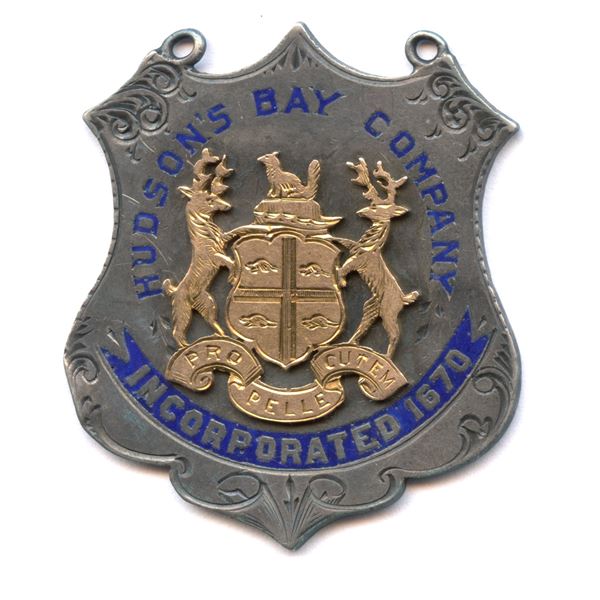

Hudson's Bay Company: Court Extends Creditor Protection Until July 31st

Table of Contents

Court Extends Creditor Protection to July 31st

The Ontario Superior Court of Justice recently granted Hudson's Bay Company an extension of its creditor protection, allowing the company more time to navigate its financial restructuring. This extension provides HBC with until July 31st to finalize its plans. The previous deadline, while not publicly specified in all press releases, was rapidly approaching, creating significant pressure on the company. This additional time is considered vital for HBC to effectively implement its proposed restructuring strategy. The court's decision was likely influenced by HBC's demonstrable progress in negotiations with creditors and its commitment to a viable restructuring plan. While the exact conditions attached to the extension remain partially undisclosed pending further filings, it's understood that HBC must meet specific milestones to maintain the protection. HBC representatives have expressed gratitude for the court's decision, highlighting the extension as essential for securing the long-term future of the company.

Implications for HBC's Financial Restructuring

HBC's financial challenges stem from a confluence of factors, including increased competition in the retail sector, shifting consumer preferences, and the impact of the COVID-19 pandemic. The restructuring process aims to address these challenges through a multifaceted approach. Potential strategies include:

- Debt Reduction: Negotiating with creditors to reduce the company's overall debt burden.

- Asset Sales: Selling non-core assets to generate cash and streamline operations. This could include the sale of individual stores or entire business units.

- Cost-Cutting Measures: Implementing efficiency measures to reduce operational expenses and improve profitability. This may involve staff reductions or renegotiating supplier contracts.

- Strategic Partnerships: Exploring strategic alliances or collaborations to enhance competitiveness and market reach.

The extended timeline offers HBC a more realistic window to implement these strategies effectively. While the success of the restructuring hinges on the successful execution of these plans, the additional time offers a significant advantage in improving the chances of a successful turnaround.

Impact on Creditors and Stakeholders

The extension of creditor protection has significant implications for various stakeholders:

- Creditors: The extended timeline might mean delays in debt repayment for creditors, although the court-approved restructuring plan will outline a revised repayment schedule. The success of the restructuring plan directly impacts the amount of debt they are eventually able to recover.

- Shareholders: The uncertainty surrounding HBC's future naturally impacts shareholder value. The success or failure of the restructuring will significantly influence the value of their investments.

- Employees: While job security remains a concern, the extended period might allow HBC to implement restructuring measures more gradually, minimizing potential job losses. However, some job losses are still considered likely as part of the cost-cutting measures.

- Canadian Retail Industry: The outcome of HBC's restructuring will have a ripple effect on the Canadian retail industry and its supply chain, impacting suppliers, competitors, and related businesses.

Potential Scenarios and Outcomes

Several scenarios could unfold:

- Successful Restructuring: HBC successfully implements its restructuring plan, reducing debt, improving profitability, and securing its long-term viability.

- Bankruptcy Filing: Despite efforts, HBC fails to meet the conditions of creditor protection and files for bankruptcy, potentially leading to liquidation of assets.

- Partial Liquidation: HBC might sell off certain assets or business units to raise capital and improve its financial position, while retaining core operations.

The ultimate outcome will depend on several factors, including the success of negotiations with creditors, the effectiveness of the restructuring plan, and the overall health of the retail market. A successful outcome will require a strategic vision, effective execution, and a favorable economic climate.

Conclusion

The court's extension of creditor protection for Hudson's Bay Company until July 31st is a critical development with significant implications for the retailer's future. The additional time provides a crucial opportunity for HBC to implement its restructuring plan and address its financial challenges. The impact extends to creditors, shareholders, employees, and the broader Canadian retail landscape. The coming months will be crucial in determining whether HBC can successfully navigate this challenging period and secure a sustainable future. Stay informed on the ongoing developments surrounding the Hudson's Bay Company's financial restructuring by checking back for updates on the HBC creditor protection case and its potential outcomes. Follow [Link to relevant news source/HBC website] for the latest information on the Hudson's Bay Company.

Featured Posts

-

Verhandlungen Nach Schlichtung Drohen Bvg Streiks Und Entlassungen

May 15, 2025

Verhandlungen Nach Schlichtung Drohen Bvg Streiks Und Entlassungen

May 15, 2025 -

The Essential Wayne Gretzky Fast Facts A Concise Overview

May 15, 2025

The Essential Wayne Gretzky Fast Facts A Concise Overview

May 15, 2025 -

Yuan Trading Range Widens As Pboc Intervention Decreases

May 15, 2025

Yuan Trading Range Widens As Pboc Intervention Decreases

May 15, 2025 -

Hudsons Bay Company Court Extends Creditor Protection Until July 31st

May 15, 2025

Hudsons Bay Company Court Extends Creditor Protection Until July 31st

May 15, 2025 -

Did Elon Musk Father Amber Heards Twins A Closer Look At The Claims

May 15, 2025

Did Elon Musk Father Amber Heards Twins A Closer Look At The Claims

May 15, 2025